cryptocurrency exchange

Coinbase Wallet will stop supporting BCH, ETC, XLM and XRP, citing ‘low usage’

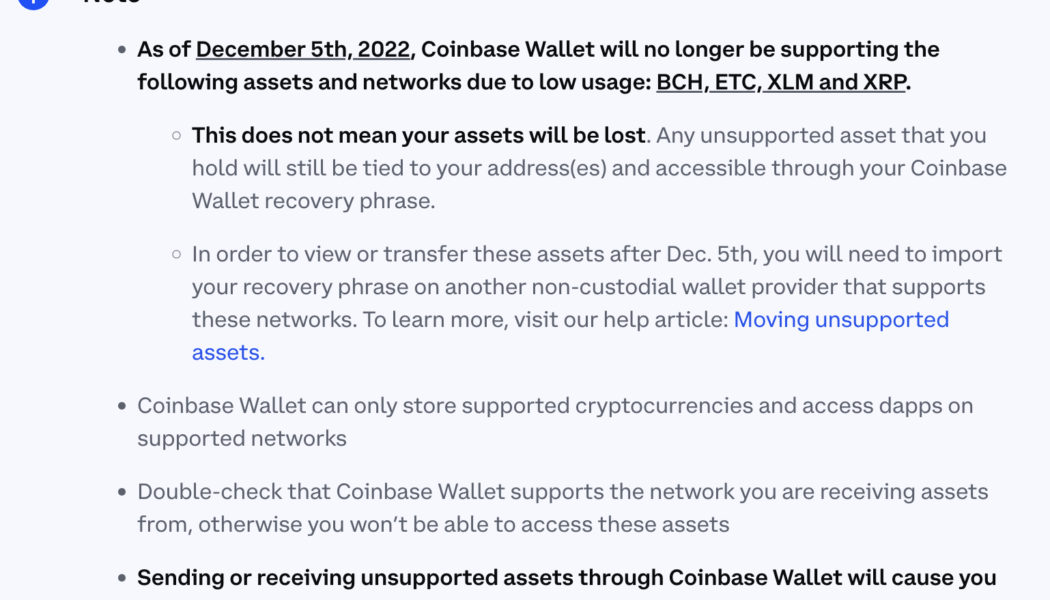

Starting on Dec. 5, the Coinbase Wallet will no longer support four major tokens. In a Nov. 29 notice on its help pages, Coinbase said the wallet will no longer support Bitcoin Cash (BCH), XRP (XRP), Ethereum Classic (ETC), and Stellar (XLM) as well as their networks. The crypto firm cited “low usage” of the four tokens in its decision to stop support starting on Dec. 5. “This does not mean your assets will be lost,” said the announcement. “Any unsupported asset that you hold will still be tied to your address(es) and accessible through your Coinbase Wallet recovery phrase.” Source: Coinbase This story is developing and will be updated. [flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=&...

Trouble in the Bahamas following FTX collapse: Report

Following the collapse of crypto exchange FTX, which was headquartered in the island country of Bahamas, Bahamians are reportedly still trying to find a way to make sense of everything, while remaining optimistic about the future. According to a report by the Wall Street Journal, the island country — which had encouraged cryptocurrency companies to feel at home with their “copacetic regulatory touch” — has been rocked by the implosion of FTX. The Bahamas was hard hit by Hurricane Dorian in 2019 and the pandemic shortly afterward in 2020 and was already struggling to find ways to strengthen its economy, which relies heavily on tourism and offshore banking for a bulk of its gross domestic product. It appeared that the prime minister of the Bahamas, Philip Davis, and his gover...

How bad is the current state of crypto? On-chain analyst explains

Despite the market downturn and the widespread negative sentiment in the industry in the wake of the FTX collapse, on-chain data still show reasons to be bullish on Bitcoin (BTC). As pointed out by on-chain analyst Will Clemente, it’s enough to look at the positions of long-term holders, which reached an all-time high despite their profitability being at an all-time low. “Long-term holders buy heavily into the bear market. They set the floor, […] and then those long-term holders distribute their holdings to new market participants in the bull market,” he told Cointelegraph in an exclusive interview. Another positive trend worth noticing after the FTX collapse, in Clemente’s opinion, is that the average crypto user is increasingly turning away from exchanges and taking self-cust...

