cryptocurrency exchange

Crypto Biz: $43T bank enters crypto — Probably nothing, right?

As crypto traders debate whether Bitcoin (BTC) is going to $25,000 or $15,000 first, the world’s largest financial institutions are laying the groundwork for mass adoption. The proverbial floodgates are unlikely to open before the United States provides a clear regulatory framework for crypto, but regulators and industry insiders are confident that guidance could come in 2023 at the earliest. In the meantime, megabanks like BNY Mellon, whose roots date back to 1784, are entering the space. This week’s Crypto Biz chronicles BNY Mellon’s foray into digital assets, JPMorgan’s ongoing experimentation with blockchain technology and Crypto.com’s new European headquarters. BNY Mellon, America’s oldest bank, launches crypto services Arguably the biggest story of the week was news of another ...

Russia blocks OKX website for alleged unreliable financial information: Reports

The website of crypto exchange OKX was blocked in Russia by the state media monitoring service Roskomnadzor on Oct. 4. The agency told the TASS news agency that the website was blocked at “the request of the Prosecutor General’s Office for the dissemination of unreliable socially significant information of a financial nature.” Roskomnadzor told local news outlet RBC that OKX had “published information related to the activities of financial pyramids, as well as information on the provision of financial services by persons who do not have the right to provide them” under Russian law. Although the website is blocked in Russia, it remains freely accessible through a VPN. According to another local report, the administration of the OKX Russian-language Discord channel stated, “We do not r...

Binance launches New Zealand-based offices following regulatory approval

Global cryptocurrency exchange Binance has registered with New Zealand’s Ministry of Business, Innovation and Employment and opened local offices in the country. In a Sept. 29 tweet, Binance said it was registered as a financial service provider in New Zealand, allowing residents to access services including spot trading, nonfungible tokens and staking. The move to the crypto-friendly Pacific nation followed regulators in Dubai, Abu Dhabi, Kazakhstan and Italy giving the green light for Binance to open an offshoot. “New Zealand is an exciting market with a strong history of fintech innovation,” said Binance CEO Changpeng Zhao. New Zealand! We are kiwis. https://t.co/UtxbVlvXFV — CZ Binance (@cz_binance) September 30, 2022 New Zealand lawmakers and regulators have largely not imposed strict...

Crypto Biz: The Voyager Digital auction is over — What now?

Voyager Digital filed for Chapter 11 bankruptcy in July after its exposure to the toxic Three Arrows Capital led to its ultimate downfall. This week, rumblings of a Voyager Digital auction surfaced, with Cointelegraph breaking the story on the afternoon of Sept. 26 after a reputable source confirmed the parties involved. A few hours later, a winner was announced: crypto exchange FTX US. But, not everyone is convinced that Voyager’s depositors will be taken care of. This week’s Crypto Biz chronicles the bidders involved in the Voyager Digital auction. It also documents the resignation of a disgruntled crypto boss and major funding plans from a blockchain-focused hedge fund. FTX US wins auction for Voyager Digital’s assets Cointelegraph reported this week that crypto exchanges FTX, Binance a...

