cryptocurrencies

Mango Markets hacker allegedly feigns Curve short attack to exploit Aave

As described by analysts at Lookonchain on Nov. 22, tokens of decentralized exchange Curve Finance (CRV) appear to have suffered a major short-seller attack. According to Lookonchain, ponzishorter.eth, an address associated with Mango Markets exploiter Avraham Eisenberg, first swapped 40 million USD Coin (USDC) on Nov. 13 into decentralized finance protocol Aave to borrow CRV for selling. The act allegedly sent the price of CRV falling from $0.625 to $0.464 during the week. Fast forward to today, blockchain data shows that ponzishorter.eth borrowed a further 30 million CRV ($14.85 million) through two transactions and transferred them to OKEx for selling. The team at Lookonchain hypothesized that the trade was conducted to drive down the token price “so many people who used CRV...

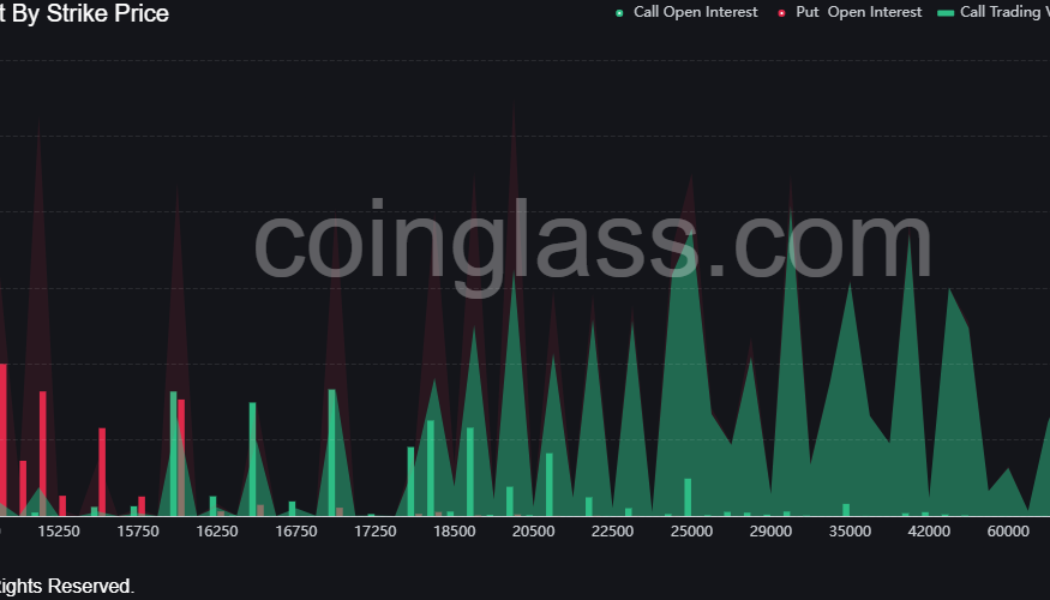

Why is Bitcoin price down today?

Bitcoin (BTC) price accelerated its sell-off on Nov. 21 to hit a new yearly low at $15,654. The move follows a market-wide decline that was catalyzed by investors running for the hills in fear that the FTX-induced contagion would infect every corner of the crypto sector. Stocks also closed the day in the red, with the tech-heavy Nasdaq down 1% and the S&P 500 losing 0.42% on the back of investors’ concerns about rising interest rates. Data from Coinglass shows over $100 million in leverage longs were liquidated on Nov. 20 and Nov. 21 as investors fear an accelerated sell-off if Digital Currency Group (DCG) and BlockFi fail to secure funding and are forced to declare bankruptcy. BTC open interest by strike price. Coinglass Some analysts are betting on Bitcoin price declining below...

