Cryptocurrency Investment

Why are institutions accumulating crypto in 2022? Fidelity researcher explains

Institutions’ investment in crypto has increased in 2022 despite the bear market, according to a recent survey by Fidelity Digital Assets. In particular, the amount of large investors betting on Ethereum have doubled in the last two years, as revelead by Chris Kuiper, the Head of Research at Fidelity Digital Assets in a recent interview with Cointelegraph. “The percentage of respondents saying they were invested in Ethereum doubled from two years ago”, pointed out Kuiper. Kuiper pointed out that Ethereum’s appeal in the eyes of institutions is likely to increase even more now that after the Merge, Ether has become a more environmentally friendly, yield-bearing asset. In general, according to the same survey, institutional players are accumulating crypto despite the cr...

Celsius users concerned over personal info revealed in bankruptcy case

Crypto lending platform Celsius filed for Chapter 11 bankruptcy on July 13, 2022. Although the Celsius case involves digital assets, it remains subject to United States Bankruptcy Code under the Bankruptcy Court for the Southern District of New York. While this may be, a series of unusual events have ensued since Celsius filed for bankruptcy. For instance, Chief United States Bankruptcy Judge Martin Glenn — the judge overseeing the Celsius case — stated on Oct. 17 that the court will look abroad for guidance. Glenn specifically mentioned that “Legal principles that are applicable in the United Kingdom are not binding on courts in the United States,” yet he noted that these “may be persuasive in addressing legal issues that may arise in this case.” While the treatment of the Celsius c...

Influential celebrities that joined the crypto club over the past year

The inclusive crypto ecosystem has become home to numerous A-list celebrities over the years — primarily driven by the nonfungible tokens (NFT) hype of 2021. However, despite the prolonged bear market and an evident dip in cryptocurrency prices, celebrities continue to pour in support for the crypto market. Over the past year, celebrities have started exploring sub-ecosystems beyond NFTs, trying to diversify their presence across trading, gaming and other investment avenues. In this light, here’s an overview of some of the most influential celebrities that got into crypto over the past year and how well-prepared they are for the next bull run. Connor McGregor partners with Tiger.Trade UFC superstar Connor McGregor, one of the highest-paid athletes, recently partnered with Tiger.Trade...

Beyond the NFT hype: The need for reimagining digital art’s value proposition

With cryptocurrency prices wavering this year, nonfungible tokens (NFTs) and other sub-ecosystem investors have also found themselves in the grips of a bear market. However, looking beyond the trading value of Ether (ETH), NFTs were primarily created to represent assets and ownership in the real and virtual world. The bear market, as a result, has reignited discussions around how NFTs can backtrack and focus on attending to use cases while the market recovers. In a conversation with Cointelegraph, Tony Ling, the co-founder of analytics platform NFTGo, shared insights into the NFT ecosystem, revealing the expected trajectory of the ecosystem. Cointelegraph: NFTs’ rise to mainstream popularity is often attributed to the various real-world use cases it can and has solved. What is your take on...

How to tell if a cryptocurrency project is a Ponzi scheme

The crypto world has experienced an increase in Ponzi schemes since 2016 when the market gained mainstream prominence. Many shady investment programs are designed to take advantage of the hype behind cryptocurrency booms to beguile impressionable investors. Ponzi schemes have become rampant in the sector primarily due to the decentralized nature of blockchain technology which enables scammers to sidestep centralized monetary authorities who would otherwise flag or freeze suspicious transactions. The immutable nature of blockchain systems that makes fund transfers irreversible also works in the scammers’ favor by making it harder for Ponzi victims to get their money back. Speaking to Cointelegraph earlier this week, KuCoin exchange CEO Johnny Lyu said that the sector was fertile ground for ...

Crypto contagion deters investors in near term, but fundamentals stay strong

The past six-odd months have been nothing short of a financial soap opera for the cryptocurrency market, with more drama seemingly unfolding every other day. To this point, since the start of May, a growing number of major crypto entities have been tumbling like dominoes, with the trend likely to continue in the near term. The contagion, for the lack of a better word, was sparked by the collapse of the Terra ecosystem back in May, wherein the project’s associated digital currencies became worthless almost overnight. Following the event, crypto lending platform Celsius faced bankruptcy. Then Zipmex, a Singapore-based cryptocurrency exchange, froze all customer withdrawals, a move that was mirrored by crypto financial service provider Babel Finance late last month. It is worth noting that si...

