Crypto news

BlockchainSpace Makes An Exceptional Move for Web3 Community Support with Metasports Acquisition

Manila, Philippines, 19th January, 2023, Chainwire BlockchainSpace CEO and Founder Peter Ing, Metasports CBO and Co-Founder Lars Hernandez, and Metasports CEO and Co-Founder Joe Josue are optimistic that the majority acquisition of Metasports will make waves in Web3 and bring great value to their stakeholders in the coming years. BlockchainSpace (BSPC), the leading data aggregator and infrastructure provider for guilds and Web3 projects, is confident that 2023 will be a banner year following the majority acquisition of Intellectual Property (IP) House, Metasports. Peter Ing, Chief Executive Officer and Founder of BSPC, believes the synergistic partnership with Metasports will bring more value to the partner guilds under BSPC’s flagship product, Guild Hub, and give Metasports an unbridled s...

Nifty News: Trump NFTs surge 800%, Yuga Labs blacklists NFT exchanges and more

Trump NFTs daily sales surge by 800% Former United States President Donald Trump’s nonfungible token (NFT) trading card collection has recently witnessed a massive resurgence in daily sales volume. Compared to Jan. 17 sales volumes, Jan. 18 and 19 saw spikes of 800% and 600% respectively, according to market metrics aggregator Cryptoslam. Some pundits believe the renewed interest could be due to his imminent return to social media networks, following reports that the former president was seeking to rejoin Facebook and Twitter ahead of the 2024 presidential election campaign. NFT Watch: Trump Digital Trading Cards see 88% increase in floor price in the past 24 hours following news of his plans to return to Twitter. : https://t.co/P6W2uHx0Sr pic.twitter.com/IJogZR6yR4 — CoinGecko (@coingecko...

FTX reboot could falter due to long-broken user trust, say observers

Several crypto industry commentators have expressed skepticism about FTX CEO John Ray’s vision to potentially reboot the crypto exchange, citing trust issues and “second-class” treatment of customers as reasons why users may not “feel safe to go back.” Former FTX CEO Sam Bankman-Fried tweeted on Jan. 20 praising John Ray for looking at a reboot of FTX, suggesting it is the best move for its customers. I’m glad Mr. Ray is finally paying lip service to turning the exchange back on after months of squashing such efforts! I’m still waiting for him to finally admit FTX US is solvent and give customers their money back…https://t.co/XjcyYFsoU0https://t.co/SdvMIMXQ5K — SBF (@SBF_FTX) January 19, 2023 This came after John Ray told The Wall Street Journal on Jan. 19 that he wa...

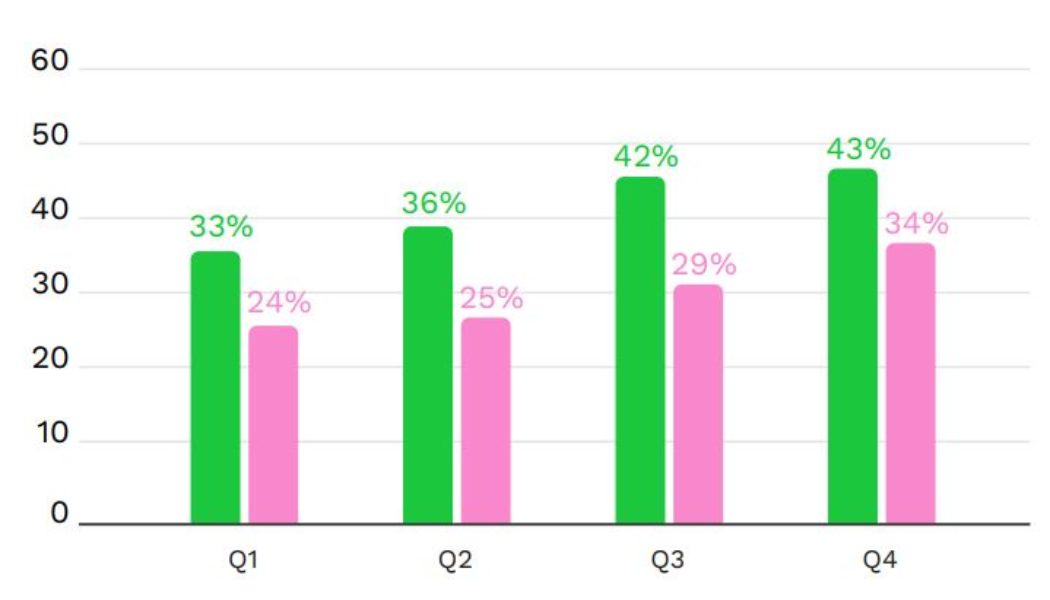

Crypto becomes second most widely-owned asset class for women: eToro survey

While traditional asset classes fail to foster broader adoption among women, crypto seems to have found success in bringing women on board, according to a recent survey. Data sent to Cointelegraph by the eToro team highlighted that crypto is now the second most widely-owned asset class for women, second only to cash. This comes from eToro’s latest Retail Investor Beat, which surveyed around 10,000 global retail investors in 13 countries. According to the survey results, there is a significant rise in crypto ownership among women. Data shows that ownership increased from 29% in the third quarter of 2022 to 34% in the last quarter. According to the eToro team, this suggests that crypto is “succeeding where traditional financial markets have sometimes failed, ” which is by br...

