cryptocurrencies

Cove Markets to join Robinhood Crypto in latest acquisition

Cove Markets, an API platform that enables users to trade across multiple centralized exchanges and manage aggregate financial data, will become part of Robinhood Crypto, as announced by the discount brokerage late Tuesday. Traders and investors can connect up to seven exchanges, including Coinbase Pro, Kraken, Bitfinex, etc., using Cove Markets to trade over 50 major currencies and altcoins. The two trading firms said they plan to increase the volume of order routing and execution on Robinhood with the acquisition. Christine Brown, chief operating officer of Robinhood Crypto, made the following remarks regarding the development: The Cove Markets team’s wealth of experience in trading execution and crypto market infrastructure will help us to build more powerful trading capabilities,...

Look out below! Analysts eye $40K Bitcoin price after today’s dip to $45.7K

On Monday, Bitcoin’s short-term outlook worsened after the price fell to an intra-day low at $45,672, a far cry from the weekend’s promising rally above the $50,000 level. With the year nearly complete, and all-time highs nearly 33% away, traders are most likely readjusting their expectations and pushing the $100,000 BTC target a bit further into 2022. Daily cryptocurrency market performance. Source: Coin360 Day traders, 4-hour chart watchers and over-leveraged longs are likely freaking out (unless they went short from $50,000 over the weekend or at this morning’s weakness), but let’s zoom out a little bit to see where Bitcoin price stands. BTC/USDT daily chart. Source: TradingView On the daily timeframe, we can see the price struggling to breakout away from the trend of daily lower ...

Law Decoded: A different Congress hearing, Dec. 6–13

The biggest regulatory story of the week was a United States House Committee on Financial Services hearing squarely focused on crypto. Even the event’s title — “Digital Assets and the Future of Finance: Understanding the Challenges and Benefits of Financial Innovation in the United States” — conveyed a different vibe than countless previous Congressional meetings that had been first and foremost about investor protection or security risks or threats to financial stability. Judging from reactions from many industry participants and experts, the exchange has been received as an overwhelming net positive, with legislators asking informed questions and otherwise acting like their goal was to understand this new thing rather than act on preconceived notions. Of course, there were tired qu...

Bitcoin price slips below $47K as stocks, crypto prepare for this week’s FOMC meeting

Bitcoin (BTC) bulls are once again on the defensive foot after the breakout momentum that put the price above $50,000 on the weekend evaporated and pulled the price under $47,000. Analysts say the slight pullback in equities markets and the upcoming Federal Open Market Committee (FOMC) meeting are the primary reasons for Dec. 13’s pullback and a few suggest that a revisit to the swing low at $42,000 could be on the cards. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what analysts are saying about the current Bitcoin price action and what they expect in the short term. Fed tapering talks put pressure on the market The current headwinds facing BTC are in large part being influenced by regulatory matters in the United States, as highlighted in a recent report from D...

SEC chair’s regulatory agenda fails to include clarity on crypto, says Hester Peirce

Hester Peirce, a commissioner for the United States Securities and Exchange Commission known by many in the space as Crypto Mom, is pushing back against the regulatory body’s agenda for not including clarification on digital assets. In a Monday joint statement, Peirce and SEC Commissioner Elad Roisman said they were “disappointed” in the failure of chairperson Gary Gensler’s regulatory agenda to include items aimed at helping companies raise capital, furthering investor protection, undoing recent rules passed by the commission and providing clarification on crypto. According to the two regulators, Gensler’s uncertain stance on digital assets may create problems for firms looking to operate in the space. “Rather than taking on the difficult task of formulating rules to allow investors and r...

Bank of Russia to ban mutual funds from investing in Bitcoin

The Russian central bank continues its strict policies regarding the cryptocurrency industry, now officially banning mutual funds from investing in cryptocurrencies like Bitcoin (BTC). On Dec. 13, the Bank of Russia published an official statement on regulating investment opportunities by mutual investment funds. Despite expanding the number of assets available for investment by mutual funds, the document prohibits fund managers from buying cryptocurrencies as well as “financial instruments whose value depends on prices of digital assets.” The statement emphasizes that mutual funds are not allowed to provide crypto exposure both to either qualified or unqualified investors. The Bank of Russia previously recommended asset managers to exclude cryptocurrencies from exposure in mutual funds in...

