crypto

The market isn’t surging anytime soon — so get used to dark times

Global markets are going through a tough period — including the cryptocurrency market. But judging by talk from the peanut gallery, it seems like some observers haven’t received the memo. “Feel like we’re relatively safe through mid-terms,” Twitter’s “CryptoKaleo” — also known simply as “Kaleo” — wrote in a Sept. 12 tweet to his 535,000 followers, referring to the United State’s November mid-term elections. The prediction was accompanied by a chart indicating his belief that Bitcoin’s (BTC) price would surge to $34,000 — a 50% gain from its roughly $20,000 level as of last week — before the end of the year. “Of course we can bleed lower,” fellow pseudonymous Twitter mega-influencer Pentoshi wrote in a Sept. 9 missive to his 611,000 followers. “But the market at this value...

Terra co-founder Do Kwon says he’s not ‘on the run’

Do Kwon, the co-founder of the Terra ecosystem, took to Twitter on Saturday asserting he’s “not ‘on the run’ or anything similar” after the Singapore Police Force (SPF) said Kwon wasn’t in the city-state. On Sept. 14, South Korean authorities issued an arrest warrant for Kwon and five other associates for alleged violations of the country’s capital markets laws. All were known to be in Singapore at the time, with prosecutors also attempting to revoke their passports a day later on Sept. 15. “For any government agency that has shown interest to communicate, we are in full cooperation and we don’t have anything to hide,” Kwon tweeted. I am not “on the run” or anything similar – for any government agency that has shown interest to communicate, we are in full cooperation and we don’t hav...

Latin America is ready for crypto — just integrate it with their payment systems

Thriving on exploiting users’ data, Web2 monopolies like Facebook and Google have ushered in an era of massive internet centralization in recent years. This concentration of power has enabled huge shares of communication and commerce closed platforms, giving users little control over how their data is collected. An emerging concept, Web3, will provide a means to pivot from centralization to an open-source internet. A recent report from Andreessen Horowitz (a16z) found that this new digital economy could reach an astounding 1 billion users by 2031. If executed correctly, the decentralized internet will allow users to take control of their data and content. While Web3 promises to radically change the internet and its ability to provide value to users worldwide, key hurdles must be overcome b...

Liquid staking is key to interchain security

Bitcoin’s genesis in 2009 will probably go down in history as one of the most notable technological events of all time. Demonstrating the first real use case for the immutable, transparent and tamper-proof ledgers — i.e., blockchain — it established the cornerstone for developing the crypto and other blockchain-based industries. Today, just over a decade later, these industries are thriving. The total crypto market capitalization hit an all-time high of $3 trillion at its peak in November 2021. There are already more than 300 million crypto users worldwide, while forecasts suggest the figure may cross 1 billion by December 2022. Although phenomenal, this journey has merely begun. Several factors have contributed to the blockchain and cryptocurrency industry’s success so far. But abov...

