cryptocurrencies

Bitcoin price consolidates in critical ‘make or break’ zone as bulls defend $42K

The waiting game continues for crypto traders after Bitcoin (BTC) is once again pinned below resistance at $43,000 and awaiting some spark in momentum that can sustain a rally back to the $50,000 range. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin has traded in a range between $41,500 and $43,000 over the past couple of days and with tensions between Ukraine and Russia escalating, many traders are less than optimistic about Bitcoin’s short-term prospects. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts are saying about their short-term expectations for Bitcoin price. Is Bitcoin on a path to zero? Well-known cryptocurrency perma-bear Peter Schiff made sure to chime in on the latest struggles for Bitcoin by post...

Super Bowl 2022: Here’s the scoreboard of crypto ads

Super Bowl commercials have always been an intrinsic part of the annual National Football League (NFL) championship, and for businesses, it’s a fair sign of making it in the real world. This year, however, marked a new milestone for the crypto community as FTX, eToro, Crypto.com and Coinbase debuted crypto ads during Super Bowl 2022. With rising demand in crypto — recently fueled by nonfungible tokens, meme tokens and the metaverse — Super Bowl crypto ads stole the limelight from traditional businesses on social media platforms such as Twitter. Let’s gauge the advertisements and echo the feelings expressed by the community. Coinbase Super Bowl 2022 commercial Coinbase is one of the most popular crypto exchanges in the United States, often taking the No. 1 spot for being the most downloaded...

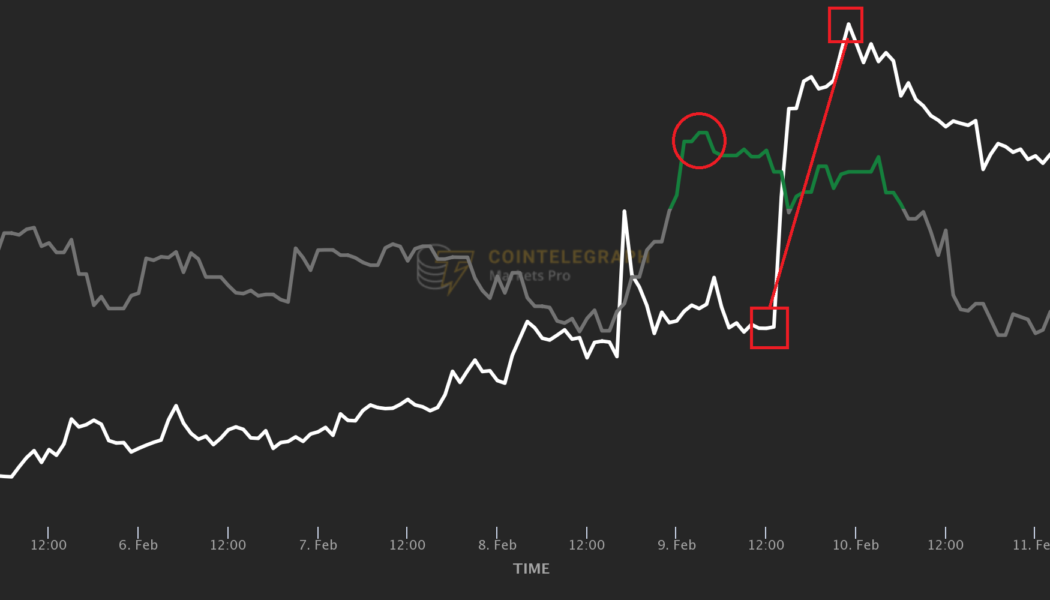

Here’s how traders got alerted to some of the biggest rallies of this week’s resurging market

This crypto winter wasn’t a very long one. Having briefly touched $34,000 in the second half of January, Bitcoin (BTC) is on its way up again, touching the $45,000 mark on Feb. 10. Many altcoins have been catching up as well and posting double-digit weekly returns. However, not all relief rallies were equally impressive. Is there a way for traders to pick the assets that are about to pull off the strongest rebounds? Luckily, bullish marketwide reversals tend to look similar in terms of both price movement and other variables that shape market activity: rising trading volumes, spikes of online attention to individual tokens, and the elevated sentiment of social media chatter around them. Furthermore, the conditions that underlie individual assets’ rallies in a resurging crypto market often ...

Injective Protocol (INJ) rallies 100%+ after launching cross-chain support for Cosmos

Trading perpetual futures contracts in decentralized apps is a crypto sub-sector ripe for growth, especially as discussions of regulation, taxation and mandatory KYC at centralized exchanges continue to take place. One DEX platform that has begun to gain traction is Injective (INJ), an interoperable layer-one protocol designed to facilitate the creation of cross-chain Web3 decentralized finance (DeFi) applications. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $3.91 on Feb. 3, the price of INJ has rallied 157.8% to a daily high of $10.08 on Feb. 11 amidst a 1,756% spike in its 24-hour trading volume to $306 million. INJ/USDT 1-day chart. Source: TradingView Three reasons for the spike in demand for INJ include the addition of support for new assets i...