ZK-rollups step into the limelight after the quest to scale Ethereum evolves

Scalability on the Ethereum (ETH) network has been a point of contention within the cryptocurrency ecosystem for years, primarily due to high fees and network congestion during periods of peak demand. The latest solution to emerge as the final fix to Ethereum’s scalability woes are Zero-knowledge rollups (ZK rollups), a form of scaling that runs computations off-chain and submits them on-chain via a validity proof. Zk rollup season — cryptowarlord.eth ( ͡° ͜ʖ ͡°) (@CryptoWarlordd) December 7, 2021 Earlier in the year, protocols that opted to use optimistic rollups such as Optimism and Arbitrum dominated the headlines and were touted as the best solution to scaling on Ethereum, but aside from Arbitrum, the hype for those protocols has quieted down and traders have pointed out that even opti...

Point of no return? Crypto investment products could be key to mass adoption

The first Bitcoin (BTC) futures exchange-traded fund (ETF) was launched in the United States back on October 19, 2021. Since then, a number of other cryptocurrency investment products have been launched in various markets. That first ETF, the ProShares Bitcoin Strategy ETF, quicklybecame one of the top ETFs of all time by trading volume on its debut, and soon after, several other Bitcoin futures ETFs were launched in the United States, providing investors with different investment options. To Martha Reyes, head of research at cryptocurrency trading platform Bequant, these options are important. Speaking to Cointelegraph, Reyes pointed out that in traditional finance, ETFs have “proved to be incredibly popular in recent years, with ETF assets expected to reach $14 trillion by 2024.” Reyes s...

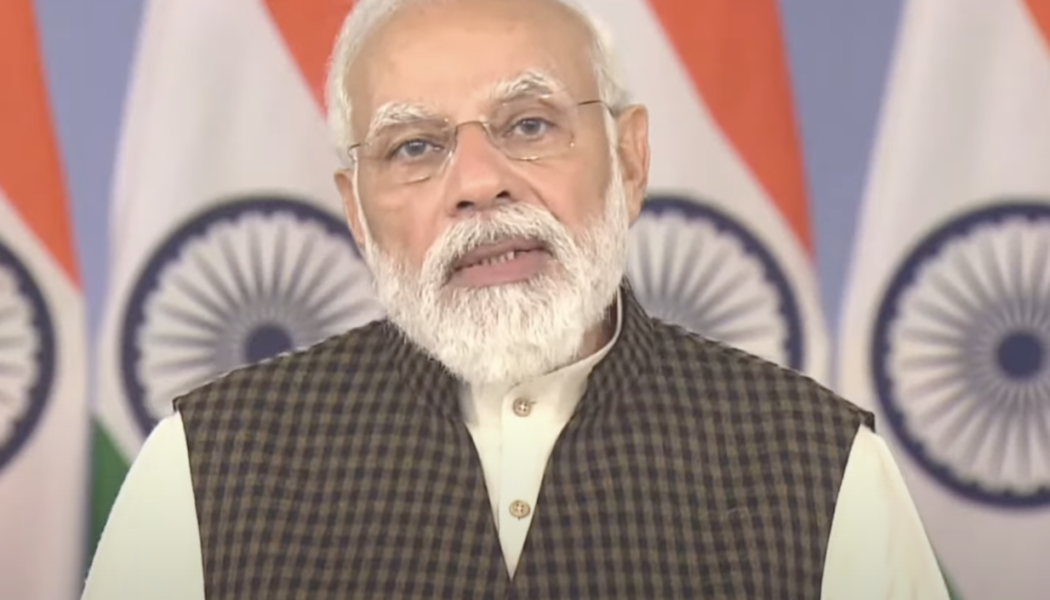

Indian PM calls for cryptocurrencies to ’empower’ democracy at global summit

Cryptocurrency made an appearance at a global online summit for world leaders in a speech from Indian Prime Minister Narendra Modi. At Friday’s events for the Summit for Democracy hosted by U.S. President Joe Biden, Modi said India would be willing to offer other countries “innovative digital solutions” to facilitate free and fair elections and governance. In addition, the Prime Minister called for a global standard on cryptocurrencies and major social media platforms, likely referring to the impact some have had on politics in India as well as many other countries: “We must also jointly shape global norms for emerging technologies like social media and cryptocurrencies so that they are used to empower democracy, not to undermine it […] By working together, democracies can meet...

