cryptocurrencies

McDonald’s jumps on Bitcoin memewagon, Crypto Twitter responds

Prominent crypto entrepreneurs and supporters, who shared memes on Twitter about doing odd jobs amid an ongoing market crash, were joined by global fast-food giant McDonalds — the brand infamously linked with temporary Bitcoin (BTC) market crashes. BTC’s price has seen a steady downfall ever since breaching an all-time high of $69,000 back in November 2022. Eventually, as Bitcoin started trading below the $40,000 mark, crypto millionaires and investors on Twitter started sharing memes about getting jobs at fast-food restaurants. Source: Twitter/PlanB Salvadoran President Nayib Bukele, too, embraced the meme culture and uploaded a new profile picture that shows him at one of his speeches sporting a badly photoshopped McDonald’s branded cap and T-shirt. #NewProfilePic pic.twitter....

Analysts say Bitcoin’s bounce at $36K means ‘it’s time to start thinking about a bottom’

Bears remain in full control of the cryptocurrency market on Jan. 24 and to the shock of many, they managed to pound the price of Bitcoin (BTC) to a multi-month low at $32,967 during early trading hours. This downside move filled a CME futures gap that was left over from July 2021. Data from Cointelegraph Markets Pro and TradingView shows that the $36,000 level was overwhelmed in the early trading hours on Monday, leading to a sell-off that dipped below $33,000 before dip buyers arrived to bid the price back above $35,500. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about the macro factors at play in the global financial markets and what to be on the lookout for in the months ahead. “Rate hikes don’t kill risk assets” F...

House members call for an end to lawmakers trading stocks — is crypto next?

Congresspeople currently HODLing or actively trading in crypto may have to stop doing so while in office if recent pushes to ban lawmakers from investing in stocks gain enough support. In a Monday letter addressed to Speaker Nancy Pelosi and Minority Leader Kevin McCarthy, 27 members of the U.S. House of Representatives called for action “to prohibit members of Congress from owning or trading stocks.” Among the bipartisan group of lawmakers who signed onto the letter was Illinois congressperson Bill Foster, who is also a member of the Congressional Blockchain Caucus. In addition, the letter seems to have support from politicians diametrically opposed on major issues like Progressive Democrat Rashida Tlaib and Republican Matt Gaetz, who is reportedly under investigation by the Justice Depar...

Vibe killers: Here are the countries that moved to outlaw crypto in the past year

Last week, Pakistan’s Sindh High Court held a hearing on the legal status of digital currencies that might lead an outright ban of cryptocurrency trading combined with penalties against crypto exchanges. Several days later, the Central Bank of Russia called for a ban on both crypto trading and mining operations. Both countries could join the growing ranks of nations that moved to outlaw digital assets, which already include China, Turkey, Iran and several other jurisdictions. According to a report by the Library of Congress (LOC), there are currently nine jurisdictions that have applied an absolute ban on crypto and 42 with an implicit ban. The authors of the report highlight a worrisome trend: the number of countries banning crypto has more than doubled since 2018. Here are the ...

El Salvador buys its cheapest 410 Bitcoin as prices reach $36K

The Central American country of El Salvador has added 410 Bitcoin (BTC) to its central reserve as BTC prices trade below $37,000, a price last seen on July 26, 2021. The fresh addition to El Salvador’s BTC reserve was announced by President Nayib Bukele who confirmed that the purchase of 410 BTC was made against $15 million, placing the price at approximately $36,585 per BTC. Nope, I was wrong, didn’t miss it. El Salvador just bought 410 #bitcoin for only 15 million dollars Some guys are selling really cheap ♂️ https://t.co/vEUEzp5UdU — Nayib Bukele (@nayibbukele) January 21, 2022 El Salvador adopted BTC as a legal tender on September 7, 2021, as a means to overcome catastrophic inflation amid the weakening spending power of the nation. Fast forward to today, th...

