cryptocurrency

Floor price of popular NFT collections collapse due to bear market

It appears there is no respite anywhere in the crypto realm in the face of Monday’s extraordinary market sell-off. Based on data from NFT Price Floor, the floor prices for Bored Ape Yacht Club (BAYC) and CryptoPunks, two of the most popular nonfungible token, or NFT, collections on the market, have fallen to 74 ETH ($92,223) and 48 ETH ($69,473), respectively. In comparison, pieces in the BAYC collection had an all-time high floor price of 153.70 ETH, while the same metric amounted to 123 ETH for CryptoPunks. The data aggregator tracks 380 collections with a total market cap of $5.58 billion at the time of publication. The sell-off among NFTs was partly exacerbated by a warning just a day prior, where Gordon Goner, co-founder of Yuga Labs — the firm owning both BAYC and CryptoP...

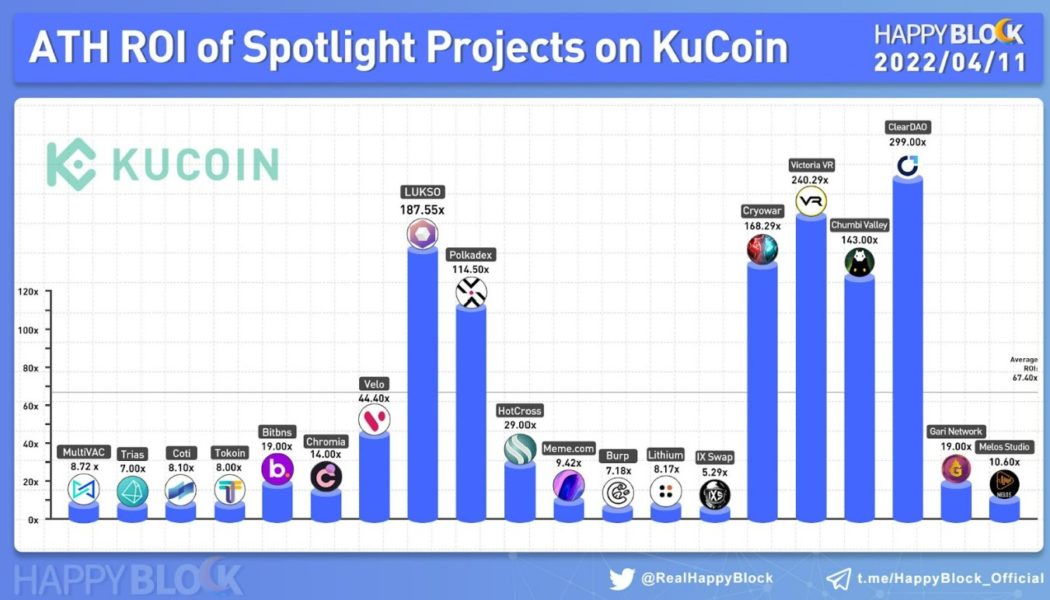

KuCoin continues to expand, chasing down Binance and Coinbase

KuCoin continues to expand and close gap to the top exchanges, such as Coinbase and Binance, as evidenced by increased utility of KCS token KuCoin Token (KCS) is the native token of KuCoin exchange, with which holders can earn daily passive income. Daily KCS bonuses are also available. Paying trading fees with KCS gets users a 20% discount on KuCoin. Also,other use cases of KCS include participating in Spotlight (IEO) , Burningdrop (a new launchpool product) and more. KuCoin’s goal to chase down the major crypto brokers remains in progress as the exchange, launched only five years ago, continues to expand its product offering and range of services. This is clearly evidenced by the push of the KCS token into more and more areas, which opens up a whole new opportunity for both the exchange a...

Is It Profitable to Swap ETH to XNO?