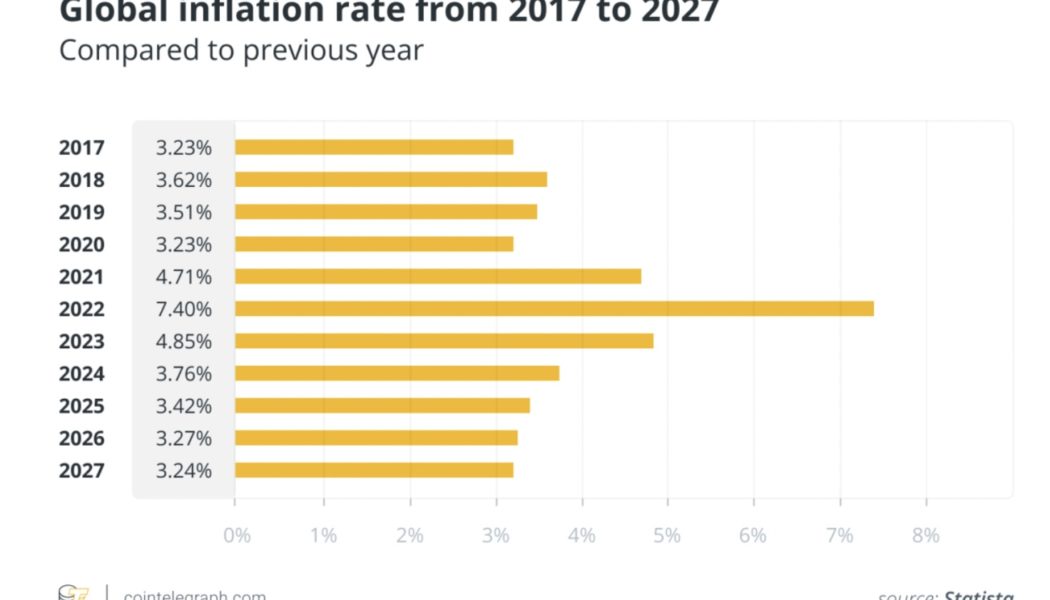

Crypto will become an inflation hedge — just not yet

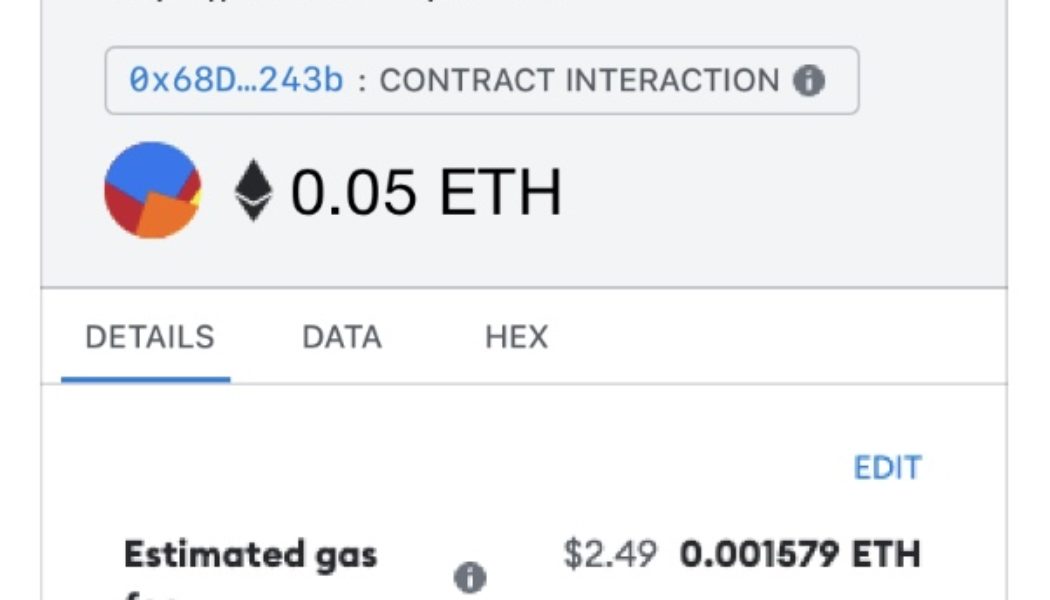

In theory, Bitcoin (BTC) should serve as a hedge against inflation. It’s easy to access, its supply is predictable, and central banks cannot arbitrarily manipulate it. However, investors aren’t treating it that way. Instead, the cryptocurrency market is mirroring the stock market. Why is that? Let’s dive into what prevents cryptocurrencies from acting as a hedge against inflation, and what needs to happen to make them a hedge in the future. Crypto could be a hedge, but it comes with inconveniences Cryptocurrencies present a unique solution, given their lack of a central governing bank. You can’t lose trust in something that doesn’t exist. Its supply is finite, so it naturally appreciates in value. People using a blockchain with proof-of-stake protocols can access their funds at any time, w...

