Crypto regulation

DeFi Pioneer Echoes SBF in Call for Tighter Crypto Regulations

Respected former decentralized finance (DeFi) project founder and developer Andre Cronje has resurfaced after a lengthy hiatus to call for tighter regulations on the crypto sector amid the implosion of multiple firms this year. The comments echo similar sentiments to that of FTX CEO Sam Bankman-Fried (SBF), who also called for more stringent digital asset industry standards last week, including greater consumer protections, transparency and disclosures. SBF was met with strong community pushback, however, with many people accusing the CEO of trying to monopolize or censor the DeFi space, among other things. In an Oct. 25 blog post titled “The Crypto Winter of 2022,” Cronje called for greater regulation of the sector, noting that “the recent decline of the crypto-market has shown the f...

Bankman-Fried ‘100%’ supports knowledge tests for retail derivatives traders

The founder and CEO of cryptocurrency exchange FTX, Sam Bankman-Fried has backed the idea of knowledge tests and disclosures to protect retail investors but said it shouldn’t just be crypto-specific. Bankman-Fried tweeted his thoughts in response to an idea floated by the Commodities Future Trading Commission (CFTC) commissioner Christy Goldsmith Romero on Oct. 15, saying the establishment of a “household retail investor” category for derivatives trading could give greater consumer protections. Romero said due to crypto, more retail investors are entering the derivatives markets and called for the CFTC to separate these investors from professional and high-net-worth individuals and have “disclosures written in a way that regular people understand or could be used when weighing ru...

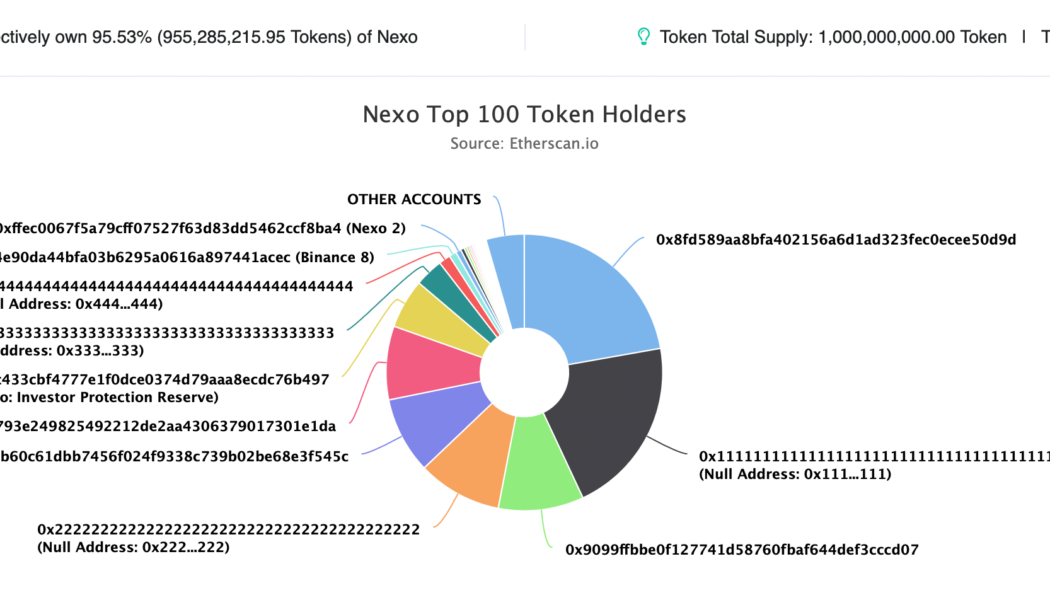

NEXO risks 50% drop due to regulatory pressure and investor concerns

Crypto lending firm Nexo is at risk of losing half of the valuation of its native token by the end of 2022 as doubts about its potential insolvency grow in the market. Is Nexo too centralized? For the unversed: Eight U.S. states filed a cease-and-desist order against Nexo on Sep. 26, alleging that the firm offers unregistered securities to investors without alerting them about the risks of the financial products. In particular, regulators in Kentucky accused Nexo of being insolvent, noting that without its namesake native token, NEXO, the firm’s “liabilities would exceed its assets.” As of July 31, Nexo had 959,089,286 NEXO in its reserves — 95.9% of all tokens in existence. “This is a big, big, big problem because a very basic market analysis demonstrates that Nexo would be...

