cryptocurrencies

US lawmakers reintroduce bill to stop IRS from taxing crypto transactions under $200

A bill previously introduced by Washington Representative Suzan DelBene aims to exempt crypto users from paying taxes on transactions under $200. According to a Tuesday draft of the Virtual Currency Tax Fairness Act of 2022, Washington Representative Suzan DelBene is seeking to amend the Internal Revenue Code of 1986 to exclude gains from certain personal transactions of virtual currency. If signed into law, the bill could stop the Internal Revenue Service, or IRS, from requiring U.S. filers to pay taxes on capital gains from crypto transactions of $200 or more. “Antiquated regulations around virtual currency do not take into account its potential for use in our daily lives, instead treating it more like a stock or ETF,” said DelBene. “Virtual currency has evolved rapidly in the past few y...

Bitcoin education center launches in El Salvador to boost adoption

Major peer-to-peer (P2P) Bitcoin (BTC) platform Paxful is working to help Salvadorans better use BTC as the cryptocurrency became legal tender in El Salvador last year. Paxful on Wednesday announced the launch of “La Casa Del Bitcoin,” a new educational and training center in El Salvador to enable free learning opportunities related to BTC. https://t.co/qSPHy997JJ — Paxful (@paxful) February 2, 2022 As part of the effort, Paxful will hold educational workshops and talks focused on Bitcoin and financial inclusion in the country. The center will focus on growing awareness around the benefits of buying and selling BTC as a means of exchange for the local community to further drive the next wave of Bitcoin mass adoption. The center will also be home to the Built With Bitcoin Foundation offices...

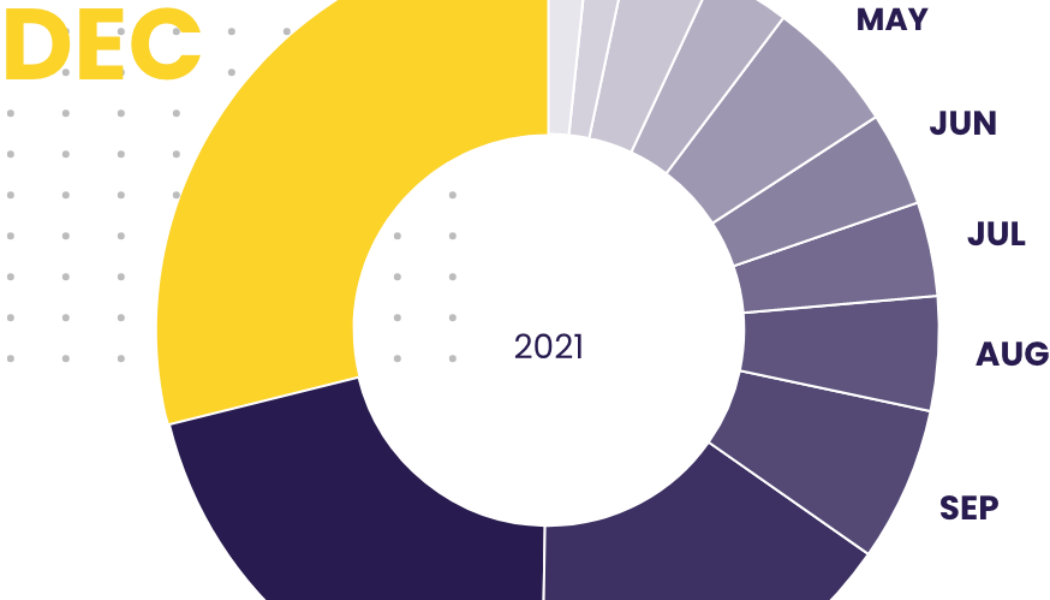

Crypto donations jumped nearly 16x in 2021, new report says

2021 was not just the year of institutionalization of crypto and new all-time highs; it also turned out to be the biggest year for crypto philanthropy. According to research data from The Giving platform, crypto donation volume rose to $69.6 million in 2021 compared to $4.2 million in 2020. Crypto donation volume spiked 1,558% or nearly 16x over the same period. The average crypto donations also saw a 236% increase, rising from an average of $3,109 in 2020 to $10,445 in 2021. The data further revealed that the average crypto donation size was 82x larger than an average cash donation. The average donation in crypto was estimated at $10,455 compared to $128 in cash. The monthly donation data revealed several interesting aspects about crypto donors. The report highlighted that the crypto...

Bitcoin price dips below $37K as a descending channel pattern comes back into play

The crypto market is once again in the red on Feb. 2 as global financial markets continue to see increased volatility. Data from Cointelegraph Markets Pro and TradingView shows that after spending the morning hovering around $38,200, BTC was hit with a wave of selling that pushed the price to $36,800. BTC/USDT 1-day chart. Source: TradingView Here is what several analysts and traders are saying about Wednesday’s Bitcoin price action and what areas to keep an eye on moving forward. Bulls are in trouble below $36,700 Insight into the major support and resistance zones of note for Bitcoin was provided by crypto trader and pseudonymous Twitter user ‘HornHairs’, who posted the following chart indicating a solid level of support near $37,400. BTC/USDT 1-hour chart. Source: Twitter Ac...

