cryptocurrencies

Vodafone auctions world’s first SMS ‘Merry Christmas’ as NFT for charity

British telco giant Vodafone has reportedly plans to auction the world’s first Short Message Service (SMS) in the form of a nonfungible token (NFT) on Dec. 21. The SMS, that reads “Merry Christmas”, was sent 29 years ago over the Vodafone network on Dec 3, 1992, and was received by Richard Jarvis, an employee at the time. The historic 15 character-long SMS will be auctioned off as an NFT in a one-off sale conducted by the Aguttes Auction House in France, according to Romanian news outlet Ziarul Financiar. By auctioning off the world’s first SMS in the form of NFT, Vodafone intends to redirect the earnings to the United Nations High Commissioner for Refugees (the UN Refugee Agency) for helping the forcibly displaced people. Source: Ziarul Financiar The advertisement banner above trans...

Altcoin Roundup: Three smart contract platforms that could see deeper adoption in 2022

Decentralized finance (DeFi) dominated media headlines throughout 2021 and the sector, along with nonfungible tokens (NFTs), helped to initiate the mass adoption of cryptocurrencies. While high yields on staking and instant profits from flipping jpegs have proven to be very lucrative for investors, it’s important to remember that none of it would have been possible without the underlying capabilities of smart contract technology. The Ethereum network remains, hands-down, the most widely used layer-one smart contract platform in the crypto ecosystem, but everyone knows about the high fee and clogged network issues of the past few years. In 2021, competing networks like Avalanche and Binance Smart Chain enabled compatibility with the Ethereum Virtual Machine (EVM) and this produced pos...

US Financial Stability Oversight Council identifies stablecoins and cryptos as threats to financial system

In an annual report published on Friday, the United States Financial Stability Oversight Council, or FSOC, voiced its concern over the adoption of stablecoins and other digital assets. Regarding stablecoins, the FSOC said consumer confidence could be undermined by factors such as illiquidity, lack of appropriate safeguards, opacity regarding redemption rights, and cyber attacks. “A run on stablecoins during strained market conditions may have the potential to amplify a shock to the economy and the financial system,” the report said. The report also alerted to developments in decentralized finance, or DeFi, where the use of high leverage could trigger a fire sale when the price of the underlying asset declines. This would result in a cycle of margin calls and further price...

Senate hearing on stablecoins: Compliance anxiety and Republican pushback

On Dec. 14, the United States Senate Banking, Housing and Urban Affairs Committee held a hearing titled “Stablecoins: How Do They Work, How Are They Used, and What Are Their Risks?” The testimonies, both spoken and written, focused largely on the last two issues, as anxieties over Know Your Customer compliance and the U.S. dollar inflation threat dominated the discussion. Held less than a week after the House of Representatives Financial Services Committee’s hearing on digital assets, which was generally perceived as “constructive”, the meeting held by the Banking Committee was expected to be tough. Senator Sherrod Brown, a Democrat from Ohio who chairs the Committee and had called the hearing, is infamous for his critical stance on the crypto industry, and the November report from Preside...

Here’s why Bitcoin traders expect choppy markets for the remainder of 2021

Inflation concerns and a general sense of trepidation about the future of the global economy continue to put a damper on Bitcoin and altcoin prices and currently the Crypto Fear and Greed index is solidly in the ‘fear’ zone where it has been parked since the beginning of December. Crypto Fear & Greed Index. Source: Alternative Despite the brief bump in prices seen across the markets following the recent Federal Open Market Committee (FOMC) meeting where Fed Chair Jerome Powell indicated that interest rates would remain low for the time being, the overall sentiment in the crypto market continues to wane, signaling that 2021 could end on a bearish note. BTC price could dampen due to macro concerns In a recent report from Delphi Digital, analysts noted that the price of Bitcoin (BTC...

Nexo partners with Three Arrows Capital to launch NFT lending & art financing service

Nexo, the crypto borrowing and exchange platform, has launched an NFT Lending Desk in partnership with NFT hedge fund Three Arrows Capital. The new lending desk caters to over-the-counter, or OTC, clients to offer crypto credit backed by NFTs. Nexo is one of the first crypto lenders to allow customers to borrow stablecoins, ETH, and other cryptocurrencies using certain NFTs as collateral. The company stated that in its initial iteration, the service will accept Bored Ape Yacht Club and CryptoPunks NFTs, with more collections on the way. Clients can also use issued lines of credit as a means of art financing by executing further NFT purchases with t borrowed funds. In a statement shared with Cointelegraph, Nexo Cofounder and Managing Partner Antoni Trenchev said: “Our partnership with...

The Giving Block launches crypto donation service for high-net worth individuals

The Giving Block, an online platform which allows nonprofit organizations and charities to accept digital asset donations, has launched a service tailored to donors wishing to send large amounts of crypto. In a Wednesday announcement, the Giving Block said it partnered with crypto tax startup Taxbit, New York-based accounting firm Friedman LLP, and Ren to start a service aimed at individuals, institutions, and advisors looking to reduce their tax exposure when donating crypto. Giving Block co-founder Pat Duffy said the Private Client Services streamlines its existing donation process allowing “high-value donors to quickly and securely give large gifts to their favorite charities while reducing their tax bill.” According to the platform, individuals wishing to make large donations in crypto...

