Cryptocurrency Exchanges

Celsius Network’s bungling showed why centralization can’t protect privacy

In Celsius Network’s recent court filing, the billion-dollar centralized finance (CeFi) platform exposed more than 14,000 pages of customer identity and on-chain transaction data without user consent — a prescient reminder that privacy absent decentralization is no privacy at all. As part of its bankruptcy proceedings, CeFi lending giant Celsius Network disclosed names and on-chain transaction data of tens of thousands of its customers in an Oct. 5 court filing. While Celsius’ user base complied with standard Know Your Customer (KYC) procedures in order to open personal accounts with the CeFi platform, none consented to nor could have anticipated a mass disclosure of this scope or scale. In addition to doxxing the multi-million dollar withdrawals of Celsius founder Alex Mashinsky and chief...

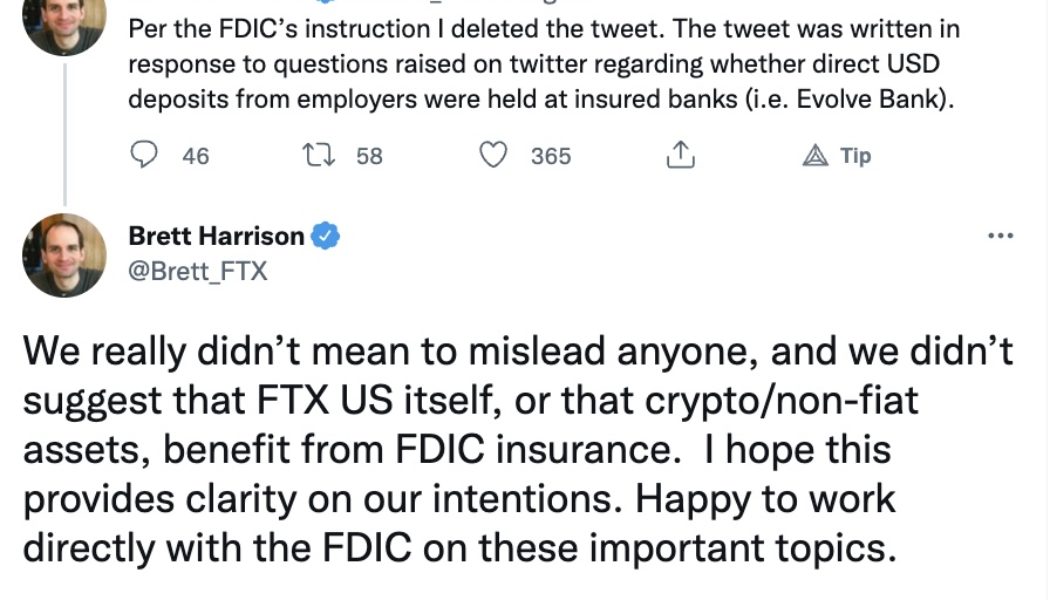

Regulators have a weak case against FTX on deposit insurance

In a cease-and-desist letter to fast-growing crypto exchange FTX, the Federal Deposit Insurance Corporation (FDIC) shed light on a now-deleted tweet from the exchange’s president, Brett Harrison, and issued a stark warning over the company’s messaging. Harrison’s original tweet said, “Direct deposits from employers to FTX US are stored in individually FDIC-insured bank accounts in the users’ names.” He added, “Stocks are held in FDIC-insured and SIPC [Security Investor Protection Corporation]-insured brokerage accounts.” Although Harrison stewarded FTX to its best-ever year in 2021, increasing revenue by 1,000%, the firm now faces the unenviable prospect of running afoul of a powerful government agency. In an attempt to clarify the situation to his 761,000 Twitter followers, Brett said, “C...

Korean financial watchdog to block tens of unregistered exchange websites

Unregistered cryptocurrency exchanges operating in South Korea could see their services grind to a halt as the Korea Financial Intelligence Unit (FIU) takes action against 16 foreign-based firms. The FIU has notified its investigative authority that 16 virtual asset service providers have been carrying out business without the necessary registrations. Major exchanges, including the likes of KuCoin, Poloniex and Phemex, were listed alongside 13 other exchanges that are set to be hamstrung by the FIU. All 16 exchanges have purportedly engaged in business activities targeting domestic consumers by offering Korean-language websites, running promotional events targeting Korean consumers and providing credit card payment options for cryptocurrency purchases. These activities all fall under the F...

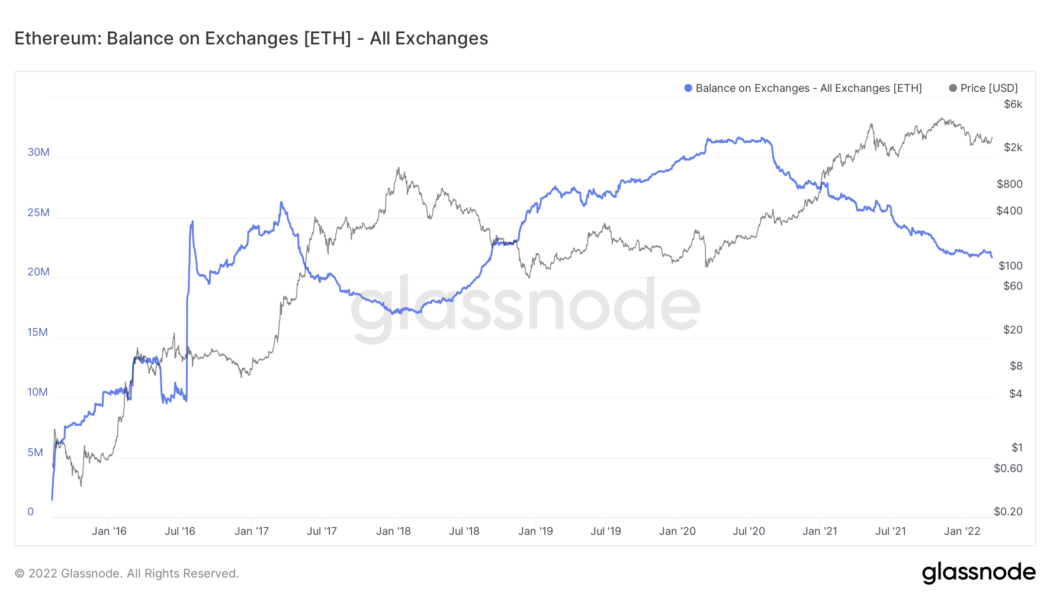

Ethereum balance on crypto exchanges falls to lowest levels since 2018

The amount of Ethereum‘s native token Ether (ETH) kept with crypto exchanges has fallen to its lowest levels since September 2018, signaling traders‘ intention to hold the tokens in hopes of a price rally in 2022. Notably, nearly 550,000 ETH — worth around $1.61 billion — have left centralized trading platforms year-to-date, according to data provided by Glassnode. The massive outflow has reduced the exchanges‘ net-Ether balance to 21.72 million ETH, down from its record high of 31.68 million ETH in June 2020. Ethereum balance on all exchanges as of March 18, 2022. Source: Glassnode Biggest weekly ETH outflow since October 2021 Interestingly, over 30% of all Ether‘s withdrawals from exchanges witnessed in 2022 appeared earlier this week, data from IntoTheBlock shows. In detail, over 180,00...