Currency

Fed forgets long-term dollar devaluation when pricing eggs in BTC

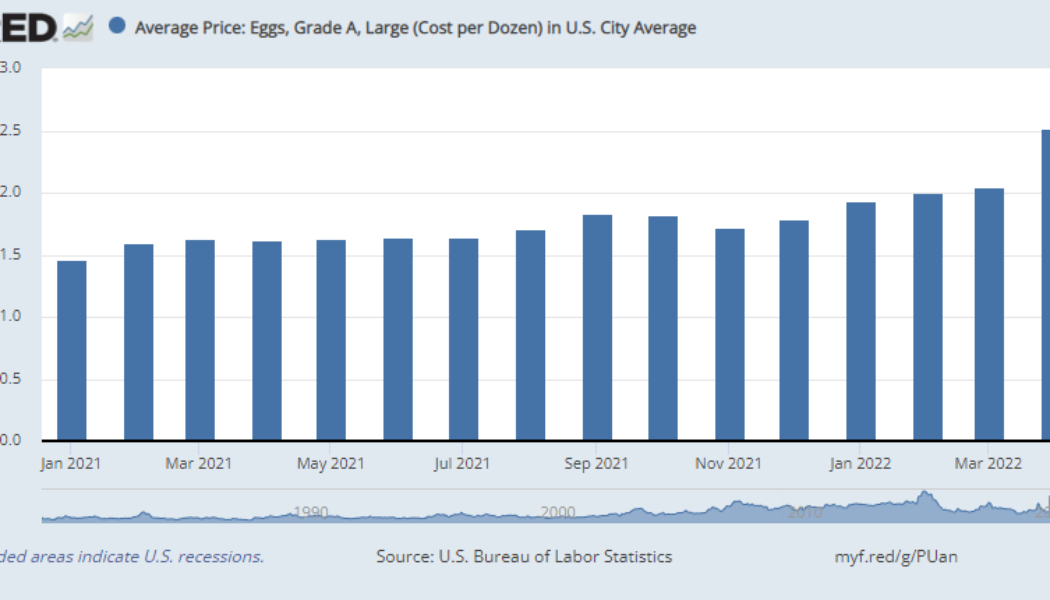

The St. Louis Federal Reserve stirred up a mix of amusement and curiosity from the crypto community on Tuesday, May 7, after publishing a post showing how the cost of eggs in Bitcoin (BTC) has fluctuated over the last 14-months compared to the U.S. dollar. On June 6, the Fed research arm posted a blog post titled “Buying eggs with bitcoins – a look at currency-related price volatility.” The FRED Blog compares egg prices in U.S. dollars vs. bitcoins. Check out the post to see which prices are more stable https://t.co/Qfy9w8zgBk pic.twitter.com/qpFH4ny33S — St. Louis Fed (@stlouisfed) June 6, 2022 The post initially features a graph showing the historical price of eggs in U.S. dollars for every month since January 2021, noting that the prices fluctuated between $1.47 and $2.52 ov...

DOGE price analysis hints at 30% drop despite Elon Musk’s Twitter bid

The brief Dogecoin (DOGE) price rally last week following Tesla CEO Elon Musk’s bid to buy Twitter appears to be fizzling out as DOGE closes the week over 8%. DOGE’s price dropped to $0.142 on April 17, three days after peaking out locally at $0.149. The Dogecoin correction, albeit modest, raised its potential to trigger a classic bearish reversal pattern with an 85% success rate of reaching its downside target. DOGE price eyes drop under $0.10 Dubbed head and shoulders (H&S), the pattern appears when the price forms three peaks in a row, with the middle one, called the “head,” in between the other two, which are of almost equal height, and are thus called the left and right “shoulders.” These three peaks hold above a common support ...

UK police seize $249.5 million worth of cryptocurrency

The British police on Tuesday said they have seized £180 million ($249.5 million) of an undisclosed cryptocurrency, as part of a money laundering investigation launched against organised crime groups that moved into cryptocurrencies in order to clean their money. The latest seizure happened in less than three weeks after the London police made a £114 million haul on June 24 as part of its money laundering investigation. By this, a cryptocurrency payload totalling £294 million ($408 million) has been reportedly seized so far under the money laundering investigation. “While cash still remains king in the criminal world, as digital platforms develop we’re increasingly seeing organised criminals using cryptocurrency to launder their dirty money,” Reuters quoted Graham McNulty, a metropolitan P...