Uzbekistan issues first crypto licenses to two local ‘crypto stores’

As Uzbekistan prepares to adopt a new cryptocurrency framework in 2023, Uzbek regulators have started issuing regulatory approvals to local crypto service providers. The National Agency for Perspective Projects (NAPP), Uzbekistan’s major cryptocurrency market watchdog, has issued the nation’s first crypto licenses, according to an official announcement released on Nov. 17. The licenses officially authorize the offering of cryptocurrency-related services by two “cryptocurrency stores,” including Crypto Trade NET LLC and Crypto Market LLC. According to the information from the NAPP’s electronic license register, both Crypto Trade NET and Crypto Market are based in Tashkent. The data also refers to Kamolitdin Nuritdinov as Crypto Market’s single founder and shareholder. Behzod Achilov is...

Uzbekistan issues first crypto licenses to two local ‘crypto stores’

As Uzbekistan prepares to adopt a new cryptocurrency framework in 2023, Uzbek regulators have started issuing regulatory approvals to local crypto service providers. The National Agency for Perspective Projects (NAPP), Uzbekistan’s major cryptocurrency market watchdog, has issued the nation’s first crypto licenses, according to an official announcement released on Nov. 17. The licenses officially authorize the offering of cryptocurrency-related services by two “cryptocurrency stores,” including Crypto Trade NET LLC and Crypto Market LLC. According to the information from the NAPP’s electronic license register, both Crypto Trade NET and Crypto Market are based in Tashkent. The data also refers to Kamolitdin Nuritdinov as Crypto Market’s single founder and shareholder. Behzod Achilov is...

Bybit launches $100M support fund for institutional traders

Crypto derivatives exchange Bybit has launched a new support fund to help institutional traders access liquidity in the wake of the FTX collapse — an event that triggered a fresh wave of panic selling across the digital asset space. The support fund, valued at $100 million, is available to market makers and high-frequency trading institutions struggling with financial or operational difficulties following the collapse of FTX earlier this month, Bybit disclosed on Nov. 24. The funds will be distributed to eligible applicants at a 0% interest rate. To be eligible, institutional traders must be active on Bybit or other exchanges. The maximum amount distributed per applicant is $10 million and the funds must be used for spot and Tether (USDT) perpetual trading on Bybit. Once the second-largest...

OKX releases Proof of Reserves page, along with instructions on how to self-audit its reserves

Crypto exchange OKX has released a Proof of Reserves page that allows users to audit its reserves to make sure it is solvent. This comes at a time when crypto exchanges are coming under greater scrutiny after the collapse of FTX. OKX announced the new page in a tweet, as well as on its blog. Don’t trust, verify → OKX Proof of Reserves (PoR) is LIVE. To set a new standard of transparency, risk management and user protection, we’re launching our first PoR. You can now verify your assets are backed 1:1 on #OKX ⤵️ Details — OKX (@okx) November 23, 2022 The Proof of Reserves page offers two different options for users to audit the exchange’s reserves. The first allows users to get a brief summary of the exchange’s current reserves and liabilities for its top three cryptocurre...

Bitpanda secures crypto licence in Germany, claims to be the first “European retail” crypto investment platform to do so

In an official blog post, Bitpanda announced that it has secured a crypto custody licence from the German financial authority, BaFin. Having obtained this licence, the Austrian-based crypto exchange can now legally market its services to residents of Germany. Bitpanda also claimed to be the first retail crypto exchange based out of Europe to have achieved this distinction. The collapse of the FTX crypto exchange has brought increased scrutiny to unregulated crypto exchanges that operate outside of a country’s jurisdiction. For this reason, many exchanges are seeking to gain licences in multiple countries to prove that they are legitimate. This latest licence adds to the list of countries Bitpanda is officially regulated in, including Austria, the United Kingdom, Italy, the Czech Republic, ...

Crypto Twitter reacts to Binance CEO’s deleted tweet about Coinbase’s Bitcoin Holdings

Coinbase was trending on Twitter on Nov. 22 after Binance CEO Changpeng Zhao, known also as CZ, sent out a tweet that appeared to question Coinbase’s Bitcoin holdings. In the since deleted tweet, CZ referenced a yahoo finance article that alleged that “Coinbase Custody holds 635,000 BTC on behalf of Grayscale.” CZ added, “4 months ago, Coinbase (I assume exchange) has less than 600K,” with a link to a 4 month old article from Bitcoinist. The Binance CEO made it clear that he was simply quoting “news reports”, and not making any claims of his own. However, his tweet was not received well by the crypto community. A screenshot of CZ’s since-deleted tweet. Shortly after, Coinbase CEO Brian Armstrong indirectly responded to CZ in a series of tweets, stating; “If you see FUD ou...