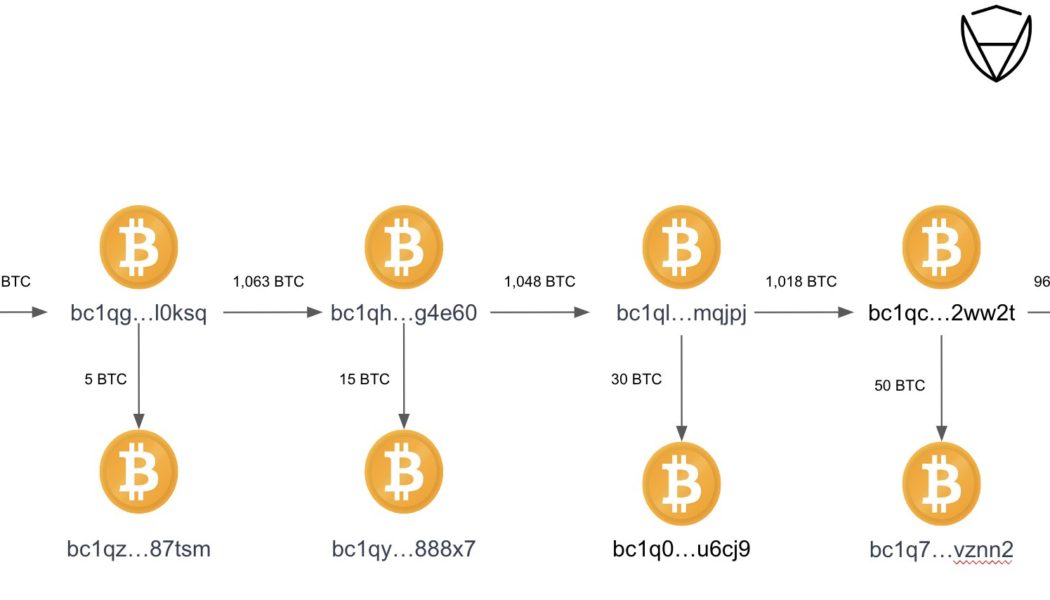

FTX hacker dumps 50,000 ETH, still among top 40 Ether holders

The hacker behind the bankrupt cryptocurrency exchange FTX started transferring their Ether (ETH) holding to a new wallet address on Nov. 20. The FTX wallet drainer was the 27th largest ETH holder after the hack but dropped by 10 positions after the weekend ETH dump. The FTX hacker drained nearly $447 million out of multiple FTX global and FTX US exchange wallets just hours after the crypto exchange filed for Chapter 11 bankruptcy on Nov. 11. Majority of the stolen funds were in ETH, making the exploiter the 27th largest ETH whale. On Nov. 20, the FTX wallet drainer 1 transferred 50,000 ETH to a new address, 0x866E. The new wallet address then swapped the ETH for renBTC (ERC-20 version of BTC) and bridged to two wallets on the Bitcoin blockchain. One of the wallets bc1qvd…gpedg held 1,070 ...

FTX-owned Liquid exchange pauses all trading after withdrawal halt

Liquid has suspended all trading operations on its platform in line with instructions from FTX Trading, the firm announced on Twitter on Nov. 20. The statement indicates that Liquid exchange paused “all forms of trading” because of the operation of the Chapter 11 process in the Delaware courts. “We have since done so while we assess the situation. We are working through these issues and will endeavor to give a fuller update in due course,” Liquid added. Liquid’s operational halt comes five days after the exchange suspended all withdrawals on its platform, citing compliance with the requirements of voluntary Chapter 11 proceedings. Japan’s Financial Services Agency previously also requested another FTX’s local subsidiary, FTX Japan, to suspend business orders on Nov. 10. As previously repor...

