cryptocurrency exchange

Cameron Winklevoss pens open letter to Barry Silbert about Gemini’s blocked funds

Jan. 2 “marks 47 days since Genesis halted withdrawals,” Cameron Winklevoss, co-founder of the cryptocurrency exchange Gemini, pointed out in an open letter to Barry Silbert, CEO of the Digital Currency Group — which owns Genesis. Winklevoss went on to make a blunt appraisal of DCG’s business practices. According to the letter Winklevoss posted on Twitter, Genesis owes Gemini $900 million for funds Gemini lent to it as part of the Gemini Earn program. “For the past six weeks, we have done everything we can to engage with you in a good faith and collaborative manner in order to reach a consensual resolution for you to pay back the $900 million that you owe,” Winklevoss wrote, adding: “Every time we ask you for tangible engagement, you hide behind lawyers, investment bankers, and process.” W...

Hong Kong brokers line up for SFC approval ahead of new virtual asset trading legislation

Financial services providers in Hong Kong are already taking the first steps to provide services to retail investors, according to local reports. Brokers and fund managers in the region have reportedly asked for advice on licensing requirements ahead of new legislation. Lawmakers in Hong Kong passed an amendment to the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO) in December 2022, which aligns with the region’s recent stance on broadening the possibility for crypto trading. The amendment introduces a new licensing scheme for virtual asset service providers, which will allow retail investors the ability to trade in virtual assets. Currently, virtual asset trading is restricted to professional investors or traders with proof of at least $1 million in bankable assets...

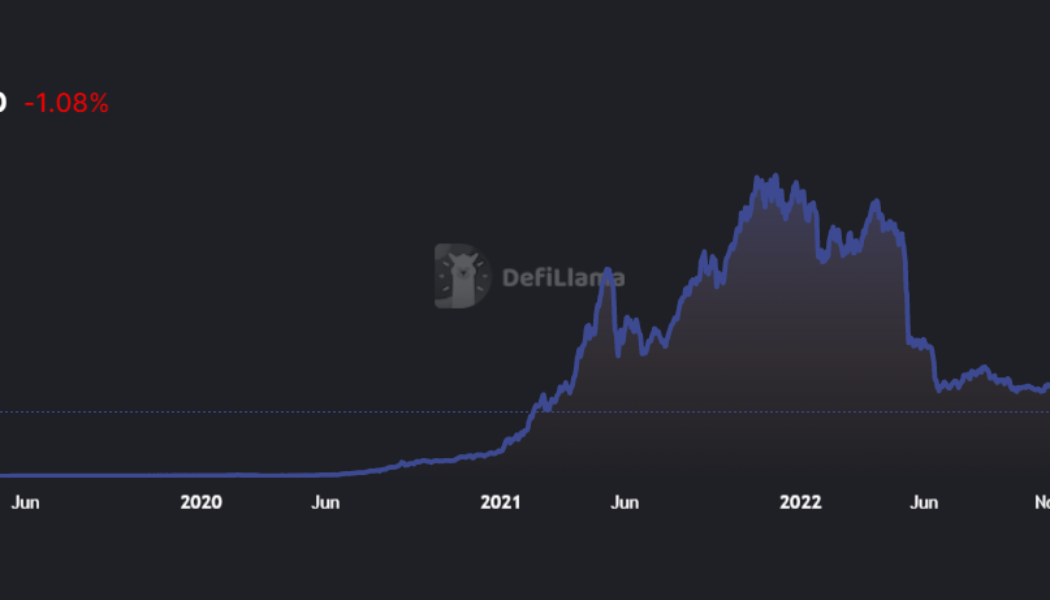

Top crypto funding stories of 2022

2022 was a watershed year for crypto venture capital, as investors poured tens of billions of dollars into blockchain-focused startups despite the overwhelmingly bearish trend in asset prices. Is the VC-dominated crypto funding model good for the industry? Only time will tell. Cointelegraph Research is still in the process of tallying all the funding figures for the year, but 2022 easily outpaced all other years in terms of total capital raised and deals completed. VC inflows were above $14 billion in each of the first two quarters before receding to just under $5 billion in the third quarter — still an impressive tally given the industry-wide contagion sparked by the sudden collapses of Celsius, Three Arrows Capital, Genesis, BlockFi and FTX, among others. Against this backdrop, we’...