Why is Bitcoin price down today?

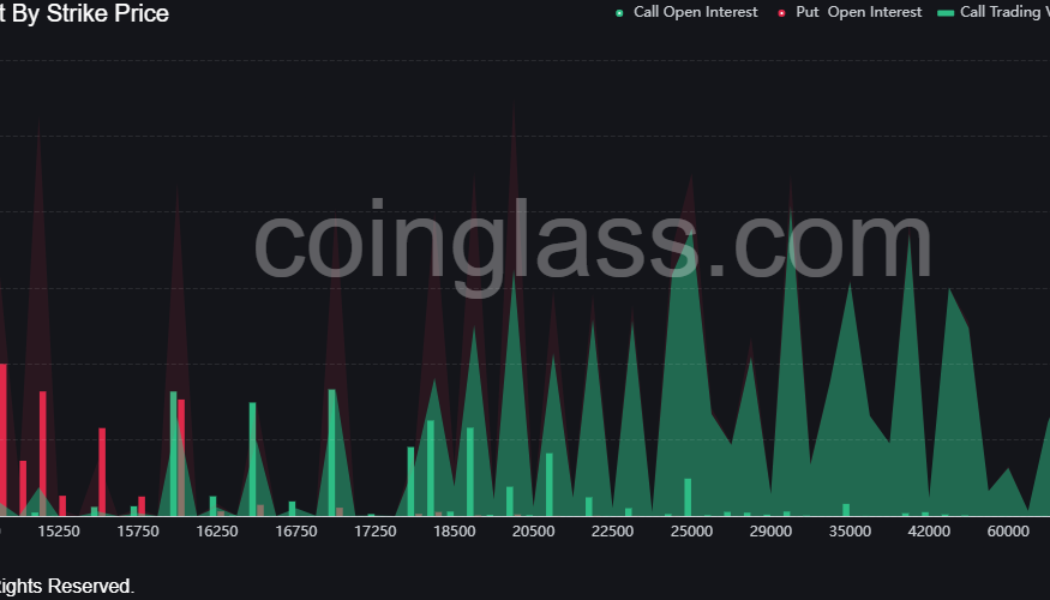

Bitcoin (BTC) price accelerated its sell-off on Nov. 21 to hit a new yearly low at $15,654. The move follows a market-wide decline that was catalyzed by investors running for the hills in fear that the FTX-induced contagion would infect every corner of the crypto sector. Stocks also closed the day in the red, with the tech-heavy Nasdaq down 1% and the S&P 500 losing 0.42% on the back of investors’ concerns about rising interest rates. Data from Coinglass shows over $100 million in leverage longs were liquidated on Nov. 20 and Nov. 21 as investors fear an accelerated sell-off if Digital Currency Group (DCG) and BlockFi fail to secure funding and are forced to declare bankruptcy. BTC open interest by strike price. Coinglass Some analysts are betting on Bitcoin price declining below...

FTX Japan plans to resume withdrawals by 2023: Report

Crypto exchange FTX’s subsidiary in Japan, FTX Japan, reportedly plans to resume withdrawals by the end of 2022. According to a Nov. 21 report from Japan-based news outlet NHK, FTX Japan has been making preparations to resume withdrawals. Japan’s Financial Services Agency, or FSA, requested the exchange suspend business orders on Nov. 10 prior to FTX Group declaring bankruptcy in the United States for more than 130 associated companies, including FTX Japan Holdings, FTX Japan, and FTX Japan Services. On Nov. 11, the FSA announced that it had taken administrative actions against FTX Japan amid reports its parent company was “facing credit uncertainties.” The orders required FTX Japan to suspend over-the-counter derivatives transactions and related margins as well as new deposits from users ...

FTX-owned Liquid exchange pauses all trading after withdrawal halt

Liquid has suspended all trading operations on its platform in line with instructions from FTX Trading, the firm announced on Twitter on Nov. 20. The statement indicates that Liquid exchange paused “all forms of trading” because of the operation of the Chapter 11 process in the Delaware courts. “We have since done so while we assess the situation. We are working through these issues and will endeavor to give a fuller update in due course,” Liquid added. Liquid’s operational halt comes five days after the exchange suspended all withdrawals on its platform, citing compliance with the requirements of voluntary Chapter 11 proceedings. Japan’s Financial Services Agency previously also requested another FTX’s local subsidiary, FTX Japan, to suspend business orders on Nov. 10. As previously repor...