Celsius bankruptcy victims get proof-of-claim deadline from US court

The ongoing case of the Celsius bankruptcy continues as the United States Bankruptcy Court in the southern district of New York State approved a new filing deadline. According to an official document, a deadline has been set for those filing any claims against the former digital assets lender. Any person or entity – which covers individuals, partnerships, corporations, joint ventures and trusts – who wishes to do so must submit a proof of claim by Jan. 3, 2023, 5:00 pm Eastern Time. Celsius itself made a thread on Twitter, informing its former users of the recent court deadline approval, along with step-by-step information as to how claims are filed: We created this video to help explain the claims process: https://t.co/jXmL1VQNxg — Celsius (@CelsiusNetwork) November 20, 2022 T...

Nayib Bukele announces Bitcoin prescription for El Salvador: 1 BTC a day

As the world’s first nation to adopt Bitcoin (BTC) as a legal tender in September 2021, El Salvador is going back to its BTC buying days after a pause for months amid bearish market conditions. El Salvador President Nayib Bukele announced on Nov.16 that the Central American nation will start purchasing BTC on a daily basis starting from Nov.17. The announcement comes nearly three months after the nation made its last BTC purchase in July 2022. We are buying one #Bitcoin every day starting tomorrow. — Nayib Bukele (@nayibbukele) November 17, 2022 El Salvador started buying BTC in September 2021, right after making it a legal tender. At the time, BTC was in the mid of a bull market and every purchase made by the nation looked lucrative as the price was hitting a new all-time high every other...

Bybit releases reserve wallet addresses amid calls for transparency

Crypto exchange Bybit publicly released the addresses of its largest crypto wallets on Nov. 16. This came on the heels of FTX’s collapse and calls within the industry for greater transparency. Bybit listed the addresses in a press release. Nansen also produced a dashboard of Bybit’s wallets which indicated that over $1 billion of the exchange’s assets are in BTC, USDT, ETH, and USDC. In the press release, the company claimed that these assets represent over 85% of the total cryptocurrency held by the exchange. 1) Disclosing Bybit main users asset wallets (excluding other assets and non consolidated wallets are too many to list ~+20%). Around $1.9B. Bybit is also working on POR solutions such as Merkel Tree on UID level. https://t.co/fAszQVKNJF — Ben Zhou (@benbybit) November 16, 2022 The c...

