CryptoPunks

Looks bare: OpenSea turns into NFT ghost-town after volume plunges 99% in 90 days

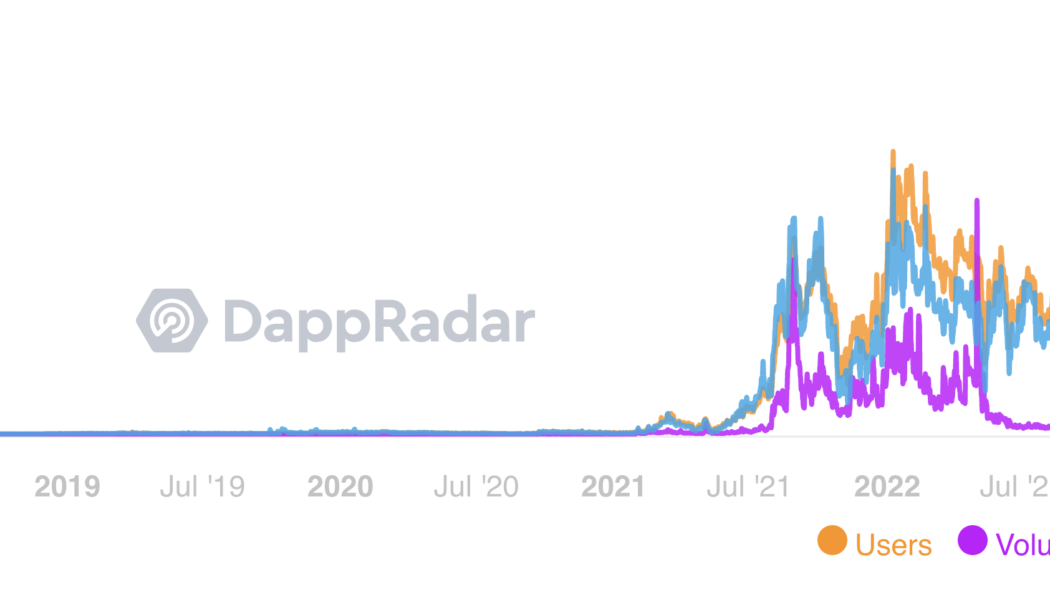

OpenSea, the world’s largest nonfungible token (NFT) marketplace, has witnessed a substantial drop in daily volumes as fears about a potential market bubble grow. OpenSea volume plummets to yearly lows Notably, the marketplace processed nearly $5 million worth of NFT transactions on Aug. 28 — approximately 99% lower than its record high of $405.75 million on May 1, according to DappRadar. OpenSea users, volume, and transactions statistics. Source: DappRadar The massive declines in daily volumes coincided with equally drastic drops in OpenSea users and their transactions, suggesting that the value and interest in the blockchain-based collectibles have diminished in the recent months. That is further visible in the falling floor prices — the minimum amount one is ready to pay for an NF...

Nearly $55M worth of Bored Ape, CryptoPunks NFTs risk liquidation amid debt crisis