Proof of reserves is becoming more effective, but not all its challenges are technical

Proof of reserves (PoR) has gone from a buzzword to a roar in recent weeks as the crypto world tries to recover from the shock and losses of the current crypto winter. After a flurry of discussion and work, criteria and rankings for adequate PoR are beginning to appear, but the fine points of how to conduct proof of reserves, or even who should do it, remain open questions. The difference between proof of assets and proof of reserves was pointed out quickly, along with their deficiencies by themselves. Traditional auditors’ attempts at providing PoR were soon frustrated, with major firms stepping up and quickly retreating. I’m sorry but no. This is not PoR. This is either ignorance or intentional misrepresentation. The merkle tree is just hand wavey bullshit without an auditor to mak...

Bithumb’s largest shareholder executive found dead following allegations of embezzlement

Mr. Park Mo, the vice president of Vidente, the largest shareholder of South Korean Cryptocurrency exchange Bithumb,was reportedly found dead in front of his home at 4 am, on the morning of Dec. 30. Prior to his death, Mr. Mo had been named as a primary suspect in an investigation launched by South Korean prosecutors for his alleged involvement in the embezzling funds at Bithumb-related companies, as well as, manipulating stock prices. In October 2021, the Financial Investigation Division of the Seoul Southern District Prosecutor’s Office launched an investigation into allegations made against Mr. Park Mo, which led to the seizing of Bithumb-affiliated companies such as Vident, Inbiogen, and Bucket Studio. Vident, a KOSDAQ-listed company, is known to be Bithumb’s la...

Sam Bankman-Fried denies moving funds from Alameda wallets

Sam Bankman-Fried, the former CEO of the now-defunct FTX exchange, has denied moving funds tied to Alameda wallets, days after he was released on a $250 million bond. On Dec. 30, Fried tweeted to his 1.1 million followers, denying any involvement in the movement of funds from Alameda wallets. In response to the allegations that he may have been responsible for moving funds out of Alameda wallets, he shared: “None of these are me. I’m not and couldn’t be moving any of those funds; I don’t have access to them anymore.” None of these are me. I’m not and couldn’t be moving any of those funds; I don’t have access to them anymore.https://t.co/5Gkin30Ny5 — SBF (@SBF_FTX) December 30, 2022 SBF’s tweet was in response to a news story published by Coint...

Mark Cuban to Bill Maher: ‘If you have gold, you’re dumb as fuck… Just get Bitcoin.’

Arguments over whether gold or Bitcoin (BTC) is a better store of value continue to occur across the cryptocurrency space and in traditional investment circles. On the latest episode of Bill Maher’s Club Random podcast, which aired on Dec. 26, billionaire owner of the Dallas Mavericks Mark Cuban advocated for Bitcoin being a better store of value than gold. In response to Maher openly admitting that he is “rooting against Bitcoin,” Cuban chimed in with a cheeky agreement, remarking, “I want Bitcoin to go down a lot further so I can buy some more.” Cuban went on to offer some friendly chastisement to Maher, saying, “If you have gold, you’re dumb as fuck,” before encouraging him to “just get Bitcoin.” [embedded content] The two then discussed the pros and cons of both asset catego...

Near Project’s Octopus Network lays off 40% of its staff amid crypto winter

Octopus Network, a decentralized app chain network natively built on NEAR Protocol, has announced that it will be “refactoring” to adapt to current market conditions. As part of its refactoring process, Octopus network will let go of roughly 40% of its team, which accounts for 12 out of 30 members. The remaining staff will also be subjected to a 20% salary cut, while its team token incentive will be suspended indefinitely. According to Louis Liu, the founder of the Octopus Network, although he has lived through previous crypto winters, “this winter is very different from the others.” Liu said he anticipates that this current “crypto winter will last at least another year, perhaps much longer,” adding that “most Web3 startups will not survive.” To survive the crypto winter, the founde...

