cryptocurrency

Momint to Tokenise Iconic South African Coins

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Bitcoin miner Mawson to defer all major capital expenditures until market conditions normalize

On Tuesday, Bitcoin (BTC) mining company Mawson Infrastructure Group said that it was suspending major capital expenditures until market conditions normalize. In addition, the firm is voluntarily reducing its energy use, also called demand response, in light of the market sell-off and high electricity prices due to inflation. Mawson received its final shipment of Canann A1246 ASIC Bitcoin Miners in June and has no further outstanding payments due for Bitcoin mining rigs. Regarding the company’s decision, CEO and founder James Manning said: “Despite a volatile market, Mawson is currently continuing to self-mine and is also participating in energy demand response programs where applicable. Additionally, we are fortunate to have no outstanding contracts to purchase ASIC Bitc...

XRP price rally stalls near key level that last time triggered a 65% crash

Ripple’s (XRP) ongoing upside retracement risks exhaustion as its price tests a resistance level with a history of triggering a 65% price crash. XRP price rebounds 30% XRP’s price gained nearly 30%, rising to $0.36 on June 24, four days after rebounding from $0.28, its lowest level since January 2021. The token’s retracement rally could extend to $0.41 next, according to its cup-and-handle pattern shown in the chart below. XRP/USD four-hour price chart featuring “cup and handle” pattern. Source: TradingView Interestingly, the indicator’s profit target is the same as XRP’s 50-day exponential moving average (50-day EMA; the red wave). XRP/USD daily price chart featuring 50-day EMA upside target. Source: TradingView Major resistance hurdle The cup-and-handle bullis...

Nonfungible airdrops: Could NFA become the next big acronym in the crypto space?

Airdrops have become the bread and butter of the crypto world — for good reason. They’re an indispensable marketing tool for up-and-coming projects that want to create a buzz around their ecosystems. Done right, distributing free tokens to the public can help elevate demand — and unlock big benefits for recipients. After all, if these altcoins end up being listed on major exchanges at a later date, their value could explode. Unfortunately though, downsides have started to emerge. These campaigns aren’t just reaching enthusiasts who passionately believe in what a project has to offer, but “airdrop hunters” who are merely scouring for ways to turn a quick profit. Airdrop hunters typically want to sell off the tokens they’ve received for free — as soon as they ca...

Chinese court invalidates 2019 car sale made using now worthless crypto token

Last week, a WeChat post published by the Shanghai Fengxian Court began circulating in crypto circles with regards to its recent ruling on a car sale in May 2019 made using digital currency. At the time, the buyer, identified only as Mr. Huang, signed a sales contract to purchase a 2019 Audi AL6 for CNY 409,800 ($59.477) in exchange for the consideration of 1,281 Unihash (UNIH) tokens with an undisclosed car dealership in Shanghai. Per the original contract, the seller was to deliver the car to Huang within three months’ time. According to the Shanghai Fengxian Court, Mr. Huang paid 1,281 UNIH on the date of the contract signing but did not receive the car within the specified duration nor afterwards. As a result, Mr. Huang took the seller to court, demanding the delivery of the vehi...

Are Cryptocurrencies Set to Soar in Africa in 2022?

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

How Ankr transformed the scalability of the BNB Chain

Cryptocurrency’s tussle with scalability is well known. Ethereum suffers from sky-high gas fees making it unusable for a lot of customers, leading to a lot of alternative Layer-1’s popping up. Binance, one of the world’s leading exchanges, was one such firm to develop its very own blockchain. While some criticise the BNB Smart Chain for being centralised, one cannot argue against the basement-level fees and impressive scalability that it offers. Its impressive performance is partially due to Ankr, the Web3 infrastructure provider. Consulting with the Binance team, Ankr implemented several open-source performance improvements which transformed the network. There was a 10x increase in RPC request throughput, 75% reduction in storage requirements, a sync process that is 100x faste...