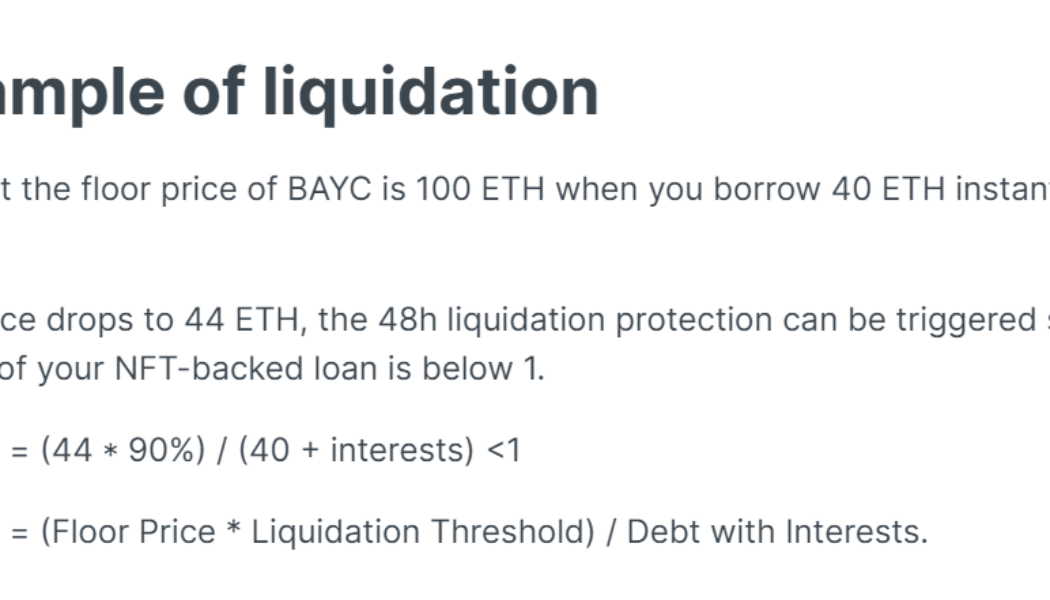

Many owners of precious Bored Ape Yacht Club (BAYC) and CryptoPunks NFTs, who used them as collateral to take out loans in Ether (ETH), have failed to repay their debts. The situation could lead up to the NFT sector’s first massive liquidation event. gm. As a result of the floor dropping to 72, the first BAYC liquidation auction on BendDAO has begun Starting price of 68.4e… Any takers or is this going to be the first bad-debt domino that falls for the platform? pic.twitter.com/7qxsIi661e — Cirrus (@CirrusNFT) August 18, 2022 BAYC “death spiral” incoming? DoubleQ, the founder of web3 launchpad Double Studio, says lending service BendDAO could liquidate up to $55 million worth of NFTs to recover its loans, fearing the so-called “health factor” of these deb...

CryptoPunks’ trading volume surges 1,847% after Tiffany & Co. launches exclusive NFT collection

On Monday, the trading volume of CryptoPunks, one of the sector’s most popular nonfungible token (NFT) collections, surged by 1,847% over 24 hours. Over $1,226.68 Ether (ETH) worth of Punk NFTs was traded during that time. The surge in interest appears to be tied to luxury jewelry retailer Tiffany & Co. launch of its own NFT collection, which has a special perk for Punk holders. Dubbed “NFTiffs,” the collection consists of 250 digital passes. Anyone can purchase NFTiffs, which are minted on the Ethereum blockchain. However, CryptoPunk holders can redeem the NFT for a customized-jewelry experience. After purchase, Punk holders can elect to receive a custom-designed pendant and an NFT digital artwork that resembles the final jewelry design. These are crafted by the...

Floor price of popular NFT collections collapse due to bear market

It appears there is no respite anywhere in the crypto realm in the face of Monday’s extraordinary market sell-off. Based on data from NFT Price Floor, the floor prices for Bored Ape Yacht Club (BAYC) and CryptoPunks, two of the most popular nonfungible token, or NFT, collections on the market, have fallen to 74 ETH ($92,223) and 48 ETH ($69,473), respectively. In comparison, pieces in the BAYC collection had an all-time high floor price of 153.70 ETH, while the same metric amounted to 123 ETH for CryptoPunks. The data aggregator tracks 380 collections with a total market cap of $5.58 billion at the time of publication. The sell-off among NFTs was partly exacerbated by a warning just a day prior, where Gordon Goner, co-founder of Yuga Labs — the firm owning both BAYC and CryptoP...

Nifty News: ‘Blue-chips’ halve in value, free-to-mint Goblintown NFT volume surges

“Blue-chip” nonfungible token (NFT) collections have seen their floor prices and market capitalization slide over the past 30 days, with some of the most well-recognized projects halving in value for these key metrics. Data collected on key Ethereum NFT projects by DappRadar shows the floor prices of established collections such as CryptoPunks, Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC) and Moonbirds are at most down around 55% over 30 days. The MAYC is the worst off of the four, with the floor price diving 55% to 16.7 Ether (ETH), or $31,300 at the time of writing. The more popular BAYC has fallen over 47% to 86.7 ETH, or $163,000, and CryptoPunks by almost 49% to 45 ETH, $85,000. The only collection to gain in the month was Moonbirds, up 22% with a 19.6 ETH floor...

Nifty News: Azuki founder under fire, CryptoPunk sells for a major loss…

The founder of the $723.5 million Azuki NFT project who goes by “Zagabond” online caused a sh*tstorm yesterday after revealing that they had previously worked on three noabandoned NFT projects. After facing strong backlash from the NFT community, they have since apologized for their “shortcomings.” The three projects in question are Tendies and CryptoPunks copycats CryptoPhunks and Cryptozunks. Zagabond suggested all three had failed due to a lack of community support , and other factors such as team members leaving or high gas fees on Ethereum (ETH). After releasing the blog via Twitter, most replies were in support of Zagabond’s honesty on the trial and error path that led to Azuki NFTs, however other sections of the NFT community weren’t as pleased. Really don’t understand all the...

CryptoPunks community reacts to the ongoing copyright battle between v1 and v2

During its initial release, 10,000 CryptoPunks were sold and made it to the secondary market before users discovered a critical smart contract exploit that made it possible for Punks’ buyers to withdraw their Ether (ETH) post-purchase. As a result, creator Larva Labs withdrew recognition of the v1 collection, fixed the exploit and released the v2 Punks collection we have now. Though, they’ve also sent mixed messages about the collection by selling off dozens of their own V1 Punks. The battle over the copyright of the CryptoPunks v1 collection is heating up as the images recently gained in market value, with Larva Labs filing a DMCA take-down notice to OpenSea and members of the v1 community striking back with their own. To complicate the matter, Larva Labs purposefully coded th...