cryptocurrency exchange

Winklevoss slams SEC charges against Gemini as ‘super lame… manufactured parking ticket’

Tyler Winklevoss, the co-founder of cryptocurrency exchange Gemini, has hit out at the regulator charging the exchange over issuing unregistered securities, calling the allegations “super lame” and a “manufactured parking ticket.” In a series of tweets on Jan. 12, Winklevoss shared his disappointment over the charges from the Securities and Exchange Commission (SEC) regarding Gemini’s “Earn” program, claiming the regulator was “optimizing for political points.” He called the SEC’s action “totally counterproductive” and said Gemini had been discussing the Earn program with the regulator “for more than 17 months.” 2/ As a matter of background, the Earn program was regulated by the @NYDFS and we’ve been in discussions with the SEC about the Earn program for more than 17 months. Th...

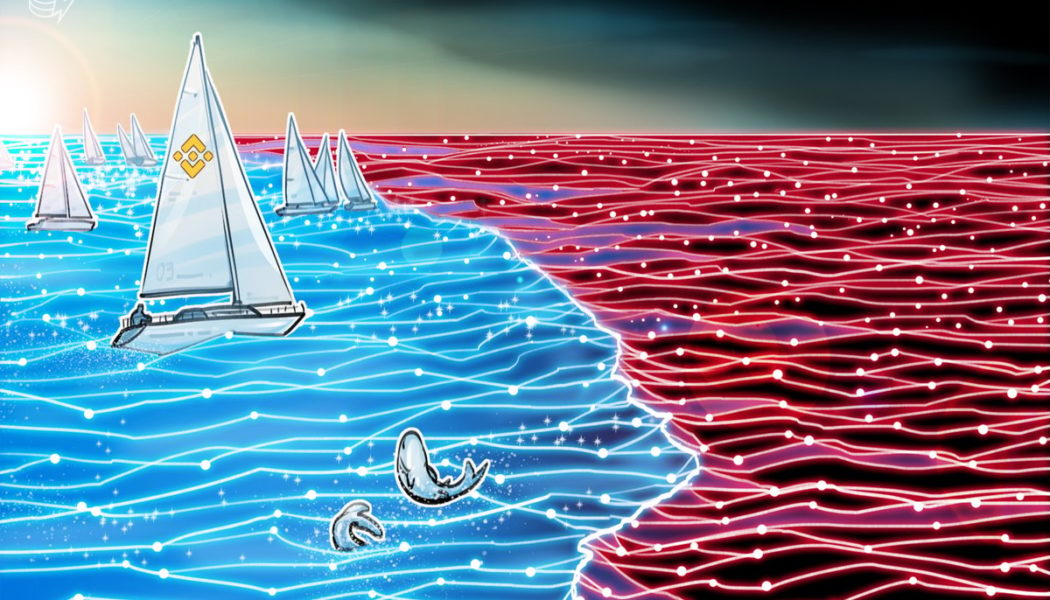

Binance approved to offer crypto services to Swedish customers

The Swedish Financial Supervisory Authority, one of the country’s financial regulatory agencies, has granted the local arm of crypto exchange Binance approval to manage and trade digital currencies. According to a Jan. 11 announcement, Binance said following “months of constructive engagement” with the financial regulator, the Swedish FSA granted Binance Nordics AB registration status on Jan. 10. This decision effectively allows Swedish residents to access Binance’s crypto services. “Sweden fully adopts EU laws and has further local requirements, so we have been careful to ensure that Binance Nordics AB has adopted risk and AML policies to match this exacting standard,” said Roy van Krimpen, Binance’s lead in the region. ”Our next big task will be the successful migration and launch ...

Crypto exchange Zipmex probed by Thai SEC amid buyout

The cryptocurrency exchange Zipmex is the focus of a new probe by the Securities and Exchange Commission (SEC) of Thailand for a breach of local rules. A Bloomberg report revealed that local authorities are looking into activities that they believe may violate business rules for digital asset service providers. This includes its offerings of certain digital asset products. According to the Thai SEC, Zipmex has until Jan. 12 to clarify whether it has been functioning as a “digital asset fund manager without permission” in Thailand. If true, the firm would have needed to obtain a permit before conducting business in the country. Cast your vote now! Zipmex is currently in the process of being acquired by V Ventures, a subsidiary of Thoresen Thai Agencies PCL, for around $100 million.&nb...

