cryptocurrency exchange

Crypto market bloodbath leads to $432M in liquidation

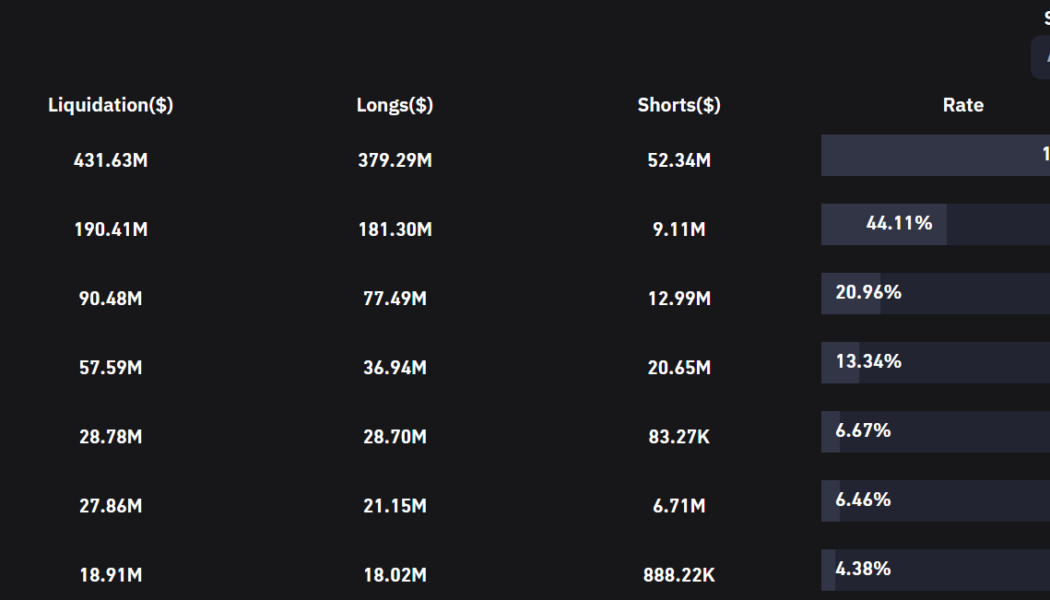

The crypto market turmoil entered the third week of September as most of the cryptocurrencies started the week on a bearish note. The total crypto market cap dipped below $1 trillion again, with several cryptocurrencies recording a double-digit downfall over the past 24 hours. The ongoing bearish turmoil has led to nearly half a billion in liquidations for the leverage crypto traders over the past 24 hours. Data from Coinglass highlight that 130,087 traders were liquidated with a total liquidations value of $431.51 million. Bitcoin (BTC) leverage traders lost $44.5 million, followed by Ether (ETH) traders with a total liquidation of $8.39 million. Long traders made a significant chunk of losses on majority of the exchanges with the average difference between the amount of long and short li...

