cryptocurrency exchange

Thai SEC launches digital hotline for Zipmex users

In the aftermath of the Thai cryptocurrency exchange Zipmex stopping withdrawals last week, local financial regulators are stepping in to look into potential losses by investors. Thailand’s Securities and Exchange Commission (SEC) is taking action to collect all necessary information from investors on how they have been affected by issues on Zipmex. The regulator officially announced on July 25 that Zipmex customers can submit information via an online forum on the Thai SEC’s official website. The SEC has received a number of complaints from people affected by Zipmex after the crypto exchange temporarily suspended withdrawals of the Thai baht and digital assets on Wednesday, the regulator said. “In the past, the SEC issued a letter requesting the company [Zipmex] to provide an efficient sy...

Sentiment and inflation: Factors putting pressure on Bitcoin price

Subsequently, there are fears that Bitcoin prices will take longer to recover. Bitcoin (BTC) has been hovering around the $20,000 range for several weeks now after the coin lost over 60% of its value from its peak in November. The recent plunge wiped out over $600 million from its market cap and caused rising concerns of a bubble burst. Negative investor sentiment Cryptocurrency investors have been on edge since Bitcoin’s fall to around $20,000. Many of them fear that more unprecedented selloffs by key players could precipitate a bigger downtrend. Further declines are likely to amplify losses and make it harder for the market to recover in the medium term. As such, many investors are holding off additional investments. Besides the fall of cryptocurrencies, the decimation of linchpin crypto...

Bitcoin price falls under $21K, bringing more capitulation or just consolidation?

On July 26, Bitcoin (BTC) price dropped below $21,000, giving back the majority of the gains accrued in the previous week and returning to the $23,300 to $18,500 range that Glassnode analysts describe as “the Week 30 high and Week 30 low.” A handful of analysts and traders attribute the July 26 to July 27 Federal Open Market Committee (FOMC) meeting and the expected Federal Reserve rate hike as the primary reasons for the current sell-off. Barring the announcement that the United States economy has entered a recession, a few traders believe that the expected 75 to 100 basis point (BPS) hike will be followed by a relief rally that could see BTC, Ether and other large-cap altcoins snack back to the top of their current range. Of course, this sentiment reflects more speculation than sou...

Crypto Biz: The 3AC saga takes another bizarre twist

About eight months ago, I vouched pretty strongly for Su Zhu to be included in the prestigious Cointelegraph Top 100. My reasoning was pretty straightforward: Zhu was not only an influential figure on social media, but he ran arguably the most revered hedge fund in crypto — Three Arrows Capital, also known as 3AC. Then, the bear market of 2022 exposed 3AC as a house of cards run by founders who believed their own hype — and made reckless business decisions along the way. With the 3AC saga still unfolding, we received privileged information this week about the company’s remaining assets. The revelations aren’t good if you’re a 3AC creditor looking to be made whole again. Source claims 3AC’s Deribit exposure is worth much less than reported An anonymous source close to the 3AC debacle ...

Zipmex resumes withdrawals for trade wallets

Cryptocurrency exchange Zipmex has resumed withdrawals from its trade wallet after two days, but said transfers, deposits and trade will continue to be disabled from its Z Wallet. In a Friday announcement, Zipmex said its Thailand-based users could make withdrawals from its trade wallet, with the function expected to be “re-enabled this evening” for clients in other countries. The crypto exchange has had withdrawals disabled since Wednesday, citing a “combination of circumstances” beyond its control, including the recent market volatility. “Ever since the black swan events surrounding the crypto space Zipmex has retrieved the majority of our funds and assets that were historically deposited with our deployment partners and have been actively working to resolve the situatio...

Crypto.com scores regulatory approval from Cyprus SEC

Singapore-based cryptocurrency exchange Crypto.com continues to aggressively expand its reach, becoming the latest crypto firm officially authorized to operate in Cyprus. Crypto.com has received regulatory approval from the Cyprus Securities and Exchange Commission (CySEC), the firm announced to Cointelegraph on July 22. The approval enables Crypto.com to offer a number of products and services to customers in Cyprus in compliance with local regulations. The new regulatory milestone comes in line with Crypto.com’s growing global presence as the firm has been actively expanding its operations, receiving approvals to operate in countries like Italy, Greece and Singapore. According to Crypto.com co-founder and CEO Kris Marszalek, the exchange currently prioritizes Europe as the main region fo...

Hardware wallet industry to outstrip crypto exchanges: Report

The crypto hardware wallet industry could be growing at a faster pace than cryptocurrency exchanges, data from several studies suggest. The current bear market has accelerated the development of the cold wallet industry, while many centralized crypto exchanges were scrambling to maintain operations. According to a report by business intelligence firm Vantage Market Research, the revenue of global crypto trading platforms amounted to $330 million in 2021. Released on July 21, the report suggests that the global crypto exchange market revenue would reach a value of $675 million by 2028 with a compound annual growth rate (CAGR) of 12.7%. That’s at least half the CAGR related to the growth of the hardware wallet industry, other reports suggest. The global hardware wallet market repor...

Crypto firms facing insolvency ‘forgot the basics of risk management’ — Coinbase

Department heads at Coinbase have weighed in on the market downturn amid solvency concerns around Three Arrows Capital, crypto lending firm Celsius, and Voyager Digital, saying the crypto exchange had “no financing exposure” to the companies. In a Wednesday blog post, Head of Coinbase Institutional Brett Tejpaul, Head of Prime Finance Matt Boyd, and Head of Credit and Market Risk Caroline Tarnok said Coinbase had not engaged in the “types of risky lending practices” exhibited by Three Arrows Capital, Celsius, and Voyager, claiming the firms were examples of practicing “insufficient risk controls.” According to the trio, crypto companies faced the possibility of insolvency caused by “unhedged bets,” large investments in Terra, and overleveraging with venture capital firms. “The issues here ...

