Crypto regulation

Deputy Minister of Malaysia’s Communication Ministry roots for legalising crypto

Deputy minister Zainul Abidin has proposed the legalisation of cryptocurrencies in Malaysia to ease financial dealings among the younger population Earlier this, the deputy minister of finance in the country spoke strongly against crypto assets In a move to indicate that the Malaysian Ministry of Communications and Multimedia (KKMM) is supporting the adoption of crypto assets, deputy minister Zainul Abidin has called for the legalisation of crypto. Speaking during a parliamentary session today, Abidin explained that it is important for Malaysia to legalise some facets of crypto and NFTs as they could potentially be useful, especially for the younger generation. He noted that the crypto space has increasingly become popular with this demographic. “We hope the government can try to leg...

Weekly Report: Russia’s largest bank can now issue digital assets, Optimism raises $150 million

Optimism aims to invest in hiring following the conclusion of a Series B funding round A FinCEN rep has said it is impossible to move large scale amounts of funds via crypto to avoid sanctions Meta could be legally charged for allowing misleading crypto ads on Facebook that falsely portrayed support by celebrity figures in Australia Sberbank has been licensed to issue and exchange virtual assets in Russia GameStop fans will by the end of July exchange NFTs for free on the retailer’s marketplace Ethereum L2 scaling solution Optimism raises $150M in a Series B funding round Optimism, an Ethereum layer two scaling solution, has completed a $150 million Series B funding round co-led by giant venture capital firms Paradigm Capital and Andreessen Horowitz (a16z) at a $1.65 billion valuatio...

CoinSmart CEO Interview: Fraud in Crypto

There are a lot of odd holidays in the calendar. My personal favourite is National Peanut Butter and Jelly Day, celebrated annually on April 2nd. It falls the day after April Fool’s Day, which, without sounding too miserable, I was never really entertained by. One holiday that is far from a joke, however, is May 9th – National Lost Sock Memorial Day, a time for us to “honour all the socks that are no longer with us”. The reason I discuss such wacky holidays is that I was surprised to note that March represents Fraud Prevention Month in Canada. Upon originally seeing this, I thought was a little over the top. Then, I thought about the harm fraud can cause and looked into the numbers. Based on the Canadian Anti-Fraud Centre (CAFC), $379 million were lost to scams and fraud in 2021 (up 130% f...

FTX becomes the first licensed digital asset exchange in Dubai

The crypto exchanges’ Europe subsidiary will offer complex crypto derivatives to institutional clients. FTX also has plans to set up its regional headquarters in the city Sam Bankman-Fried’s crypto trading platform FTX has become Dubai’s premier recipient of a virtual asset exchange (VAX) licence, according to a press release sent out today. The American exchange’s Europe and Middle Eastern subsidiary, FTX Europe, will now be operating legally in the city and would play a role in Dubai’s push to spur the growth of global virtual assets regulation. “Really excited to receive the first (and so far only) digital asset exchange licence from Dubai!” SBF tweeted following the news. The licence allows FTX to offer enterprise investors exposure ...

EU Parliament votes against the proposal limiting Proof-of-Work cryptocurrencies

EU lawmakers rejected the proposed ban of cryptocurrencies that use the Proof-of-Work mechanism The proposal, which has been a hot debate in recent days, would have led to the outlawing of Bitcoin and other PoW cryptocurrency projects Today, the European Parliament Committee on Economic and Monetary affairs voted on the proposed draft suggesting the ban of cryptocurrencies leveraging the Proof-of-Work consensus mechanism. The proposal, which could have compelled PoW cryptocurrencies to shift to sustainable mechanisms, failed to get enough backing during the vote and was consequently rejected. The majority of EU parliamentarians voted against including the provision out of a draft of the Markets in Crypto Assets (MiCA)framework. Patrick Hansen was among the first to share news on Twitter. &...

