Crypto trading

June gloom takes on a new meaning in another 2022 down month

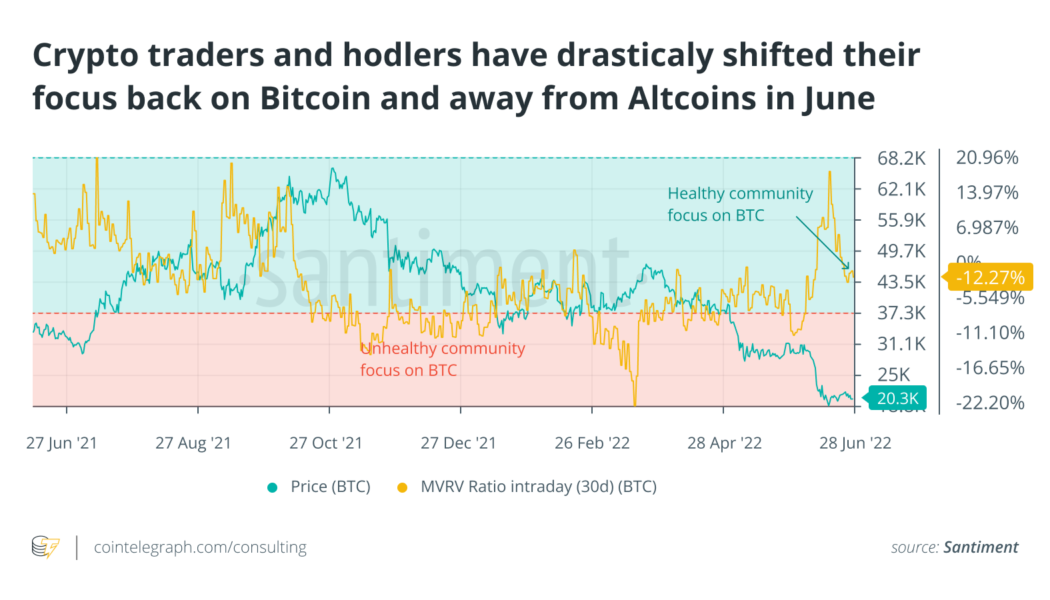

The market cap of Bitcoin (BTC) dropped another 33% in June, which is now beginning to numb the Twitter community. On the upside, many crypto traders who wanted out did so fairly aggressively from March to May. But, the less optimistic news is that the stagnancy in address activity may need to change for prices to get a running start on recovery. Unlike April and May, the altcoin pack didn’t struggle tremendously more than Bitcoin. BTC’s 33% drop was pretty middle of the road in terms of corrections. In a vacuum, crypto bulls would prefer seeing altcoins continuing to lag, pushing more traders back toward Bitcoin as a relative “safe haven.” Nevertheless, June was a tale of two halves. June 1-15 saw a massive 25% further downswing for Bitcoin. Comparatively, June 16-30 was looking up until ...

Aussie banks ANZ and NAB won’t ‘endorse’ retail speculation on crypto

Executives at two of Australia’s “big four” banks have ruled out allowing retail customers to trade cryptocurrency on their platforms, with one reasoning that customers don’t understand “basic financial well-being.” Speaking at the Australian Financial Review Banking Summit on Tuesday Maile Carnegie, executive for retail banking at Australia and New Zealand Banking Group (ANZ), said that from speaking to retail customers, she believed “the vast majority of them don’t understand really basic financial well-being concepts.” “Are we really going to make it easier and less friction and implicitly endorse speculating on crypto when they don’t understand basic financial well-being? The answer was no.” Carnegie said ANZ had considered a cryptocurrency product from as early as 2017, adding she was...

