cryptocurrency exchange

RUNE rally: A closer look at THORChain’s new synthetic assets

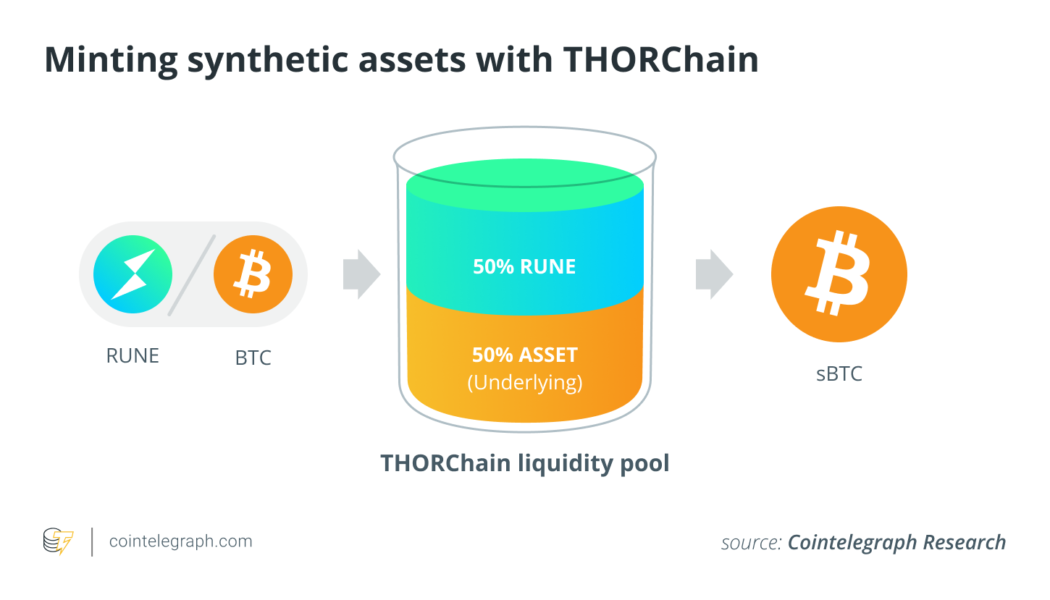

THORChain (RUNE) has appreciated nearly 41% in the past seven days, according to the data from Cointelegraph Markets Pro, and its recent price action is even leading the entire crypto market in the first quarter of 2021. Its mainnet launch, which was originally slated last year, is one of the main factors that led to its recent price surge. But, the other factor that provided added momentum is the integration of synthetic assets to its network. Why was this such a huge deal, and what are its implications for THORChain going forward? THORChain is often compared to Uniswap since it provides users a way for traders to swap different tokens. The only difference is THORChain lets users trade layer-1 coins in a decentralized manner, whereas Uniswap is limited to only the tokens that are of the E...

Tennis star Naomi Osaka becomes ambassador for crypto exchange FTX

Naomi Osaka, once one of the highest-ranked tennis players in the world, has become the latest figure in sports and entertainment to endorse crypto exchange FTX. In a Monday announcement, FTX said Osaka will be taking an equity stake in the exchange as well as receiving an undisclosed amount of cryptocurrency as compensation for her endorsement. According to the crypto exchange, the tennis star will be part of a “long-term partnership” aimed at bringing women into the space. “We have seen the statistics about how few women are part of crypto by comparison, which kind of mirrors the inequality we see in other financial markets,” said Osaka. “Cryptocurrencies started with the goal of being accessible to everyone and breaking down barriers to entry.” If @StephenCurry30 @TomB...

Fact or fiction? Did ApeCoin (APE) really drop by 80% since launch?

ApeCoin (APE), the governance token of the well-known Bored Ape Yacht Club (BAYC) NFT project was airdropped to BAYC and Mutant Ape Yacht Club (MAYC) owners at 8.30 am EST on March 17 and only eight hours after APE became tradable in the open market, it has already jumped to the 110th most traded token ranked by CoinGecko, totaling $900 million in trading volume across all tracked platforms. As one would expect, there were some volatile price movements minutes after the airdrop and headlines show the price of APE dropping 80% since its launch. This raises the question of whether the ordinary BAYC and MAYC owner could have sold APE at $40 instead of $14, which it is trading for at the time of publishing. Let’s take a look at APE’s price minutes after the airdrop was claimed and the token li...

