cryptocurrency exchange

3 things the crypto sector must offer to truly mainstream with TradFi

In the past year, we’ve seen the crypto economy undergo exponential expansion as heaps of money poured into various cryptocurrencies, decentralized finance (DeFi), nonfungible tokens (NFT), crypto indices, insurance products and decentralized options markets. The total value locked (TVL) in the DeFi sector across all chains has grown from $18 billion at the beginning of 2021 to $240 billion in January 2022. With so much liquidity in the ecosystem, the crypto lending space has also grown a significant amount, from $60 million at the beginning of 2021 to over $400 million by January 2022. Despite the exponential growth and the innovation in DeFi products, the crypto lending market is still only limited to token-collateralized loans, i.e. pledge one cryptocurrency as collateral to borro...

Renewed interest in the Metaverse sends Decentraland (MANA) price 75% higher

The influence of blockchain technology on the ongoing digital revolution cannot be overstated as the rise of the Metaverse and the integration of virtual reality is transforming the way humans interact on a global scale. One project that is beginning to gain traction in its effort to bridge the old world with the new is Decentraland (MANA), a virtual reality (VR) ecosystem built on the Ethereum network that allows users to create, engage with and monetize digital content through a variety of interactive experiences. Data from Cointelegraph Markets Pro and TradingView shows that over the past two weeks, the price of MANA has climbed 70% from a low of $1.70 on Jan. 22 to a daily high of $2.90 on Feb. 1 as the wider crypto market struggled under bearish pressure. MANA/USDT 1-day chart. ...

3 reasons why Telos (TLOS) price hit a new all-time high

It seems crypto winter is upon us and during times like these, projects that continue to forge ahead by focusing on development and expansion are often rewarded by traders who are looking to set up long positions where strong fundamentals trump the absence of short-term gains. One project that has weathered the storm in the crypto markets to establish a new all-time high is Telos (TLOS), a blockchain network created with the EOSIO software that aims to bring speed and scalability to smart contracts for decentralized finance (DeFi), nonfungible tokens (NFTs), gaming and social media. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $0.42 on Jan. 10, the price of TLOS has soared 229% to a new high of $1.39 thanks in part to a record-high trading volume of...

Bitcoin price dips below $37K as a descending channel pattern comes back into play

The crypto market is once again in the red on Feb. 2 as global financial markets continue to see increased volatility. Data from Cointelegraph Markets Pro and TradingView shows that after spending the morning hovering around $38,200, BTC was hit with a wave of selling that pushed the price to $36,800. BTC/USDT 1-day chart. Source: TradingView Here is what several analysts and traders are saying about Wednesday’s Bitcoin price action and what areas to keep an eye on moving forward. Bulls are in trouble below $36,700 Insight into the major support and resistance zones of note for Bitcoin was provided by crypto trader and pseudonymous Twitter user ‘HornHairs’, who posted the following chart indicating a solid level of support near $37,400. BTC/USDT 1-hour chart. Source: Twitter Ac...

Altcoin Roundup: Cross-chain bridge tokens moon as crypto shifts toward interoperability

Interoperability is shaping up to be one of the main themes for the cryptocurrency market in 2022 as projects across the ecosystem unveil integrations that make their networks Ethereum (ETH) Virtual Machine (EVM) compatible. While this has been one of the long-term goals of the ecosystem as a step on the path to an interconnected network of protocols, it has also created a new decentralized finance (DeFi) market for multi-chain bridges and decentralized finance. Here are three of the top volume cross-chain bridges that the cryptocurrency community uses to transfer assets between blockchain networks. Multichain Multichain (MULTI), formerly known as Anyswap, is a cross-chain router protocol that aims to become the go-to router for the emerging Web3 ecosystem. According to data from Defi Llam...

Reuters: Binance was withholding information from regulators, repeatedly shunned own compliance department

In a report published on Friday, Reuters laid out the findings of its investigation into the regulatory compliance practices of Binance, the world’s largest cryptocurrency exchange by trading volume. The authors suggest the existence of a recurring pattern whereby the company’s CEO Changpeng Zhao, while proclaiming its openness to government oversight, ran an organization that systematically denied regulators’ requests for financial and corporate structure information and shirked proper client background checks. The reported findings are based on the accounts of Binance’s former senior employees and advisers, as well as the review of documents such as internal correspondence and confidential messages between several national regulators and the company. According to the document, several hi...

Former Binance US CEO Catherine Coley is still missing, and no one seems to be talking

Around the time Binance.US announced former Comptroller of the Currency Brian Brooks would be leading the crypto exchange, former CEO Catherine Coley effectively dropped off the face of the digital world. Coley, who had regularly posted updates on Binance.US and her personal life to her Twitter account, has been inactive on the social media platform since April 19. Her job experience on LinkedIn ends with her two years as CEO of Binance.US, which she left in June 2021, and her online silence has led at least one news outlet to reach out to San Francisco authorities to determine if she had been reported missing — as of October, the answer was “no.” Major figures in crypto also noticed the absence of Coley. Ripple chief technology officer David Schwartz said in July that the former Binance.U...

