cryptocurrencies

100 digital payment token firms in Singapore fail to win licenses: Report

More than 100 out of 170 “digital payment token services” in Singapore have reportedly failed to obtain licenses from the local financial regulator, the Monetary Authority of Singapore, or MAS. Amid apparently tough regulation, 103 companies related to the digital payment industry in Singapore found their regulatory exemptions removed, Japan’s financial publication The Nikkei reported Monday, citing data from the MAS. Sanjay Jain, CEO at Dubai-based crypto exchange Bitxmi, said that their Singaporean branch has failed to secure a license from the MAS. “We can’t operate in Singapore,” Jain noted. “We have an office there, but it’s just more or less — there’s one person for our accounting and legal issues.” Bitxmi exchange appears on the official list of entities...

Hive Blockchain on track to mine more Bitcoin, less Ether this quarter

Publicly traded crypto mining firm Hive Blockchain is expecting to produce 6,900 Ether (ETH) and 670 Bitcoin (BTC) for the fiscal quarter ending on Dec. 31, marking a respective drop and increase over that of the previous quarter. In a Wednesday notice to shareholders, Hive said it had mined 6,280 Ether from Oct. 1 to Dec. 21 and was on track to mine more than 65 ETH daily for the remainder of 2021. This projected total — 6,900 ETH — would represent a decrease of more than 20% from the 8,688 ETH the company mined from July 1 to Sept. 30. However, Hive is expecting its Bitcoin production to increase by 2% quarterly, from roughly 656 BTC to 670 BTC. “This increase [in Bitcoin] has been driven by the previously announced investments that have been made into new generation miner...

Indian parliament’s agenda for winter session no longer includes crypto bill

The Indian government may still be considering a bill that could ban certain cryptocurrencies in the country, but lawmakers are unlikely to vote on any legislation in the current parliamentary session. According to a Friday publication, India’s lower house of parliament, Lok Sabha, will likely not be looking at a bill proposing the prohibition of “all private cryptocurrencies” before its winter session ends on Thursday. The Cryptocurrency and Regulation of Official Digital Currency Bill does not appear as one of the seven bills on the government body’s agenda over the last days of its 2021 session. A Nov. 23 bulletin for the Lok Sabha stated that Indian lawmakers could vote on legislation that creates “a facilitative framework for creation of the official digital currency” issued by ...

Binance VC arm leads $60M round in cross-chain protocol Multichain

Binance Labs, the venture capital and incubation arm of Binance cryptocurrency exchange, has led a financing round for the cross-chain protocol Multichain, previously known as Anyswap. Shortly after rebranding from Anyswap last week, Multichain has raised $60 million in a seed funding round led by Binance Labs, the firm officially announced on Dec. 21. Other participants in the raise included major VC firms and industry investors like Sequoia China, IDG Capital, Three Arrows Capital, Primitive Ventures, DeFiance Capital, Circle Ventures, Hypersphere Ventures, HashKey and Magic Ventures. Apart from providing capital investment for Multichain, Binance is also building a stronger relationship with the cross-chain protocol. On Dec. 20, Multichain announced that it is now officially recommended...

