cryptocurrency exchange

Data transfer network Plaid integrates 4 major crypto exchanges

United States data transfer network Plaid has added four major cryptocurrency exchanges to its platform, giving users the ability to connect their digital asset portfolios to other applications more easily. Crypto platforms Binance.US, Gemini, Robinhood and SoFi are now supported by the Plaid network, the company announced Thursday. Support for additional platforms, such as Blockchain.com and BitGo, is scheduled to commence later this year. We now support leading digital asset exchanges on the Plaid network, including @BinanceUS, @Gemini, @Robinhood & @SoFi with plans to support additional crypto providers like @Blockchain and @BitGo later this year. https://t.co/I1QlXmL8hQ — Plaid (@Plaid) July 14, 2022 The integrations are intended to help crypto users “bridge data portability ...

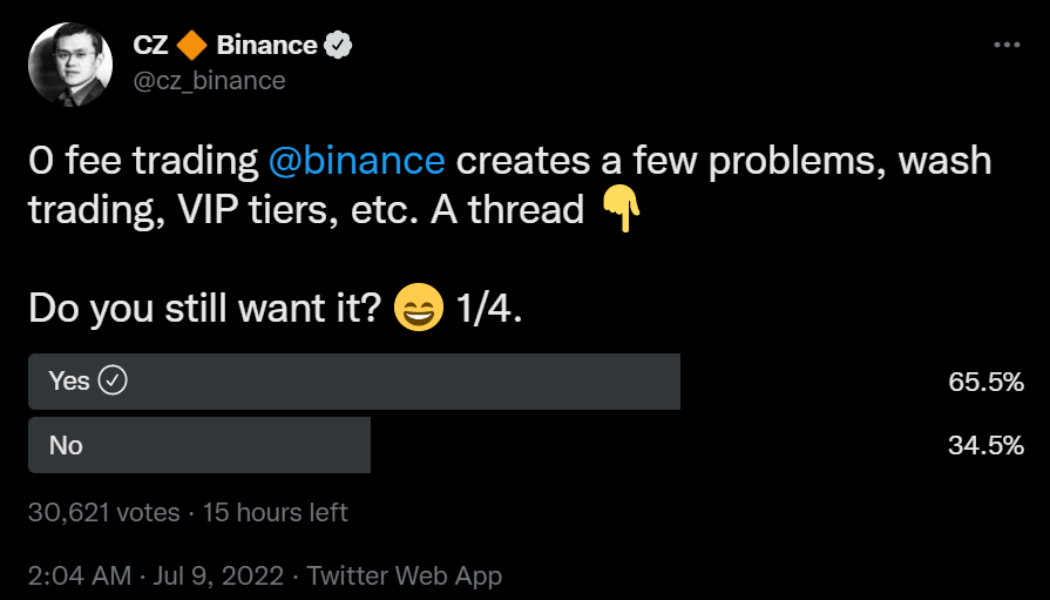

Binance users support 0-fee trading despite CZ’s wash trading concerns

Both traditional and crypto investors consider trading fees as one of the most significant liabilities when it comes to investing over exchanges. So no wonder when Changpeng “CZ” Zhao, the founder and CEO of Binance, asked investors about their interest in trading on the crypto exchange with no fees, the response was a resounding yes despite the inherent risks pointed out by the entrepreneur. Binance stands as the biggest crypto exchange, outdoing its nearest competition FTX by 10x in terms of the trading volume. Zhao, known for implementing features based on community feedback, reached out over Twitter to gauge investor sentiment regarding the complete removal of trading fees. 0 fee trading @binance creates a few problems, wash trading, VIP tiers, etc. A thread Do you still want it? 1/4. ...

Binance users support 0-fee trading despite CZ’s wash trading concerns

Both traditional and crypto investors consider trading fees as one of the most significant liabilities when it comes to investing over exchanges. So no wonder when Changpeng “CZ” Zhao, the founder and CEO of Binance, asked investors about their interest in trading on the crypto exchange with no fees, the response was a resounding yes despite the inherent risks pointed out by the entrepreneur. Binance stands as the biggest crypto exchange, outdoing its nearest competition FTX by 10x in terms of the trading volume. Zhao, known for implementing features based on community feedback, reached out over Twitter to gauge investor sentiment regarding the complete removal of trading fees. 0 fee trading @binance creates a few problems, wash trading, VIP tiers, etc. A thread Do you still want it? 1/4. ...

Voyager Digital freezes trading, deposits, withdrawals and rewards, blames 3AC default

Cryptocurrency exchange Voyager Digital announced Friday that it was temporarily suspending trading, deposits, withdrawals and loyalty rewards. “The failure of a borrower, Three Arrows Capital, to repay a substantial loan from us makes this the right path forward,” Voyager Digital CEO Stephen Ehrlich said on Twitter soon after the service suspension went into effect. “This decision, while far from optimal, will give us time to work to strengthen our balance sheet, a necessary condition to protect assets and preserve the future of the Voyager platform we have built together,” Ehrlich continued. A statement issued by the company said it has engaged Moelis & Co. and the Consello Group as financial advisers, and Kirkland & Ellis as legal advisers. Voyagers, today we made the diff...

KuCoin CEO slams insolvency rumors citing “no plan to halt withdrawal”

Crypto exchange KuCoin found itself at the center of discussion when a sub-community of Crypto Twitter started warning investors about an incoming ban on funds withdrawal. KuCoin CEO, Johnny Lyu, was however quick to dismiss the unvetted rumors before they picked up steam. Prominent crypto figures on Twitter, including trader @KongBTC and blockchain investigator @otteroooo, requested their followers to withdraw all of their funds from the KuCoin while claiming that the exchange may soon stop all users from withdrawing funds. WITHDRAW FROM KUCOIN RIGHT NOW Not a drill no time for thread like and retweet to spread the message otter hardly wrong in such matters — otteroooo (@otteroooo) July 2, 2022 Rumors linked KuCoin’s intent to stop withdrawals with Terra’s (LUNA) and 3AC collapse, which a...