Bitcoin, Ether and NFTs will ‘never become legal tender’ in India, says Finance Secretary

T.V. Somanathan, the finance secretary for the Indian government, is reportedly pushing back against the narrative that cryptocurrencies will be widely accepted in the country — by dismissing the possibility of using them as legal tender. According to a Wednesday tweet from Asian News International, Somanathan said that a digital rupee backed by the Reserve Bank of India, or RBI, will be accepted as legal tender, but major cryptocurrencies have no chance of doing so. The finance secretary added that because digital assets including Bitcoin (BTC) and Ether (ETH) do not have authorization from the government, they will likely remain “assets whose value will be determined between two people.” “Digital rupee issued by RBI will be a legal tender,” said Somanathan. “Rest all aren’t legal t...

Kiss this: You can buy Gene Simmons’ Las Vegas mansion with crypto

Rock legend Gene Simmons says he will accept crypto payments for the sale of his $13.5 million mansion in Las Vegas. The iconic bassist and co-lead singer of Kiss will accept payments in or a combination of Bitcoin, Ethereum, Litecoin, Uniswap, Polkadot, Aave or Try.Finance according to hard rock news site, Blabber Mouth. Listing broker Evangelina Duke-Petroni from Berkshire Hathaway Home Services told the Las Vegas Review-Journal in a Feb 1 interview that any potential crypto payment for the property would have to be “verified through closing costs, including taxes and commissions.” The three-level mansion sprawls across over 11,000 square feet in the Ascaya luxury community overlooking the Las Vegas skyline. Rock legend @GeneSimmons is selling his home in Henderson’s Ascaya communi...

First cross-chain governance proposal passes on Aave

On Monday, the first cross-chain governance proposal passed on decentralized finance, or DeFi, borrowing and lending platform Aave (AAVE). According to DeFi Llama, the amount of total value locked on Aave is approximately $12 billion. As told by its developers, a proposal executed on Aave, which is built on the Ethereum (ETH) network, was sent to the Polygon (MATIC) FxPortal. The mechanism then read the Ethereum data and passed it for validation on the Polygon network. Afterward, the Aave cross-chain governance bridge contract received this data, decoded it and queued the action, pending a timelock for finalization. The development team wrote: The Aave cross-chain governance bridge is built in a generic way to be easily adapted to operate with any chain that supports the EVM [Et...

SEC’s proposed rule on exchanges could threaten DeFi, says Crypto Mom

Hester Peirce, a commissioner for the U.S. Securities and Exchange Commission known by many in the space as Crypto Mom, is warning that a proposed rule from the agency could potentially affect the regulation of firms involved with decentralized finance. According to a Tuesday Bloomberg report, Peirce said that the 654-page proposal recently released by the SEC to amend the definition of “exchange” as defined by the Securities Exchange Act of 1934 could impact the digital asset space. The SEC commissioner reportedly opposed opening the proposal to public comment and said the text could impose additional regulations on decentralized finance, or DeFi, firms. “The proposal includes very expansive language, which, together with the chair’s apparent interest in regulating all things crypto, sugg...

Law Decoded: Russia flounders, America competes, IMF keeps fuming, Jan. 24–31

One of the most fascinating implications of the collision between traditional political institutions and the crypto space is how it can reveal the glaring lack of cohesion within power systems that otherwise look monolithic. Digital assets reside in a parallel policy dimension where neither a centralized consensus nor a clear rulebook exists, leading to a surprising variety of voices and opinions emerging in the absence of a politically coordinated course. Last week, a rare lively policy debate broke out in Russia in the aftermath of its central bank’s attempt to promote a hardline stance on crypto. One does not often see such a public interagency disagreement on substantive issues. Below is the concise version of the latest “Law Decoded” newsletter. For the full breakdown of policy develo...

