cryptocurrencies

Here’s why AI-equipped NFTs could be the real gateway to the Metaverse

Nonfungible tokens (NFTs) have been largely acquired as proof-of-profile pictures (PFPs) that represent a brand, embody culture or ultimately, reflect as a static status symbol. Blue-chip NFTs like the Bored Ape Yacht Club or Cool Cats were not originally backed by any tangible utility other than speculative value and hype, along with the promise of an illustrative roadmap, but in 2022, investors are looking for a little bit “more.” However, nonfungible tokens are finding their use beyond branding and status symbols by attempting to build out an existence in the Metaverse and some are ambitious enough to start within it. The Altered State Machine (ASM) Artificial Intelligence Football Association (AIFA) has introduced a novel concept to NFTs called nonfungible intelligence or NFI. By...

Crypto community condemns Canada for freezing dissidents’ Bitcoin wallets

Global cryptocurrency enthusiasts have expressed concerns over Canadian authorities freezing bank accounts and crypto wallets involved in funding local COVID-19 protests. On Thursday, Ontario Superior Court Justice Calum MacLeod issued an order freezing all the digital assets and bank accounts associated with “Freedom Convoy,” a series of ongoing protests against COVID-19 vaccine mandates and restrictions. According to a report by the Toronto Star, the amount of funds frozen so far in bank accounts and digital wallets with Bitcoin (BTC) and other assets is estimated at more than $1 million. “The names of both individuals and entities as well as crypto wallets have been shared by the RCMP with financial institutions and accounts have been frozen and more accounts will be frozen,” Deputy Pri...

U.S. inflation breaks 40-year record: Can Bitcoin serve as a hedge asset?

On Feb. 9, the United States Bureau of Labor Statistics reported that the Consumer Price Index, a key measure capturing the change in how much Americans pay for goods and services, has increased by 7.5% compared to the same time last year, marking the greatest year-on-year rise since 1982. In 2019, before the global COVID-19 pandemic broke out, the indicator stood at 1.8%. Such a sharp rise in inflation makes more and more people consider the old question: Could Bitcoin, the world’s largest cryptocurrency, become a hedge asset for high-inflation times? What’s up with the inflation spike? Ironically, the fundamental reason behind the unprecedented inflation spike is the U.S. economy’s strong health. Immediately after the COVID-19 crisis, when 22 million jobs were slashed and national econom...

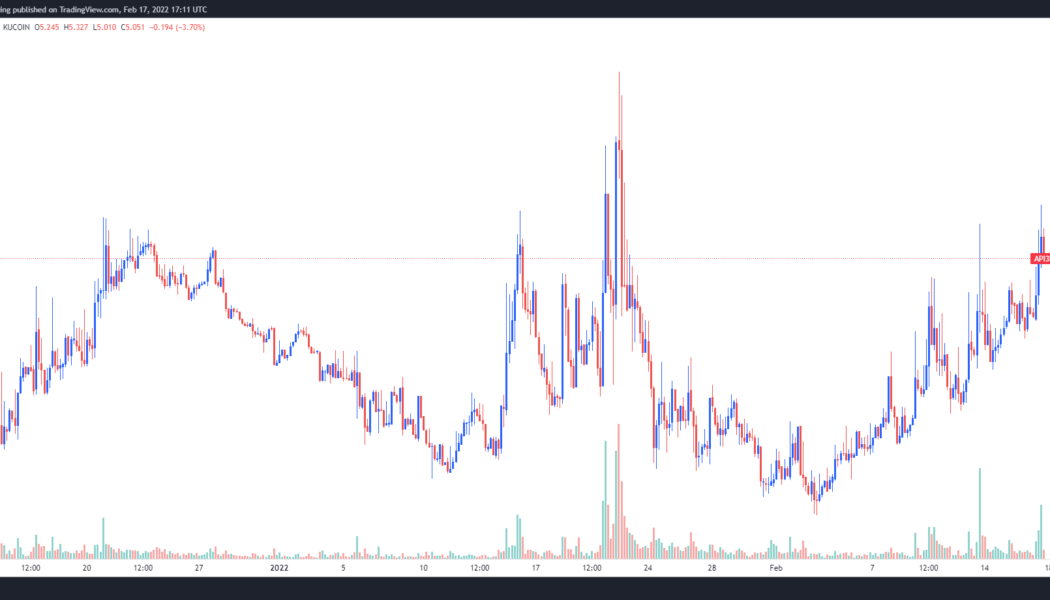

API3 price gains 55% after new partnerships and exchange listings attract investors

In the emerging Web3 world, data is the most valuable commodity, and oracle solutions provide a valuable role in facilitating the accurate and secure transmission of data between blockchains and data sources. One project that is taking a different approach to developing oracles is API3 (API3), a project which harnesses application programming interfaces (APIs) to create first-party oracles through the use of decentralized APIs capable of broadcasting data directly to blockchain networks. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $3.22 on Feb. 3 the price of API3 climbed 72% to reach a daily high of $5.55 on Feb. 17 as the wider cryptocurrency corrected after news of Russia escalating it’s incursion into Ukraine made waves in the news....