NFT sales topped 101 million in 2022: DappRadar report

Over the last year, nonfungible tokens (NFTs) continued to play an important role in the growing Web3 industry. NFTs initiated a shift away from hype-based drops, to utility-centric projects with long-term value. A new DappRadar report on blockchain and decentralized application (DApp) adoption in 2022 revealed that the NFT sale count last year reached 101 million — a 67.57% increase from the previous year. According to the report, the Ethereum ecosystem holds the top spot in the NFT ecosystem, holding 21% of the market share and over 21.2 million transactions processed. It is followed by Wax (14.5 million), Polygon (13.3 million) and Solana (12.9 million). Both the Solana and ImmutableX ecosystems saw massive growth from the previous year in terms of transaction activity, with a 440%...

FTX-linked Moonstone bank to exit the crypto space

Moonstone Bank, a rural Washington state bank that received an estimated $11.5 million investment from FTX’s sister company, Alameda Research, says that it will be exiting the crypto space and returning to its “original mission” as a community bank. In a Jan. 18 statement, the bank said that the change in strategy comes as a result of “recent events in the crypto assets industry and the changing regulatory environment surrounding crypto asset businesses.” As part of the bank’s initiative to “return to its roots,” it said that it will no longer use the name Moonstone Bank and will be rebranding and re-adopting the Farmington State Bank name, known in the local community for 135 years. According to the bank, the change is estimated to take effect in the coming weeks and loca...

Nexo agrees to $45M settlement with SEC and states over earn product

Crypto lender Nexo Capital has agreed to pay $45 million in penalties to the U.S. Securities and Exchange Commission (SEC) and the North American Securities Administrators Association (NASAA) for failing to register the offer and sale of its Earn Interest Product (EIP). The news was announced by the SEC and NASAA in two separate statements on Jan. 19. According to the statement from the SEC, Nexo agreed to pay a $22.5 million penalty and cease its unregistered offer and sale of the EIP to U.S. investors. The additional $22.5 million will be paid in fines to settle similar charges by state regulatory authorities, the report said. NASAA said in its statement that the settlement in principle comes after investigations into Nexo’s alleged offer and sale of securities after the past year of inv...

Samsung’s Bitcoin ETF, $700M bust, Coinbase exits Japan: Asia Express

Our weekly roundup of news from East Asia curates the industry’s most important developments. Samsung’s new Bitcoin ETF On Jan. 13, Samsung Asset Management, a wholly-owned subsidiary of the namesake South Korean conglomerate, successfully listed the Samsung Bitcoin Futures Active ETF on the Hong Kong Stock Exchange. According to local news outlet Edaily, the ETF debuted under the ticker 3135:HK and seeks to replicate the performance of spot Bitcoin by investing in Bitcoin futures listed on the Chicago Mercantile Exchange (CME). The ETF will also simplify the procedures for investors seeking exposure to regulated Bitcoin products in the Asia-Pacific time zone. Park Seong-jin, head of Samsung Asset Management’s Hong Kong office, commented: “Hong Kong is the only market in Asia where B...

Opinion: Bots are a critical tool for retail investors

The thing about the future, where robotic super traders battle over micromovements in stock price, is that it’s already here. With access to algorithmic trading bots a click away, we could be seeing the fall of human investors and the triumph of artificial intelligence. Algorithmic trading bots are programmed to buy and sell when they detect preprogrammed conditions and can execute pretty much any trading strategy. They have been used by professional traders for two decades, and these firms have taken them into the crypto markets too. Now, a new crop of accessible crypto trading tools has hit the market, made with retail clients in mind. I know — I have built several of them. Currently, I’m working on a system that helps neophyte investors find their own risk preferences based on the...

Binance tightens rules on NFT listings

According to a Jan. 19 announcement by Binance, the cryptocurrency exchange has tightened its rules for nonfungible tokens, or NFT, listings. Starting Feb. 02, 2023, all NFTs listed on Binance before Oct. 2, 2022, and have an average daily trading volume lower than $1,000 between Nov. 1, 2022, and Jan. 31, 2023, will be delisted. In addition, after Jan. 21, 2023, NFT artists can only mint up to five digital collectibles per day. Binance NFT requires sellers to complete know-your-customer (KYC) verification and have at least two followers before listing on its platform. In addition to the revised rules, Binance said it would forthwith “periodically review” NFT listings that do not “meet its standards” and recommend them for delisting. “Users can repo...

DeFi problems and opportunities in 2023: Market Talks

On this week’s episode of Market Talks, Cointelegraph welcomes Grant Shears, founder of Blocmates — an educational and consultancy company that aims to create crypto, decentralized finance (DeFi) and Web3 content that anyone can understand. This week, to kick things off, the show takes a look at the emerging trends of 2023 and what people should look forward to. What industries could really take off this year, and which sector could have the most potential to grow? It’s no secret that 2022 was not a great year for DeFi, an industry that arguably imploded on itself by offering unsustainable high yields that eventually caused the model to collapse. Host Ray Salmond, Cointelegraph’s head of markets, asks Shears if there are any projects this year that plan to fix this problem, and what that f...