cryptocurrency exchange

Binance-owned Trust Wallet adds buy option via Binance Connect

Trust Wallet, a major self-custodial cryptocurrency wallet owned by the Binance crypto exchange, has completed a significant integration to enable easier crypto purchases. The Trust Wallet platform has integrated Binance’s official fiat-to-crypto provider Binance Connect, allowing users to purchase more than 200 crypto assets directly from credit or debit cards, the firm announced to Cointelegraph on June 22. Trust Wallet’s new crypto buy option is designed to simplify the process of buying crypto, enabling verified Trust Wallet users to fund their wallet with more than 40 fiat currencies. In order to add funds on Trust Wallet via Binance Connect, users will need to proceed with the similar Know Your Customer (KYC) checks to those on Binance. “It will keep a similarly high standard and pro...

Crypto exchange BlockFi secures $250M credit from FTX amid bear market

BlockFi, a cryptocurrency exchange and digital wallet service provider, has secured a $250 million credit from leading crypto platform FTX. Today @BlockFi signed a term sheet with @FTX_Official to secure a $250M revolving credit facility providing us with access to capital that further bolsters our balance sheet and platform strength. — Zac Prince (@BlockFiZac) June 21, 2022 BlockFi has signed a term sheet with FTX crypto exchange to secure a $250 million revolving credit facility. A revolving credit facility is a type of credit that enables you to withdraw money, use it to fund your business, repay it and then withdraw it again when you need it. Zac Prince, the CEO of BlockFi, confirmed the news in a Twitter thread, claiming the new flow of capital would bolster the firm’s balance sheet a...

What decentralization? Solend approves whale wallet takeover to avoid DeFi implosion

On Sunday, the decentralized finance (DeFi) sector came under scrutiny again after DeFi protocol Solend put together a spur-of-the-moment governance proposal related to one of the whale wallets at risk of liquidation. The proposal, dubbed “SLND1 : Mitigate Risk From Whale,” was abruptly launched on Sunday without announcement and the vote closed with a 97% approval rating. The scandal comes on the heels of last week’s sudden layoffs from Coinbase and BlockFi, and the liquidation debacle of Three Arrows Capital. Adding to the melee of unexpected volatility and market sell-offs, the spur-of-the-moment alterations of a supposed decentralized autonomous organization, or DAO, show that crypto is not as “decentralized” as its users may have thought. Details of the proposal include the...

Regulations and exchange delistings put future of private cryptocurrencies in doubt

The core principles of cryptocurrency were based on financial independence, decentralization and anonymity. With regulations being the key to mass adoption, however, the privacy aspect of the crypto market seems to be in jeopardy. In 2022, even though no particular country has come up with a universal regulatory outline that governs the whole crypto market, most countries have introduced some form of legislation to govern a few aspects of the crypto market such as trading and financial services. While different countries have set different rules and regulations in accordance with their existing financial laws, a common theme has been the strict implementation of Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. A majority of crypto exchanges operating with a license obt...

Former president of the New York Stock Exchange joins Uniswap Labs as an advisor

On Wednesday, Uniswap announced that former New York Stock Exchange president Stacey Cunningham will join the company as an advisor. Cunningham served as the first female president of the New York Stock Exchange after beginning her career as a trader on its floor. She said in a statement that she believes in the potential of Uniswap’s commitment to fairer markets.Uniswap is betting on her experience with TradFi translating over to DeFi to further help them evolve their place in Web3. Cunningham has also been listed as one of BBC’s 100 Women, and joined the NYSE board of directors in December 2021. 1/ We are beyond honored to welcome Stacey Cunningham @stacey_cunning, former president of the New York Stock Exchange @NYSE, as an Advisor to Uniswap Labs. — Uniswap Labs (@Uniswap) J...

FINRA may hire employees terminated from crypto firms: Report

The United States Financial Industry Regulatory Authority, or FINRA, reportedly plans to “bulk up” its capability to monitor crypto — a move that could include scooping up employees recently terminated from crypto companies. According to a Tuesday Reuters report, FINRA president and CEO Robert Cook encouraged crypto workers who expect to be on the chopping block to reach out to the financial regulator as part of its efforts to increase resources related to the space. Major crypto exchanges in the United States including Coinbase and Gemini have announced plans to cut staff amid extreme market volatility, likely resulting in the loss of thousands of jobs. “We are already having to be engaged in the space and we think that as a result it’s appropriate for us to bulk up our c...

