cryptocurrency exchange

Female investors led crypto market growth in 2021, says new report

The crypto market is maturing and is no longer driven by speculation, according to a new report from BTC Markets (BTCM). According to the report by the Australian cryptocurrency exchange, the crypto market’s growth in 2021 was driven by utility. The BTCM Investor Study Report 2021 is an in-depth analysis of data from the BTCM exchange for the year 2021, divided by demographics (age, gender, investor type) to anonymously examine and analyze cryptocurrency investment habits among its 325,000 customers. As per the report, “crypto queens” or rather female investors on the platform have grown at a faster rate than their male counterparts. Female investors surged by 126% in comparison to male investors, who increased by 83%. According to the report, the most significant in...

US sanctions Russia’s largest darknet market and crypto exchange Garantex

The United States Department of the Treasury’s Office of Foreign Assets Control has announced it will impose sanctions on darknet market Hydra and virtual currency exchange Garantex. In a Tuesday announcement, the Treasury Department said it had worked with the Department of Justice, the Federal Bureau of Investigations, the Drug Enforcement Administration, the Internal Revenue Service Criminal Investigation and Homeland Security Investigations to sanction the Russia-based darknet marketplace as well as Garantex. The move from the U.S. government agencies came the same day the German Federal Criminal Police announced it had shut down Hydra’s servers in Germany and seized more than $25 million worth of Bitcoin (BTC) connected to the marketplace. Illegaler #Darknet-Marktplatz „Hydra Market“ ...

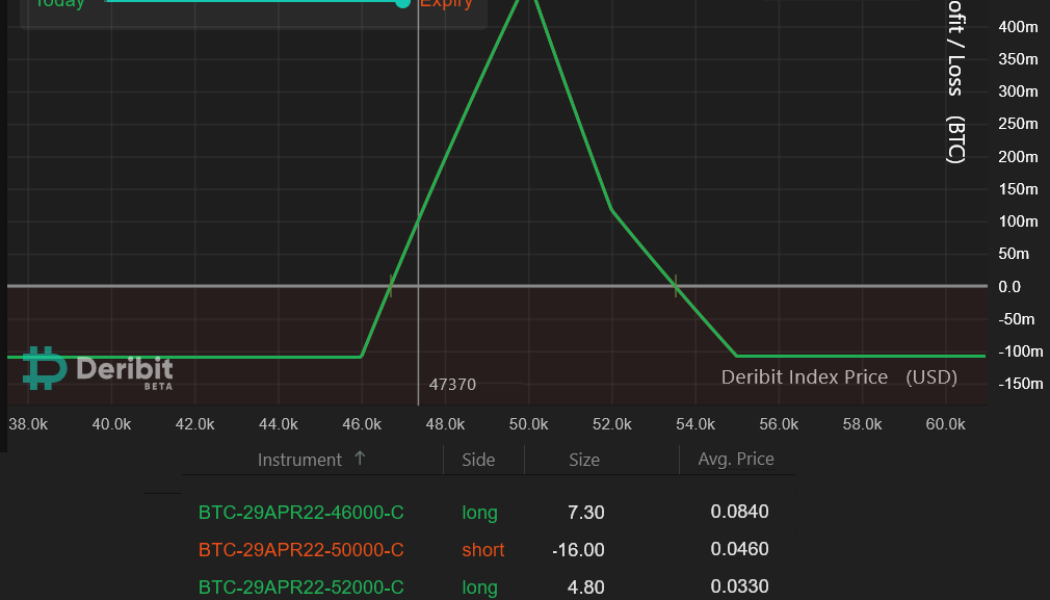

Here’s how pro traders use Bitcoin options to profit even during a sideways market

Bitcoin (BTC) price swings might be impossible to predict, but there is a strategy frequently used by pro traders that yields high returns with minimal cost. Typically, retail traders rely on leveraged futures positions which are highly susceptible to forced liquidations. However, trading Bitcoin options provide excellent opportunities for investors aiming to maximize gains while limiting their losses. Using multiple call (buy) options can create a strategy capable of returns six times higher than the potential loss. Moreover, these can be used in bullish and bearish circumstances, depending on the investors’ expectations. The regulatory uncertainty surrounding cryptocurrencies has long been a significant setback for investors and this is another reasons why neutral market strategies...

Binance becomes official crypto exchange partner of 64th Grammy Awards

The Recording Academy, a major music recording company famous for its annual music awards Grammy Awards, has inked a partnership with Binance, the world’s largest crypto exchange by trading volumes. According to a joint announcement on Thursday, Binance became the first-ever official crypto exchange partner of the 64th Annual Grammy Awards and Grammy Week events to bring various Web3 technology solutions and experiences to the organization’s events and projects. The partnership was announced just a few days before the 64th Grammy Awards ceremony, which will take place on April 3 at the MGM Grand Garden Arena in Las Vegas. Recording Academy co-president Panos Panay specified that the agreement envisions the development of new monetization avenues for the Recording Academy and the crea...