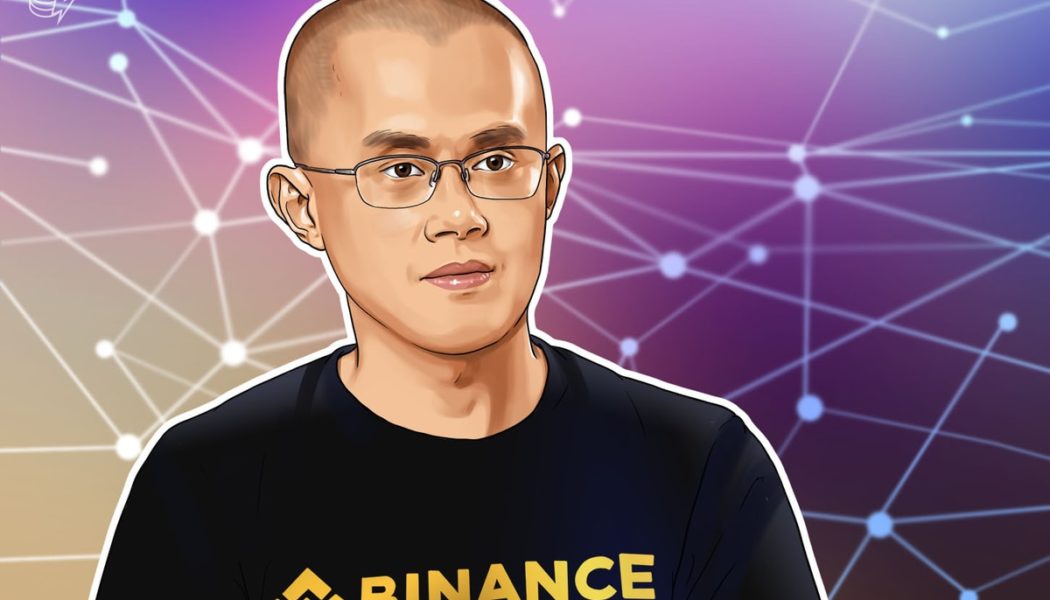

CZ addresses reasons behind Binance’s recent FUD

Binance CEO Changpeng “CZ” Zhao took to Twitter on Dec. 23 to share his perspective on the reasons behind the recent fear, uncertainty, and doubt (FUD) surrounding the crypto exchange. According to CZ in the thread, Binance’s FUD is primarily caused by external factors – not by the exchange itself. One of the reasons mentioned by the CEO was that part of the crypto community hates centralization. “Regardless if a CEX helps with crypto adoption at a faster rate, they just hate CEX,” he noted. CZ also pointed out that Binance has been seen as competition by many industry players, with increasingly lobbying against the exchange and “loaning sums of money to small media that’s worth many times the media outlet’s market value, including buying the...

Xmas dinner table: What to tell your family about what happened in crypto this year

After a lackluster rise of crypto in 2021, which saw many new crypto millionaires and several crypto startups attain unicorn status, came the dramatic fall in 2022. The industry was plagued by macroeconomic pressures, scandals and meltdowns that wiped out fortunes virtually overnight. As 2022 comes to a close, many crypto proponents are perplexed about the state of the industry, especially in light of the recent FTX collapse and the contagion it has caused, taking down several firms associated with it. Many who couldn’t stop talking about crypto and recommending their family to invest in it last year at Christmas dinner could see the tables turn this year, with them having a lot of explaining to do about the state of crypto today. While as awkward as that conversation is going to be,...

2 executives of crypto exchange AAX arrested in Hong Kong: Report

Hong Kong police arrested two executives of the crypto exchange AAX accused of fraud and misleading the police, according to local media reports. Weigao Capital CEO Liang Haoming and former AAX CEO Thor Chan were arrested on Dec. 23. Local authorities accused them of claiming there was “system maintenance” as an excuse to delay customers from withdrawing assets amid liquidity issues. One of the executives also allegedly lied to the police about the timeline of his activities in the company, deliberately misleading law enforcement. Two bank accounts of AAX as well as the executive’s bank accounts and properties have been frozen. A third executive reportedly fled overseas with an AAX wallet and private keys that police believe contain around $30 million in digital assets. His propertie...

U.S. delays crypto tax reporting rules, as it still can’t define what a ‘broker’ is

A key set of crypto tax reporting rules is being delayed until further notice under a decision made by the United States Treasury Department. The rules were supposed to be effective in the 2023 tax filing year, in accordance with the Infrastructure Investment and Jobs Act passed in November, 2021. The new law requires that the Internal Revenue Service (IRS) develop a standard definition of what a “cryptocurrency broker” is, and any business that falls under this definition is required to issue a Form 1099-B to every customer detailing their profits and losses from trades. It also requires these firms to provide this same information to the IRS so that it will be aware of customers’ incomes from trading. However, more than 12 months have passed since the infrastructure bill became law, but ...