cryptocurrency exchange

Crypto Bahamas: Attendees talk the future of NFTs

The crypto community headed to Nassau in the Bahamas this week for the inaugural Crypto Bahamas conference. Like most conferences, panels fill up the agenda and on Wednesday the topics at Crypto Bahamas ranged from NFTs to crypto in sports and to asset allocation in Web3. During one particular conversation, titled Evolution of NFTs: Culture, Utility and Regulation, panelists had some insightful musings on the NFT market. To put the Crypto Bahamas conference into context, Sam Bankman-Fried’s cryptocurrency exchange FTX moved its headquarters from Hong Kong to the Bahamas in Sept. 2021. It recently inked a multi-year partnership with Anthony Scaramucci’s investment firm SkyBridge Capital, and its events arm SkyBridge Alternatives, or SALT. They jointly presented the conferenc...

Cuban central bank makes it official: VASP licensing coming in May

In a move that could potentially foster the growth of Cuba’s nascent tech industry, the Banco Central de Cuba (BCC), the country’s central bank, will begin issuing licenses for Bitcoin (BTC) and other virtual asset services providers, or VASPs. According to the Official Gazette No. 43 published Tuesday, which includes a Central Bank of Cuba resolution, anyone wanting to provide virtual-asset-related services must acquire a license first from the central bank. It reads: “The Central Bank of Cuba, when considering the license request, evaluates the legality, opportunity and socioeconomic interest of the initiative, the characteristics of the project, the responsibility of the applicants and their experience in the activity.” Furthermore, the document states that those organizations that do n...

Binance.US leaves Blockchain Association to form own DC government affairs team

Binance.US announced today that it is creating a team in Washington to engage with lawmakers on digital asset policy. Simultaneously, it has withdrawn from the advocacy group Blockchain Association. Both organizations sides have been tight-lipped about the split, commenting publicly only with short statements. A Binance.US spokesperson told Cointelegraph, “We believe it’s time we had a clear voice with meaningful impact in the emerging policy debates around digital assets and cryptocurrencies in Washington. We are excited to establish our own Government Affairs team in D.C. to actively engage in direct and constructive dialogue with U.S. policymakers on smart regulation that increases clarity and trust, while allowing American innovation and leadership to flourish in crypto.” Binance found...

Brain drain: India’s crypto tax forces budding crypto projects to move

India’s 30% crypto tax came into law on March 31 and was effective April 1, despite warnings from several stakeholders about its possible ill impact on the budding crypto industry. As predicted, within just a couple of weeks of the new crypto tax law coming into effect, trading volume across major crypto exchanges dropped as much as 90%. The decline in trading activity was attributed to traders either moving their funds away from centralized crypto exchanges or adopting a holding strategy over trading. Many crypto exchanges were hoping that a crypto tax would at least offer some form of recognition to the crypto ecosystem and help them get easy access to banking services. However, the effect has been the opposite. On April 7, the National Payment Corporation of India (NPCI) issued a ...

Half of assessed jurisdictions don’t have ‘adequate laws and regulatory structures’ — FATF

The Financial Action Task Force, or FATF, reported that many countries, including those with virtual asset service providers (VASPs), are not in compliance with its standards on Combating the Financing of Terrorism (CFT) and Anti-Money Laundering (AML). In a report released Tuesday on the “State of Effectiveness and Compliance with the FATF Standards,” the organization said 52% of the assessed jurisdictions in 120 countries had “adequate laws and regulatory structures in place” to assess risks and verify beneficial owners of companies. In addition, the FATF reported that only 9% of countries were “substantially effective” in this area. “Countries need to prioritize their efforts and demonstrate improvements in recording, reporting and verifying information regarding legal perso...

Crypto exchange CoinDCX raises $135M funding to support Indian Web3

Crypto exchange CoinDCX became India’s first crypto business to complete a Series D funding round, raising $135 million in support of various Web3 and crypto initiatives in the country. The latest funding round resulted in CoinDCX doubling its valuation to $2.15 billion, which was led by Pantera and Steadview and saw participation from prominent investors including Kingsway, DraperDragon and Republic. Existing investors such as B Capital Group — a venture capitalist firm from Facebook co-founder Eduardo Saverin — Coinbase, Polychain and Cadenza also joined in on the oversubscribed funding round to increase their investments in the crypto exchange. Excited to share that CoinDCX has raised over USD 135 million, in our latest Series D funding round. Another step closer to our dream of m...

