cryptocurrencies

Gold vs BTC correlation signals Bitcoin becoming safe haven: BofA

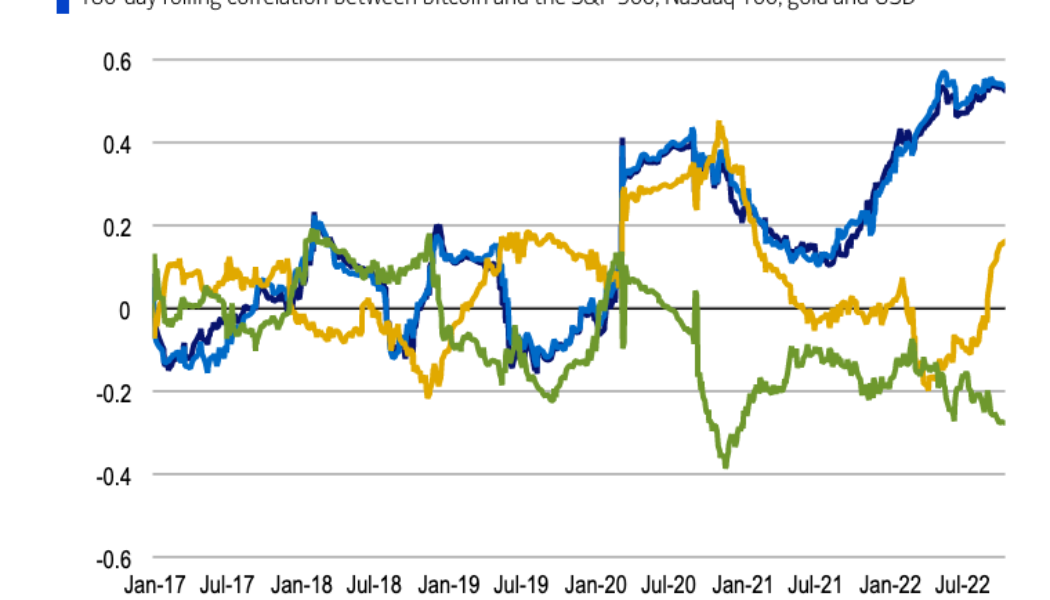

Despite the ongoing cryptocurrency bear market, investors have been increasingly looking at Bitcoin (BTC) as a safe haven, a new study suggests. The rise in the correlation between Bitcoin and gold (XAU) is one of the major indicators demonstrating investors’ confidence in BTC amid the ongoing economic downturn, according to digital strategists at the Bank of America. Bitcoin’s correlation with gold — which is commonly viewed as an inflation hedge — has been on the rise this year, hitting its highest yearly levels in early October. The growing correlation trend started on Sept. 5 after remaining close to zero from June 2021 and turning negative in March 2022, BofA strategists Alkesh Shah and Andrew Moss said in the report. “Bitcoin is a fixed-supply asset that may eventually become an infl...

Wealthy crypto believer and incoming UK PM Rishi Sunak once commissioned a royal NFT

Rishi Sunak is set to become prime minister of the United Kingdom within days. Sunak was defeated for the top government post by Liz Truss on Sept. 5, but she resigned after 45 days in office. Indications so far are that his selection for the office is good news for the crypto industry. Sunak was chancellor of the exchequer, or head of the treasury, from early 2020 to July 5, when he resigned during a scandal that shook Boris Johnson’s government. During that time, Sunak repeatedly voiced his support for crypto. Speaking in April about proposed regulatory reform related to stablecoins, Sunak said: “It’s my ambition to make the U.K. a global hub for crypto-asset technology, and the measures we’ve outlined […] will help to ensure firms can invest, innovate and scale up in this country. This ...

Reddit NFT trading volume hits all-time high as wallet holders near 3 million

According to data provided by Polygon and Dune Analytics, the trading volume of Reddit nonfungible token (NFT) avatars has eclipsed $1.5 million in the past 24 hours. The increase represents over one-third of the collection’s cumulative trading volume of $4.1 million since launch. At the same time, the daily sales volume of Reddit NFTs also witnessed a new all-time high of 3,780 digital collectibles changing hands. Reddit avatars are created by independent artists and are minted as NFTs on the Polygon blockchain. Users can purchase such collectibles on Vault, Reddit’s cryptocurrency wallet. They can then be worn and displayed as profile pictures when users create content on the popular social media platform. After being purchased purchase, the NFTs can be bought and sold on secondary marke...

Japanese port city wants to become the Web3 hub for the country

In Japan, the city of Fukuoka is looking towards the future of Web3 in its latest partnership with Astar Japan Labs – the company behind Japan’s leading blockchain, the Astar network. Fukuoka is the country’s second-largest port city and has officially been designated as a National Special Strategic Zone. Now it also plans to become the country’s hub for all things Web3 and crypto. The Astar Japan Labs partnership will allow both entities to work together on new use cases for Web3 technologies. Fukuoka joins more than 45 companies working with Astar, including Microsoft Japan and Amazon Japan. According to the announcement, the city wants to attract global, competitive businesses to the area. Representatives from Astar will regularly visit the city to provide education and new use ca...