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Edge announces confidential no-KYC digital currency Mastercard

On Wednesday, self-custody crypto exchange Edge announced a no-Know Your Customer (KYC) debit Mastercard that can be funded with Bitcoin and other digital currencies. Without KYC verification, users would be able to spend their crypto at more than 10 million merchant terminals in the United States. Currently, one can fund the Edge Mastercard using Bitcoin (BTC), Bitcoin Cash (BCH), Dogecoin (DOGE), Litecoin (LTC) and Dash (DASH) directly from the Edge app. In a statement to Cointelegraph, representatives at Edge say that the card is compliant with Anti-Money Laundering and Counter-Terrorism Financing regulations because of a $1,000 daily spending limit on the card (approx. $30,000 monthly). In addition, the card is only available for use at U.S. merchant terminals. Paul Puey, a co-founder ...

Exotic Markets Interview: Generating yield by selling optionality

It has been a turbulent time in the cryptocurrency markets recently. With the macro climate worsening to the point that we have more bearish sentiment than at any time since the Great Financial Crisis, coupled with the now-infamous UST debacle that saw a stablecoin worth $18 billion vanish into thin air, investors are fighting an intensely risk-off environment. It is precisely this environment that highlights how vital diversification and portfolio allocation is. This is part of the thesis behind Exotic Markets, who we interviewed last week following the launch of a Dual Currency Note (DCN) on the Solana network. In short, this product allows investors to generate yield by selling upside. Investors receive upside in their preferred currency, while avoiding the need for wrapped ...

Revoland Interview: What exactly does blockchain gaming offer compared to conventional gaming?

Blockchain gaming is quite an exciting space, with new innovations cropping up all the time. With the meteoric rise of both e-gaming and cryptocurrency in recent years, and the various potential use cases that incorporating blockchain into gaming could offer, it makes sense that we are seeing an exciting sector pop up which merges these two dynamic industries. Revoland is one such firm operating in this space. As the first blockchain-based multiplayer online battle arena (MOBA) game, it recently raised $10.6 million during seed and pre-sale rounds. The project calls on gamers to team up with colleagues, family, and friends to compete with other players for rewards in $LAND, a native token of the platform. The title was developed by Chain X Game (CXG): a London-based metaverse g...

Amid P2E downturn, Sky Mavis turns to user-generated content for Axie Infinity

On Tuesday, Sky Mavis, creator of the popular fantasy monster-battle nonfungible token (NFT) game Axie Infinity, announced that it had accepted the first user-created projects in its Axie Infinity Builders Program. Out of 2,000 applications submitted, just 12 were selected for the Builders Program. Among the many perks, chosen teams will receive a minimum $10,000 grant — denominated in Axie Infinity’s governance token, Axie Infinity Shards (AXS) — to fund project development. They will also receive permission to monetize their game using the Axie Infinity brand with a revenue-share model. Notable projects include Across Lunacia, a platforming adventure for Axie NFTs, and Mech Infinity, a battle royale game involving Axies and their unique abilities. Philip La, game product lead at Ax...

Hodler’s guide to travel: Which platforms accept cryptocurrency?

The global economy is becoming increasingly digital, and it’s no surprise that cryptocurrencies and blockchain technology are starting to have an impact on the travel industry. Many travel agencies now accept Bitcoin (BTC) and other digital currencies as payment, with some even providing discounts to customers who pay in cryptocurrency. Here is a list of popular travel booking platforms that take BTC, as well as embrace blockchain technology. 1INCH Network to bring crypto payments to the travel industry The decentralized exchange aggregator 1inch Network on Thursday announced a partnership with the travel booking platform Travala.com, which will allow users to pay for their hotel bookings with cryptocurrency. Users of Travala.com can now use their favorite cryptocurrency to purchase ...

The End of the Digital Gold Rush: How to Make Money on Bitcoin’s Collapse?

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

ECB President declaring crypto as “worth nothing” is missing the point

It’s disappointing to see the President of the ECB, Christine Lagarde, declare that cryptocurrencies are “worth nothing” on Dutch television this past Sunday. I thought we were past that point. Sure, a big bulk of the market is likely worth nothing, but to have the head of the central bank publicly declare all cryptocurrencies as worthless in one swift sentence comes across as increasingly out-of-touch. “My very humble assessment is that (cryptocurrency) is worth nothing. It is based on nothing, there is no underlying assets to act as an anchor of safety”, she said. While she may be right that there are no underlying assets to a lot of these currencies, she’s missing the point. Network effects alone can render an asset worth something, even if there is nothing physical of value underneath....