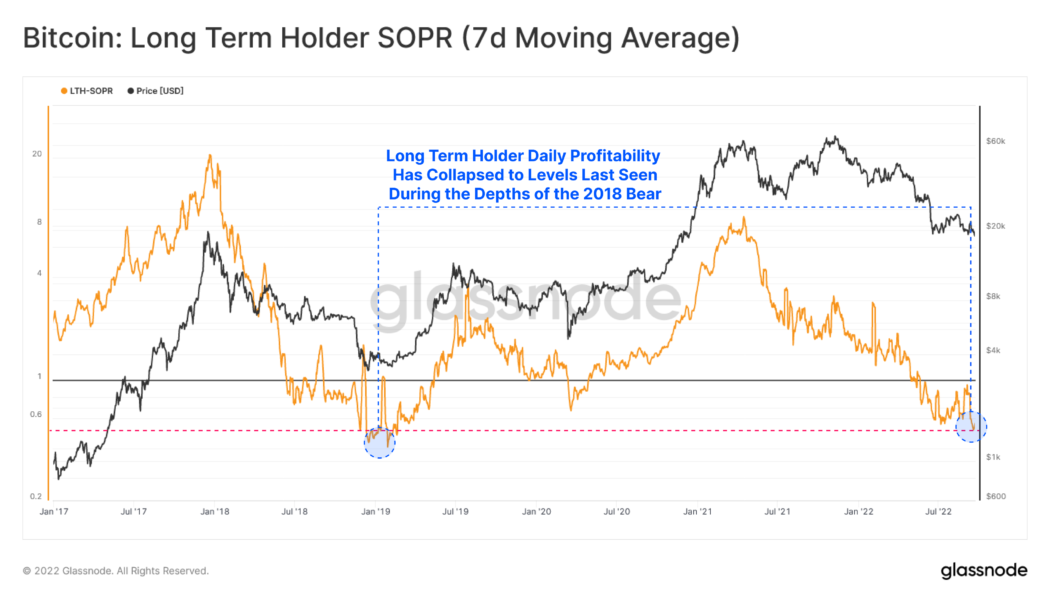

Bitcoin profitability for long-term holders decline to 4-year low: Data

Bitcoin’s (BTC) long-term profitability has declined to levels last seen during the previous bear market in December 2018. According to data shared by crypto analytic firm Glassnode, BTC holders are selling their tokens at an average loss of 42%. Bitcoin long term holders. Source: Glassnode The Glassnode data indicate that long-term holders of the top cryptocurrency selling their tokens have a cost basis of $32,000, meaning the average buying price for these holders selling their stack is above $30,000. The current market downturn added to the declining profitability can be attributed to several macroeconomic factors. The BTC market still has a heavy correlation with the stock market, especially tech stocks, which are currently seeing an even bigger downtrend than crypto. The rising inflat...

FTX reportedly considers bailing out Celsius via asset bid

Crypto exchange FTX, led by crypto billionaire Sam Bankman-Fried (SBF), is reportedly considering bailing out Celsius Network by bidding on the bankrupt lender’s assets. Coincidently, the information came out the same day Alex Mashinsky resigned as the CEO of Celsius. “I regret that my continued role as CEO has become an increasing distraction, and I am very sorry about the difficult financial circumstances members of our community are facing,” said Mashinsky while explaining his decision. For FTX, acquiring the assets of Celsius would imply the exchange’s intent to save the lending firm, similar to what FTX US did for Voyager by securing the winning bid of approximately $1.4 billion. Bloomberg reported on FTX’s interest in Celsius Network based on insights from a person familiar wit...

FTX, Binance and CrossTower are competing to buy Voyager Digital assets: Source

Cryptocurrency exchanges FTX, Binance and CrossTower are competing to acquire beleaguered crypto lender Voyager Digital’s assets out of bankruptcy, according to insider sources. According to details published by former investment banker and angel investor Simon Dixon, the three exchanges are competing in an auction to acquire Voyager Digital, and have each proposed their own terms and conditions for the acquisition. The details, which were also posted to Reddit, suggested that FTX and Binance have each proposed roughly $50 million in cash for Voyager’s assets, though Binance’s dollar amount is higher. The cash amount would go toward “deficiency and other claims,” the source said. IF THEY WANT YOU TO TAKE THE HIT PUSH FOR EQUITY TO FILL THE HOLE: https://t.co/ThslVDktYY – LATEST...

Coinsquare acquires publicly traded crypto exchange CoinSmart

Canada’s crypto exchange landscape appears to be consolidating after Coinsquare, one of the largest digital asset trading platforms in the country, acquired CoinSmart for an undisclosed amount. On Thursday, Coinsquare announced that it had entered into a definitive agreement to purchase all issued and outstanding shares of CoinSmart’s wholly-owned subsidiary Simply Digital. Once the deal becomes final, CoinSmart will hold a roughly 12% ownership stake in Coinsquare on a pro-forma basis. Shares of the CoinSmart crypto exchange, which trade on the NEO Exchange, were up 67% on Friday, largely in response to the news. The acquisition makes Coinsquare one of Canada’s largest crypto exchanges and expands its operational and business capabilities. Founded in 2014, Coinsquare has expanded it...