Is asymmetric information driving crypto’s wild price swings?

It has long been believed that investors possessing inside knowledge help drive cryptocurrencies’ price volatility, and a number of academic papers have been published on this topic. This is why Coinbase’s intention to regularly publish in advance a catalog of tokens being assessed for listing on its prominent trading platform is noteworthy. Coinbase’s plans, announced in an April 11 blog along with 50 crypto projects “under consideration” for Q2 2022, could help tamp down the pervasive speculation that surrounds small-cap tokens. Meanwhile, this can help alleviate industry concerns about “information asymmetry,” which typically occurs when one party to a transaction — a seller, for instance — is much better informed than another transactional party, such as a buyer. Last week’s pre-...

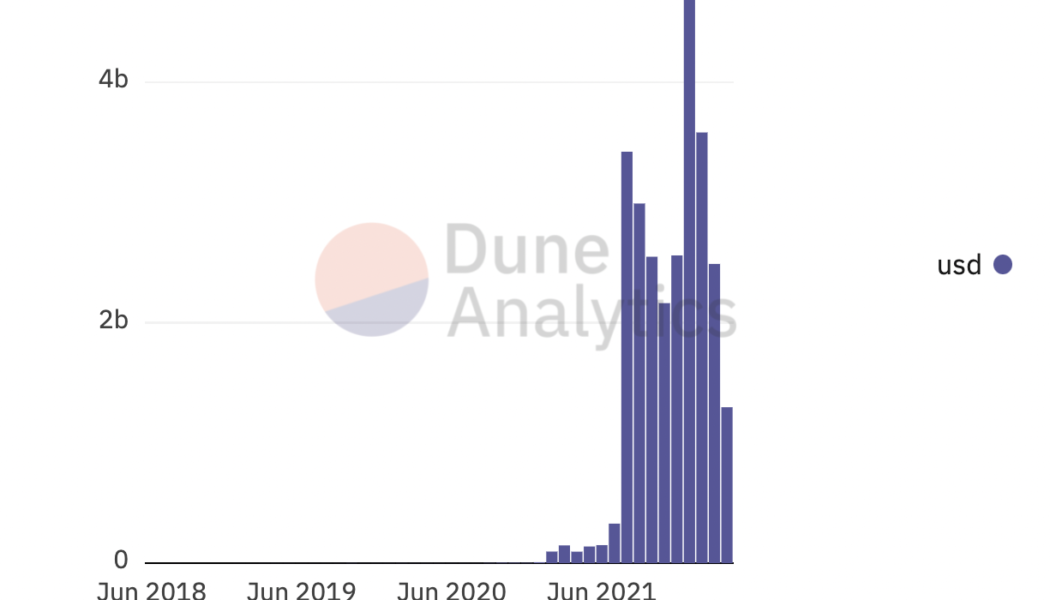

Is the surge in OpenSea volume and blue-chip NFT sales an early sign of an NFT bull market?

In the last two months, OpenSea began to cool down from its New Year’s bull run and many nonfungible token (NFT) pundits began to speculate about the beginning of a bear market once sales took a slight downward trend after closing out a record-breaking $5 billion in total volume sales in January. However, for the last seven days, the total sales volume has already exceeded the $1 billion mark and just a week into April, it seems the NFT markets are waking up to a resurgence of blue-chip caliber projects. Cue the “spring awakening.” OpenSea Monthly Volume. Source: DuneAnalytics @rchen8 Traders searching for the next Bored Ape Yacht Club (BAYC) project have patiently waited for another project to come in with the same force and brand equity. Some top contenders have been emerging...

Belarus-born crypto platform halts operations for Russians in response to invasion of Ukraine

Crypto trading company Currency.com has announced it halted operations for clients based in Russia following the country’s “violence and disorder” imposed on the people of Ukraine. In a Tuesday announcement, Currency.com said Russian residents would no longer be able to access its services following the platform’s decision to stop Russia-based clients from opening new accounts. According to Currency.com’s website, the Gibraltar-based crypto trading platform has offices in Kyiv, London, and Vilnius, but was previously licensed and headquartered in Belarus. “We condemn the Russian aggression in the strongest possible terms,” said Vitalii Kedyk, head of strategy for the platform’s London operations and CEO of Currency.com’s Ukraine arm. “In these circumstances we can no longer continue to ser...

