cryptocurrency exchange

Crypto.com unblocks users, reverses glitched LUNA trades that made 30-40x

Crypto.com was one of the few crypto exchanges to keep LUNA trades open as Terra’s death spiral saw an unrecoverable price crash of LUNA and stablecoin UST. However, a technical glitch on Crypto.com’s mobile application allowed users to get away with a 30-40x profit on LUNA trades momentarily. On Friday, Crypto.com abruptly barred users from trading after an internal tool detected the system quoting incorrect prices for LUNA due to some error. Just when Crypto Twitter started raising concerns about trade reversals on the exchange, Kris Marszalek, CEO of Crypto.com, revealed details about a glitch that allowed users to make away with massive profits. There was a lot of customers who were buying at wrong prices and of course some also jumped onto the opportunity to exploit the glitch to the ...

Robinhood shares spike 30% after Sam Bankman-Fried buys $650M stake

Sam Bankman-Fried, the billionaire founder and CEO of cryptocurrency exchange FTX has acquired a substantial 7.6% stake in the popular online brokerage, Robinhood. The news was well received by the market, with Robinhood’s (HOOD) stock price initially soaring over 30% in after hours trading. At the time of writing the price has settled to a 24% overall gain. According to a securities filing made with the Securities and Exchange Commission on Thursday, Bankman-Fried purchased a total of $648 million in Robinhood shares at an average price of $11.52. The purchases disclosed by Bankman-Fried reportedly began in mid-March and continued through until Wednesday. In the securities filing, Bankman-Fried made it clear that he had, “no intention of taking any action toward changing or influenc...

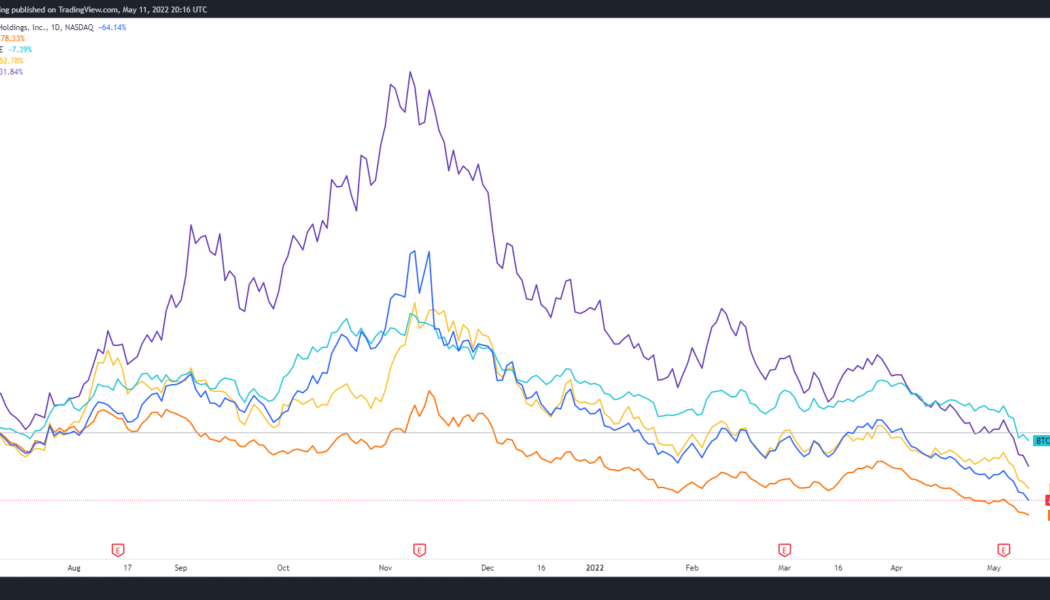

Crypto-associated stocks hammered as COIN and HOOD drop to record lows

Bad news continues to dominate crypto media headlines and May 12’s juiciest tidbit was the unexpected collapse of the Terra ecosystem. In addition to the weakness seen in equities, listed companies with exposure to blockchain startups and cryptocurrency mining have also declined sharply. Bitcoin mining stocks continue bleeding… Mining investors probably wish they had simply bought bitcoin instead at the beginning of 2022, as most bitcoin mining stocks have underperformed bitcoin by a wide margin. pic.twitter.com/anSoUEoUJ1 — Jaran Mellerud (@JMellerud) May 11, 2022 While it may be easy to blame the current pullback solely on Terra’s implosion, the truth is that the price of Bitcoin mining stocks has largely mirrored the performance of BTC since reaching a peak in November...