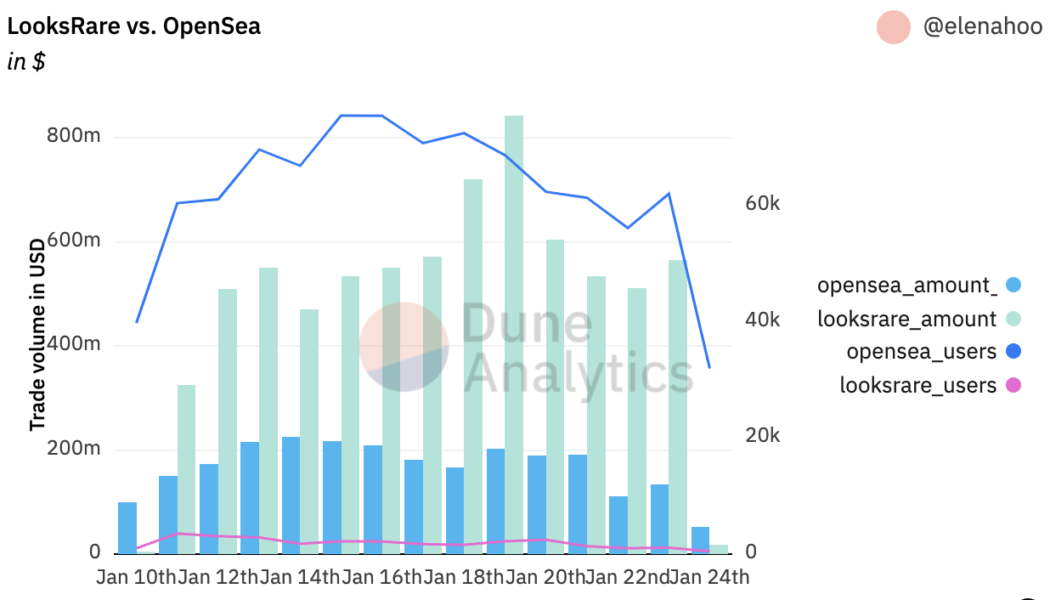

Clever NFT traders exploit crypto’s unregulated landscape by wash trading on LooksRare

LooksRare made its debut on Jan.10 and the recently launched NFT marketplace has drawn a lot of attention, not only because its daily trade volumes were more than double Opensea’s on the second day of trading, but also because it has become the new playground for wash traders. Wash trading is a series of trading activities involving the same trader buying and selling the same instrument simultaneously, creating artificially high trading volume and a manipulated market price for the asset in play. In the United States, wash trading in traditional financial markets has been illegal since 1936 and the most recent highly publicized scandal related to wash trading is the manipulation of LIBOR in 2012. While wash trading has been highly regulated and closely monitored by exchanges and regulators...

Altcoin Roundup: Cross-chain bridge tokens moon as crypto shifts toward interoperability

Interoperability is shaping up to be one of the main themes for the cryptocurrency market in 2022 as projects across the ecosystem unveil integrations that make their networks Ethereum (ETH) Virtual Machine (EVM) compatible. While this has been one of the long-term goals of the ecosystem as a step on the path to an interconnected network of protocols, it has also created a new decentralized finance (DeFi) market for multi-chain bridges and decentralized finance. Here are three of the top volume cross-chain bridges that the cryptocurrency community uses to transfer assets between blockchain networks. Multichain Multichain (MULTI), formerly known as Anyswap, is a cross-chain router protocol that aims to become the go-to router for the emerging Web3 ecosystem. According to data from Defi Llam...

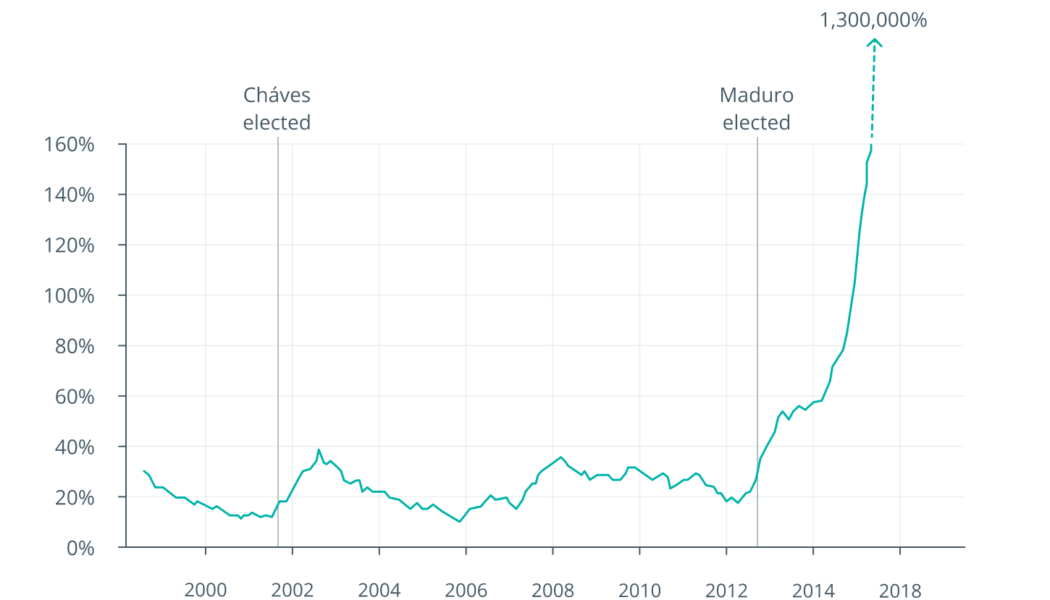

Digital Denarius: How a crypto revolution could have saved the Roman Empire

Two currency crises two thousand years apart. Modern-day Venezuela and the Roman Empire have more in common than you might think. Both know too well the dangers of soaring inflation and a collapse in investor confidence. But, only one has crypto on its side. Venezuela’s official currency, the bolívar, has suffered from hyperinflation for half a decade due to repeated currency devaluations, minimum wage rises and significant public spending increases. For a sustained period of several centuries, the Roman Empire enjoyed the enormous trade and commercial benefits associated with the world’s first fiat currency, as explored in my book Pugnare: Economic success and failure. The Roman currency was comprised of three coins: gold (Aureus), silver (Denarius) and copper or brass coins (Sestertius a...