cryptocurrency exchange

Indian authorities freeze $8.1M in WazirX funds as part of AML investigation

India’s Directorate of Enforcement, or ED, has announced it froze roughly $8.1 million in funds and conducted a search connected to cryptocurrency exchange WazirX as part of an investigation into instant personal loan fraud. In a Friday announcement, the Directorate of Enforcement alleged WazirX facilitated transactions by unnamed fintech firms “to purchase crypto assets and then launder them abroad” as part of a scheme involving Chinese-backed companies circumventing India’s licensing regulations. In its investigation, the ED said it ordered WazirX bank accounts containing 646.7 million Indian rupees — roughly $8.1 million at the time of publication — frozen and conducted a search connected to co-founder Sameer Mhatre. According to the regulator, the investigation was still ongoing. Howev...

Voyager plans to resume cash withdrawals on Aug. 11

Crypto lender Voyager Digital Holdings has reported users may be able to make cash withdrawals from the app more than a month after suspending trading, deposits, withdrawals and loyalty rewards. In a Friday blog post, Voyager said clients with U.S. dollars in their accounts could withdraw up to $100,000 in a 24-hour period starting as early as Aug. 11, with the funds received in 5–10 business days. The announcement followed a judge ruling on Thursday the crypto lending firm was cleared to return $270 million in customer funds held at the Metropolitan Commercial Bank in New York. “Requests will be processed as quickly as possible but will require some manual review, including fraud reviews and account reconciliation, and timing will depend, in part, upon the individual banks to which custom...

US lawmakers request crypto firms provide info on diversity and inclusion

A group of five lawmakers from the United States House of Representatives has requested data on the diversity and inclusion practices of 20 major firms dealing with cryptocurrencies and Web3. In a Thursday notice, House Financial Services Committee chair Maxine Waters along with Representatives Joyce Beatty, Al Green, Bill Foster and Stephen Lynch penned a letter requesting U.S.-based crypto firms provide information on “how and whether the industry is working toward a more equitable environment for everyone.” The lawmakers sent letters to 20 companies including Aave, Binance.US, Coinbase, Crypto.com, FTX, Kraken, Paxos, Ripple and Tether as well as venture capital firms Andreessen Horowitz, Haun Ventures and Sequoia Capital. “There is a concerning lack of publicly available data to effect...

Ledger reportedly seeking additional $100 million in funding

Having raised a mammoth $380 million funding at a $1.5 billion valuation in June, French cryptocurrency hardware wallet maker Ledger is looking to raise an extra $100 million, according to a Monday report from Bloomberg. In June, Ledger raised $380 million in a funding round led by 10T Holdings. Now, according to reports, the company is seeking an additional $100 million to help it continue its rapid expansion. Business is said to be thriving as investors seek cold storage for their cryptocurrency, according to sources quoted by Bloomberg. Hardware storage wallets from Ledger are a type of offline storage that isn’t connected to the internet, making them more secure against hacking than online wallets. This allows users to manage their own cryptocurrency without worrying about their ...

New York AG calls for whistleblowers ‘deceived or affected’ by the crypto market crash

New York Attorney General Letitia James has opened the doors for investors who may have witnessed misconduct at a crypto firm amid the extreme market volatility to file a complaint as a whistleblower. In a Monday notice, James called on New York-based crypto users who have been locked out of accounts at exchanges or lending platforms, unable to access funds, or “deceived about their cryptocurrency investments” to contact the Office of the Attorney General. As a whistleblower, an individual filing a complaint with authorities could be kept anonymous — the New York Attorney General’s website already includes the option to submit relevant documents and information through a Tor Browser. “Investors were promised large returns on cryptocurrencies, but instead lost their hard-earned money,” said...

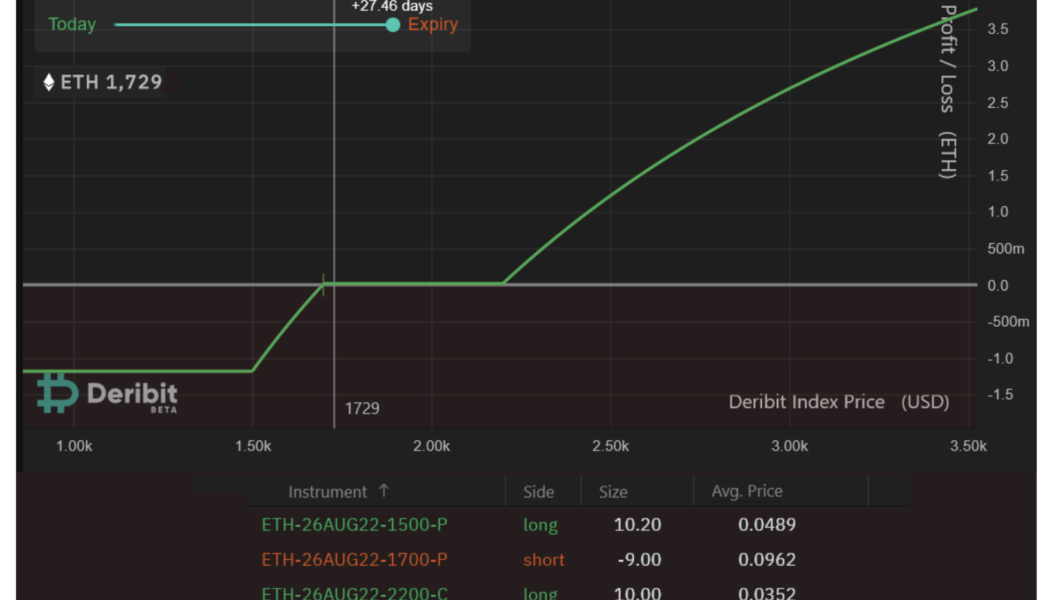

Pro traders may use this ‘risk averse’ Ethereum options strategy to play the Merge