Binance tells regulators it will cease operations in Ontario… for real this time

Binance confirmed in an undertaking to the Ontario Securities Commission, or OSC, in Canada dated Wednesday that the crypto exchange will cease activities involving Ontario residents. Binance will also stop opening new Ontario accounts, and provide fee waivers and reimbursements to certain Ontario users under the administration of a third party, the company said. The undertaking appears to mark the end of a disagreement that started in June when Binance announced that it would no longer service Ontario accounts and customers were advised to close out active positions by the end of the year. The month prior to Binance’s announcement, the OSC introduced a new prospectus and registration requirements for cryptocurrency exchanges. In December, Binance told investors that it was allowed t...

Altcoin Roundup: DeFi token prices are down, but utility is on the rise

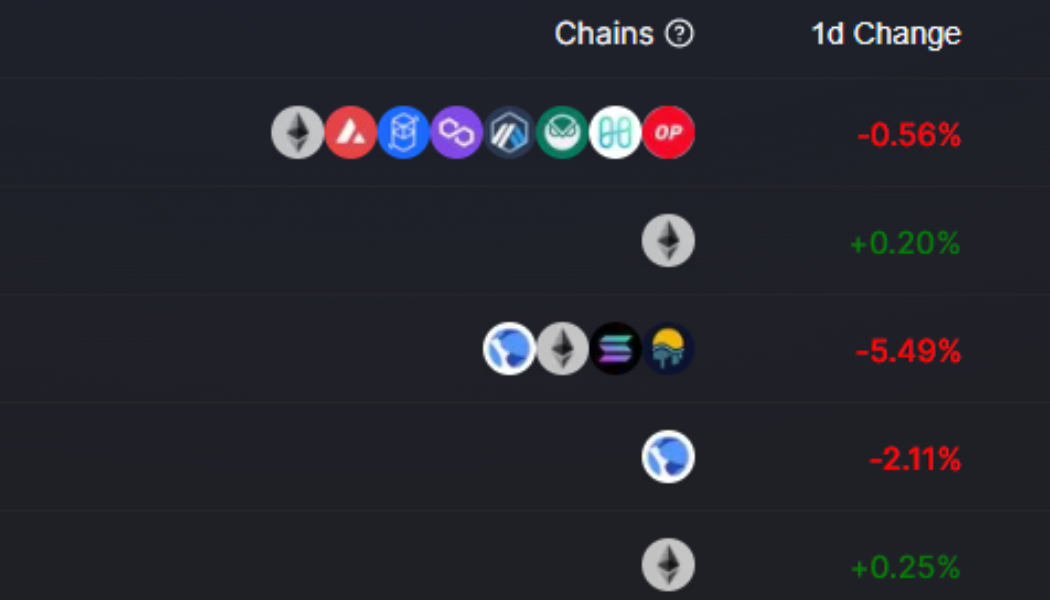

The decentralized finance (DeFi) sector has been sitting in the backseat since whipping up a frenzy in the summer of 2020 through the first quarter of 2021. Currently, investors are debating whether the crypto sector is in a bull or bear market, meaning, it’s a good time to check in on the state of DeFi and identify which protocols might be setting new trends. Here’s a look at the top-ranking DeFi protocols and a review of the strategies used by users of these protocols. Stablecoins are the foundation of DeFi Stablecoin-related DeFi protocols are the cornerstone of the DeFi ecosystem and Curve is till the go-to protocol when it comes to staking stalbecoins. Top 5 protocols by total value locked. Source: Defi Llama Data from Defi Llama shows four out of the top five protocols in terms of to...

Swiss crypto bank Sygnum secures in-principal approval in Singapore

Sygnum Singapore, a subsidiary of Switzerland-based cryptocurrency bank Sygnum, is expanding services after securing new regulatory approval from local authorities. The company announced Tuesday that Sygnum Singapore received in-principle approval from the Monetary Authority of Singapore (MAS) to offer three additional regulated activities under capital markets services (CMS) license. The CMS license was initially granted in 2019, allowing Sygnum Singapore to conduct asset management activities. The latest in-principle regulatory approval upgrades Sygnum Singapore to enable new tools like providing corporate finance advisory services, dealing with tokenized capital market products and digital assets, as well as offering custodial services for asset and security tokens. With the additional ...