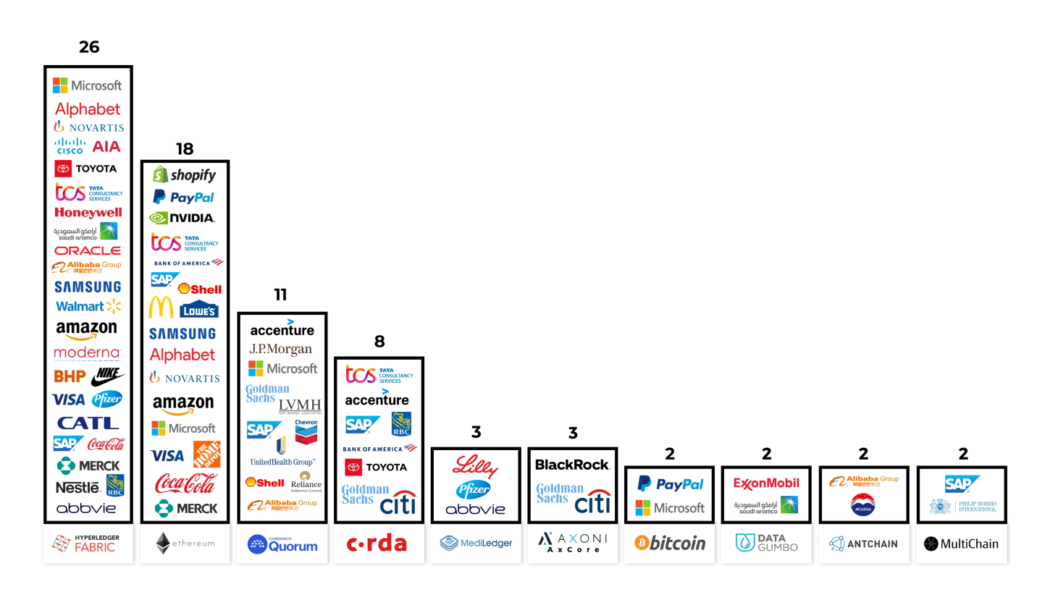

Decentralized and traditional finance tried to destroy each other but failed

The year 2022 is here, and banks and the traditional banking system remain alive despite decades of threatening predictions made by crypto enthusiasts. The only endgame that happened— a new Ethereum 2.0 roadmap that Vitalik Buterin posted at the end of last year. Even though with this roadmap the crypto industry would change for the better, 2021 showed us that crypto didn’t destroy or damage the central banks just like traditional banking didn’t kill crypto. Why? To be fair, the fight between the two was equivalently brutal on both sides. Many crypto enthusiasts were screaming about the coming apocalypse of the world’s financial systems and described a bright crypto future ahead where every item could be bought with Bitcoin (BTC). On the other hand, bankers rushed t...