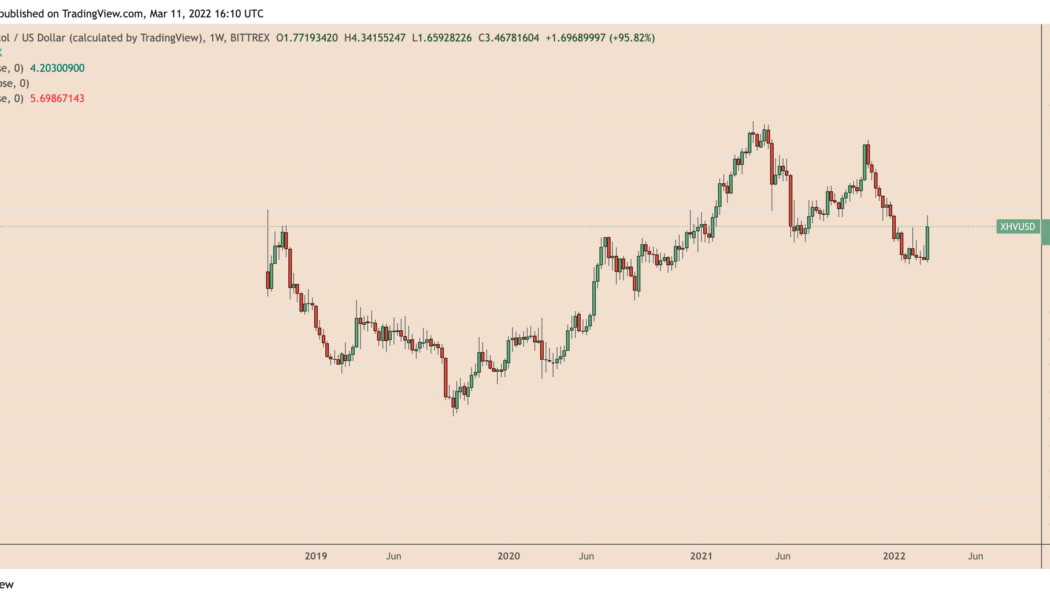

Haven Protocol (XHV) shows strong signs of bottoming out after crashing 90%

Haven Protocol (XHV) showed signs of returning to its bullish form as its price doubled in just five days of trading. What’s pumping Haven Protocol? XHV’s price surged by up to 107% week-to-date to climb above $3.60 on March 11, its highest level in more than three months. Interestingly, the move upside followed a period of aggressive selloffs that saw XHV’s value dropping from nearly $20 in November 2021 to as low as $1.60 in early February 2022 — an approximately 90% decline. XHV/USD weekly price chart. Source: TradingView Traders started returning to the Haven Protocol market against the prospects of two macroeconomic scenarios: U.S. President Joe Biden’s executive order that focuses on cryptocurrencies and hardline western sanctions on Russian oligarchs amid an ...

UK’s financial regulator orders shut down of crypto ATMs

The FCA says all crypto ATMs in the UK have been operating illegally The regulator, therefore, ordered operators of crypto-to-cash machines to halt their services or face legal consequences The FCA, UK’s financial conduct regulator, has banned the operation of crypto ATMs in the country. The financial authority stated in a Friday notice that it had asked all operators of these machines to suspend their activities or “face enforcement action.” No crypto ATM operator has received approval The order comes on the grounds that the operators have not registered with the regulator. The FCA pointed out that it has not yet given the green light to offer crypto ATM services to any of the crypto-entities that have completed registration. “Crypto ATMs offering crypto asset exch...

Crypto market rallies on reports of a ‘positive’ Biden crypto executive order

News of the release of a now-deleted Treasury response to Biden’s crypto executive order has sent bullish waves in the market Bitcoin has gained more than 8.25%, racing past $42,000, while Ethereum has retested $2,750 Reports of the highly-anticipated crypto executive order from the White House being bullish or neutral in the worst case have spurred a market rally on Wednesday morning. Treasury’s response hints Biden’s crypto executive is likely not bearish Late yesterday, US Secretary of Treasury Janet Yellen published a response to the Biden crypto order even before the latter was released. The incident struck as unintentional since the response shared was dated March 09 (today) yet went up live a day earlier. In the statement, Yellen ‘accidentally gave an inkling...

Treasury Secretary Yellen ‘mistakenly’ publishes response to Biden’s executive order

The Biden administration will support responsible innovation around digital assets The executive order will also look to establish consumer and investor protection measures International partners will be involved in defining standards for digital assets The office of the United States Secretary of the Treasury Janet Yellen yesterday released a statement, dated March 9 (today), that indicated that President Biden’s executive order would support responsible innovation via a coordinated approach to establishing digital asset policy. Strange, and maybe accidental Meant to be a response to the yet-unreleased directive by the White House, the statement by the Treasury secretary has since been deleted but was captured by a web archive. Yellen explained that this approach benefits the nation...

Here’s why the UK’s FCA is not impressed with EQONEX’s agreement with Bifinity

The FCA says the agreement granted Bifinity certain contractual rights over Eqonex The UK financial markets regulator insists it retains powers to suspend an unfit firm’s crypoasset registration The UK’s Financial Conduct Authority yesterday sent out a note indicating that it is still keeping a close eye on Binance. The message came on the heels of Binance’s subsidiary pay tech firm Bifinity completing a strategic agreement with FCA-regulated EQONEX Limited. Binance launched payment tech company Bifinity yesterday, noting that EQONEX, the first publicly listed digital asset firm in the US, would receive a $36 million convertible loan as part of the agreement. Further, the cooperation would also give Bifinity the right to appoint the CEO, CFO, and Chief Legal Officer of EQ...

Report: President Biden set to sign a crypto executive order this week

The executive order will put focus on possible legal and economic impacts of digital assets The White House’s approach has come under keen scrutiny in recent days, with concerns that Russia could use crypto to evade economic sanctions US President Joe Biden will reportedly sign an executive order on crypto this week, potentially leading towards a framework for the regulation of digital assets. Talks of market-wide crypto regulation have been around since last October, as the government resolved to fight the then surging threat of cybercrime and ransomware. Now, according to a report published yesterday, Bloomberg says the order could be signed as soon as tomorrow. Citing an individual familiar with the matter who preferred to remain unidentified, the news outlet explained that t...

Weekly Report: BitDAO makes bold bet with $633 million allocation

Here are some of the interesting headlines you might have missed in the cryptocurrency sector this week: Rarify gets a $10 million boost in a funding round led by Pantera Capital Rarify, an infrastructure firm that provides businesses and institutions with a platform to natively incorporate non-fungible tokens (NFTs), has completed a $10 million funding round. The raise, which now puts the firm’s valuation at $100 million, was led by asset management company Pantera Capital, with the involvement of other investors including Slow Ventures, Greycroft, Protocol Labs, Hyper, and Eniac Ventures. By providing infrastructure to support enterprise-scale NFT integration, Rarify helps companies jump into the NFT scene with ease. According to the firm’s co-founder Revas Tsivtsivadz, the firm aims to ...