June roundup: Who’s hiring and who’s firing in the crypto space

Amid the recent volatility in the crypto market affecting investments and stock prices, many firms made significant staff cuts in the last month while others continued hiring. In June, major crypto exchange Gemini was among the first to reportedly cut 10% of its employees amid the bear market, saying conditions were “likely to persist for some time.” Coinbase and Crypto.com followed, announcing plans to reduce staff by 18% and 5%, respectively. Coinbase CEO Brian Armstrong cited the so-called crypto winter as part of the reason for the cuts, but also stated the firm had been growing “too quickly.” Market conditions largely have not changed following many decisions to downsize, and other firms have been forced to make cuts. Crypto lending firm BlockFi announced it would be reducing staff by...

Roger Ver denies CoinFLEX CEO’s claims he owes firm $47M USDC

Roger Ver, an early Bitcoin investor and Bitcoin Cash proponent, has pushed against claims from crypto investment platform CoinFLEX regarding an alleged $47-million debt. In a Tuesday tweet, Ver — not mentioning CoinFLEX by name — said he had not “defaulted on a debt to a counter-party,” and alleged the crypto firm owed him “a substantial sum of money.” The denial followed rumors on social media that the BCH proponent was involved in the platform halting withdrawals due to “a high-networth client who has holdings in many large crypto firms” not covering their debts. CoinFLEX CEO Mark Lamb took to Twitter shortly after the statement to claim the company had a written contract with Ver “obligating him to personally guarantee any negative equity on his CoinFLEX account and top up margin regul...

Bitcoin’s bottom might not be in, but miners say it ‘has always made gains over any 4-year period’

Your favorite trader is saying Bitcoin (BTC) bottomed. At the same time, the top on-chain indicators and analysts are citing the current price range as a “generational buy” opportunity. Meanwhile, various crypto and finance media recently reported that Bitcoin miners sending a mass of coins to exchanges are a sign that $17,600 was the capitulation move that pins the market bottom. There’s so much assurity from various anon and doxed analysts on Crypto Twitter, yet Bitcoin price is still in a clear downtrend, and the metrics don’t fully reflect that traders are buying every dip. A critical component of BTC price that many investors often overlook is the condition and sentiment of Bitcoin miners, which is exactly why Cointelegraph had a chat with Rich Ferolo of Blockware Solutions and ...

FTX may be planning to purchase a stake in BlockFi: Report

Crypto exchange FTX is reportedly in talks to acquire a stake in BlockFi after the company issued a $250 million credit to the lending firm. According to a Friday report from the Wall Street Journal, FTX is currently in discussions with BlockFi regarding the crypto exchange purchasing a stake in the firm, but no equity agreement has been reached. The reported ongoing talks followed BlockFi signing a term sheet with FTX to secure a $250 million revolving credit facility on Tuesday. “BlockFi does not comment on market rumors,” a BlockFi spokesperson told Cointelegraph. “We are still negotiating the terms of the deal and cannot share more information at this time. We anticipate sharing more on the terms of the deal with the public at a later date. FTX founder and CEO Sam Ban...

Celsius Network hires advisers ahead of potential bankruptcy: Report

Crypto lending platform Celsius Network has reportedly onboarded advisers from a management consulting firm in advance of the company possibly facing bankruptcy. According to a Friday report from the Wall Street Journal, Celsius hired an unknown number of restructuring consultants from the firm Alvarez & Marsal to advise the platform on potentially filing for bankruptcy. The report followed one from June 14, which said Celsius had hired lawyers in an attempt to restructure the company amid its financial issues. Steady lads https://t.co/5YAdmq5kt8 — Ben McKenzie (@ben_mckenzie) June 24, 2022 Celsius has been at the forefront of discussions in the media around significant volatility in the market amid the crypto lending platform’s decision to pause “all withdrawals, swaps and transfers b...

Bybit enters into settlement agreement with Ontario Securities Commission

Bybit announced that it reached a settlement agreement with the Ontario Securities Commission (OSC) on Thursday, a day after the OSC released a Statement of Allegations against the crypto asset trading platform. The agreement includes several measures to be taken by Bybit as it engages in registration talks with the Canadian regulator. This announcement comes after the OSC issued financial penalties against Bybit and KuCoin, claiming violation of securities laws and operating unregistered crypto-asset trading platforms. According to the Settlement Agreement, Bybit has disgorged revenues totaling approximately $2.47 million and compensated the OSC $7,707 (CAD 10,000) for costs. No additional monetary penalties were levied on Bybit as part of the agreement. Also, Bybit announced that it woul...

Crypto brokerage FalconX raises $150M at $8B valuation

Despite the ongoing bearish trend in cryptocurrency markets, venture capital firms continue pouring capital into major industry players like FalconX. FalconX, the institutional-level digital asset platform and crypto brokerage, has raised $150 million in fresh funding as part of its Series D financing round. Completed in early June, the funding round values FalconX at $8 billion, more than doubling from its previous Series C-round valuation of $3.75 billion in August 2021, the firm announced to Cointelegraph on Wednesday. The firm has now raised more than $430 million in total. FalconX’s latest investment round was led by the Singaporean sovereign wealth fund GIC and Facebook’s Eduardo Saverin-backed B Capital Group. Other investors included prominent industry investors and VC firms like T...