Biden expected to issue executive order on crypto and CBDCs next week: Report

The White House will reportedly be issuing an executive order as early as next week directing government agencies to study different aspects of the digital asset space with the goal of creating a comprehensive regulatory framework. In a Thursday report from Yahoo! Finance, Jennifer Schonberger said an official familiar with the matter within the Biden administration revealed the executive order could arrive as soon as next week. The directive from President Biden would reportedly order the Office of the Attorney General, the State Department, and the Treasury Department to study the potential rollout of a U.S.-issued central bank digital currency. In addition, the Director of the Office of Science and Technology Policy — the newly appointed Alondra Nelson — would provide an evaluation on t...

NEO price climbs after China’s BSN gives the project the green light on NFT marketplaces

As the field of viable layer-1 blockchain protocols continues to expand, with newer entrants trying to solve the issue of high transaction costs and slow processing times, older projects find themselves utilizing their history and track record to set themselves apart and secure a market share that will ensure their survival through the next market cycle. Neo (NEO) fits the bill described above, and the project is attempting to stage a revival in 2022 as governments around the world slowly open to the fact that blockchains and digital currencies have certain benefits and capabilities that can be integrated into public and private enterprise. Data from Cointelegraph Markets Pro and TradingView shows that the price of NEO has climbed 60%, since hitting a low of $16.10 on Jan. 24, to hit...

Bitcoin price is ‘likely starting the next push up’ if $42K holds as support

The cryptocurrency market remains in a state of flux as investors are once again focused on what steps the U.S. Federal Reserve might take to combat rising inflation and markets wobble as the situation in Ukraine remains tense. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) has hovered around the $44,000 support level and traders are hopeful that an inverse head and shoulders chart pattern will lead to a sustained bullish breakout. BTC/USDT 1-day chart. Source: TradingView Here’s a survey of what several analysts in the market are keeping an eye on moving forward as global issues from inflation to war continue to make their presence felt in the cryptocurrency market. On-Balance Volume shows a bullish reversal Insight into what may lie ahead for Bi...

Fed never did it: US Senate Banking head lashes out at Super Bowl crypto ads

The Super Bowl advertisements by crypto companies, including Coinbase, FTX and several others, ruled social media and news headlines for their out-of-the-box approach. However, United States Senate Banking Committee Chief Sherrod Brown was not impressed and blasted the ad-makers for not including appropriate warnings and risks involved. Brown, during the Tuesday Senate hearing on stablecoins, brought in the topic of popular crypto advertisements that aired during the Super Bowl. He said most of these ads failed to tell people about the downsides of investing in cryptocurrencies. The companies failed to mention the wild price swings and prevalent scams that occur in the market or the fact that the crypto market is not as well regulated as the traditional ones. Super Bowl advertisement ...

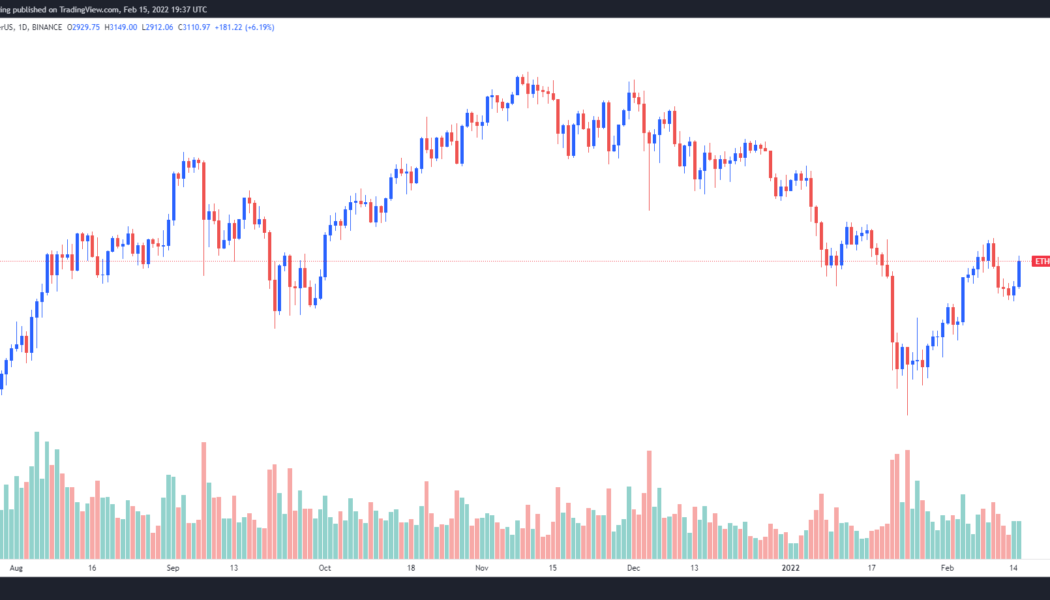

Traders say $4,000 Ethereum back on the cards ‘if’ this bullish chart pattern plays out