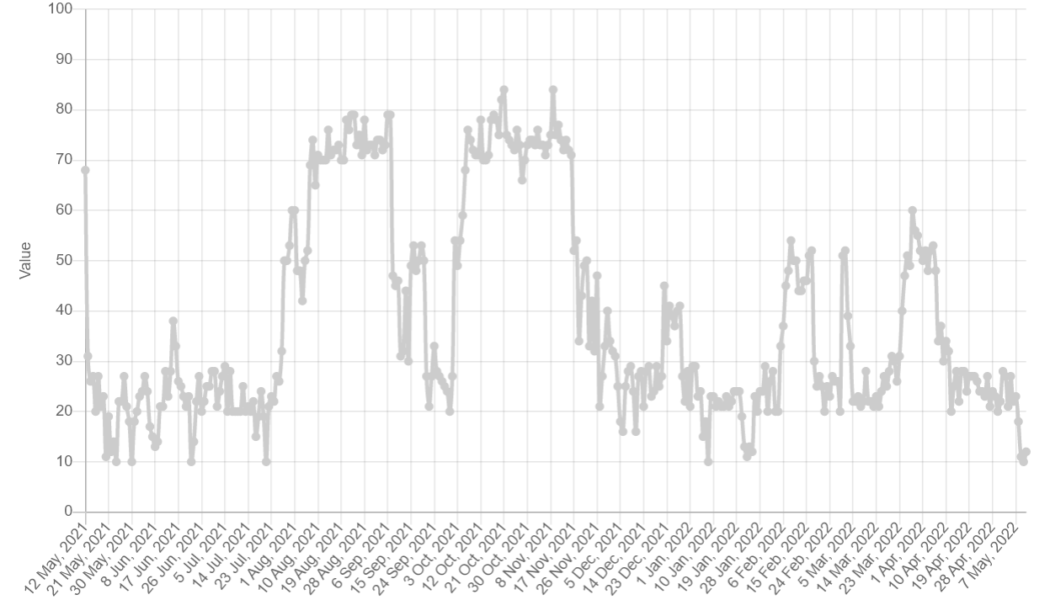

Bitcoin fights to hold $29K as fear of regulation and Terra’s UST implosion hit crypto hard

Bitcoin (BTC) price initially bounced from its recent low at $29,000 but the overall market sentiment after a 25% price drop in five days is still largely negative. Currently, the crypto “Fear and Greed Index,” which uses volatility, volume, social metrics, Bitcoin dominance and Google trends data, has plunged to its lowest level since March 2020 and at the moment, there appears to be little protecting the market against further downside. Crypto “Fear and Greed index”. Source: Alternative.me Regulation continues to weigh down the markets Regulation is still the main threat weighing on markets and it’s clear that investors are taking a risk-off approach to high volatility assets. Earlier this week, during a hearing of the Senate Banking Committee, United S...

Head of Bitstamp’s European arm becomes latest CEO of global crypto exchange

Bitstamp, one of the oldest crypto exchanges in the world, has announced the appointment of Jean-Baptiste (JB) Graftieaux as its new global CEO following the departure of Julian Sawyer. In a Monday announcement, Bitstamp said Sawyer, who first became CEO of the crypto exchange in October 2020, “has decided to pursue other opportunities.” Graftieaux took over the position on May 7, having been the Bitstamp Europe CEO since May 2021. According to the exchange, Graftieaux has 20 years of experience in “crypto, payments, and financial sectors,” having first joined Bitstamp in November 2014 as the firm’s chief compliance officer following five years at PayPal. “JB was with Bitstamp in its early days, and has admirably led our European business over the past year,” said Bitstamp’s board of direc...