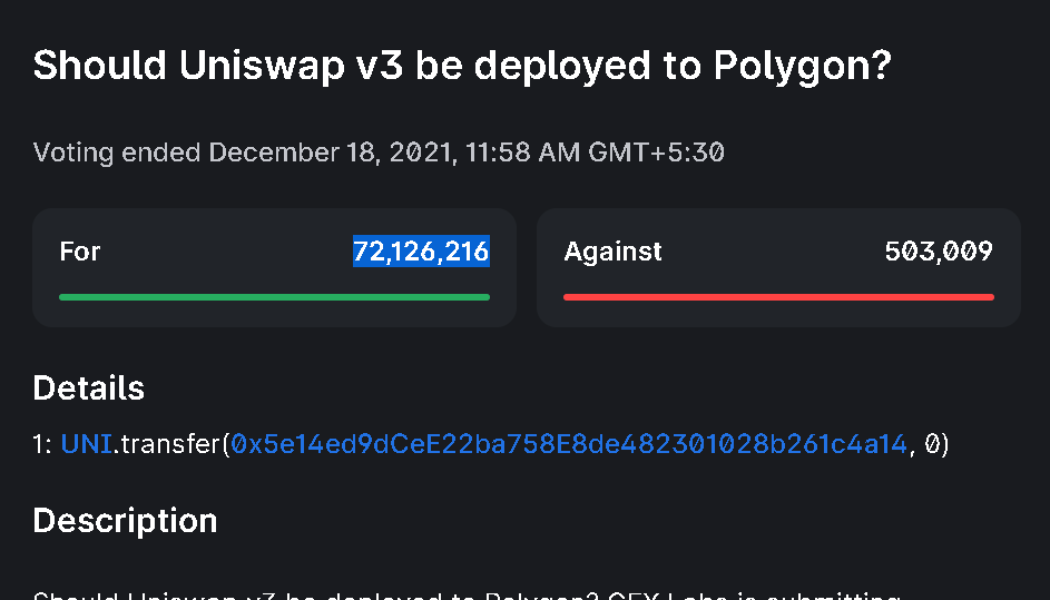

Uniswap v3 contracts deployment on Polygon approved with 99.3% consensus

The Uniswap community has approved the governance proposal that sought deployment of Uniswap v3 contracts over the Polygon PoS Chain. The approval comes in the form of an on-chain vote that saw the participation of over 72.6 million users from the community. Uniswap Labs announced to deploy Uniswap v3 contracts based on the votes that reflected over 99.3% approval consensus and will be supported by a $20 million fund — $15 million for long-term liquidity mining campaign and $5 million for the overall adoption of Uniswap on Polygon (MATIC). The Uniswap community has voted to deploy v3 on @0xPolygon through the governance process. ⚡️ Uniswap Labs will deploy Uniswap v3 contracts within a few days. Stay tuned. pic.twitter.com/LwVLwEngPl — Uniswap Labs (@Uniswap) December 18, 202...

Celebrities that rode the crypto wave in 2021

Overshadowing its glory in previous years, the crypto ecosystem managed to maintain a year-long spotlight throughout 2021. Key catalysts include mainstream adoption of Bitcoin (BTC), a meme coin frenzy driven by Shiba Inu (SHIB) and Dogecoin (DOGE), and proactive participation from popular celebrities and authority figures. The year 2021 witnessed a greater inflow of influencers and celebrities to the space than ever before. All the way from mainstream tech entrepreneurs and presidents to rappers and reality TV stars, celebrities have gotten involved in crypto in their own unique ways. While some chose to create their own versions of crypto ecosystems and tokens, others helped spread awareness of various projects. As a tribute to all those who showed involvement in our world of crypt...

Crypto mainstream adoption: Is it here already? Experts Answer, Part 1

Sameep is the founder of QuickSwap, a decentralized exchange on Polygon that allows users to swap, earn, stack yields, lend, borrow and leverage all on one decentralized, community-driven platform. “Just compare the overall market caps from the beginning of 2021 until today to illustrate how much crypto has grown this year. According to CoinMarketCap, on Jan. 1, crypto’s market cap was about $773 billion. Now it’s over $2.3 trillion. Despite the dollar’s rapid inflation, to me, annual growth of more than $1.5 trillion definitely suggests that mass adoption has begun, but there’s still a lot of room for crypto to continue to grow. To enable that growth, more people need to learn about the alternatives to expensive layer-o...

Polkadot envisions Web3 disruption with multiple parachain launches

Open-source blockchain platform Polkadot announced the launch of its first parachains (or parallelized chain) aimed at improving the interoperability between multiple blockchains. According to the announcement, the Polkadot team invested five years into the development of the parachains, which were allocated to teams via auctions, namely, Acala, Moonbeam, Parallel Finance, Astar, and Clover. With individual blockchains running in parallel within the Polkadot ecosystem, the auction winners will be able to lease slots on Polkadot’s Relay Chain for up to 96 weeks at a time. Developed by Polkadot Founder and Ethereum co-founder Gavin Wood, the Relay Chain helps in coordinating the consensus and communication between parachains: “And as the ecosystem grows, especially with nascent e...

From DeFi year to decade: Is mass adoption here? Experts Answer, Part 1

Dominik is the co-founder and chairman of the Iota Foundation, an open-source distributed ledger and cryptocurrency designed for the Internet of Things. “The biggest difference between crypto in 2017 and crypto in 2022 is the establishment of tangible business models and use cases within our ecosystem thanks to DeFi. We no longer have to wait for external parties such as large companies to drive adoption. We can do it ourselves with applications that introduce much-needed innovation to the base level of our economy — finance. 2021 has been a tremendous year for early-stage validation and growing excitement toward DeFi’s potential. But it’s still early stages. DeFi isn’t yet comparable to fintech companies like Revolut or N26 (2 million to 5...