Global and macroeconomic concerns ranging from rising inflation rates in the United States to the prospect of Russia invading Ukraine continue to spark volatility in financial markets. To the surprise of many analysts, the mood in the cryptocurrency market shifted in a positive direction on Feb. 15 after Bitcoin (BTC) climbed to $44,500 and Ether (ETH) regained support at $3,100. Data from Cointelegraph Markets Pro and TradingView shows that after bouncing off a low of $2,826 in the early trading hours on Feb. 15, the price of Ether rallied 11.4% to a daily high of $3,148. ETH/USDT 4-hour chart. Source: TradingView Here’s a look at what several traders in the market are saying about the recent price action for Ether and what to be on the lookout for in the weeks ahead. Ether is in a heavy ...

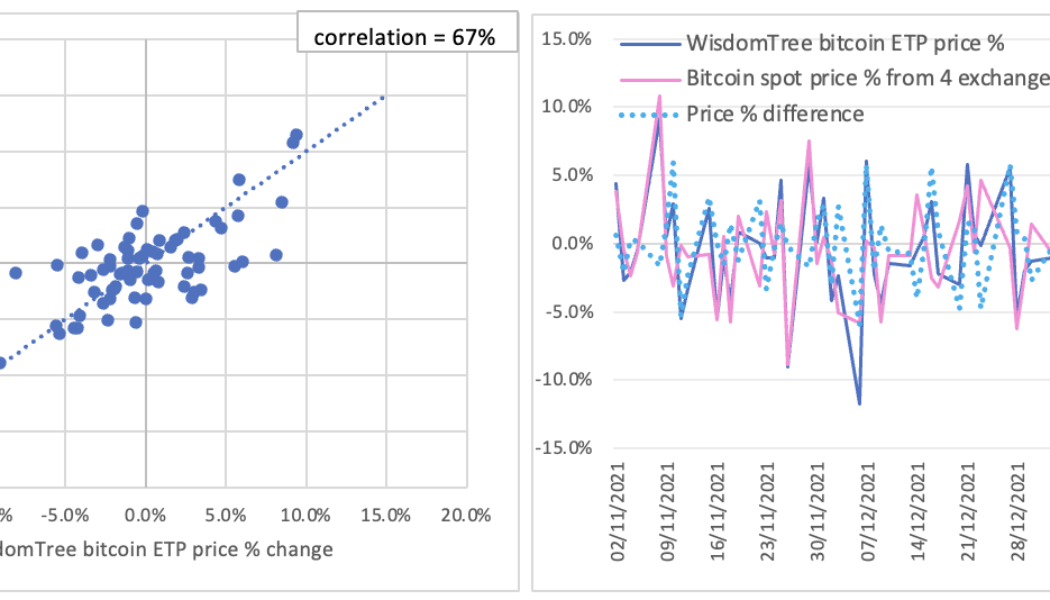

Here’s why the SEC keeps rejecting spot Bitcoin ETF applications

It is not the first time the U.S. Securities and Exchange Commission (SEC) rejected proposals for a Bitcoin spot exchange traded product (ETP), but efforts continue to be made by different financial institutions. The recent attempt made by Cboe BZX Exchange on Jan. 25 to list the Fidelity Wise Origin Bitcoin Trust as a Bitcoin ETP has also failed. The SEC letter published on Feb. 8 pointed out that the exchange has not met its burden to demonstrate the fund is “designed to prevent fraudulent and manipulative acts” and “to protect investors and the public interest”. Although proposals of Bitcoin spot ETPs have never been approved by the SEC and such products are not available in the U.S. market, they do exist in the European market. By investigating the prices of these ETPs traded in ...

Russian Ministry wants to legalize Bitcoin mining in specific areas

While the Russian government continues to work out a regulatory regime for digital assets, a federal ministry has made another proposal regarding the crypto mining industry. Russia’s Ministry of Economic Development has greenlighted the concept of crypto mining regulation in the country, proposing to allow mining operations in areas with “sustainable surplus in electricity generation,” local news agency Izvestia reported Tuesday. As part of the proposal, the ministry suggested introducing lower fees for setting up mining farms and data centers in specific Russian regions as well as offering reduced energy rates for such facilities. The ministry also wants to establish a power use limit for mining by individuals, reportedly proposing to introduce higher energy rates for increased energy spe...

Belarus president signs decree to support free circulation of crypto

Belarusian President Alexander Lukashenko has signed a decree affirming the country’s formal support of free circulation of cryptocurrencies like Bitcoin (BTC). Lukashenko’s press office announced Monday that the president has signed a decree “On the register of virtual wallet addresses and the circulation of cryptocurrency.” The document provides a legal basis for Belarus Hi-Tech Park to establish and manage a register of crypto wallet addresses used in illegal activities. The decree document specifically details the process and standards for seizing cryptocurrency from criminals by the government. The decree intends to protect crypto investors from potential losses and to “prevent unintentional involvement in activities prohibited by law.” The announcement points out that Belarus has tak...