cryptocurrencies

Gemini allegedly suffered data breach; 5.7 million emails leaked

Cryptocurrency exchange Gemini appears to have suffered a data breach on or before Dec. 13. According to documents obtained by Cointelegraph, hackers gained access to 5,701,649 lines of information pertaining to customers’ account numbers, email addresses and partial phone numbers. In the case of the latter, hackers apparently did not gain access to the full phone numbers, as certain numeric digits were obfuscated. The leaked database did not include sensitive personal information such as names, addresses and other Know Your Customer information. In addition, some emails were repeated in the document; thus, the number of customers affected is likely lower than the total rows of information. Gemini currently has 13 million active users. Security breaches in the Web3 industry, even if mild i...

Bahamian securities regulator slams new FTX CEO over ‘misstatements’

The Securities Commission of Bahamas has slammed the current CEO of bankrupt crypto exchange FTX John J. Ray III for his statements regarding the ongoing investigation into FTX. In a press release sent to Cointelegraph, the Bahaman regulator didn’t directly point toward the exact statements of the CEO, but addressed recent reports that suggest the Bahamas’ government asked former CEO Sam Bankman-Fried to create a new multi-million token and hand over the control to them. The said report also alleged Bahamas officials tried to help Bankman-Fried regain access to key computer systems of the FTX. According to United States lawyers, Bahamas officials were “responsible for directing unauthorized access” to FTX systems in order to take over control of digital assets under the s...

Crypto community members discuss bank run on Binance

Within the past 24 hours, cryptocurrency exchange Binance has seen outflows of over $1.14 billion due to rising FUD — or fear, uncertainty and doubt — within the crypto ecosystem. According to Binance CEO Changpeng “CZ” Zhao, the exchange has seen this before, and he believes “it is a good idea to ‘stress test withdrawals’ on each CEX [centralized exchange] on a rotating basis”. We saw some withdrawals today (net $1.14b ish). We have seen this before. Some days we have net withdrawals; some days we have net deposits. Business as usual for us. I actually think it is a good idea to “stress test withdrawals” on each CEX on a rotating basis. 1/2 https://t.co/uF9lLPDSyS — CZ Binance (@cz_binance) December 13, 2022 The bank run on Binance comes a month after CZ triggered a bank ...

Web3 game DOGAMÍ secures $14M total funding

DOGAMÍ, an augmented reality mobile game involving nonfungible token (NFT) pet companions, has completed a $14 million seed funding round, according to a Dec. 12 press release provided to Cointelegraph. The Web3 mobile gaming company raised $7 million led by VC firm XAnge after initially securing $6 million from industry leaders in January 2022. DOGAMÍ, with community members in over 80+ countries, indicated that it has already sold 12,000 NFTs of dog avatars and 12,000 NFTs of canine accessories through a collaboration with omni-channel clothing retailer GAP. The company has also launched its first mobile application, “DOGA House”, which allows users to discover and interact with their “NFT puppies” in the “DOGAMÍ universe” while earning DOGA cryptocurrency. Relate...

‘Old money has all but fled,’ Huobi co-founder discusses challenges of running $400M VC fund

In a new Twitter post dated Dec. 12, Du Jun, co-founder of cryptocurrency exchange Huobi Global, shared new insight on his experience of running ABCDE Capital, a $400 million Web 3.0 venture capital (VC) fund, in June this year. According to Jun, the idea for ABCDE Capital came in March, and by April, it was already registered in Singapore. However, amidst the $40 billion Terra Luna implosion in May, Jun said that “old money has all but fled” after the incident. We chose to start @ABCDECapital at the most difficult time of the market. Hope to bring a glimmer of light to builders and bring more fairness, innovation and strength to crypto industry. https://t.co/GmxFFsG7qL — Du Jun (@DujunX) June 17, 2022 Undeterred, Jun continued that in August, the VC fund was fully operational,...

ConsenSys launches zkEVM private beta testnet

According to a new blog post on Dec. 13, Web 3.0 ecosystem developer ConsenSys unveiled its zero-knowledge Ethereum Virtual Machine (zkEVM) network for private beta testing. Designed and operated by ConsenSys, developers can deploy and manage decentralized applications using tools such as MetaMask, Truffle, and Infura as if they were using EVM directly. In addition, users can bridge assets between the Goerli testnet and the zkEVM to test their smart contracts and decentralized applications, or dApps. “Testnet participants can also bridge tokens, transfer tokens, and interact with deployed dApps listed on our upcoming ecosystem portal page. We intend to learn whether the developer experience of the zkEVM has the potential to accelerate innovation in Web3 and will be evaluating f...

$75M worth of FTX’s political donations at risk of being recalled due to bankruptcy: Report

Following the collapse of FTX and its Nov. 11 bankruptcy filing, $73 million worth of its political donations is currently at risk of being recalled to repay the failed exchange’s creditors, according to a report by Bloomberg. Speculators online allege that the former FTX CEO and his executives sought to influence industry regulations with their generous multimillion-dollar donations to politicians and super PACs. Sam Bankman-Fried and executives Ryan Salame and Nishad Singh are believed to have been high-paying donors to both the Republican and Democratic United States political parties. Many politicians who were at the receiving end of FTX’s generosity now face difficulty regarding what to do next, as they may be forced to return the money to the bankruptcy trustee. In order to...