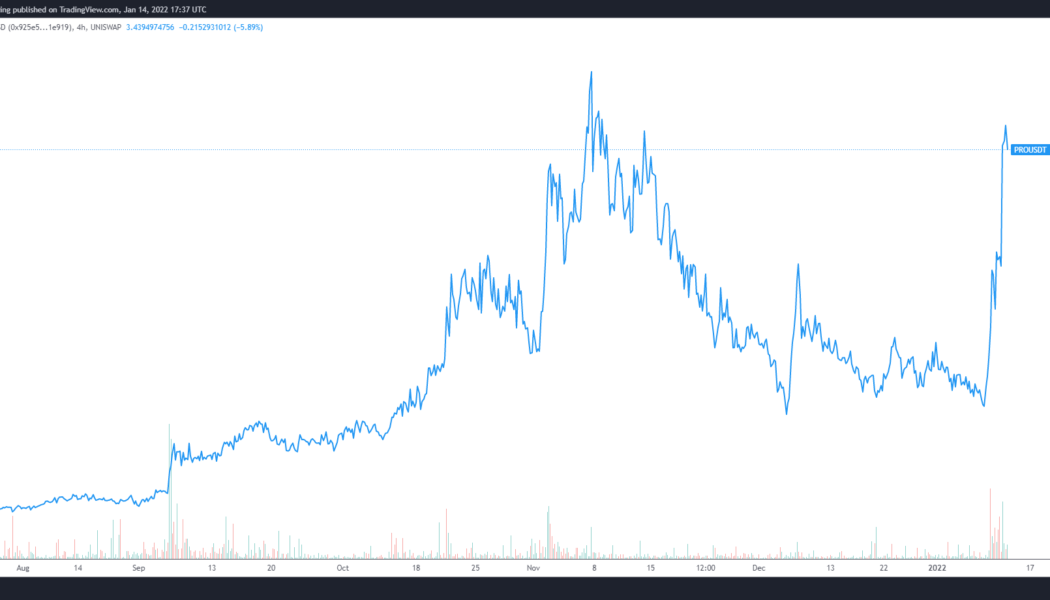

Propy rallies 227% as real estate NFTs become reality and PRO lists at Coinbase

Nonfungible tokens (NFTs) skyrocketed in popularity over the course of 2021 as the wider public became enthralled with projects like the Bored Ape Yacht Club and CryptoPunks, but these one-of-a-kind digital images are only scratching the surface of what NFT technology is capable of. One project focused on expanding the functionality of NFTs beyond the digital art space is Propy, a protocol focused on the integration of blockchain technology with the real estate sector by automating the closing process of home buying to make the entire process faster, simpler and more secure. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $1.12 on Jan. 12, the price of PRO moved 227% higher to hit a daily high at $3.67 on Jan. 14 as its 24-hour trading volume spi...

3 reasons why Harmony (ONE) rallied back to its all-time high this week

Bitcoin price is still a ways from its $69,000 all-time high but this isn’t stopping altcoins from moving toward new highs. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $0.13 on Dec. 4, the price of Harmony (ONE) has risen 163% to establish a new all-time high of $0.38 on Jan. 14 ONE/USDT 1-day chart. Source: TradingView Three reasons for the growing strength of Harmony include an expanding ecosystem, the launch of multiple cross-chain bridges and developers interest in finding Ethereum network alternatives. ONE benefits from Harmony’s $300 million ecosystem development fund One of the biggest boosts to the overall health of the Harmony ecosystem began back in September when the project launched a $300 million developer incentive p...

2021: A year of mass adoption for cryptocurrencies in Brazil

Throughout 2021, the Brazilian cryptocurrency market managed to distance itself from the police pages and finally win acceptance with the general public, whether in the financial market or even in the greatest national passion: soccer. Last year, Bitcoin (BTC) acted as a strong alternative to the Brazilian real that ended 2021 by breaking negative records and reaching a devaluation of 6.5% by December, making it the 38th worst currency in the world. In a year of ups and downs for Bitcoin, the biggest cryptocurrency hit a bottom of 167,000 real in January and soared along with global markets to 355,000 real in May. Faced with Bitcoin’s dip, the BRL/BTC pair was stuck below 200,000 reals until August, when it began to rise to a new historic high of 367,000 real on Nov. 8. Faced with the need...

Bitfinex advises Ontario-based users to close accounts before March 1

In a Friday announcement, Bitfinex said it would be immediately closing the accounts for Ontario-based customers who have no balances on the platform. In addition, it planned to restrict access to those who do not have open positions in the exchange’s peer-to-peer financing market or open margin positions. Users who have balances or open positions on Bitfinex and are one of the roughly 15 million residents of Ontario — which includes Toronto and the nation’s capital city of Ottawa — “will no longer have access to any services” starting on March 1. The exchange advised customers to withdraw funds before the effective date. Though Bitfinex did not mention the Ontario Securities Commission, or OSC, the region’s financial watchdog has been responsible for cracking down on crypto exchange...

Japan-based crypto exchange DeCurret plans to sell to HK’s Amber Group: report

The holding company behind DeCurret, the Japan-based company offering trading and exchanges of digital assets, reportedly plans to sell its crypto business to investment platform Amber Group. According to a Wednesday report from the Nikkei newspaper, DeCurret Holdings intends to sell the crypto branch of its business to the Hong Kong-based company Amber Group in February. Though the details of the acquisition are unclear, the news outlet reported that the sale price would be in the millions of dollars. DeCurret established a new business structure in December 2021, launching a holding company, DeCurret Holdings, and separating its digital currency and crypto business into separate subsidiaries. Under the proposed arrangement, DeCurret Inc. will represent the company’s crypto exchange busin...