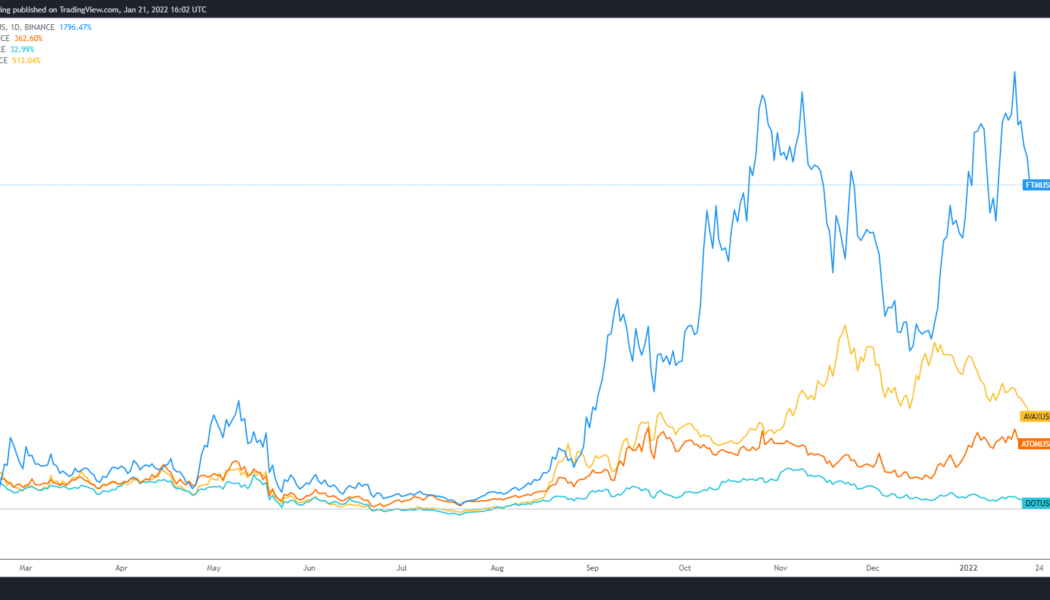

3 possible reasons why Polkadot is playing second fiddle in the L1 race

2021 was a sort of “coming-of-age” for many layer-one (L1) blockchain protocols because the growth of decentralized finance (DeFi) and nonfungible tokens (NFTs) forced users to look for solutions outside of the Ethereum (ETH) network where high fees and network congestion continued to be barriers for many. Protocols like Fantom (FTM), Avalanche (AVAX) and Cosmos (ATOM) saw their token values rise and ecosystems flourished as 2021 came to a close. Meanwhile, popular projects like Polkadot (DOT) underperformed, comparatively speaking, despite the high expectations many had for the sharded multi-chain protocol. FTM/USDT vs. AVAX/USDT vs. ATOM/USDT vs. DOT/USDT daily chart. Source: TradingView Setting aside the specific capability that each protocol offers in terms of transactions ...

Buyback-and-burn: What does it mean in crypto?

Miners can burn virtual currency tokens using the proof-of-burn (PoB) consensus mechanism. Proof-of-burn is one of several consensus mechanisms blockchain networks use to verify that all participating nodes agree on the blockchain network’s genuine and legitimate state. A consensus mechanism is a collection of protocols that use several validators to agree on the validity of a transaction. PoB is a proof-of-work mechanism that does not waste energy. Instead, it works on the idea of allowing miners to burn tokens of virtual currency. The right to write blocks (mine) is then awarded in proportion to the coins burned. Miners transmit the coins to a burner address to destroy them. This procedure uses few resources (aside from the energy necessary to mine the coins before burning them) an...