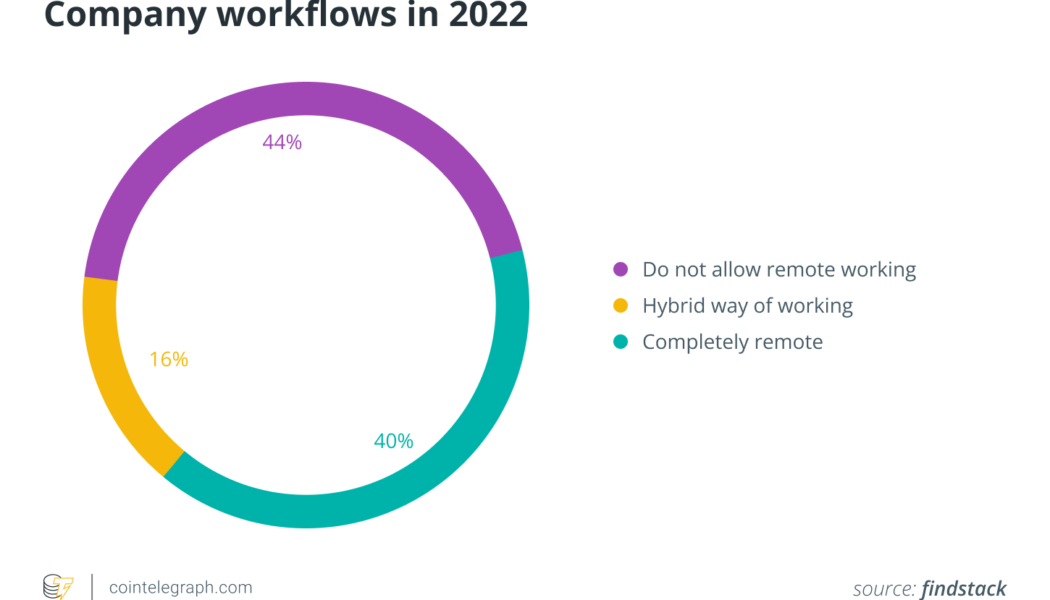

Remote work could redefine the global workforce for good

As the global economy continues to reel from the devastation caused by the COVID-19 pandemic, there is increasing data suggesting that more and more people are now favoring a remote work-based lifestyle. In this regard, a survey sample of working United States citizens shows that Millennial and Generation Z workers prefer joining a remote workforce and decentralized autonomous organizations (DAOs) as opposed to going to an office. As part of the study, more than 1,100 U.S. citizens were asked to provide their preferences regarding remote work and the emergence of DAOs in recent years. Using research pertaining to DAOs published by the Harvard Law School, the survey showed how DAOs have seen their coffers grow from a respectable $400 million to a whopping $16 billion over the course of 2021...

Crypto layoffs mount as exchanges continue to be ravaged by the prevailing bear market

There’s no denying that the crypto market has been gripped by immense bearish pressure over the past year, as made evident by the fact that the total capitalization of this sector has continued to hover below the $900 billion mark for most of the year after having scaled up to an all-time high of $3 trillion in 2021. These conditions have been characterized by many companies facing insolvency, as well as many of the world’s top exchanges laying off their staff in recent months. Moreover, the recent FTX debacle has set in motion a contagion effect that has continued to have a major effect on several crypto platforms, dissuading newer investors from entering the space in the process. Since Q2 2022, a host of prominent crypto entities (including many digital asset trading and lending platform...

Huobi net outflows crossed over 60M within the past 24 hours: Report

Cryptocurrency exchange Huobi has seen over $94.2 million dollars in net outflows within the past week. Within the past 24 hours alone, approximately $60 million has flowed out of the exchange, according to crypto analytics company Nansen. In the past 24 hours, Huobi has seen a significant increase in net outflows $60.9M* of the $94.2M* net outflow in the past week occurred in the past day alone *Contains Ethereum, Avalanche, BNB Chain, Fantom, & Polygon flows pic.twitter.com/JV1Tg13QMY — Nansen (@nansen_ai) January 6, 2023 Nansen also reported that a significant portion of withdrawals were in Tether (USDT), USD Coin (USDC), and Ether (ETH), from wallets with high balances. The significant increase in outflows from the exchange was allegedly triggered by rumors circulating on Twi...

Macroeconomic data points toward intensifying pain for crypto investors in 2023

Undoubtedly, 2022 was one of the worst years for Bitcoin (BTC) buyers, primarily because the asset’s price dropped by 65%. While there were some explicit reasons for the drop, such as the LUNA-UST crash in May and the FTX implosion in November, the most important reason was the U.S. Federal Reserve policy of tapering and raising interest rates. Bitcoin’s price had dropped 50% from its peak to lows of $33,100 before the LUNA-UST crash, thanks to the Fed rate hikes. The first significant drop in Bitcoin’s price was due to growing market uncertainty around potential rate hike rumors in November 2021. By January 2022, the stock market had already started showing cracks due to the increasing pressure of imminent tapering, which also negatively impacted crypto prices. BTC/USD daily price chart. ...

$3.9 billion lost in the cryptocurrency market in 2022: Report

Immunefi, a bug bounty and security services platform for the Web3 ecosystem, published a report on Jan. 6 revealing that the crypto industry lost a total of 3.9 billion dollars in 2022. According to the report, hacks were found to be the main cause of the losses, accounting for 95.6% of the total, with fraud, scams, and rug pulls comprising the remaining 4.4%. Immunefi also found that decentralized finance (DeFi) was the most targeted sector, suffering 80.5% in losses, compared to centralized finance (CeFi) which suffered a loss of 19.5%. According to the report: “DeFi has suffered $3,180,023,103 in total losses in 2022, across 155 incidents. This number represents a 56.2% increase compared to 2021, when DeFi lost $2,036,015,896, in 107 incidents.” BNB and Ethereum were the mos...