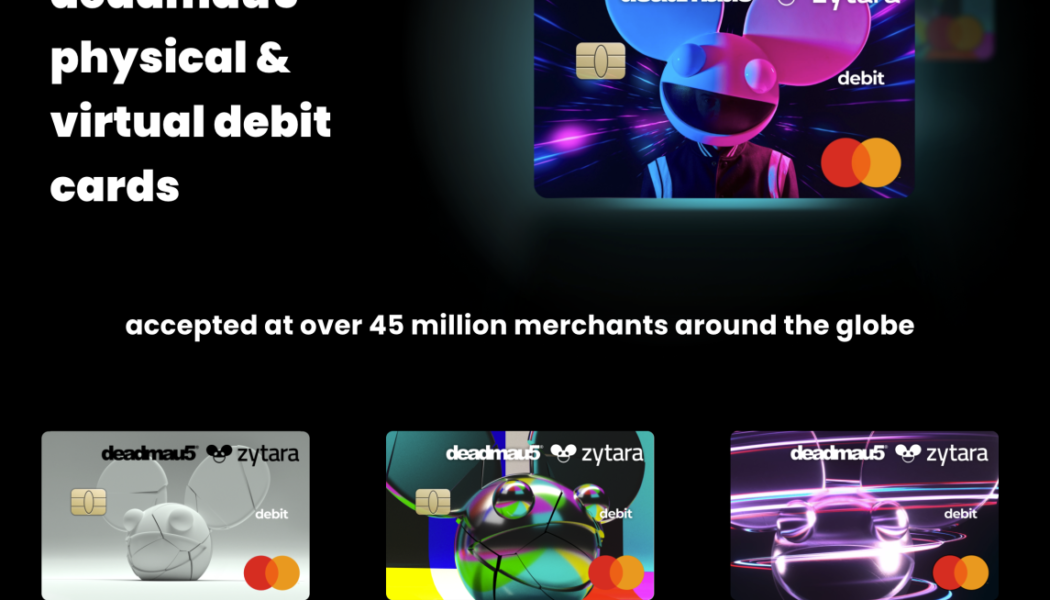

deadmau5 and Zytara Partner to Launch Groundbreaking Digital Banking Experience

Canadian electronic music icon deadmau5 has formed a groundbreaking partnership with Zytara, an innovative fintech company, to change virtual banking as we know it. The partnership will offer the first-ever branded digital banking experience, according to a press release shared with EDM.com. Zytara’s technology is said to enable fans to “interact with deadmau5’s brand” through the company’s banking app, where they can discover merchandise, concerts, pop-ups and more. Fans will also be able to receive a deadmau5-branded virtual or physical debit card, which can be used at 45 million merchants worldwide. Zytara’s debit cards with deadmau5 branding. Zytara Scroll to Continue Recommended Articles This shape-shifting partnership is the latest i...

ICI Bucharest to use Elrond blockchain to develop decentralized domains and an institutional NFT marketplace

On Tuesday, Romania’s National Institute for Research and Development In Informatics, also known as ICI Bucharest (ICI), announced that it would be building an institutional nonfungible tokens, or NFTs, marketplace and a decentralized Domain Name System. Both services will be built on the Elrond (EGLD) blockchain, which is known for its ability to speed up transactions via sharding. ICI was founded in 1970 and is currently the most institution for government-sponsored research in the field of information technology in Romania. It currently supervises the Romanian National Register for Domain Names. As told by Elrond, the initiatives would be the first of their kind within the European Union. One use for the NFT marketplace would potentially be to digitize, access, transfer and ...

Chain.com tokens lose 96% of value in 24 hours due to flash crash before recovery

On Tuesday, tokens of cloud blockchain infrastructure provider Chain.com (XCN) suddenly lost over 90% of their value before recovering most of their losses later in the day. In a post-mortem analysis published by Chain.com, the firm said that a market maker and API error at 1:00 pm SGT (5:00 am UCT) began to cause XCN to drop in large percentiles. As the event took place, corresponding bids became stuck via API orders, causing further downward selling pressure due to low liquidity and margin calls. But by approximately 3:00 pm SGT (7:00 am UCT), developers at Chain.com conferred with exchanges and market participants that the issue was not due to a breach or exploit, and prices began to recover. According to Deepak.eth, CEO of Crypto.com, a single large margin call appears to have ex...