Cybersecurity in Africa

Digital Payments: Survey Reveals 35% South Africans Faced Phishing Scams

Image sourced from isnews.stir.ac.uk According to the Kaspersky Digital Payment survey, 35% of respondents from South Africa faced phishing scams when using online banking or mobile wallet services. 43% have personally encountered fake websites, and 59% experienced scams (via texts or calls) using social engineering. When asked about awareness of threats against digital payment methods, the majority of respondents from South Africa report that they are aware of both financial phishing attacks (94%) and online scams (95%). 78% also stated that they are informed about banking malware on PCs and on mobile. This type of malicious software steals money from users’ bank accounts. However, 98% think that banks and payment companies should educate users more about the threats online. When it comes...

Cassava Wins $50-Million Investment for Africa’s Cybersecurity

The Cassava and C5 Team. African integrated tech firm, Cassava Technologies, today announced that it has secured a $50-million investment from C5 Capital (C5), a specialist venture capital firm that invests in cyber security, space, and energy security. The investment is part of a broader funding round to accelerate Cassava’s growth. The investment by C5 will contribute to the acceleration of the work that Cassava has undertaken to increase digital connectivity and inclusion on the continent. As part of the investment plan, Cassava will be the go-to-market partner in Africa for C5’s cutting-edge portfolio companies to deliver best-in-class cyber security, satellite and space technology and clean energy. C5 and Cassava already announced a joint venture through which Haven Cyber, a C5 portfo...

How a Career in Cybersecurity Can Secure Your Future

Nash Lewis. According to a salary and hiring report by the professional recruitment group, Michael Page, cybersecurity is one of the top in-demand technology jobs in South Africa. Cybersecurity is an issue of critical importance and companies are prioritising hiring talent with the expertise of putting safeguarding measures in place. In response to this, the Banking Sector Education and Training Authority has developed new occupational qualifications to address the growing need for formal qualifications related to cybersecurity in South Africa. Interest in cybersecurity understandably follows increased demand for advanced technology by customers, especially within the fintech sector. With more customers conducting online transactions, the risk for potential cyber-attacks has rapidly increa...

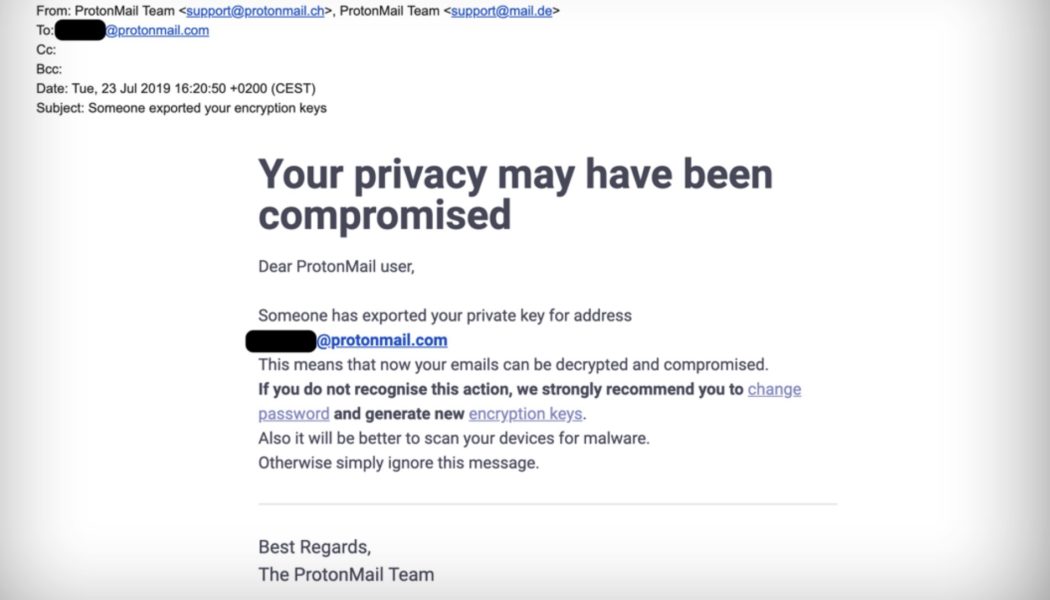

The Great Phishing Fail

Anna Collard, SVP Content Strategy & Evangelist at KnowBe4 Africa. In 2021, phishing attacks increased by 7.3% according to the ESET Threat Report, and the Cisco 2021 Cybersecurity threat trends report revealed that around 86% of organisations had at least one person click a phishing link. This echoes the findings of recent KnowBe4 Security Awareness Research that found people keep clicking – on fake emails from HR, the business and IT. As Anna Collard, SVP Content Strategy & Evangelist at KnowBe4 Africa, points out, the majority of top email categories that people fall for are those that fit in to everyday life – invoices, purchase orders, shared files, and COVID-19 related topics. “As our quarterly report on the top-clicked phishing tests shows, the emails that catch people are t...

How Loadshedding Can Cause Cyber Security Risks

Image sourced from Forbes. Work-from-anywhere (WFA) model have greatly expanded in South Africa in recent weeks, as loadshedding forces remote workers to seek power from a multitude of sources, in malls and coffee shops, meaning they may be alternating between mobile phones, tablets and laptops across any number of potentially unsecured public Wi-Fi hotspots. This mobility increases the cyber security risks presented by all these devices that are often poorly secured to begin with. Smartphones, in particular, have become a critical part of the remote workforce toolkit. They are such an integral part of each person’s daily routine, people may regard them as trusted and safe. As a channel to your personal data, banking and accounts, and a link to your work and business data, smartphones...

What Happens When Cybercriminals Impersonate CEOs?

Image sourced from Feed Navigator. Traditional payment fraud has been rife for some time, where the cybercriminal impersonates the CEO, or other senior members of staff, to convince the finance department to make an urgent payment to either a new supplier or update their bank details. Now over the past month, there has been an increase in an evolved method of change of bank details or payment fraud cyber-attack. This new trend involves an internal change of bank details, mostly for the CEO. The change of bank details fraud uses fake banking confirmation letters and the trust of finance people to update an existing supplier’s details. The growing number of successful attacks have proven to be very costly to businesses of all sizes. Owing to this, many businesses have now implemented stronge...

Only 20% of Cybersecurity Workforce Are Women Despite Industry Skills Deficit

Image sourced from OpportunitiesNB. “Diversity is more than gender. It is race, culture, ability and country. It is mixing up the talent pool and adding in the unique insights and perspectives that different people from different walks of life bring to create teams that are more engaging and innovative,” opines Anna Collard, SVP Content Strategy & Evangelist at KnowBe4 AFRICA. “It will also go a very long way towards filling the very real and very large security skills hole that is growing wider every day.” According to Collard, diversity is a critical and strategic step that the cybersecurity industry depends on to ensure longevity and ongoing security capability. “Women only make up about 20% of the current cybersecurity workforce and yet one of the top pain points for the CISO is th...

Should West African Businesses Embrace Mobile Authentication for Security?

Sourced from International IDEA Digital technology has not only profoundly altered the way we live our lives, but also changed the pace of communication and commerce, allowing us to do everything, immediately. While this has effectively impacted every aspect of our lives, it also inevitably changed the way we are targeted by fraudsters. Along with the world transforming to digital, so has crime. According to an Accenture report published in 2019, the total value at risk of cybercrime over the next five years is an estimated $5.2 trillion. The average cyberattack costs $13 million, according to the same report, with phishing, social engineering and stolen device crime making up $2.4 million of the cost of an average attack. In West Africa, cybercrime is on the increase, with a recent analys...

- 1

- 2