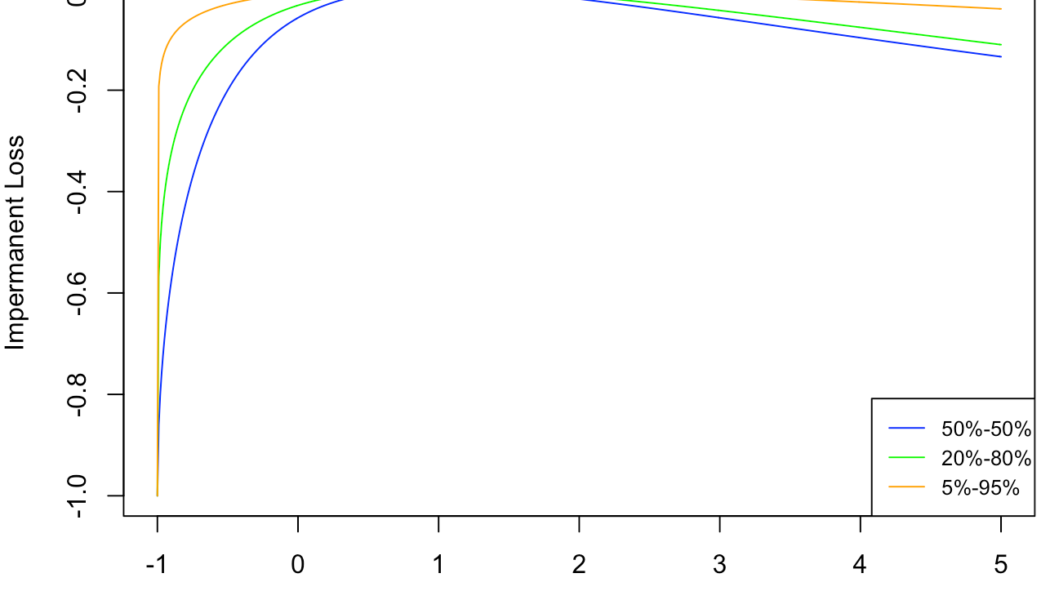

Impermanent loss challenges the claim that DeFi is the ‘future of France’

Impermanent loss is one of the most recognized risks that investors have to contend with when providing liquidity to an automated market maker (AMM) in the decentralized finance (DeFi) sector. Although it is not an actual loss incurred from the liquidity provider’s (LP) position — rather an opportunity cost that occurs when compared with simply buying and holding the same assets — the possibility of getting less value back at withdrawal is enough to keep many investors away from DeFi. Impermanent loss is driven by the volatility between the two assets in the equal-ratio pool — the more one asset moves up or down relative to the other asset, the more impermanent loss is incurred. Providing liquidity to stablecoins, or simply avoiding volatile asset pairs, is an easy way to reduce impermanen...

Altcoin Roundup: JunoSwap, Solidly and VVS Finance give DeFi a much-needed refresh

Decentralized finance (DeFi) was the talk of the town in early 2021, but it has since taken a back seat to more appealing sectors like nonfungible tokens (NFTs), memecoins and blockchain gaming. Now that cross-chain bridges and interoperability have allowed for the easier migration of assets to competing chains, a new class of DeFi protocols is arising to challenge those left from 2021. Here’s a look at three DeFi projects that have launched on some of the up-and-coming layer-1 blockchain networks, catching the eye of the crypto community. VVS Finance VVS Finance is the largest DeFi protocol on the Cronos network, a project that emerged out of the Crypto.com ecosystem which has since been fully rebranded to Cronos (CRO). The goal of VVS Finance is to offer instant swaps with low fees...