WSJ: Terraform Labs claims case against Do Kwon is ‘highly politicized’

Terraform Labs, the company behind the development of the Terra (LUNA) blockchain said South Korea’s case against its co-founder Do Kwon has become political, alleging prosecutors expanded the definition of a security in response to public pressure. “We believe that this case has become highly politicized, and that the actions of the Korean prosecutors demonstrate unfairness and a failure to uphold basic rights guaranteed under Korean law,” a Terraform Labs spokesman said to The Wall Street Journal on Sept. 28. South Korean prosecutors issued an arrest warrant for Kwon on Sept. 14 for violations of the countries capital markets laws, but Terraform Labs laid out a defense arguing Terra (now known as Terra Luna Classic (LUNC)) isn’t legally a security, meaning it isn’t covered by capital mar...

Canadia’s new opposition leader is a Bitcoiner

Canadian politician and noted crypto advocate Pierre Poilievre has taken the helm of Canada’s Conservative Party, which looks set to give the current administration a run for its money in the next federal election. The pro-crypto politician reportedly won the leadership of the Conservative Party of Canada in a landslide victory on Sept. 10, securing 68.15% of the electoral points up for grabs, and far outpacing his nearest opponent Jean Charest who received just 16.07% of the vote. Poilievre has been a member of the Conservative Party since 2003, first winning office in the 2004 election. He has since served as a Member of Parliament for seven terms and held various roles including Shadow Minister for Finance and Minister of Employment and Social Development. Poilievre has been known...

Terra’s collapse prompts UK regulation of stablecoins

The collapse of UST and LUNC has made it a matter of urgency for the United Kingdom as well as other jurisdictions to have proper regulatory frameworks for digital assets The, the UK hope will ensure economic and financial stability as well as safeguard investors from losing out on their investments by oversighting stablecoin issuers. The United Kingdom has become the latest country to express concern on the stability of stablecoins and call for their regulation. This echoes the sentiments of the European Union as well as the United States Consumer Financial Protection Bureau – both having raised questions on the long-term stability of these digital assets. The authorities, in the consultation paper they released, hope that proper regulation will create a conducive environment for investor...

Seoul authorities launch an official investigation on the TerraUSD crash

Terraform Labs employees have been summoned by South Korean prosecutors in a bid to establish the exact cause of the collapse of Terra assets The investigators have also tightened up scrutiny on exchanges to make sure investors are protected from the same fate that befell Terra and its native tokens South Korean authorities have reportedly launched a full-scale investigation to find the exact reason for the collapse of algorithmic stable coin UST and its sister token LUNA. The investigation is being conducted by the joint financial and securities crime investigation team from the Seoul Southern District Prosecutors Office. Investigators probing to determine if there was price manipulation The investigation team seeks to find from the Terra lab employees if the project’s founder, Do Kwon, i...

Weekly Report: FTX’s Sam Bankman-Fried to spend billions on political and acquisition initiatives

FTX chief Sam Bankman-Fried early this week hinted that he would continue with his political donations, financially backing the ‘right’ presidential candidate in the 2024 US Elections. Details on this and other top headlines in the crypto space below: SBF to join the league of major political donors in the next US elections The crypto exchange billionaire known to be pro-Democratic party has set his sights on breaking the biggest political donation ever made in the US. In a podcast session, SBF revealed that he was willing to spend as much as $1 billion – a figure he described as a “sort of a soft ceiling”. He confirmed he would put “north of $100 million,” adding that the exact amount would depend on the candidate running and the political seats in question. This is not the fir...

India’s crypto exchange CoinSwitch calls for regulatory clarity

The country’s central bank has previously raised concerns over the assets’ threat to the country’s macro-economic and financial stability Last month, two major exchanges disabled deposits via the popular payment system in use within the country The uncertainty surrounding India’s crypto space has left traders and investors with doubts and strings of unanswered questions. This murky scenario has created mixed signals in the country with one of the highest potentials for crypto investors – India is the second-most populous country in the world – and threatened the freedom of exchanges to operate freely. New Delhi’s income tax imposition on crypto could be a sign of approval The central bank’s growing concern for investor welfare is warranted, cautioning that dealing in digital assets is at i...

ECB President declaring crypto as “worth nothing” is missing the point

It’s disappointing to see the President of the ECB, Christine Lagarde, declare that cryptocurrencies are “worth nothing” on Dutch television this past Sunday. I thought we were past that point. Sure, a big bulk of the market is likely worth nothing, but to have the head of the central bank publicly declare all cryptocurrencies as worthless in one swift sentence comes across as increasingly out-of-touch. “My very humble assessment is that (cryptocurrency) is worth nothing. It is based on nothing, there is no underlying assets to act as an anchor of safety”, she said. While she may be right that there are no underlying assets to a lot of these currencies, she’s missing the point. Network effects alone can render an asset worth something, even if there is nothing physical of value underneath....