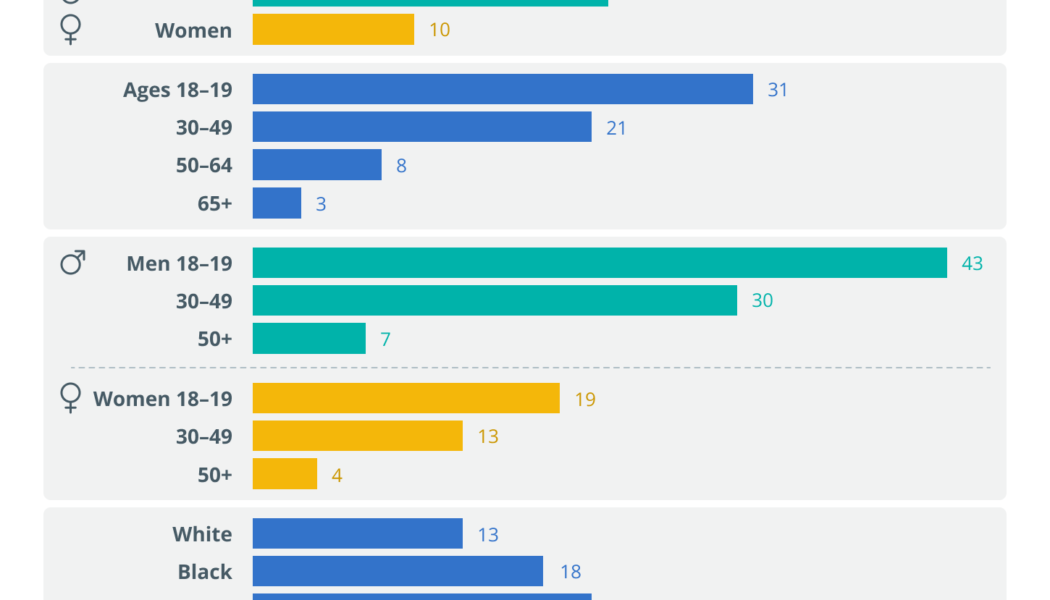

Love in the time of crypto: Does owning cryptocurrency make daters more desirable?

Cryptocurrency has become one of the most widely discussed topics of 2022. As such, it shouldn’t come as a surprise that mentioning “crypto” in an online dating profile may generate additional attention. A newstudy from brokerage firm eToro found that 33% of Americans who were surveyed would be more likely to go on a date with someone who mentioned crypto assets in their online dating profile. Out of the 2,000 adult residents in the United States between the ages of 18 and 99 surveyed, more than 40% of men and 25% of women indicated that their interest in a potential date is stronger when crypto is written on a dating profile. Crypto: What’s love got to do with it? Callie Cox, U.S. investment analyst at eToro, told Cointelegraph that the findings from eToro’s inaugural “Crypto & ...

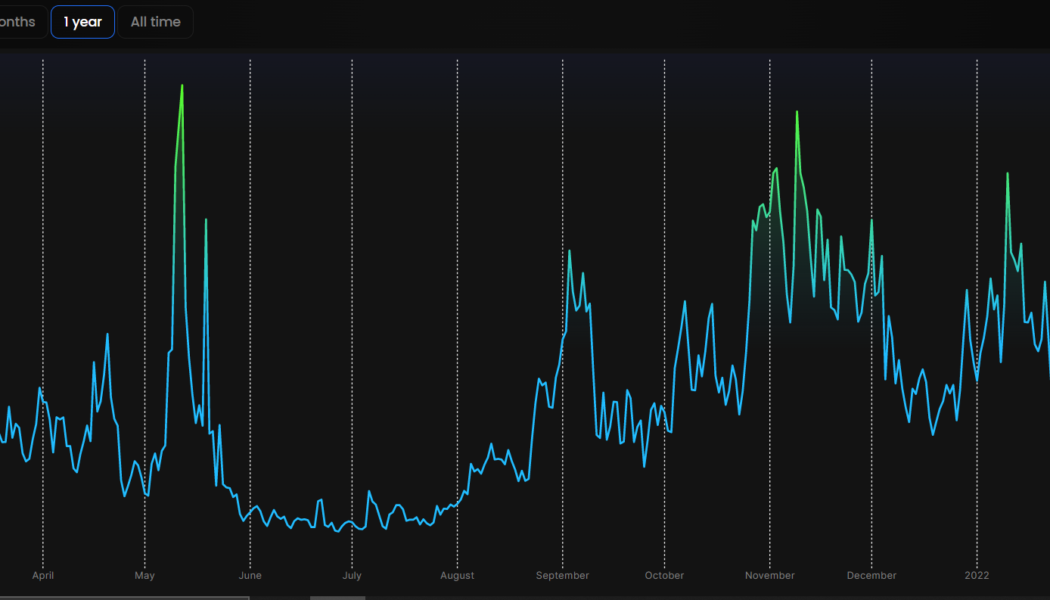

Ethereum’s average and median transaction fee slip, lowest in six months

The infamous transaction fees of the Ethereum (ETH) ecosystem underwent a decremental phase from Jan. 10 to record the lowest average and median fees of $14.17 and $5.67 — lowest since September 2021. Data from Blockchair shows that the average transaction fee of ETH in January was $53.03, which at its peak was $70.83 back in May 2021. Just within a month, the average fees saw an almost 73.3% decline as evidenced by the following chart. Additionally, the resultant median transaction fee also witnessed an 81.02% drop from January’s $29.88. In the last six months, ETH’s median transaction fee was seen lowest in September at $6.26. Interestingly enough, the transaction count of the Ethereum network has also come down to numbers that were last seen back in early 2019. Blockchair data sho...