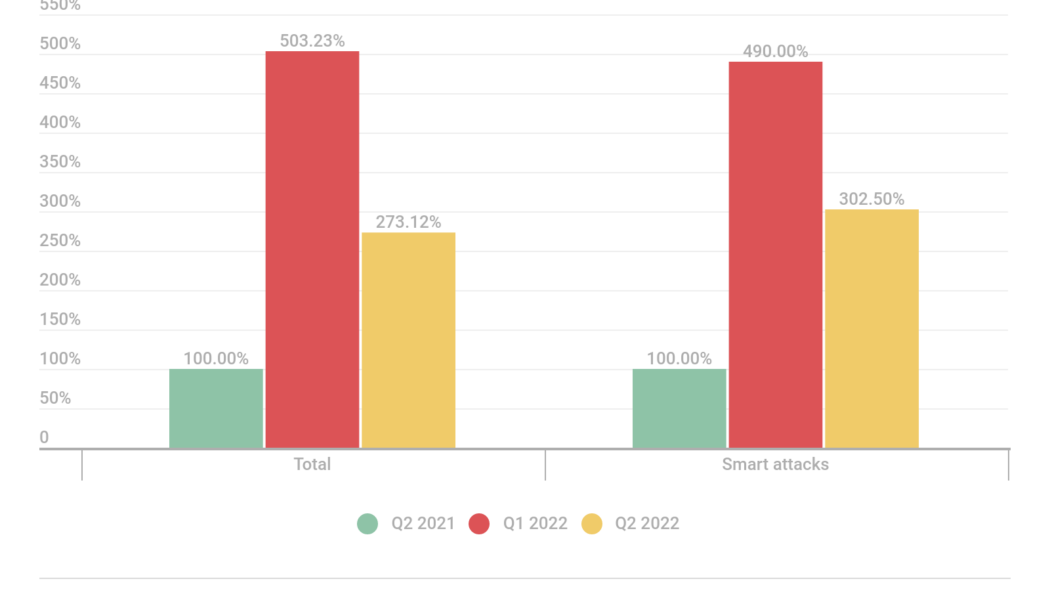

The Crypto Collapse & Rising DDoS Smart Attacks

Image sourced from Shutterstock. During Q2 2022, Distributed Denial of Service (DDoS) attacks reached a new level as the share of smart attacks and average duration saw steep increases. Compared to the previous year, the average duration of a DDoS attack rose 100 times, reaching 3,000 minutes. The share of smart attacks almost broke the four-year record, accounting for nearly 50% of the total. Experts also expect an increase in overall DDoS activity, especially with the recent collapse of cryptocurrency. These and other findings are part of a quarterly DDoS report issued by Kaspersky. A Distributed Denial of Service (DDoS) attack is designed to hinder the normal functioning of a website or crash it completely. During an attack (which usually targets government institutions, retail or ...

We Attended a Secret Party In the Forest at Tomorrowland 2022—Here’s What It Looked Like

In the throes of the crypto winter, FTX found warmth in the effervescent confines of Tomorrowland. Cryptocurrency and electronic dance music have been inextricably linked thanks to the widespread adoption of digital collectibles by DJs. In fact, the 2021 IMS Business Report found that 76% of all music NFTs were issued by electronic music artists. The nexus of all this activity is music festivals, where NFT and crypto developers can escape the dangerous, theft-laden interwebs to demonstrate the utilities of their projects in a controlled environment. So FTX, a popular cryptocurrency exchange which averages roughly $10 billion of daily trading volume, touched down at the largest EDM festival in the world. The company organized a hidden stage called The Hill during each day of the 2022 e...

Audius Hacked for $1 Million Via Malicious Governance Proposal

In the midst of a blistering $2 trillion crypto crash that has roiled the blockchain industry, the world’s leading blockchain-based streaming platform has sustained a seven-figure attack. In a malicious exploit that used the platform’s built-in governance structure as a means to withdraw tokens, Audius reportedly sustained a hack which saw the perpetrator make a speedy exit with over $1 million. According to Cointelegraph, the hacker was able to solely request the transfer of 18 million $AUDIO tokens by establishing themselves as the singular guardian of the contract, known as “Proposal #85.” The 18 million tokens were originally worth $6 million at the time, but due to the hacker’s move to hastily dump the reserves on the open market simultaneously, the resul...