Bob Dylan goes meta as Sony and Universal partner with Snowcrash NFT platform

Solana-based NFT marketplace Snowcrash has announced that Sony Music and Universal Music Group — the two largest music labels in the world — have officially partnered with the upcoming platform. The two music labels will release Bob Dylan and Miles Davis NFT collections later this year, ahead of wider integration with their rosters of artists. Jesse Dylan, who probably not coincidentally is Bob Dylan’s son, is the co-founder of the Snowcrash marketplace, which draws its namesake from Neal Stephenson’s 1992 sci-fi novel that also invented the term Metaverse. Bob Dylan is a major investment by both labels: UMG spent around $400 million on his song catalog in 2020, while Sony bought his recorded music rights for more than $150 million last year. In a statement, Dylan the younger stipulated th...

Crypto firms may still face SEC penalties for self-reporting securities laws violations: Report

The U.S. Securities and Exchange Commission’s enforcement director has reportedly said cryptocurrency companies will not receive amnesty for reporting themselves for possible violations of securities laws. According to a Monday report from Reuters, the SEC director of the agency’s division of enforcement, Gurbir Grewal, said the agency may view crypto companies’ conduct “more favorably” if they reach out first for self-reporting securities law violations. However, he added that though firms may face smaller penalties, they will not be completely off the hook. “Our message to [crypto companies] is not, ‘Register your product and we’ll just ignore the billions you have under management in this crypto lending product and your violations of the securities laws,’” said G...

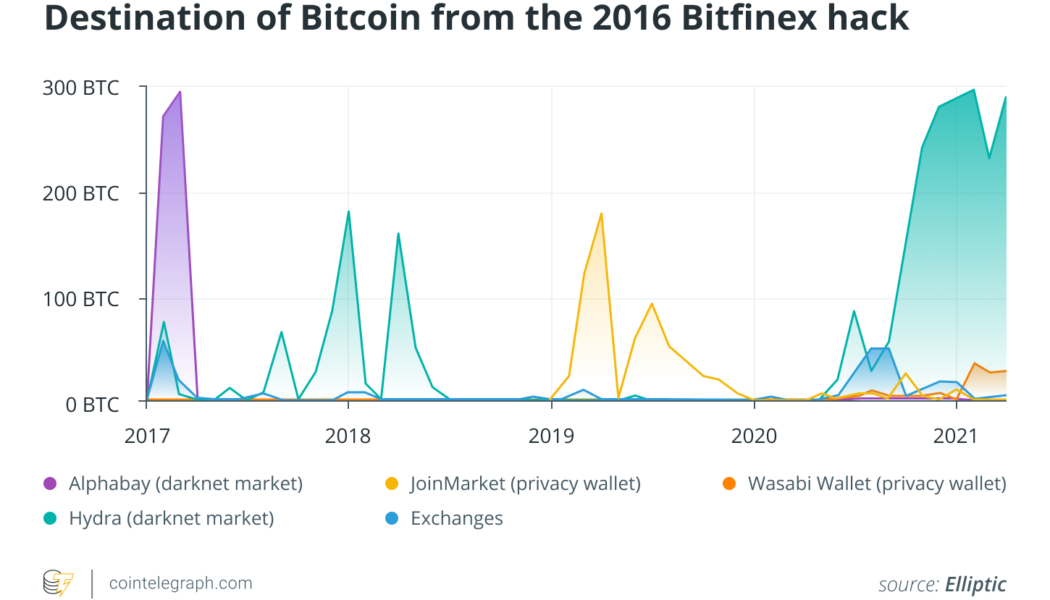

Blockchain forensics is the trusted informant in crypto crime scene investigation

The seizure by the U.S. Department of Justice of $3.6 billion worth of Bitcoin (BTC) lost during the 2016 hack of Bitfinex’s cryptocurrency exchange has all the ingredients of a Hollywood film — eye-popping sums, colorful protagonists and crypto cloak-and-dagger — so much so that Netflix has already commissioned a docuseries. But, who are the unsung heroes in this action-packed thriller? Federal investigators from multiple agencies including the new National Cryptocurrency Enforcement Team have painstakingly followed the money trail to assemble the case. The Feds also seized the Colonial Pipeline ransoms paid in crypto, making headlines last year. The Internal Revenue Service (IRS) seized $3.5 billion worth of crypto in 2021 in non-tax investigations, according to the recently releas...