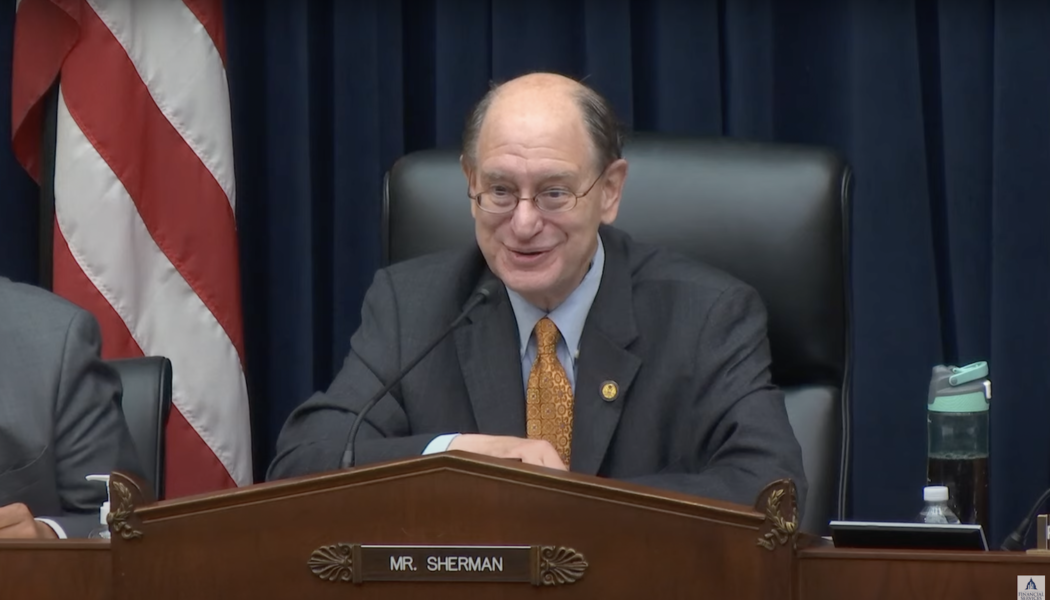

US lawmaker criticizes SEC enforcement director for not going after ‘big fish’ crypto exchanges

Brad Sherman, the congressperson who previously called for banning cryptocurrencies in the United States, criticized the Securities and Exchange Commission’s (SEC) approach to enforcement among major crypto exchanges. In a Tuesday hearing before the House Committee on Financial Services, Sherman said SEC enforcement director Gurbir Grewal needed to show “fortitude and courage” when pursuing securities cases against cryptocurrency exchanges in the United States. The lawmaker added that the SEC enforcement division had “gone after” XRP as a security, but not the crypto exchanges that processed “tens of thousands” transactions of the token. “If XRP is a security — and you think it is, and I think it is, why are these crypto exchanges not in violation of law and is it enough that the crypto ex...

Bit2Me to onboard 100k blocked crypto investors from 2gether exchange

Following a recent agreement between the two crypto exchanges, Bit2Me announced plans to onboard 2gether’s 100,000 crypto investors, who were recently blocked from trading due to the exchange’s inability to operate amid unfavorable market conditions. On July 10, Spanish cryptocurrency trading platform 2gether shut down its free trading services, citing its inability to justify its related operational costs due to crypto winter. Instead, the users were being charged 20 euros as maintenance fees. Providing relief to the recently displaced crypto investors, Bit2Me reached an agreement with 2gether to onboard its users without imposing any fees — allowing users to move over their holdings and resume their trading activities. In addition, Bit2Me decided to reimburse the 20 euros back to the use...

CoinFLEX resumes withdrawals, limiting users to 10%

Cryptocurrency exchange CoinFLEX is partially reopening user withdrawals, raising cautious optimism that the company was gradually recovering from liquidity constraints that were triggered by a high-profile client default. Beginning at 5 am UTC on Friday, all CoinFLEX users will be able to withdraw up to 10% of their funds, the company said. All existing withdrawal requests will be canceled and returned to their respective accounts, giving users the ability to initiate new requests in accordance with the 10% limit. The remaining 90% of user balances will be considered “locked funds,” or funds that appear on their balance but cannot be withdrawn, traded or used as collateral. The new guidelines apply to all assets except flexUSD, an interest-bearing stablecoin, which “cannot be withdr...

Why is there so much uncertainty in the crypto market right now? | Market Talks with Crypto Jebb and Crypto Wendy O

In the fourth episode of Market Talks, we welcome YouTube media creator and crypto educator Crypto Wendy O. Crypto Wendy O is a YouTube media creator and crypto educator. Wendy became interested in cryptocurrency and blockchain technology in November of 2017. She has been into crypto full-time since the summer of 2018 and focuses on providing transparent marketing & media solutions for blockchain companies globally. Wendy also provides free education via YouTube and Twitter to her growing audience of over 170 thousand, giving her the largest following of any female crypto influencer in the world. Some of the topics up for discussion with Wendy are the new consumer price index (CPI) numbers and how they might impact the crypto market going forward, and why there is so much uncertai...