Hackers copied Mango Markets attacker’s methods to exploit Lodestar: CertiK

According to a post-mortem analysis provided by CertiK of the $5.8 million Lodestar Finance exploit that occurred on Dec. 10, 5. The hacker burned a little over 3 million in GLP, their profit on this exploit was the stolen funds on Lodestar – minus the GLP they burned. 6. 2.8 Million of the GLP is recoverable, which is worth about $2.4 million. We are going to reach out to the hacker and… — Lodestar Finance (,) (@LodestarFinance) December 10, 2022 In a similar instance, CertiK said that Lodestar Finance hackers “artificially pumped the price of an illiquid collateral asset which they then borrow against, leaving the protocol with irretrievable debt.” “Despite some of the losses being potentially recoverable, the protocol is functionally insolvent right n...

SushiSwap CEO reveals DEX lost $30M on LP incentives this year

According to a new Twitter post by SushiSwap CEO Jared Grey, the decentralized exchange, or DEX, experienced a $30 million loss in the past 12 months on incentives for liquidity providers, or LPs. As explained by Grey, SushiSwap currently employs a token-based emission strategy to incentivize LPs, but the current rate is “unsustainable.” “We commissioned Flipside to build dashboards to showcase these results; we’ll make them available by EOY.” Moving forward, Grey plans to rework SushiSwap’s tokenomics so that LPs are no longer subsidized with emissions and redesign the entire model of bootstrapping liquidity on the exchange. ” In Q1 2023, we will bring innovation to scale swap volume & prioritize TVL. As LPs experience a more profitable swap e...

Florida best-prepared US state for widespread crypto adoption: Research

It’s not just pro-crypto regulations but also a supporting infrastructure that allows sustainable crypto adoption in any jurisdiction. Weighing in factors such as the number of Bitcoin (BTC) ATMs, blockchain companies and public interest in cryptocurrencies, Florida comes out as the most crypto-ready state in the United States. The U.S. hosts a network of 33,865 Bitcoin ATMs, representing 87.1% of total crypto ATM installations worldwide. In addition, the nation contributes to 37.8% of the global Bitcoin hash rate, which makes the US the most dominant player in crypto. However, a state-wise analysis reveals that not all 50 states are equally prepared for the inevitable mainstream crypto adoption. Research conducted by Invezz regarded Florida as the crypto capital of the US for its active e...

US regulator seeks feedback on DeFi’s impact on financial crime: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. The United States regulators want to take a closer look at money laundering and terror financing laws by the Financial Crimes Enforcement Network (FinCEN), as it asked banking sector players for feedback on DeFi’s crime risks. Ethereum developers are targeting the last week of March for Ethereum’s Shanghai hard fork and some additional improvement upgrades by June of next year. Ankr protocol has deployed $15 million to buy back the bad debt resulting from its recent exploit and the resultant circulation of HAY (HAY). Chainlink deploys staking to increase the security of oracle services. Stakers will earn Chainlink...

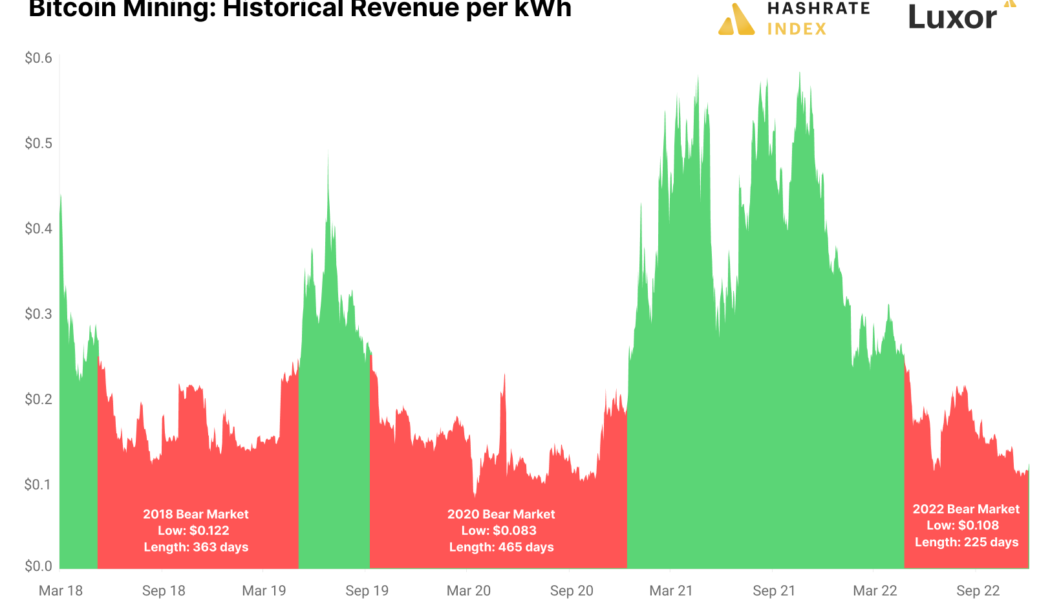

Data shows the Bitcoin mining bear market has a ways to go

Bitcoin (BTC) mining is the backbone of the BTC ecosystem and miners’ returns also provide insight into BTC’s price movements and the health of the wider crypto sector. It is well-documented that Bitcoin miners are struggling in the current bear market. Blockstream, a leading Bitcoin miner recently raised funds at a 70% discount. Current mining activity shares similarities to historic BTC bear markets with a few caveats. Let’s explore what this means for the current Bitcoin cycle. Analysis shows that based on previous cycles the bear market may continue Bitcoin mining profitability can be measured by taking the miner’s revenue per kilowatt hour (kWh). According to Jaran Mellerud, a Bitcoin analyst for Hashrate Index, a BTC mining bear market has a sustained period of revenue per kWh of les...