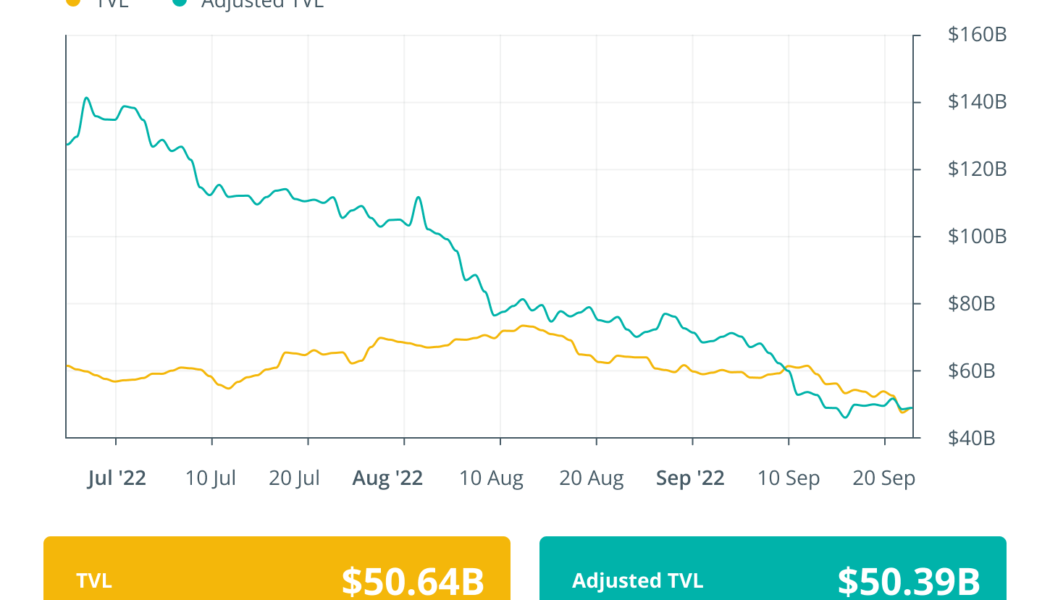

Tornado Cash saga left a void, says Chainalysis chief scientist: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. Chainalysis chief scientist shared his views on the Tornado Cash saga and said that the incident has left a void for illicit fund mixing services, but the real impact of the sanctions could be determined in the long run. The staking ecosystem of Ethereum post Merge could have a significant impact on the crypto economy, according to a new report. Institutional lending platform Mapple Finance launched a $300 million lending pool for Bitcoin mining farms. The Tribe DAO, a decentralized autonomous organization, voted in favor of repaying affected users of the $80 million exploit on DeFi platform Rari Capital’s liquidi...

Moscow Exchange drafting bill on digital financial assets and securities trading: Report

The Moscow Exchange (MOEX) is drafting a bill to allow trading in digital financial assets (DFAs) and securities based on them, according to a report in the Russian press. The stock exchange is writing the bill on the behalf of the Russian Central Bank, which does not have the power to introduce legislation, Vedomosti newspaper reported on Thursday. Speaking at a banking conference, MOEX supervisory board chair Sergei Shvetsov said the bill in preparation foresees trading in both DFAs and DFA certificates that would trade like securities. “The exchange and its subsidiaries will apply to the regulator and I hope that they will receive the status of exchange operators” to trade in DFAs, Shvetsov said. He added: “We want the market to make its own choice between blockchain accounti...

Blurring the line between crypto and TradFi could redefine global finance

Despite the current struggle in the global economy, the gap between traditional finance (TradFi) and crypto seems to be closing with each passing day. For example, earlier this month, Vienna-based fintech unicorn Bitpanda announced that it was adding commodities to its list of investment options, thus allowing investors to rake in profits from short-term price fluctuations related to traditional instruments such as oil, natural gas and wheat. In a recent interview with Cointelegraph, the company’s CEO, Eric Demuth, noted that the bear market had had no major impact on investor demand. He claims that more people are now looking for solutions that can bring the world of TradFi and decentralized finance (DeFi) together. Not only that, there are lessons to be learned about what works out...