Traders delay $100K Bitcoin prediction, but still expect a blow-off top in 2022

Bullish traders that drank the “Bitcoin to $100,000 by year-end” Kool-Aid are now coming to terms with the fact that there may be no Santa Claus rally to wrap up 2021. At the moment, the pipe dream has morphed into simple hopes that the top cryptocurrency can at least finish the year above $50,000. Data from Cointelegraph Markets Pro and TradingView shows that the bounce in price seen in BTC following remarks from Federal Reserve Chair Jerome Powell has pretty much evaporated and over the past 48-hours the price has swept fresh lows at $45,500 and from the look of things, the price could drop even further. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what traders think about Bitcoin’s current price action and what could be in store for the remainder o...

Listing frenzy! Coinbase adds nearly 100 crypto assets for trading in 2021

As of today, Coinbase has 139 tradable assets. The exchange added a whopping 83 assets to its trading list in 2021, nearly double the number of assets it had accumulated in the eight years since its founding. Is this rapid expansion a simple cash-grab? Are any of these lesser-known tokens and coins securities? Is this irresponsible or overly ambitious? What does this rapid expansion of assets by Coinbase mean? A money grab? I feel the answer to the first question is an emphatic “No!” Coinbase is making a lot of money on trading fees, but its token list expansion is not about the money. Coinbase started out with a small booth at a conference “just trying to make something that customers wanted,” pitching T-shirts and a hosted Bitcoin (BTC) wallet. Now, Coinbase is the second-largest c...

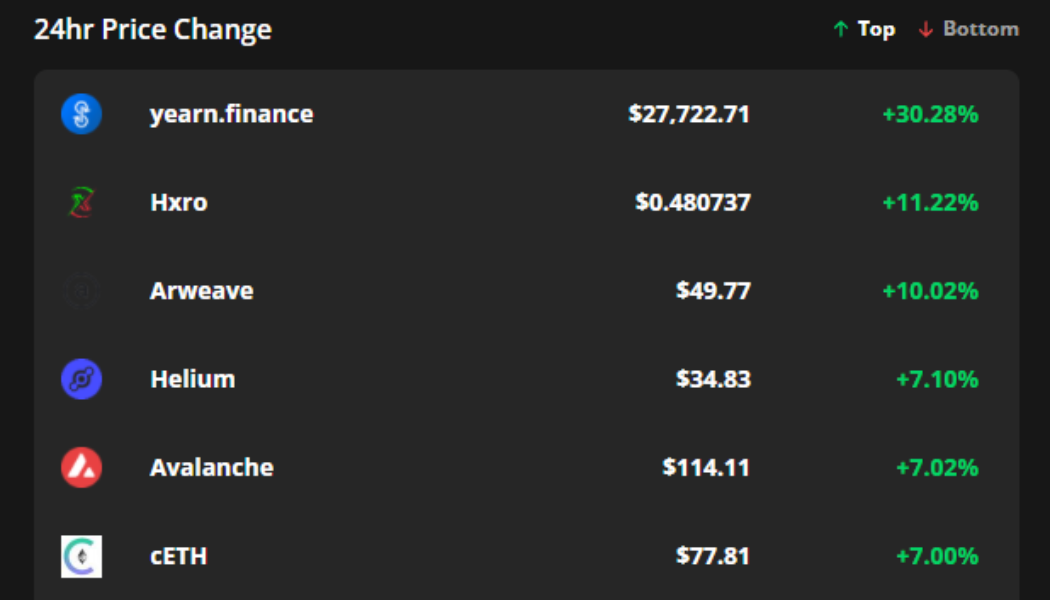

YFI, HXRO and AR post gains even as Bitcoin price dips to $45.5K

Bitcoin (BTC) bulls took another beating on Dec. 17 as a midday onslaught dropped the price to $45,500. The price did manage a quick bounce back to $47,000 but sweeping a new daily low could be a sign that additional downside is in store. Amid the wider market downturn, several altcoins provided weary traders with a source of refuge as token buybacks and increased network activity helped bolster their prices and provide shelter from the storm. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were Yearn.finance (YFI), Hxro (HXRO) and Arweave (AR). YFI benefits from token buybacks Yearn.finance is a decentralized finance (DeFi) aggregator service that ...