Bitcoin exchange inflows see biggest one-day spike since March 2020

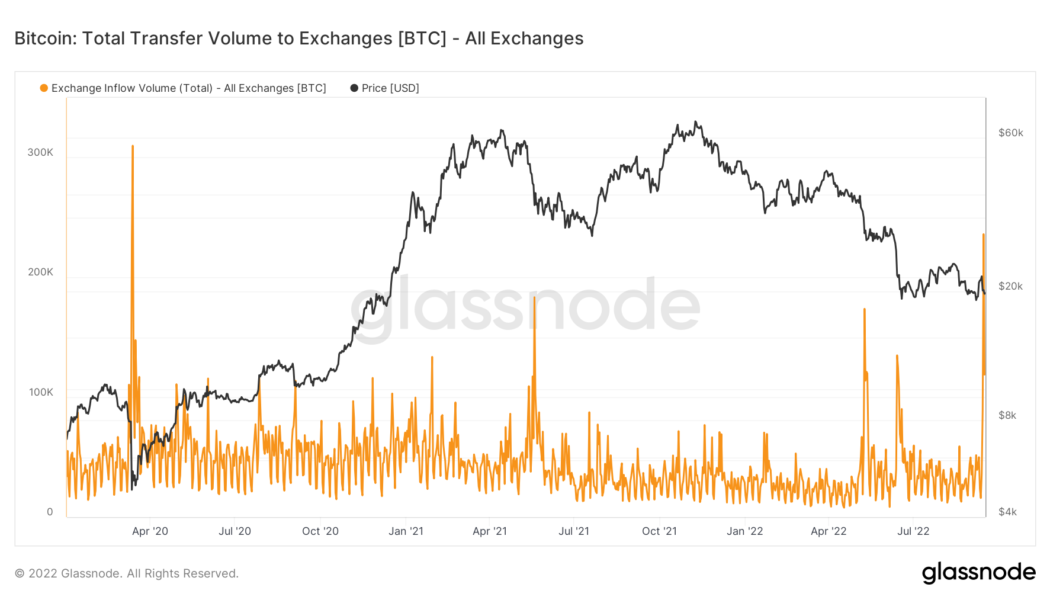

Bitcoin (BTC) exchanges have seen huge volumes this month as price declines lead to renewed interest in trading. Data from sources including on-chain analytics firm Glassnode shows exchange inflows hitting their highest since March 2020. “The scent of volatility is in the air” On Sept. 14, over 236,000 BTC made its way to the 1 major exchanges tracked by Glassnode. This was the largest single-day spike since the chaos that surrounded Bitcoin’s dip to just $3,600 in March 2020. Bitcoin total transfer volume to exchanges chart. Source: Glassnode The sell-offs in May 2021 and May and June this year failed to match the tally, suggesting that more of the Bitcoin investor base is currently aiming to reduce exposure. Separate data from analytics firm Santiment covering both centralize...

Brother of former Coinbase employee pleads guilty to charges related to insider trading: Report

Nikhil Wahi, who was arrested for allegedly working with his brother and an associate on a scheme to commit insider trading using crypto, has reportedly entered a guilty plea for wire fraud conspiracy charges. According to a Monday report from Reuters, Wahi admitted to authorities during a virtual hearing that he used confidential information obtained from Coinbase to make profits from trading crypto. Wahi’s brother Ishan worked as a product manager at Coinbase, during which time he allegedly shared information regarding the launch dates of tokens with his brother and an associate, Sameer Ramani. The trio allegedly used the insider information to make roughly $1.5 million in gains from trading 25 different cryptocurrencies between 2021 and 2022. “I knew that it was wrong to receive C...

Dubai grants regulatory approval for Blockchain.com office: Report

Blockchain wallet and cryptocurrency exchange platform Blockchain.com has reportedly secured regulatory approval from Dubai’s Virtual Assets Regulatory Authority, or VARA. According to a Friday report from Reuters, VARA signed an agreement which will allow Blockchain.com to open an office in Dubai. The crypto firm currently operates several offices in North America, Europe, South America, and Singapore. Great work by the team here – Dubai ✅✅https://t.co/8nQm8w8y3g — Peter Smith (@OneMorePeter) September 9, 2022 Since Dubai’s prime minister and ruler Sheikh Mohammed bin Rashid Al Maktoum announced the establishment of the crypto regulator and an accompanying law in March, VARA has granted approval for Crypto.com, OKX and FTX subsidiaries to offer crypto-related services ...

More than 50% of reported Bitcoin trading volume is ‘likely to be fake or non-economic’ — Report

Bitcoin trading data from 157 exchanges reportedly did not match up to what companies claimed. According to an Aug. 26 report from Forbes, Javier Pax of the news outlet’s digital asset arm said there was a mismatch between the Bitcoin (BTC) trading data reported by crypto exchanges and the actual numbers. The Forbes contributor found that a group of small exchanges had BTC trading volumes roughly 95% less than those reported, while those operating “with little or no regulatory oversight” — including Binance and Bybit — claimed to have more than double the analyzed volume: $217 billion as opposed to $89 billion. “More than half of all reported trading volume is likely to be fake or non-economic,” said Pax. “The global daily Bitcoin volume for the industry was $128 billion on June 14. That i...

Former CFTC commissioner Jill Sommers joins FTX US Derivatives board

Jill Sommers, who served as a commissioner at the United States Commodity Futures Trading Commission, has joined the board of directors for FTX US Derivatives. In a Thursday announcement, crypto exchange FTX US’ derivatives arm said Sommers had become its latest board member in a move seeming to increase the company’s regulatory efforts. Sommers served as a CFTC commissioner from 2007 to 2013 under former Presidents Barack Obama and George W. Bush and was the managing director of regulatory affairs for the Chicago Mercantile Exchange. According to Sommers, FTX US Derivatives aimed to become “the most regulated digital asset exchange in the world.” She said the board would work closely with regulators, suggesting discussions with the CFTC and others within the United States government. “Add...