How to identify and avoid a crypto pump-and-dump scheme?

Educating oneself about the crypto ecosystem is crucial for investors to pursue during a bear market while awaiting a bull cycle. That being said, having a good understanding of crypto investment entails keeping an eye out for fraudulent projects that threaten to drain assets overnight, a.k.a. pump-and-dump schemes. Pump-and-dump in crypto is an orchestrated fraud that involves misleading investors into purchasing artificially inflated tokens — typically marketed and hyped by paying celebrities and social influencers. SafeMoon token is one of the most prominent examples of an alleged pump-and-dump scheme involving A-list celebrities, including Nick Carter, Soulja Boy, Lil Yachty and YouTubers Jake Paul and Ben Phillips. Once the investors have purchased tokens at inflated prices, the peopl...

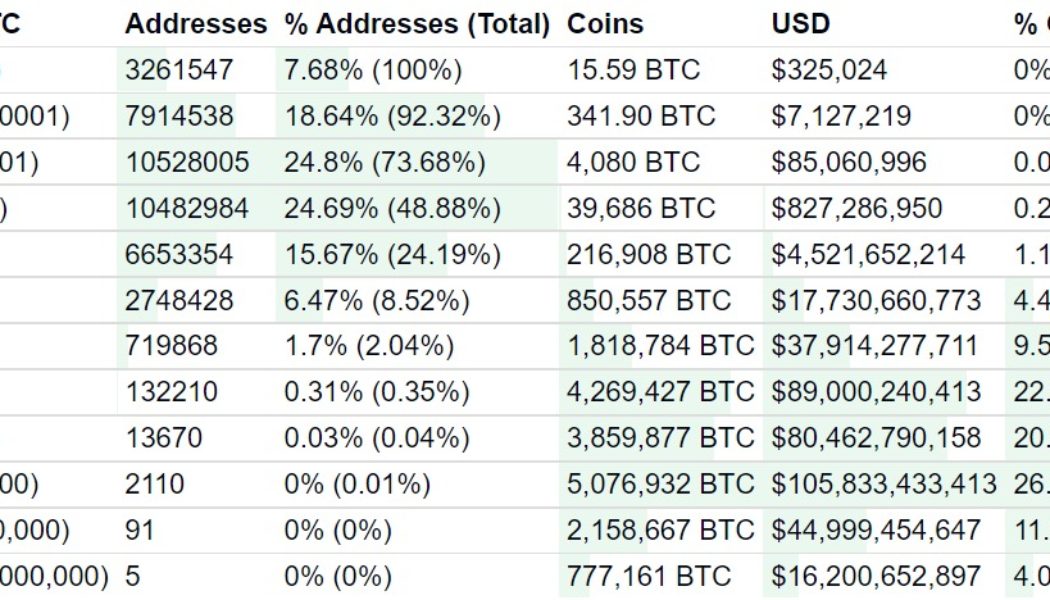

Hodlers and whales: Who owns the most Bitcoin in 2022?

One of the main features of the Bitcoin blockchain is its transparency. Bitcoin lets anyone see every transaction that has ever been made on its network and check the balance of every address out there. Because of this transparency, we’re able to know who owns the most Bitcoin (BTC) in 2022. It’s important to look at who owns the most BTC, as the cryptocurrency’s supply is limited to 21 million coins. In February, Kim Grauer, director of research at blockchain forensics firm Chainalysis, told Cointelegraph that an estimated 3.7 million BTC have been lost, effectively deflating the cryptocurrency’s circulating supply. Experts estimate that as Bitcoin’s adoption rises, demand for it will skyrocket. As 3.7 million coins are estimated to be lost and a significant amount is being held on-chain ...

Hodlers and whales: Who owns the most Bitcoin in 2022?