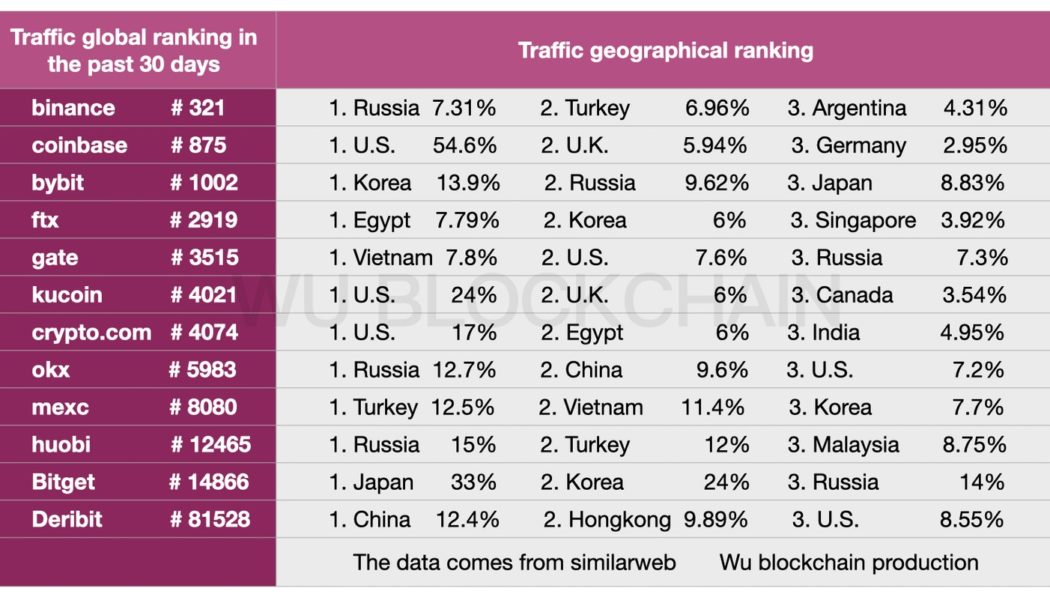

Deribit and OKX attract significant traffic from China despite a blanket ban: Report

Data from website traffic metric provider Similarweb shows that Deribit and OKX continue to attract significant traffic sources from China despite a blanket ban on crypto transactions and foreign exchanges last year. China has banned the use of cryptocurrencies more than a dozen times in the last decade. However, the one imposed in September last year was considered the harshest one. Several crypto exchanges including Huobi and Binance had shut doors for the Chinese traders in fear of regulatory action. The strict regulatory reforms ensured that Chinese traders mainly shifted their focus to decentralized exchanges (DEXs) and protocols. Chinese crypto traders have always found a way to bypass strict crypto regulatory measures imposed by the government. While many believed the blanket ban on...