Binance resumes withdrawals as many retail crypto investors monitor exchanges

Major crypto exchange Binance has announced that it had resumed Bitcoin withdrawals after more than three hours amid extreme market volatility. In an update during what many are calling cryptocurrency’s “Black Monday,” Binance said on its website the exchange would be processing Bitcoin (BTC) network withdrawals within “the next couple of hours” following the resumption of activity. The platform announced Monday that it had temporarily paused BTC withdrawals, with CEO Changpeng Zhao saying on Twitter that all user funds were “SAFU.” #Bitcoin network withdrawals have now resumed on #Binance.https://t.co/FhxXi3LeBg — Binance (@binance) June 13, 2022 While BTC trading activity on Binance seems to have been restored, withdrawals for users on Celsius have remained frozen since...

Anonymous hacker served with restraining order via NFT

Law firms Holland & Knight and Bluestone have served a defendant in a hacking case with a temporary restraining order through a nonfungible token, marking the first known legal process to be facilitated by an NFT. The so-called “service token” or “service NFT” was served to an unnamed defendant in a hacking case involving LCX, a Liechtenstein-based cryptocurrency exchange that was hacked in January for almost $8 million. As Cointelegraph reported at the time, the attack compromised the platform’s hot wallets, resulting in the loss of Ether (ETH), USD Coin (USDC) and other cryptocurrencies. Holland & Knight has become the first law firm to serve a defendant by #NFT, which was created and airdropped by our #AssetRecovery Team. Learn more from our client @LCX. https://t.co/wWs2cOVVY1 ...

Ethereum 2.0 vs. the top Ethereum killers|The Market Report

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts give you the details about Ethereum 2.0, its main competitors, and how they differ from each other. To kick things off, we break down the latest news in the markets this week. Here’s what to expect in this week’s markets news breakdown: Bitcoin ‘Bart Simpson’ returns as BTC price dives 7% in hours: Bitcoin (BTC) price action failed to crack $32,000 and headed back to square one, sparking $60 million of long liquidations in the process. How much longer will we stay in the current price range? What is it going to take for Bitcoin to break out from here? Bad day for Binance with SEC investigation and Reuters exposé: The United States Securities and Exchange Commission...

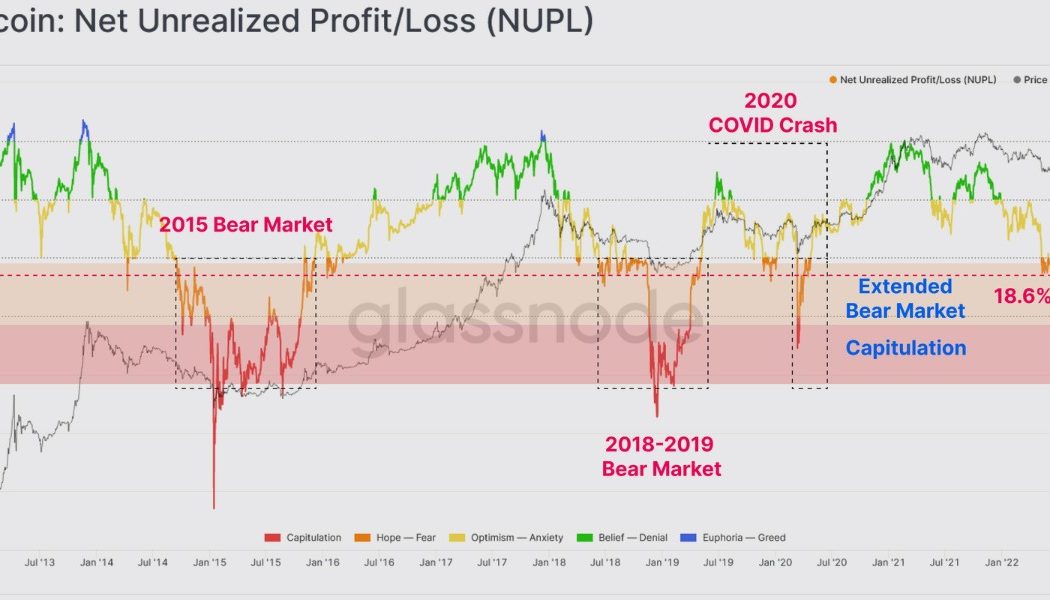

Traders think Bitcoin bottomed, but on-chain metrics point to one more capitulation event

The bull market euphoria that carried prices to new highs throughout 2021 has given way to bear market doldrums for any Bitcoin (BTC) buyer who made a purchase since Jan. 1, 2021. Data from Glassnode shows these buyers “are now underwater” and the market is gearing up for a final capitulation event. Bitcoin net unrealized profit/loss. Source: Glassnode As seen in the graphic above, the NUPL, a metric tha is a measure of the overall unrealized profit and loss of the network as a proportion of the market cap, indicates that “less than 25% of the market cap is held in profit,” which “resembles a market structure equivalent to pre-capitulation phases in previous bear markets.” Based on previous capitulation events, if a similar move were to occur at the current levels, t...