Binance joins association to address compliance with global sanctions

Binance has become one of the first crypto firms to join the Association of Certified Sanctions Specialists, orACSS, in an effort to stay in compliance with global sanctions. In a Jan. 6 announcement, Binance said its team of sanctions compliance personnel would be undergoing training as part of the certification process at ACSS. According to the association’s website, the group offered an examination addressing “knowledge and skills common to all sanctions professionals in varied employment settings.” “The blockchain industry is still in its early years, and it’s our priority to continue upholding the highest level of compliance amid a fast-evolving space,” said Binance’s global head of sanctions, Chagri Poyraz. “At the end of the day, we want to continue setting the industry standard for...

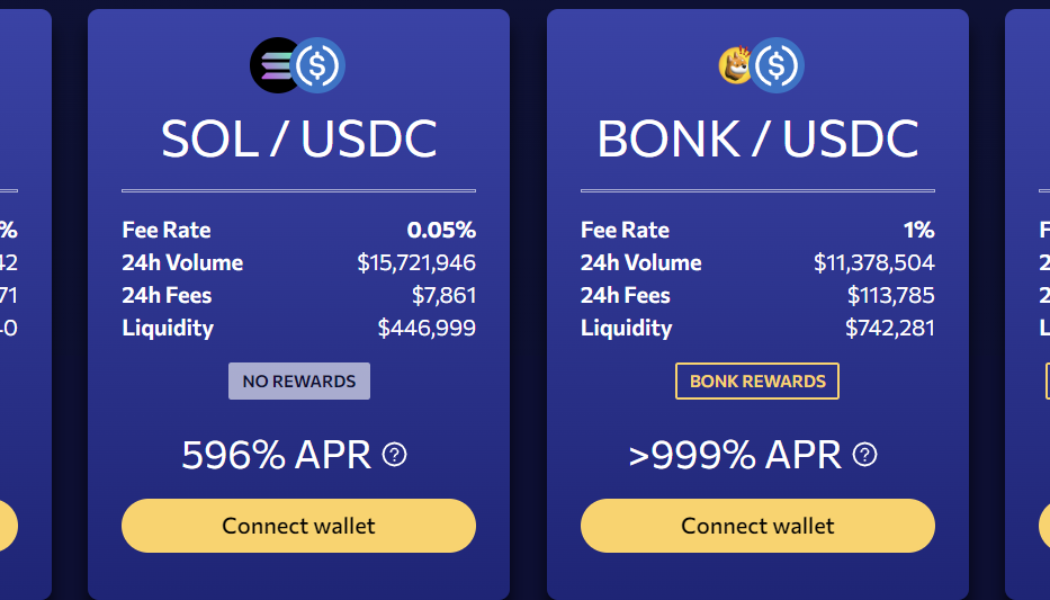

Bonk token goes bonkers as traders chase after high yields in the Solana ecosystem

Bonk, a meme token modeled after Shiba Inu (SHIB) that launched on Dec. 25, is skyrocketing and some traders believe the token’s trading volume is potentially driving Solana’s (SOL) price up. Over the past 48 hours, SOL price has gained 34%, and in the past 24 hours, Bonk has climbed 117%, according to data from CoinMarketCap. While the wider crypto market remains suppressed, traders are hoping that Bonk could present new opportunities during the downturn. According to the project’s website, Bonk is the first dog token on the Solana blockchain. Initially, 50% of the token supply was airdropped to Solana users with a mission to remove toxic Alameda-styled token economics. The airdrop resulted in more than $20 million in trading volume according to the Solana decentralized exchange Orc...

Coinbase agrees to $100M settlement with NY regulator

The New York State Department of Financial Services, or NYDFS, has reached an agreement with Coinbase following an investigation into the cryptocurrency exchange’s compliance program. In a Jan. 4 announcement, the NYDFS said Coinbase will pay a $50-million fine in response to violations of New York’s financial services and banking laws, as well as invest $50 million to correct its compliance program. According to the financial regulator, the crypto exchange had many compliance “deficiencies” related to anti-money laundering (AML) requirements. The NYDFS reported issues with Coinbase’s process for onboarding users and monitoring transactions. “Coinbase has acknowledged its failures in this respect to the Department,” said the NYDFS. “Furthermore, certain of these issues have been known to C...

Bithumb former chair Lee Jung-Hoon acquitted in the first instance

Lee Jung-hoon, the former chair of the South Korean cryptocurrency exchange Bithumb, was found not guilty on Jan. 3 by the 34th Division of the Criminal Agreement of the Seoul Central District Court. Jung-Hoon was on trial under accusations of violating the Act on the Aggravated Punishment Of Specific Economic Crimes due to fraud. The case has been ongoing since October 2018, when the former chairman allegedly defrauded 100 billion won ($70 million) during negotiations for the acquisition of Bithumb from Kim Byung-gun, chairman of the cosmetic surgery company BK Group. Jung-hoon could’ve faced an 8-year sentence had he been found guilty. According to the local press, in its official response to the ruling, Bithumb said it respects the court’s decision. The exchange also clarified that it i...