Beijing court rejects monetary compensation in Bitcoin mining contract plea

A district court in Beijing has rejected monetary compensation in a Bitcoin (BTC) mining contract plea against a blockchain company. The Chaoyang District People’s Court on Wednesday deemed the Bitcoin mining contract between the plaintiff and the blockchain firm “invalid,” the South China Morning Post reported on Dec. 16. The plaintiff in the case reportedly paid 10 million yuan ($1.6 million) to the blockchain firm for deployment of mining machines, but incurred losses on his investment. The Beiijng based plaintiff claimed he earned only 18.5 Bitcoin on his investment and demanded an additional 217.17 BTC in compensation for his losses. The court rejected the plea and also directed the Sichuan branch of the National Development and Reform Commission to look into any illegal mining going ...

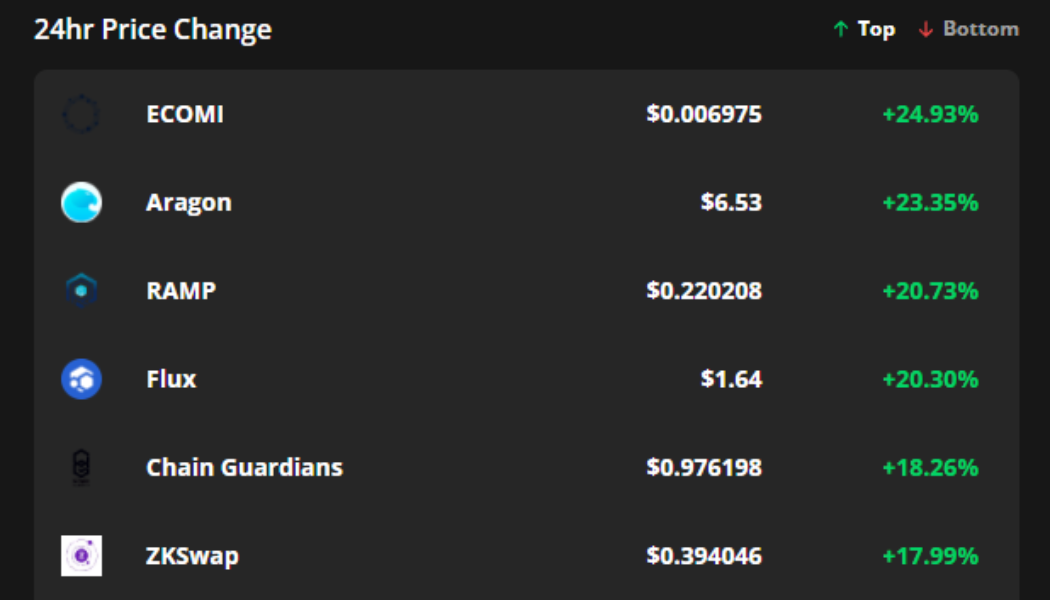

ECOMI, Aragon and Ramp breakout after Bitcoin price pushes above $49K

Cryptocurrency prices and investor sentiment reversed course on Dec. 15 after Federal Reserve chairman Jerome Powell confirmed the bank’s plan to hike interest rates in 2022 and slow down the bond purchasing program that had been in play since the emergence of the coronavirus in March 2020. Following the announcement, Bitcoin (BTC) price tacked on a 1.65% gain, bringing the price above $49,000 and Ether trekked back above the $4,000 mark. Altcoins followed suit with their usual double-digit gains and for the moment, it appears as if bulls have taken back control of the market. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were ECOMI (OM...

Six senators urge Treasury Secretary to clarify definition of broker in infrastructure law before 2022

A bipartisan group of U.S. senators have called on Treasury Secretary Janet Yellen to clarify the language in the infrastructure bill signed into law by President Joe Biden around the tax reporting requirements on crypto. In a Tuesday letter, Senators Rob Portman, Mike Crapo, Pat Toomey, Mark Warner, Kyrsten Sinema, and Cynthia Lummis urged Yellen to “provide information or informal guidance” on the definition of “broker” in the recently passed infrastructure law, HR 3684. Under the current wording, people in the crypto space including miners, software developers, transaction validators and node operators are required to report most digital asset transactions worth more than $10,000 to the Internal Revenue Service, or IRS. However, according to the U.S. lawmakers, the law contains an ...

UK advertising watchdog bans crypto ads for Coinbase and Kraken

The Advertising Standards Authority, or ASA, the United Kingdom’s independent advertising regulator, has taken down another batch of cryptocurrency-related ad campaigns promoting several major industry firms. On Dec. 15, the advertising watchdog issued several rulings on ad violations involving six crypto-related firms including Coinbase, Kraken, eToro, Exmo, crypto broker Coinburp and Luno crypto exchange. The ASA also issued a similar ruling for pizza chain Papa John’s. All seven ads or promotions were banned for “irresponsibly taking advantage of consumers inexperience and for failing to illustrate the risk of the investment,” the rulings said. The ASA argued that Coinbase’s European branch specifically put out a “misleading” promotion on its paid Facebook ad in July 2021, including a t...

KKR leads $350M raise for crypto custody bank Anchorage Digital

Major cryptocurrency custody bank Anchorage Digital has closed a fresh funding round, bringing its valuation to over $3 billion. Anchorage Digital announced on Wednesday that it had raised $350 million in a Series D funding round led by equity investment giant KKR. According to the announcement, this is the first time for KKR to directly invest in equity in a company in the crypto industry. The company invested through its Next Generation Technology Growth Fund II, which is dedicated to developing equity investment in the technology space. “As a pioneer in enabling institutional investors to access digital assets, Anchorage has built a best in class, institutional-grade digital asset platform that combines the best practices of both modern security and usability,” KKR senior leader of tech...