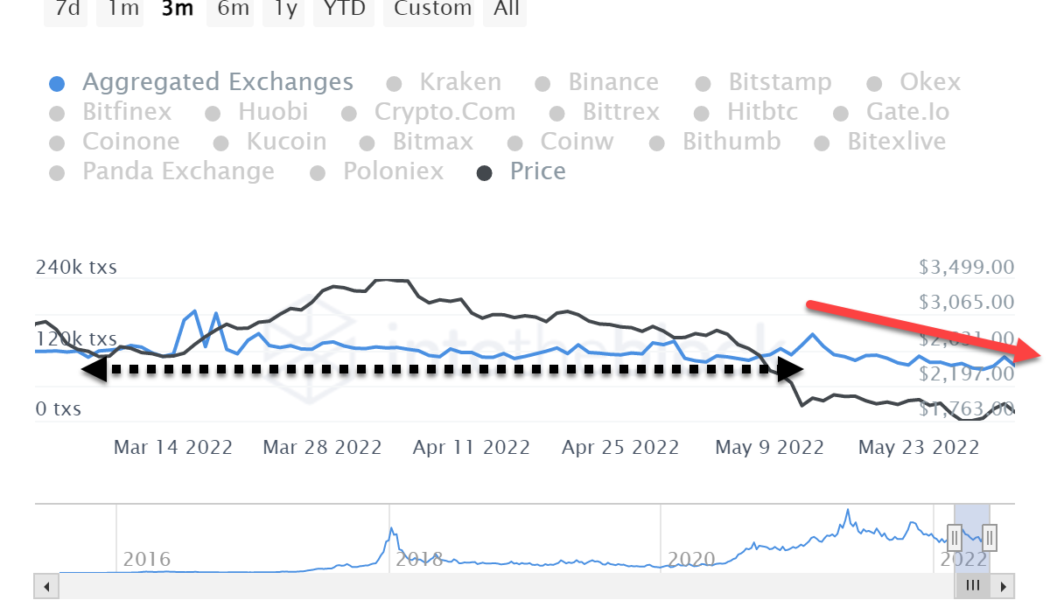

Ethereum’s Merge FOMO isn’t priced in, making a spike to $2.6K a possibility

In a May 30 tweet, Ethereum (ETH) core developer Tim Beiko confirmed that the much-anticipated Ropsten testnet trial of the Merge from proof-of-work to proof-of-stake can be expected “around June 8 or so.” Interestingly, Ether’s price action is relatively unchanged despite the unexpected bullish announcement. There was a +10% spike on May 30, but those gains were given back between May 31 and June 2. It is very likely that the Merge — currently anticipated in August — has yet to be priced in, giving traders and investors a possible early entrant advantage. It’s essential to monitor on-chain data From an investing and trading viewpoint, cryptocurrency markets have a distinct disadvantage in comparison with regulated markets and transparency. The stock market is chock full of legally r...

Was Terra’s UST cataclysm the canary in the algorithmic stablecoin coal mine?

The past week has not been an easy one. After the collapse of the third-largest stablecoin (UST) and what used to be the second-largest blockchain after Ethereum (Terra), the depeg contagion seems to be spreading wider. While UST has completely depegged from the U.S. dollar, trading at sub $0.1 at the time of writing, other stablecoins also experienced a short period where they also lost their dollar peg due to the market-wide panic. Tether’s USDT stablecoin saw a brief devaluation from $1 to $0.95 at the lowest point in May. 12. USDT/USD last week from May. 8–14th. Source: CoinMarketCap FRAX and FEI had a similar drop to $0.97 in May. 12; while Abracadabra Money’s MIM and Liquity’s LUSD dropped to $0.98. FRAX, MIM, FEI and LUSD price from May. 9 – 15th. Source: CoinMarketCap A...