UK financial watchdog extends registration deadline for some crypto firms

The Financial Conduct Authority, the United Kingdom’s financial regulator, has extended the temporary registration status of some firms offering crypto services beyond its Friday deadline. In a Tuesday statement, the FCA said “a small number of firms” in the crypto space will continue to have temporary registration status in the United Kingdom “where it is strictly necessary.” The financial regulator reiterated that temporarily exempting the crypto firms from its previously announced Friday deadline “does not mean that the FCA has assessed them as fit and proper” but included situations in which a company “may be pursuing an appeal” or was still in the process of winding down operations. “Only firms that are registered with us or on our list of firms with temporary registration can continu...

Huobi Tech to launch crypto tracking ETF in Hong Kong for retail traders

Huobi Tech, a public listed fund manager in Hong Kong, plans to launch a cryptocurrency tracking exchange-traded fund (ETF) for retail investors. The Hong Kong Stock Exchange-listed company has reportedly submitted a proposal to the Securities and Futures Commission (SFC) for its crypto ETF. The new ETF product will be focused on retail investors with assets less than HK$8 million (US$1 million), reported South China Morning Post. The vice president of the firm Romeo Wang said stressed that a Hong Kong-regulated crypto ETF would offer better security to investors and also noted that they are actively engaged with the SFC and hopes to maintain positive communication to offer regulated crypto ETF products in the market. Huobi Tech didn’t respond to Cointelegraph’s requests for comments at th...

Mark Karpeles announces commemorative NFT drop for Mt. Gox users

The former CEO of thnow-defunct crypto exchange Mt. Gox has announced that certain users will be eligible to receive commemorative nonfungible tokens, or NFTs. In a Monday announcement on Twitter, Mark Karpelès said that crypto users who were Mt. Gox customers between 2010 and 2014 — during which time the exchange was hacked and subsequently declared bankruptcy — could register to claim a free NFT. According to the CEO, the offer extends to users who had a balance or have claimed losses from the defunct exchange. “Mt. Gox customers are early adopters, some of them were on BitcoinTalk when Satoshi Nakamoto was still posting,” said the project website. “A new token or NFT airdrop is a great way to engage users and at the same time erase a bit of the loss incurred in Mt. Gox.” You can claim y...

Crypto.com will air campaign in support of Ukraine during Academy Awards

Cryptocurrency exchange Crypto.com plans to use its ad time during the 94th Academy Awards on Sunday to air a TV spot regarding the humanitarian crisis in Ukraine. In a Wednesday announcement, Crypto.com CEO Kris Marszalek said the exchange had partnered with the International Committee of the Red Cross, or ICRC, to launch a campaign aimed at helping those suffering under war-torn conditions in Ukraine. The CEO did not specify what the campaign would entail, but the platform already allows donations in crypto, fiat and nonfungible token purchases to the humanitarian network Red Cross Red Crescent. The exchange will match up to $1 million in donations until March 31. “The humanitarian crisis caused by the conflict in Ukraine continues to escalate, and I believe it’s our responsibility to su...

Ethereum price breaks through $3K, but analysts warn that a retest is needed

The cryptocurrency market continues to forge ahead on March 23 despite facing headwinds on multiple fronts. At the moment, global conflict, rising inflation and widespread economic uncertainty are taking a toll on financial markets and helping to highlight the need for a diversified investmen portfolio. Altcoins have managed to gain some ground in recent days, led by Ethereum, the top smart contract platform, which managed to climb back to the major support and resistance zone at $3,000 where bulls are now battling for control. ETH/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts in the market are saying about the path forward for Ether and whether or not further upside is expected in the short-term. Upcoming test of $3,125 A general overview of the recent...

Fetch.ai (FET) gains 43% after $150M development fund and Cosmos IBC announcement

Development across the cryptocurrency ecosystem continues to move forward despite the day-to-day whipsaw price movements and this progress is furthering the public’s awareness of Web3 and the value of blockchain technology. One project that has been climbing the charts amid a marketing push to develop better brand recognition is Fetch.ai, a protocol focused on building a token-based decentralized machine learning network capable of supporting the smart infrastructure being built around the digital economy. Data from Cointelegraph Markets Pro and TradingView shows that the price of FET has climbed 43.13% over the past two days, rallying from a low of $0.322 on March 21 to an intraday high at $0.46 on March 23 as its 24-hour trading volume underwent a five-fold increase. FET/USDT 4-hou...

Ireland’s central bank follows UK’s example in warning of crypto advertisements

The Central Bank of Ireland issued a warning to consumers about the risks around crypto investments in addition to “misleading” advertisements, including those pushed by influencers on social media. In a Tuesday notice, Ireland’s central bank said the warning was part of a campaign organized by the European Supervisory Authorities, made up of the European Securities and Markets Authority, the European Banking Authority, and the European Insurance and Occupational Pensions Authority. The Central Bank of Ireland said that cryptocurrencies were “highly risky and speculative” for retail investors and warned people to be mindful of “the risks of misleading advertisements, particularly on social media, where influencers are being paid to advertise crypto assets.” “In Ireland and across the EU we...