Leading centralized exchanges extend market share in 2022

The top centralized cryptocurrency exchanges have reached all-time highs for market share this year as the trading volume in crypto consolidates onto the platforms of only a few trusted companies. These named “top-tier” crypto exchanges have increased their market share from 89% in August 2021 to 96% in February 2022, according to data collected by United Kingdom analytics company CryptoCompare published on Monday. The firm analyzed over 150 active centralized exchanges, ranking them on security, number of assets available, regulatory compliance, Know Your Customer checks and more, grading them from a top score of AA to a low of F, with “top tier” receiving a grade B or above. A total of 78 exchanges received a “top tier” grade, with Coinbase, Gemini, Bitstamp and Binance as the only four ...

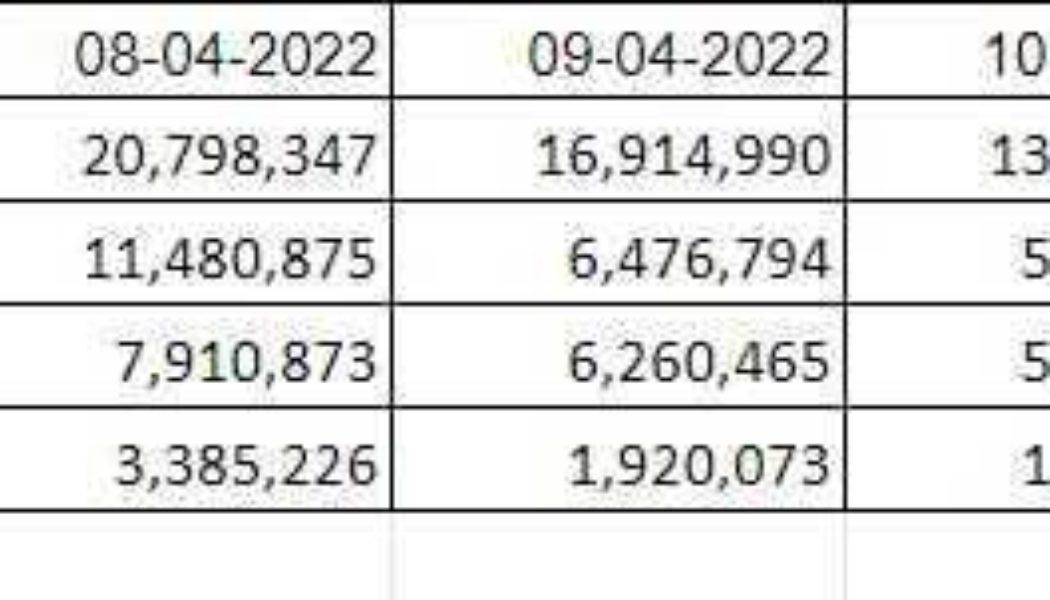

Indian crypto exchanges’ volume plunges down as 30% tax goes into effect

Fresh data on Indian crypto exchanges’ trading volume reveals a significant decline in trading practices among Indians just ten days after the tax rule implementation. India’s new 30% crypto tax rule came into effect on April 1, despite many stakeholders and exchange operators warning against its ill effects. A research data report shared by Indian blockchain analytic firm Crebaco with Cointelegraph shows that trading volume on top Indian crypto exchanges has declined as high as 70% in the past 10 days. Crypto Trading Volume on Major Indian Exchanges Source: Creabaco The trading volume on WazirX, the leading crypto exchange in India, declined from $47.8 million on April 1 to $13.2 million on April 10. CoinDCX’s trading volume dropped from $12.16 million to $5.76 million, ...

Number of UK crypto firms operating under FCA temporary registration status drops

The number of firms permitted to offer crypto services to U.K. residents under temporary registration status from the Financial Conduct Authority has dropped from 12 to five. According to a Thursday update to its list of “Cryptoasset firms with Temporary Registration,” the United Kingdom’s financial regulator named CEX.IO, Revolut, Copper, Globalblock and Moneybrain as companies in the crypto space allowed to operate in the country in addition to the 34 registered crypto asset firms the FCA has approved since August 2020. The FCA said on March 30 that it would be extending the temporary registration status for “a small number of firms where it is strictly necessary,” which included 12 companies at the time. In the United Kingdom, firms permitted to “carry out crypto ...