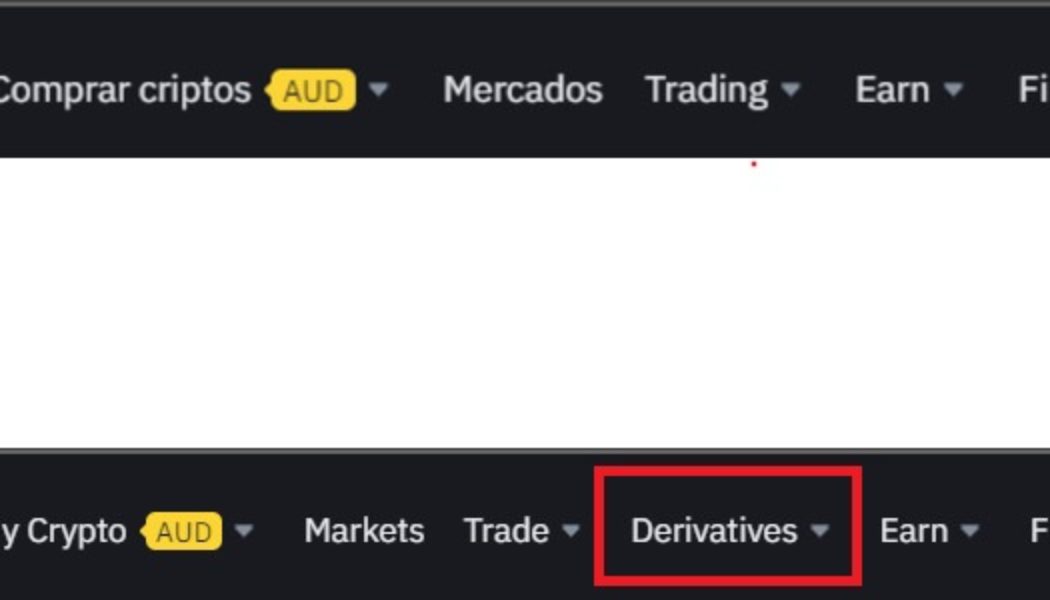

Binance reportedly halts crypto derivatives service in Spain

Binance stands as one of the most persistent crypto exchanges when it comes to gaining regulatory approval and operational licenses from regulators across the world. In this effort to operate as a fully licensed financial institution, the exchange has stopped offering it’s crypto derivatives services in Spain as it reportedly awaits approval from the Spanish regulator, Comisión Nacional del Mercado de Valores (CNMV). As evidenced by Binance’s official Spanish website, the crypto exchange removed the derivatives drop-down menu, which is still available on the global version. According to local news publication La Información, the move to hide derivatives offering in Spain comes as a way to comply with the requirements set by CNMV, a.k.a. the National Securities Market Commission....

Coinbase’s plans to purchase firm behind Mercado Bitcoin fall through: Report

Coinbase and Brazilian company 2TM, the parent company of Mercado Bitcoin, have reportedly scrapped talks around the crypto exchange purchasing the firm. According to a Tuesday Bloomberg report, 2TM and Coinbase have ended discussions around the United States-based crypto exchange buying the Brazilian company, which was valued at more than $2 billion. It’s unclear what led to the purchase not going through, as 2TM reportedly declined to comment and a Coinbase spokesperson said it was simply “committed to the Brazilian market.” Coinbase and 2TM scrapped talks over a possible purchase by the exchange of the Brazilian cryptocurrency brokerage https://t.co/HmZxDj7Koi — Bloomberg Crypto (@crypto) May 4, 2022 As the parent company of Mercado Bitcoin — one of the largest crypto brokerage firms in...

France’s financial authority approves Binance’s registration as digital asset service provider

The Autorité des Marchés Financiers (AMF), France’s authority responsible for regulating the financial market, has granted Binance’s registration to provide crypto-related services in the country. In a Wednesday update, the AMF included Binance France SAS in its list of registered digital asset service providers in France. The registration was a step toward allowing the crypto exchange to provide crypto-related services in France including custodying assets, exchanging digital assets for other tokens or legal tender, and operating a digital asset platform. According to the AMF, registration requires checks to ensure “good repute and competence of the managers and beneficial owners” as well as compliance with regulations on anti-money laundering and combatting the financing of terrorism. Bi...

Belgian financial regulator FSMA to regulate crypto exchange services

A new rule imposed by Belgium’s financial regulatory agency, the Financial Services and Markets Authority (FSMA), will now require crypto exchanges and custodial wallet services in the region to register within a sharp deadline. Starting tomorrow, May 1, legal individuals and entities that wish to provide crypto exchange services or custodial wallets in Belgium will have to register in advance, according to the information released by the FSMA. As from 1 May 2022, providers of exchange services between #virtual #currencies and legal currencies, or custody #wallet services will have to register with the #FSMA. Please consult the FAQs. https://t.co/P44mkovn5L pic.twitter.com/aAdtQ9Dqwx — FSMA (@FSMA_info) April 29, 2022 Crypto businesses in Belgium that have been already operating before thi...