Sam Bankman-Fried denies report FTX plans to purchase stake in Huobi

Global crypto exchange FTX will not be acquiring a majority stake in Huobi, according to CEO Sam Bankman-Fried, or SBF. In a Monday tweet, SBF explicitly denied a Bloomberg report that claimed FTX was planning to purchase crypto exchange Huobi. Cointelegraph reported on Aug. 12 that Huobi co-founder Leon Li was considering selling his majority stake, valued at more than $1 billion, in the company. “We are not planning to acquire Huobi,” said SBF. Just to be explicit because apparently a lot of people are saying this: No, we are not planning to acquire Huobi. — SBF (@SBF_FTX) August 29, 2022 Under SBF’s leadership, both FTX and Alameda Research have stepped in a few times amid the bear market to bail out crypto firms facing liquidity issues. In a June NPR interview, Bankman-Fried...

Binance froze $1M corporate account due to law enforcement request

Major crypto exchange Binance has confirmed it restricted account access to $1 million in crypto for a Tezos tool contributor after being called out on social media. In a Thursday Twitter thread, Binance said it had restricted the account of Tezos staking rewards auditor Baking Bad “as the result of a law enforcement request.” The Tezos contributor alleged that the crypto exchange had blocked access to its corporate account containing Bitcoin (BTC), Ether (ETH), Polgyon (MATIC), Tether (USDT) and other tokens since July 1 “without any explanations” — a claim Binance denied. “BakingBad is well aware of [Binance’s actions], as he was already advised of this multiple times and provided the LE contact form through our support chat system on 7/6, 7/12, and 7/22,” said Binance. “Attempting to mi...

Coinbase says it will ‘evaluate any potential forks’ following the Merge

Cryptocurrency exchange Coinbase has updated its information related to Ethereum transitioning to proof-of-stake to include forks that could arise. In a Thursday update to an Aug. 16 blog post, Coinbase said it would evaluate any potential forks in the Ethereum blockchain on a “case by case basis.” The crypto exchange previously said it planned to ‘briefly pause’ Ether (ETH) and ERC-20 token deposits and withdrawals during the Merge, expected to occur between Sept. 10 and 20. “Should an ETH PoW fork arise following The Merge, this asset will be reviewed with the same rigor as any other asset that is listed on our exchange,” said Coinbase. Rest assured, all potential forked tokens of Ethereum, including PoW forks, will go through the same strict listing review process that is do...

Siam Commercial Bank abandons plans to purchase $500M stake in crypto exchange Bitkub

Thailand’s oldest bank has scrapped plans it first announced in November 2021 to become the majority shareholder of crypto exchange Bitkub. In a Thursday announcement, Siam Commercial Bank’s SCB X Group said it would no longer be paying 17,850 million Baht — roughly $536 million in November and $497 million at the time of publication — to acquire a 51% stake in the Thailand-based crypto exchange. The bank cited concerns with Bitkub “resolving various issues” according to recommendations from the country’s Securities and Exchange Commission without a definite timeline. According to the SCB, the company conducted a due diligence exercise on Bitkub following the November 2021 announcement it planned to become a majority shareholder, resulting in “many opportunities for cooperation in various ...

FTX revenue reportedly grew 1000% in one year, leaked documents reveal

FTX was among the many crypto exchanges with a front-row seat to witness the crypto hype of 2021, back when Bitcoin (BTC) and other cryptocurrencies hit their all-time highs. Driven by massive customer onboarding, partnerships, sponsorships and other factors, FTX’s revenue reportedly grew 1000% in 2021 — revealed internal documents. Audited financials of FY 2020-2021 show FTX witnessing a 1000% increase in revenue — growing from $90 million in 2020 to $1.2 billion in 2021, claimed CNBC alleging access to the documents. The revenue breakdown discloses a 1842.85% increase in operating income for FTX, from $14 million to $272 million in one year. The crypto exchange amassed $388 million in net income, a 2182.35% increase from last year’s $17 million. FTX has reportedly made $270 million in th...

Are non-KYC crypto exchanges as safe as their KYC-compliant peers?

Many see implementing Know Your Customer (KYC) tools in crypto as a deterrent to the Bitcoin (BTC) Standard, which has predominantly promoted anonymized peer-to-peer transactions. However, regulators stay put on promoting KYC and anti-money laundering (AML) implementations as a means to ensure investors’ safety and protection against financial fraud. While most crypto exchanges have begun implementing regulatory recommendations to remain at the forefront of crypto’s mainstream adoption, investors still have the choice to opt for crypto exchanges that promote greater anonymity by not imposing KYC processes. But does opting for the latter as an investor mean compromising on safety? A matter of trust Anonymity goes both ways in most cases. Owners of crypto exchanges running non-KYC (or ...