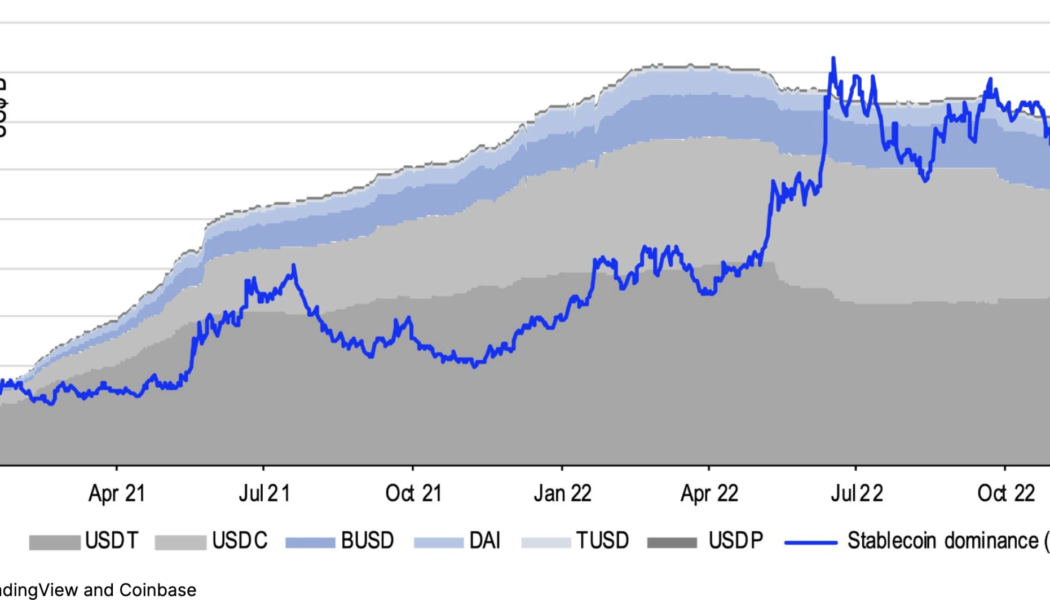

FTX crisis could extend crypto winter to the end of 2023: Report

The FTX crisis has deterred investor confidence and created a liquidity crisis in the crypto market, which could very well extend the crypto winter until the end of 2023, according to a new report. A research report from Coinbase analyzing the fallout in the crypto ecosystem in the wake of the FTX collapse noted that the implosion of the world’s third-largest crypto exchange has created a liquidity crisis that may contribute to an extended crypto winter. Many institutional investors in FTX had their investments stuck on the platform after it filed for bankruptcy on Nov. 11. The FTX implosion has also deterred investors and large buyers away from the crypto ecosystem. Coinbase highlighted that the stablecoin dominance has reached a new high of 18%, indicating that the liquidity crisis might...

What are crypto whale trackers and how do they work?

There are dedicated solutions to track the actions of crypto whales. These solutions can provide analytics on whale actions and, in some instances, can also make investment/trading decisions for the user. Crypto traders and investors constantly track the amount of cryptocurrencies going in and out of exchanges. When a cryptocurrency like Bitcoin or Ether (ETH) is moved in large quantities into an exchange, it is expected to see some sell action resulting in a fall in price. Conversely, if cryptocurrencies flow out of exchanges into wallets, it is considered a precursor to a rise in price. This is because when exchanges have a high net outflow of cryptocurrencies, they have reduced supply resulting in an increase in price. Oftentimes, a whale could buy cryptocurrencies on an exchange and mo...

Traders expect 200% upside from MATIC, but does Polygon network data support that?

In the past year, Polygon (MATIC) has focused on growing their list of high-profile partners which includes luminaries like Disney, Starbucks and Robinhood. The recent announcements of partnerships with both Instagram and JPMorgan have speculators pushing the token price up nearly 200%. In addition to partnerships, blockchain adoption through network usage is important to analyze. Blockchain adoption can be analyzed by looking into daily active users of the blockchain, protocols using the technology, number of transactions and total locked value. Total value locked on Polygon rises above $1B Total value locked (TVL) is one cryptocurrency indicator used to assess the market’s sentiment towards a particular blockchain. TVL on Polygon requires utilizing the MATIC blockchain and locking ...

Automation opens up pathway to a simplified, more user-friendly DeFi

Few doubt the potential that DeFi has to redefine crucial aspects of finance for all. But, as it stands, using DeFi platforms and protocols is often time consuming and anything but easy. One of the biggest draws of DeFi are the yields users can earn on farming and staking protocols. However, the yields on offer are constantly changing, meaning crypto enthusiasts need to stay locked to their screens to ensure they aren’t missing out. Given the 24-hour nature of this fast-moving industry, keeping on top of things is often easier said than done. Some protocols are also pretty difficult to use, requiring users to monitor a plethora of different pools. And even when you find the best returns that the market has to offer, the process of manual compounding can be quite tedious. In search of...

Canada to examine crypto, stablecoins, and CBDCs in new budget

The Canadian federal government is set to launch a consultation on cryptocurrencies, stablecoins, and Central Bank Digital Currencies (CBDCs) as revealed in its new mini-budget. The government’s “2022 Fall Economic Statement” released on Nov. 3 by Deputy Prime Minister Chrystia Freeland works as a fiscal update in conjunction with its main yearly budget. The statement included a small section on “Addressing the Digitalization of Money” that outlined the government’s crypto plans. It said the rise in cryptocurrencies and money digitalization is “transforming financial systems in Canada and around the world” and the country’s financial system regulation “needs to keep pace.” The statement opined that money digitalization “poses a challenge to democratic institutions around the world” h...