Ether (ETH) is reaching a make-it or break-it point as the network moves away from proof-of-work (PoW) mining. Unfortunately, many novice traders tend to miss the mark when creating strategies to maximize gains on potential positive developments. For example, buying ETH derivatives contracts is a cheap and easy mechanism to maximize gains. The perpetual futures are often used to leverage positions, and one can easily increase profits five-fold. So why not use inverse swaps? The main reason is the threat of forced liquidation. If the price of ETH drops 19% from the entry point, the leveraged buyer loses the entire investment. The main problem is Ether’s volatility and its strong price fluctuations. For example, since July 2021, ETH price crashed 19% from its starting point within 20 d...

KuCoin crypto exchange debuts USDT-dominated NFT ETF

Seychelles-headquartered cryptocurrency exchange KuCoin has launched an exchange-traded fund (ETF) tied to major nonfungible token (NFT) assets like Bored Ape Yacht Club (BAYC). KuCoin’s NFT ETF Trading Zone went live on Friday, the firm announced. The new investment product is launched in collaboration with NFT infrastructure provider Fracton Protocol. The KuCoin NFT ETF is a Tether (USDT)-dominated product that marks particular underlying NFT assets like Bored Ape Yacht Club. BAYC is one of five NFT ETFs that KuCoin is launching. Trading under the symbol hiBAYC, the asset is an ERC-20 token representing 1/1,000,000 ownership of the target BAYC in the BAYC meta-swap of Fracton Protocol. The ETF aims to increase liquidity as it enables exposure to NFTs via the USDT stablecoin instead of Et...

Dubai permits full operation to FTX subsidiary FZE via first MVP license

On Friday, FZE, a subsidiary of crypto exchange FTX, was awarded Dubai’s first Minimal Viable Product (MVP) license, allowing full operation of the exchange in the region. Dubai’s Virtual Asset Regulatory Authority (VARA) issued the operating license to FZE under the MVP program, which according to Helal Saeed Almarri, the director general of Dubai WTC Authority, is designed for secure and sustainable growth in Dubai. For now, the FTX FZE exchange’s operations are in the test phase and will be focused on providing various crypto services. According to FTX CEO Sam Bankman-Fried, the newly licensed exchange will operate under a model incorporating regulatory oversight and Financial Action Task Force (FATF) compliance controls catering to Tier 1 international financial markets. In addit...

CoinFLEX announces staff cuts as part of measures to reduce costs by up to 60%

Cryptocurrency exchange CoinFLEX said it had downsized a “significant number” of team members in an effort to cut operating costs. According to a Friday blog post, CoinFLEX said it had cut some staff across “all departments and geographies” as part of measures to reduce the company’s costs by 50% to 60%. The majority of the remaining team members will focus on product and technology, and the exchange said it would consider scaling as “volume comes back.” “The intention is to remain right-sized for any entity considering a potential acquisition of or partnership opportunity with CoinFLEX,” said the exchange. On Saturday, CoinFLEX halted withdrawals after an unnamed party reportedly failed to meet a $47 million margin call. CEO Mark Lamb later took to Twitter to confirm rumors that CoinFLEX ...

Crypto Biz: Elon Musk: The ultimate crypto tourist

Elon Musk’s Tesla proved to be the ultimate paper hands after the electric vehicle maker sold 75% of its Bitcoin (BTC) holdings in the second quarter. I say, good riddance. The cult of personality isn’t good for Bitcoin, and neither is a technologist who treats the asset as his plaything. As far as we are aware, Musk hasn’t sold any of his personal Bitcoin stash and Tesla still has an estimated 10,800 BTC on its books. Still, the less we have to hear about Musk and Bitcoin, the better. In this week’s Crypto Biz, we chronicle Tesla’s sale of BTC, KuCoin’s fight against fake news and Cathie Wood’s sale of Coinbase stock. Tesla reports $64M profit from Bitcoin sale Tesla’s decision to sell most of its Bitcoin wasn’t as boneheaded as it appeared at first. The company scored a $64 million...

Deposits at non-bank entities, including crypto firms, are not insured — FDIC

The United States Federal Deposit Insurance Corporation, or FDIC, has issued an advisory informing the public it “does not insure assets issued by non-bank entities, such as crypto companies.” In a Friday notice, the FDIC advised banks in the U.S. that they needed to assess and manage risks in third-party relationships with crypto firms. The government agency said that while deposits at insured banks were covered for up to $250,000, no such protections applied “against the default, insolvency, or bankruptcy of any non-bank entity, including crypto custodians, exchanges, brokers, wallet providers, or other entities that appear to mimic banks.” “Some crypto companies have misrepresented to consumers that crypto products are eligible for FDIC deposit insurance coverage or that customers are F...

Fed demands Voyager remove ‘false’ claims deposits are FDIC insured

Cypto lender Voyager Digital has been directed to remove “false and misleading” statements that its user’s deposit accounts are FDIC insured. In a joint letter written on July 28 by Seth Rosebrockfrom & Jason Gonzalez, Assistant General Counsel at the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) to Voyager Digital, the authors said the representations “likely misled and were relied upon” by customers who placed funds with Voyager who now no longer have access to it. “These representations are false and misleading and, based on the information we have to date, it appears that the representations likely misled and were relied upon by customers who placed their funds with Voyager and do not have immediate access to their funds.” The Fed and FDIC allege that V...