Understanding the Risks to Cryptocurrency Trading

Sourced from Hacker Noon. Alongside self-fertilizing crops and low-carbon shipping, cryptocurrencies have made the World Economic Forum (WEF) list of top tech trends in 2022 bolstered by research by the Thomson Reuters Foundation that describes it as moving from the ‘fringes of finance to the mainstream’. Perceptions around cryptocurrencies have shifted, with several countries adopting it as legal tender, banks looking to create their own forms of digital currency, and consumers putting their savings into crypto wallets instead of traditional financial institutions. Anna Collard, SVP Content Strategy & Evangelist at KnowBe4 Africa. Countries are either considering or are already partially using Central Bank Digital Currency (CBDC), which essentially allows for companies and individuals...

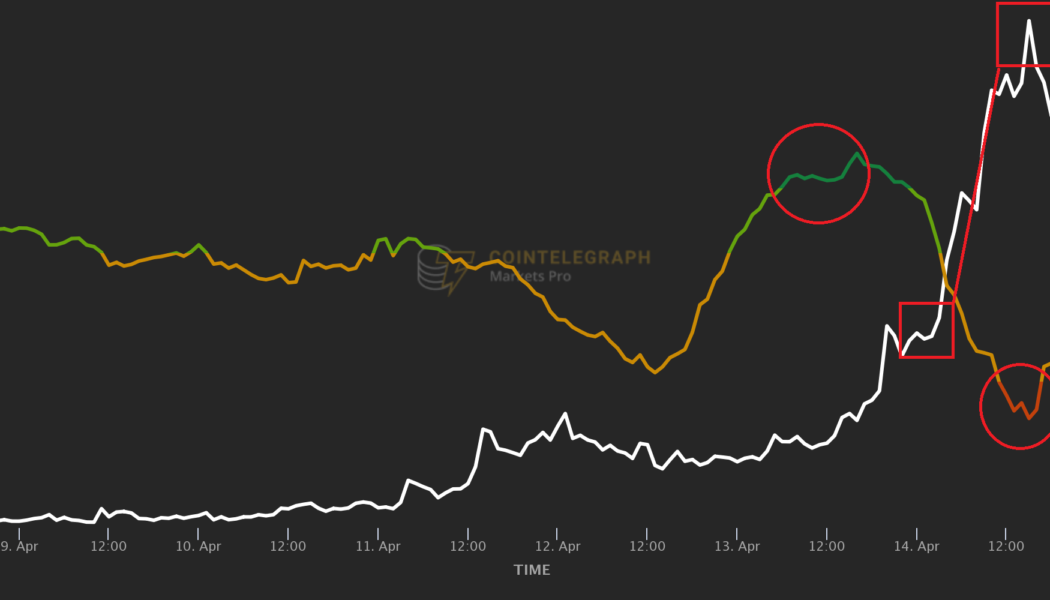

Overheated DOGE: 5 times crypto traders were warned before their assets tanked

Everybody loves a crypto bull market, but every green wave inevitably gives way to periods of sideways or downward movement. Skilled traders know that these phases of the market cycle can be rife with profit opportunities, too. Anticipating not only a digital asset’s upward price movements, but downturns and corrections can be useful when deciding on when to exit a position and lock in gains, as well helping to add toprofits by shorting crypto assets whose prices decline. In addition to a keen eye and common sense, anticipating price drops can be aided by data intelligence tools. One AI-driven indicator that can help investors see the signs of an upcoming dip early is the VORTECS™ Score, exclusively available to the members of Cointelegraph Markets Pro. Its job is to sift through ye...

Bitcoin Arbitrage: The Story of Free Money

Bitcoin arbitrage opportunity in South Africa. You might be thinking, “What on earth is arbitrage trading?” or “I’ve heard of this before and always wondered what it is”. Whichever one you thought of, we’re going to make the understanding of what it is and how to take advantage of it as simple as possible. OVEX – one of South Africa’s top cryptocurrency exchange and brokerage firms offers a fully managed arbitrage service, register now, sit back and make money. What Is Arbitrage? In a nutshell, arbitrage is purchasing an asset in one market and simultaneously selling it in another market at a higher price and thus profiting on the temporary difference in price. So what is the holy grail of outperforming the market? Taking advantage of inefficiencies in the market is considered ...