Women remain bullish on crypto investment despite market lull: Survey

The crypto market downturn is proving a difficult storm to weather for both investors and businesses alike in the industry. However, according to new data, this hasn’t stopped women from being bullish on crypto. A new survey conducted by BlockFi, a crypto trading and investment platform, asked women across the United States about their views of and participation in the crypto industry between Sept. 2021 and Mar. 2022. According to the findings one in ten women chose crypto as their first investment, with 17% of that being Millennial women investors and 11% Gen Z. Findings even revealed that of the women surveyed 7% of Gen X, which includes individuals born between 1965-1980, reported crypto as their first investment. However, as past data has revealed, more education and clarity surroundin...

Telegram username auction marketplace ‘almost’ ready to launch

The popular messaging app Telegram has developed a new marketplace that doesn’t involve nonfungible tokens (NFTs). The social messaging platform said that it is all set to launch its marketplace for auctioning unique usernames for social platforms, an idea first floated in August. In an official announcement on its Telegram channel, the firm said that the development phase of the marketplace is near its end. The marketplace is based on its native blockchain called The Open Network (TON). The idea was first teased by the company founder Pavel Durov in late August this year when he proposed a marketplace that could utilize “NFT-like smart contracts” to auction highly-sought after usernames. Durov made the suggestion after the “success” of domain name auctions by The Open Network (TON), a lay...

Unsung hero saves DeFi protocol from potential exploit: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. The last week’s headline was dominated by some of the biggest hacks in DeFi. This week is redemption time for many DeFi protocols that either averted an attempted hack or got a significant chunk of their stolen funds back. The BitBTC bridge reportedly had a bug that would essentially allow an attacker to mint fake tokens on one side of the bridge and swap them for real ones. However, one Twitter user was able to foresee the vulnerability and informed the cross-bridge platform about it. The Moola Market attacker has scored about a half-million dollar “bug bounty” after choosing to return a majority of the cryptocur...

Not like China: Hong Kong reportedly wants to legalize crypto trading

Hong Kong is taking action to regain its status as a global cryptocurrency hub by launching several legal initiatives related to the crypto industry. A city and special administrative region of China, Hong Kong is willing to distinguish its crypto regulation approach from the blanket crypto ban in mainland China. The government of Hong Kong is considering introducing its own bill to regulate crypto in its own China-free way, according to Elizabeth Wong, head of the fintech unit at the Securities and Futures Commission (SFC). One of the SFC’s initiatives is allowing retail investors to “directly invest into virtual assets,” Wong said during a panel held by InvestHK, the South China Morning Post reported on Oct. 17. Such an initiative would mark a significant shift from the SFC’s stance over...

Acting US FDIC head cautiously optimistic about permissioned stablecoins for payments

Acting United States Federal Deposit Insurance Corporation (FDIC) chairman Martin Gruenberg spoke Oct. 20 about possible applications of stablecoins and the FDIC’s approach to banks considering engaging in crypto asset-related activities. Although he saw no evidence of their value, Gruenberg conceded that payment stablecoins merit further consideration. Gruenberg began his talk at the Brookings Institute with an expression of frustration seemingly common among many regulators: “As soon as the risks of some crypto-assets come into sharper focus, either the underlying technology shifts or the use case or business model of the crypto-asset changes. New crypto-assets are regularly coming on the market with differentiated risk profiles such that superficially similar crypto-assets may pose sign...

South Africa declares crypto to be a financial product subject to financial services law

The Financial Sector Conduct Authority (FSCA), South Africa’s financial regulator, published a notice on Oct. 19 indicating that the country’s 2002 Financial Advisory and Financial Intermediary Services Act (FAIS) has been updated to include a definition of crypto assets. A decision of this type has been expected for several months, and it brings crypto assets under regulation in South Africa for the first time. The FSCA notice, which went into force on publication in the Green Gazette (the government gazette of record), states that a crypto asset is “a digital representation of value” that can be electronically traded, transferred and stored but is not issued by a central bank. Additionally, it “applies cryptographic techniques” and uses distributed ledger technology. The notice goes on t...

Report: Half of all DeFi exploits are cross-bridge hacks

According to a new report by crypto data aggregator Token Terminal, approximately 50% of exploits in decentralized finance, or DeFi, occur on cross-chain bridges. In two years’ time, more than $2.5 billion have been stolen by hackers from exploiting vulnerabilities on cross-chain bridges. The amount is enormous comparison to other security breaches, such as DeFi lending hacks ($718 million) and decentralized exchange exploits ($362 million) in that period. Bridge exploits account for ~50% of all DeFi exploits, totaling ~$2.5B in lost assets These hacks can typically be attributed to smart contract loopholes (e.g. Wormhole & Nomad) or compromised private keys (e.g. Ronin & Harmony). What will it take to create secure bridges? pic.twitter.com/LrVf0W0zeK — Token Terminal (...

Report: India ranks third in the world in terms of Web 3.0 workforce size

According to a new study published by the National Association of Software and Services Companies (NASSCOM), a non-profit organization in India with over 3,000 members, the country currently possesses 11% of the world’s Web 3.0 talent. The figure makes India the world’s third largest regarding its Web 3.0 workforce, employing nearly 75,000 blockchain professionals today. Furthermore, the industry group expects the talent pool to grow by over 120% within the next two years. India is also home to 450 Web 3.0 startups, four of which are unicorn companies. Through April 2022, the Indian Web 3.0 ecosystem has raised $1.3 billion in funding. Moreover, over 60% of Indian Web 3.0 startups have expanded their footprints outside of the country. The vast majority of firms listed in the st...