Bitcoin’s last security challenge: Simplicity

It’s been just 13 years since Bitcoin’s (BTC) “Mayflower moment,” when a tiny handful of intrepid travelers chose to turn their back on the Fiat Empire and strike out to a new land of financial self-sovereignty. But, whereas it took 150 years for the American colonists to grow sufficient in number to throw off the yoke of unrepresentative government, the Republic of Bitcoin has gone from Pilgrims to Revolutionary Army in little over a decade. What sort of people are these new Bitcoiners? How do their character, demographics and technical knowledge differ from earlier adopters? Is “Generation Bitcoin” sufficiently prepared to protect their investment against current and future security threats? And, most importantly, what are the challenges that the rapidly growing community must urgently a...

Investors underestimate Bitcoin’s “huge upside potential”, Fidelity researcher says

Chris Kuiper, Head of Research at Fidelity Digital Assets, is convinced that Bitcoin (BTC) should be treated separately from other digital assets and believes it plays an exclusive role in investors’ portfolios. Fidelity Digital Assets’ latest report, titled Bitcoin First, targets two main concerns that Fidelity’s clients have raised towards BTC — eventually being replaced by some other cryptocurrencies and lower upside potential left compared to other coins. According to Kuiper, BTC offers a unique value proposition as the most decentralized and censorship-resistant monetary network. That, according to him, is a non-incremental sort of innovation similar to the invention of the wheel. “You can’t reinvent something that’s already been invented in terms of the m...

Hungary’s central bank chief wants EU-wide crypto trading and mining ban

György Matolcsy, Governor of the Hungarian National Bank, has proposed a blanket ban on all cryptocurrency trading and mining operations across the European Union. Governor Matolcsy cited the recent crypto ban imposed by China in a blog post shared by the Hungarian central bank a.k.a. Magyar Nemzeti Bank (MNB) titled “Time has come to ban crypto trading and mining in the EU.” He also pointed out the Russian central bank’s proposal that calls for a blanket ban on domestic cryptocurrency trading and mining. Reciprocating the proposals for a crypto ban, Matolcsy said: “I perfectly agree with the proposal and also support the senior EU financial regulator’s point that the EU should ban the mining method used to produce most new bitcoin.” The governor strongly believes in cryptocurrency’s...

DeFi flashes early revival signs as retail and institutional inflows trickle in

Decentralized finance (DeFi) has had a rough go so far in 2022, and data from Messari shows the top ten-ranked DeFi assets currently down between 10% to 50% since the start of the year. Top ten DeFi tokens by market capitalization. Source: Messari A positive is, the situation may change soon as funds have began to flow back into the DeFi ecosystem following a month of declines as data shows institutional and retail funds returning to crypto markets. Data from Defi Llama shows that the total value locked in all of DeFi platforms has climbed to $211.1 billion on Feb. 11, up from a low of $185.14 billion on Jan. 31 Total value locked in DeFi. Source: Defi Llama A closer look at the individual protocols that contribute to the total TVL shows that the biggest drawdowns in TVL over the past 30 d...

DeFi flashes early revival signs as retail and institutional inflows trickle in

Decentralized finance (DeFi) has had a rough go so far in 2022, and data from Messari shows the top ten-ranked DeFi assets currently down between 10% to 50% since the start of the year. Top ten DeFi tokens by market capitalization. Source: Messari A positive is, the situation may change soon as funds have began to flow back into the DeFi ecosystem following a month of declines as data shows institutional and retail funds returning to crypto markets. Data from Defi Llama shows that the total value locked in all of DeFi platforms has climbed to $211.1 billion on Feb. 11, up from a low of $185.14 billion on Jan. 31 Total value locked in DeFi. Source: Defi Llama A closer look at the individual protocols that contribute to the total TVL shows that the biggest drawdowns in TVL over the past 30 d...

Analysts say Bitcoin price is in the ‘profit-taking’ zone with a ceiling at $45K

The price action for Bitcoin (BTC) continues to tantalize investors and once again, concerns over the state of the global economy and rising inflation have prompted warnings that the Fed’s upcoming interest rate hikes could do more damage then good to the state of the market. Data from Cointelegraph Markets Pro and TradingView shows that the price of BTC has hovered near the $43,000 support level in trading on Feb. 11 after rallying 20% from the $37,000 leve over the past week. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts expect next for BTC and the wider cryptocurrency market. “Expecting a move to $40,000” Insight into the bullish and bearish scenarios related to Bitcoin price was offered by crypto trader and pseudonymous Twitter analyst ‘Crypto_Ed_NL’, w...