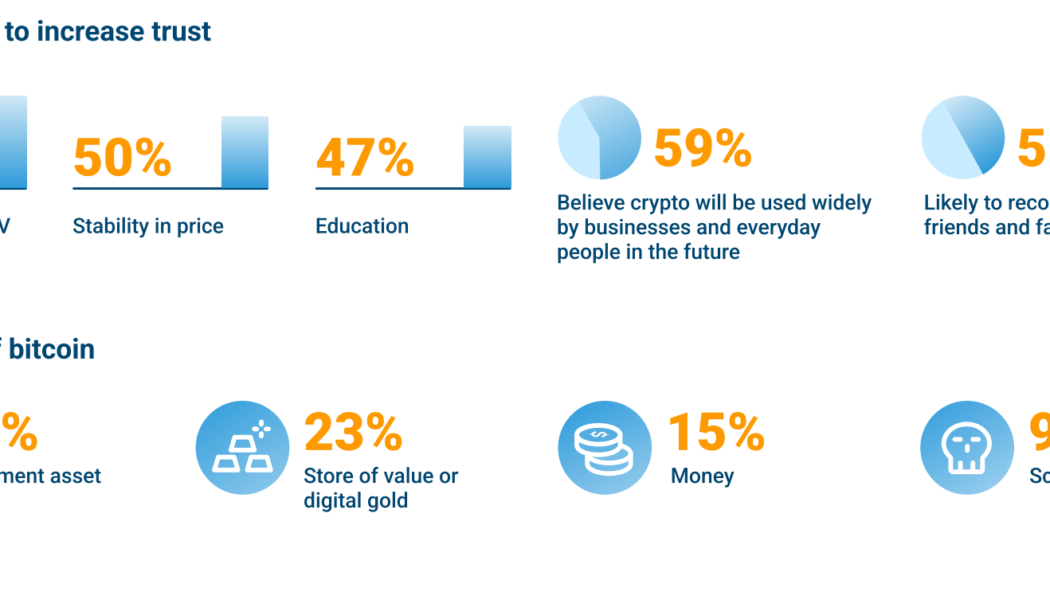

Singaporean investors’ appetite for crypto is key to mainstream adoption — Survey

As Singapore continues to play an active role in boosting crypto adoption across the Asia-Pacific region, the country’s first licensed crypto exchange Independent Reserve conducted a retail-focused survey to better understand the underlying potential of the regulated market. Independent Reserve’s survey — conducted across all age groups and genders of the Singapore population — revealed a strong affinity for various financial opportunities brought forward by decentralized finance (DeFi) and other investment opportunities. As explained by Raks Sondhi, managing director of Independent Reserve Singapore, the country’s rapid crypto adoption is driven by high level of trust and confidence in the future of crypto: “58% [Singaporeans surveyed] perceive Bitcoin as an investment asset or a sto...

Crypto Bahamas: Attendees talk the future of NFTs

The crypto community headed to Nassau in the Bahamas this week for the inaugural Crypto Bahamas conference. Like most conferences, panels fill up the agenda and on Wednesday the topics at Crypto Bahamas ranged from NFTs to crypto in sports and to asset allocation in Web3. During one particular conversation, titled Evolution of NFTs: Culture, Utility and Regulation, panelists had some insightful musings on the NFT market. To put the Crypto Bahamas conference into context, Sam Bankman-Fried’s cryptocurrency exchange FTX moved its headquarters from Hong Kong to the Bahamas in Sept. 2021. It recently inked a multi-year partnership with Anthony Scaramucci’s investment firm SkyBridge Capital, and its events arm SkyBridge Alternatives, or SALT. They jointly presented the conferenc...