Naira appreciates at N493 to dollar in parallel market

The naira, on Thursday, appreciated by 1.8 percent to N493 to a dollar at the parallel market as the Central Bank of Nigeria (CBN) increased forex supplies to banks. The local currency, which opened at N502 per dollar, gained N17 to N485 during midday trading before closing at N493/$1, according to data on abokiFX.com, a website that collates parallel rates in Lagos. It also appreciated against the pound sterling to close at N710 and N600, gaining N3 and N6, respectively, on the street. At the importer and exporter (I&E) window, it appreciated 0.13 percent to close at N411.50 to the dollar. Last week, Godwin Emefiele, CBN governor, met with bank CEOs and agreed to increase the amount of foreign exchange allocated to banks to meet legitimate needs. Emefiele cautioned them to ensure that...

Naira slides again at official market

Naira for the second day in a row fell against the U.S. dollar at the official market Wednesday, but managed a rebound at the parallel market, a day after hitting its lowest black-market rate in at least four years. Data on the FMDQ Security Exchange where forex is officially traded showed that the naira closed at N412.00 per $1 at the Nafex window. The local currency performance on Wednesday represents a N0.25 or 0.06 per cent decrease from N411.75 the rate it traded in the previous session on Tuesday. The trading session on Wednesday witnessed a forex turnover of $131.86 million, this translates to a 23.44 per cent depreciation from $172.24 million posted in the previous session on Tuesday. The domestic currency experienced an intraday low of N420.97 and a high of N400.00 before closing ...

Nigerian journalist: Why I returned missing $3,000 to owner

Mr Abdulkadir Shehu, a journalist with Progress FM, a private radio station in Gombe, said he returned the $3,000 dollars he found along the road to its owner, because it would be wrong for him to claim it. Shehu told newsmen in Gombe on Monday, that as at the time he returned the money, he had less than N2000 on him. “I was really in dire need of money at the time because I had received a call from Kano that my son was sick and needed to be tested for kidney and liver diseases at the hospital. “They couldn’t go ahead with the test because there was no money. “My son is still under medical supervision, but I will try to get the N35,000 for the test on Tuesday,’’ he said. Shehu stressed that poverty should not be an excuse for anyone to do what is wrong, adding that a person’s honesty is be...

N60 billion mint: PDP demands sack of finance minister

The Peoples Democratic Party, PDP, has called for the sack of Finance Minister, Zainab Ahmed, over what it described as an attempt to mislead Nigerians. The call follows her denial of the revelations by the Edo state Governor, Godwin Obaseki, that N60 billion was printed in March to support federal allocation to states.” Edo State governor Godwin Obaseki had earlier in the week, lamented the sorry state of the nation’s economy, stressing that the federal government had to order the printing of currency to the tune of N60 billion to share among the tiers of government, a claim dismissed by the Finance, Budget and National Planning Minister, Zainab Ahmed. In a statement signed by Kola Ologbondiyan, national publicity secretary of the party, the PDP maintained that “the admission by Central B...

Analysts: Printing currency could hurt economy

Analysts have expressed concerns over a recent claim that the federal government resorted to printing money to augment the monthly allocation to the three tiers of government, warning that it could heighten inflationary pressure with dire consequences for the country’s exchange rate and economy. The analysts, in separate interviews with newsmen, warned that a sustained policy of printing the currency, if not well managed, would hurt the economy. The concern came on the heels of recent revelation by Governor of Edo State, Mr. Godwin Obaseki, that due to the dwindling revenue in the face of declining oil revenue arising from the growing sources of alternative sustainable energy, the federal government had to print money to augment the amount available for sharing by the federal, state and lo...

Sudan announces new cabinet with ex-rebels as ministers

Sudan’s Prime Minister Abdalla Hamdok announced Monday a new cabinet bringing in seven ex-rebel chiefs as ministers, following a peace deal in October aimed to end decades of war. Veteran rebel leader and economist Gibril Ibrahim, of the Justice and Equality Movement (JEM) – which played a major role in the Darfur conflict – was appointed as Sudan’s new finance minister. “We have reached consensus on over 25 ministries,” Hamdok said, during a press conference in Khartoum. “This line up aims to preserve this country from collapse… we know there will be challenges but we are certain that we will move forward.” Hamdok dissolved the previous cabinet on Sunday to make way for a more inclusive line up in government. Two ministers were selected from the military, with the remaining coming from th...

- 1

- 2