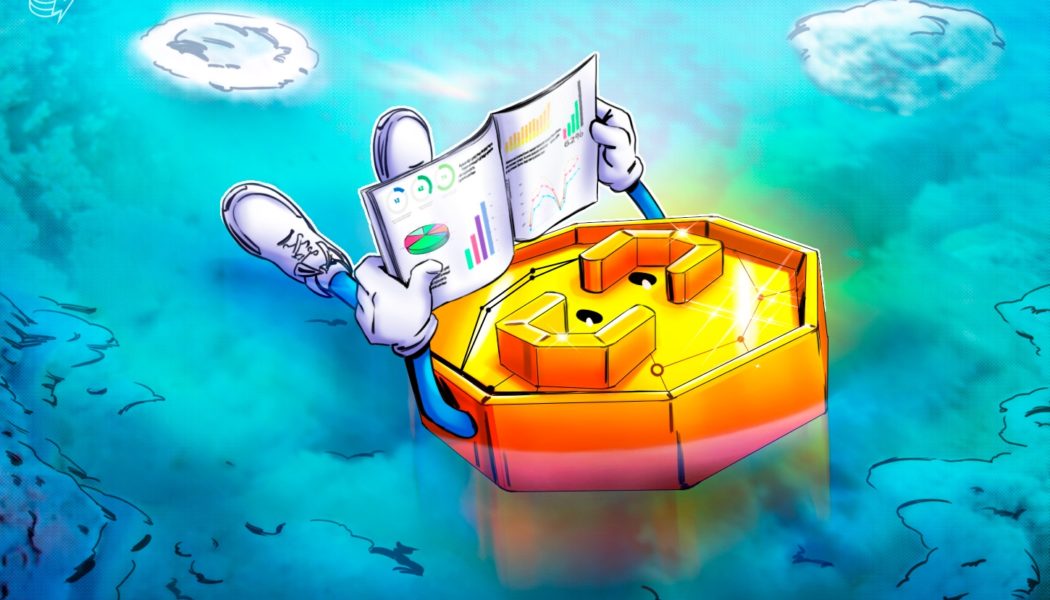

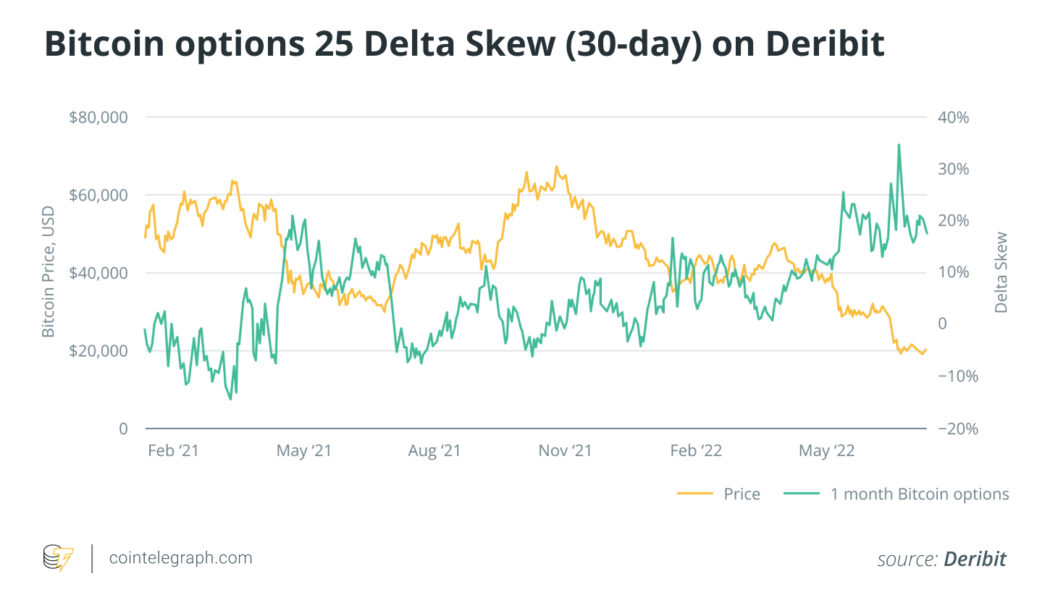

The battle between crypto bulls and bears shows hope for the future

The blockchain space is seeing some areas of strength despite the perceived downturn in the market. The perpetual futures funding rates for Bitcoin (BTC) and Ether (ETH) have flipped back to positive on major exchanges, which shows bullish sentiment among derivatives traders. In addition, Bitcoin started trading below its cost basis, which has marked previous areas of market bottoms. In contrast, June saw decentralized finance (DeFi) experience a 33% decrease in total value locked and crypto stocks provide a -42.7% average month-over-month return. There is an ongoing battle between bullish and bearish sentiments in different areas of the market. To help cryptocurrency traders maneuver through the battlefield, Cointelegraph Research recently launched its monthly “Investor Insights Rep...