Indian prime minister Modi’s hacked Twitter account attempts BTC scam

The official Twitter account of Indian Prime Minister Narendra Modi got compromised earlier today, which was then used to share misleading information about the mainstream adoption of Bitcoin (BTC) and redistribution of 500 BTC among the Indian citizens. On Dec. 10, Modi said in a virtual event virtual summit hosted by US President Joe Biden that technologies such as cryptocurrencies should be used to empower democracy and not undermine it: “By working together, democracies can meet the aspirations of our citizens and celebrate the democratic spirit of humanity.” While the long-awaited Lok Sabha Winter Session, a parliamentary meetup intended to discuss the legality of cryptocurrencies in the region, did not conclude the government’s stance on crypto, hackers from unknown origins man...

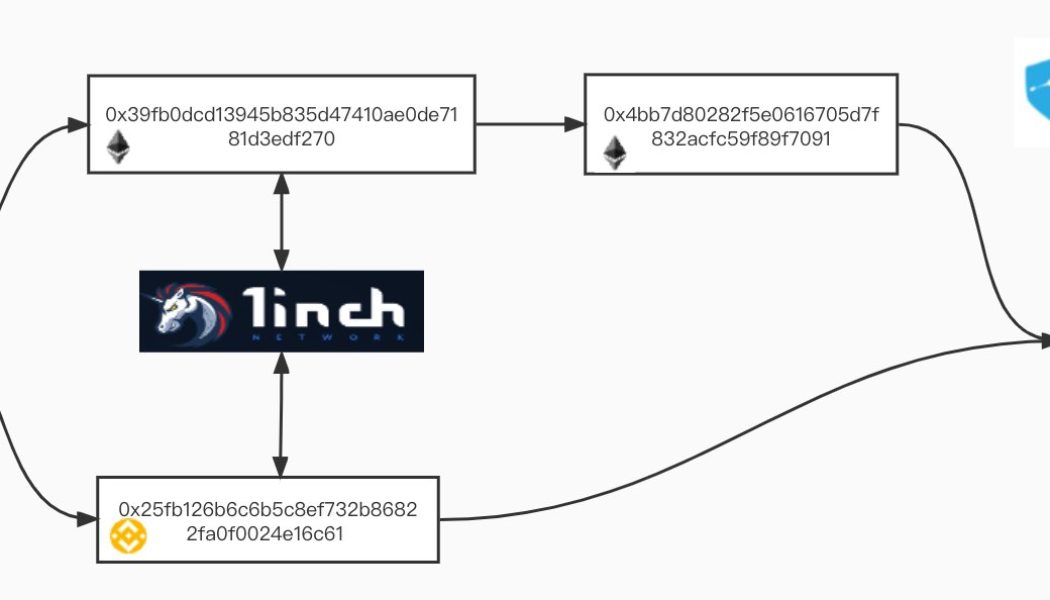

AscendEX loses $80M following ERC-20, BSC, Polygon hot wallet compromise

Crypto trading platform AscendEX suffered a loss of $77.7 million in a hot wallet compromise that allowed hackers to access and transfer tokens hosted over the Ethereum (ETH), Binance Smart Chain (BSC) and Polygon (POLY) blockchains. Soon after realization, AscendEX proactively warned its users about the stolen funds, confirming that the hackers were not able to access the company’s cold wallet reserves. 22:00 UTC 12/11, We have detected a number of ERC-20, BSC, and Polygon tokens transferred from our hot wallet. Cold Wallet is NOT affected. Investigation underway. If any user’s funds are affected by the incident, they will be covered completely by AscendEX. — AscendEX (@AscendEX_Global) December 12, 2021 According to PeckShield, a blockchain security and data analytics company, around $60...

South Africa’s financial regulator plans to introduce framework aimed at protecting vulnerable crypto investors: Report

Unathi Kamlana, the commissioner of South Africa’s Financial Sector Conduct Authority, has reportedly said the government’s rollout of a crypto framework would be aimed at mitigating any potential risks. According to a Friday report from Bloomberg, Kamlana said the financial regulator planned to present a regulatory framework early in 2022 intended to protect investors from “potentially highly risky” crypto assets. The commissioner said any framework on crypto would be created in coordination with the Prudential Authority and Financial Surveillance Board of the South African Reserve Bank. “What we want to be able to do is to intervene when we think that what is provided to potential customers are products that they don’t understand that are potentially highly risky,” said Kamlana. “We must...