cryptocurrency

New Bitcoin SV Ambassadors Appointed for East & West Africa

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

CEXs refuse blanket asset freeze of all Russian users, though questions linger

Centralized exchanges (CEX) and CEOs from companies such as Binance, Coinbase and Kraken have all stated they would only freeze the assets of Russian clients specifically targeted by Western sanctions — not that of everyday Russian users. A few days prior, Mykhailo Fedorov, Ukraine’s minister of digital transformation, had called for “all major crypto exchanges to block [wallet] addresses of Russians” and “also to sabotage ordinary users [by freezing their assets].” In explaining why he was not preemptively banning all Russians (though, Coinbase is not available in Russia), Brian Armstrong, CEO of Coinbase, specifically wrote: “We believe everyone deserves access to basic financial services unless the law says otherwise. Some ordinary Russians are using crypto as a lifeline...

Citadel to foray into crypto as CEO Griffith changes his mind on the asset class

Citadel Securities chief Ken Griffith admitted he got his assessment of cryptocurrencies He also added Citadel plans to become a market maker in crypto in the coming months Founder and CEO of investment firm Citadel Securities Ken Griffith has finally capitulated and now taken a much softer stance on crypto. An outspoken naysayer, the 53-year-old has, on constant occasions in the past, expressed his distaste for crypto finance and refused to acknowledge it. Speaking during a recent instalment of the Bloomberg Wealth with financier David Rubenstein yesterday, Griffith explored a breadth of subject matters, including the Ukraine situation, the chaotic market, and sanctions. He has come round but is not yet entirely convinced Responding to a question from David Rubenstein, the billionai...

Payment services provider Shift4 acquires The Giving Block for $54 million

According to an investor presentation published Tuesday, U.S.-based payment solutions provider Shift4 announced its acquisition of The Giving Block in cash and stock for $54 million, plus a potential earnout of up to $246 million. The Giving Block is an online platform that allows over 1,300 nonprofit organizations and charities to accept crypto donations. As told by its annual report, the organization processed $69.64 million in crypto donations, an increase of 1,558% from 2020. Out of this amount, approximately $12.3 million came from donations by nonfungible token, or NFT, projects. Ether (ETH) became the most-popular crypto donated for the first time, accounting for nearly half of the total volume. Last month, The Giving Block provided Cointelegraph with a sample list of six char...

BNY Mellon announces Chainalysis partnership to track customer crypto transactions

Bank of New York Mellon has partnered with Chainalysis to enhance its crypto risk management Chainalysis software provides a plethora of services, including flagging high-risk transactions Having added support for Bitcoin back in February last year, America’s oldest bank is now making further moves to enhance its custodial suite of services for crypto. BNY Mellon announced yesterday that it has partnered with blockchain software company Chainalysis to track its customer’s crypto transactions. BNY Mellon, the largest custodian bank globally with $46.7 trillion in assets, sought the services of Chainalysis to track and analyse crypto products easily. The bank believes this will help it manage the legal risks that come with dealing in them. Tracking customers’ crypto A...

Security firms seek to make it more difficult for scammers to get away with DeFi project hacks

The rise of community-oriented blockchain security companies may be making it more difficult for alleged bad actors to get away without a trace. Early Wednesday, CertiK issued a community alert regarding Flurry Finance, where its smart contracts were allegedly breached by hackers, leading to $293,000 worth of funds being stolen. Shortly after the incident, CertiK published the wallet addresses of the alleged perpetrator, the address of the malicious token contract, and a PancakeSwap pair address allegedly involved in the attack, leading to a warning issued on BscScan. While the firm audited the project’s smart contracts, it appears that the exploit was the result of external dependencies. #CommunityAlert @FlurryFi’s Vault contracts were attacked leading to around $293K worth of asset...

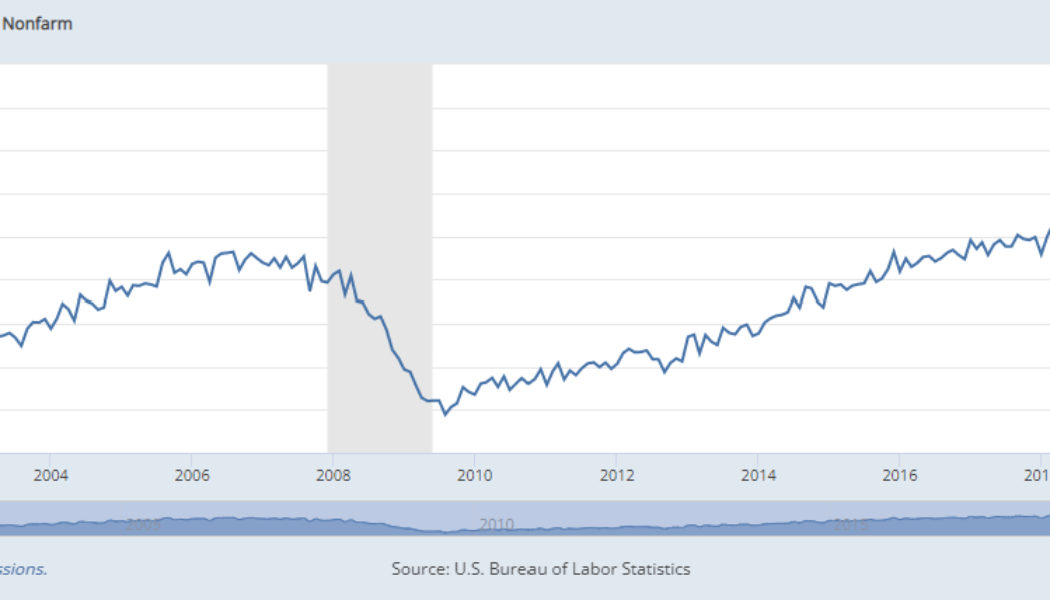

JP Morgan’s Christine Moy resigns, latest exec to flee Wall Street for crypto?

The inexorable flow of workers handing in their notices has become known as the Great Resignation. Over 33 million Americans quit their jobs between spring 2021 and end of year, with the graph below showing visually quite how stark the trend has been in historical terms. Via FRED St. Louis Pandemic Effects The pandemic has ushered in a completely new way of working. Employees have realised quite how un-fun sitting in traffic is for two hours each day, or how much they dislike packing into a rush-hour subway, their face brushing up against the sweaty armpit of a 6”4 guy (why is there always somebody without deodorant?). People enjoy flexible hours (especially with children in the picture) and an employer that cares about their desires. Personally, I thank a higher power every mo...