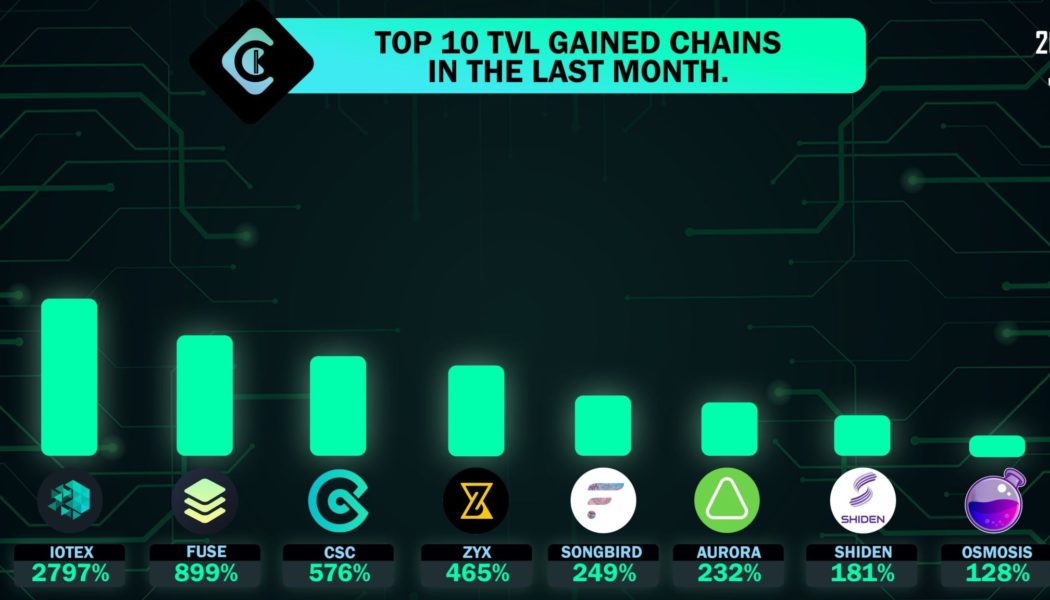

MetisDAO TVL surges by 99,800% as the layer-2 race heats up

Attracting liquidity has become a de facto arms race in the growing decentralized finance (DeFi) landscape. Projects constantly battle to attract investors’ funds by offering enticing yields for crypto holders willing to take a risk and lock up their assets, and protocols use these funds to build out their products and attract attention from larger investors. One protocol that has been gaining traction in the total value locked (TVL) race is MetisDAO, a layer-two rollup platform designed to fully support the application and business migration from Web2 to Web3. Top 10 TVL gainers over the past month. Source: CCK Ventures Alongside the growth in the TVL on its protocol, the METIS token has also received a boost of momentum, with data from Cointelegraph Markets Pro and CoinGecko showin...

Redditors share their thoughts on buying Bitcoin at all-time highs

Many crypto enthusiasts turned to social media on Friday to voice their frustrations with the state of the crypto market. One Reddit user named imyourkingg allegedly invested 30% of his net worth into Bitcoin (BTC) a few months ago, saying: “I don’t need this money for the next 5 to 10 years, but I have to admit sometimes I get so afraid of Bitcoin’s future; I mean it crashes or never reach $100k, $200k as the predictions for 2025+ says or at least $55k again lol, and I lose that money, especially when all of my friends, my mom and family call me crazy for investing on it.” Crypto’s decentralized nature means there are no circuit breakers equivalent to the ones that exist on traditional stock exchanges. The resulting bull/bear cycles can be extreme, and d...

NFTs and DeFi overturn a banker’s generational curse of poverty in 2 years

Brenda Gentry, a former USAA mortgage underwriter from Texas, believes that the cryptocurrency ecosystem offers a fighting chance to overcome the generational curse of poverty. Gentry, a.k.a. MsCryptoMom, left her decade-long job as a banker to pursue a full-time crypto career as her initial investments from early 2020 confirmed the “unprecedented opportunities offered by crypto.” She currently runs Gentry Media Productions, a firm that advises decentralized finance (DeFi) and nonfungible token (NFT) projects — generating up to 20 ether (ETH) each month, nearly $50,000 at the time of writing. Speaking to Cointelegraph, Gentry recollected the moment she first bought crypto: “It was early 2020 during the lockdown. I bought Bitcoin, Ethereum and Link on Coinbase. When I started, I almos...

Bitcoin falls to $36K, traders say bulls need a ‘Hail Mary’ to avoid a bear market

Bitcoin (BTC) price continues to sell-off and the knock-on effect is an even sharper correction in altcoins and DeFi tokens. At the time of writing, BTC price has sank to its lowest level in 6 months and most analysts are not optimistic about an immediate turn around. Data from Cointelegraph Markets Pro and TradingView shows that a wave of selling that began late in the day on Jan. 20 continued into midday on Friday when BTC hit a low of $36,600. BTC/USDT 1-day chart. Source: TradingView Here’s a check-in with what analysts have to say about the current downturn and what may be in store for the coming weeks. Traders expect consolidation between $38,000 and $43,000 The sudden price drop in BTC has many crypto traders predicting various dire outcomes along the lines of an ext...