One of the main features of the Bitcoin blockchain is its transparency. Bitcoin lets anyone see every transaction that has ever been made on its network and check the balance of every address out there. Because of this transparency, we’re able to know who owns the most Bitcoin (BTC) in 2022. It’s important to look at who owns the most BTC, as the cryptocurrency’s supply is limited to 21 million coins. In February, Kim Grauer, director of research at blockchain forensics firm Chainalysis, told Cointelegraph that an estimated 3.7 million BTC have been lost, effectively deflating the cryptocurrency’s circulating supply. Experts estimate that as Bitcoin’s adoption rises, demand for it will skyrocket. As 3.7 million coins are estimated to be lost and a significant amount is being held on-chain ...

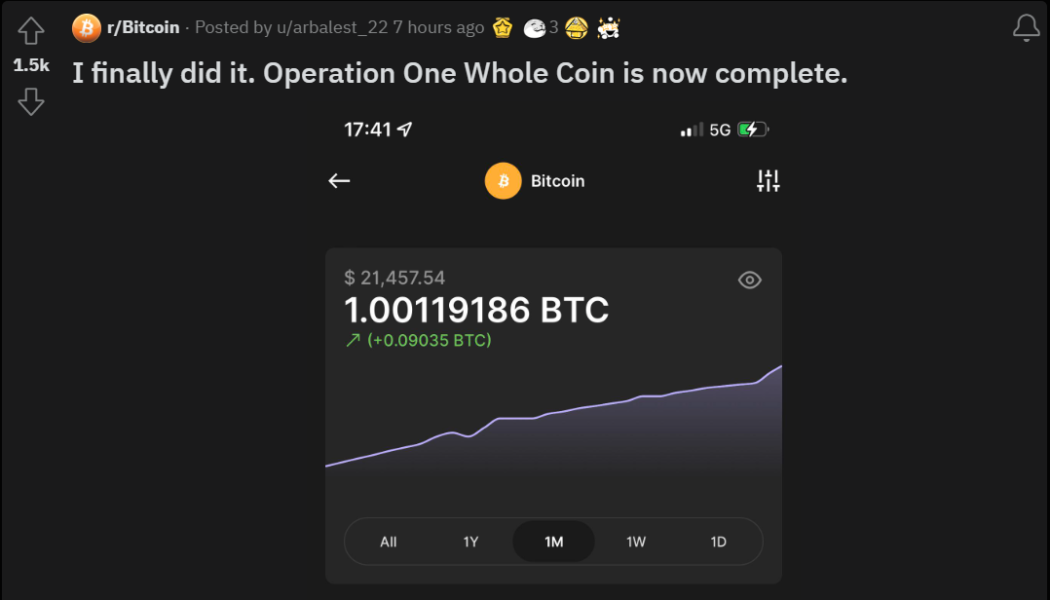

Small-time investors achieve the 1 BTC dream as Bitcoin holds $20k range

Ever since early Bitcoin (BTC) investors woke up millionaires as the ecosystem gained tremendous popularity alongside the mainstreaming of the internet, investors across the globe have been in the rush to accumulate as many of the 21 million BTC — one Satoshi at a time. With BTC recently trading at the $20,000 range for the first time since 2020, small-time investors found a small window of opportunity to achieve their dream of owning at least 1 BTC. On June 20, Cointelegraph reported that the number of Bitcoin wallet addresses containing one BTC or more increased by 13,091 in just 7 days. While the total number of addresses holding 1 BTC saw an immediate reduction in days to come, the crypto community on Reddit continues to welcome new crypto investors that hodled their way into becoming ...

True Global Ventures doubles down on Web3 with $146M ‘follow-on’ fund

Venture capital firm True Global Ventures 4 Plus (TGV4 Plus) has announced the closure of a $146 million funding round earmarked for a wide range of Web3 projects — highlighting investors’ continued interest in crypto despite an ongoing bear market. The latest closure, dubbed the TGV4 Plus Follow On Fund, was led by a group of 15 general partners who committed over $4 million on average (over 40%, or $62 million) into the fund. The majority of the funding will be primarily injected into Web3 companies within TGV’s portfolio, while the remaining will be used to invest in late-stage Web3 opportunities. TGV previously invested in numerous Web3 initiatives using a base fund dedicated to the late-stage Series A, B and C across three business verticals: entertainment and gaming, financial servic...

- 1

- 2