Crypto news

Crypto to play ‘major role’ in UAE trade: foreign trade Minister

Crypto will play a “major role” in the United Arab Emirates’ global trade moving forward, says the UAE’s minister of state for foreign trade Thani Al-Zeyoudi. Speaking with Bloomberg on Jan. 20 in Davos Switzerland — where world leaders are currently gathered for the 2023 World Economic Forum — Al-Zeyoudi provided a host of updates regarding the UAE’s trade partnerships and policies heading into 2023. Minister Thani Al-Zeyoudi: Bloomberg Commenting on the crypto sector, the minister stated that “crypto will play a major role for UAE trade going forward,” as he outlined that “the most important thing is that we ensure global governance when it comes to cryptocurrencies and crypto companies.” Al-Zeyoudi went on to suggest that as the UAE works on its crypto regulatory regime, the...

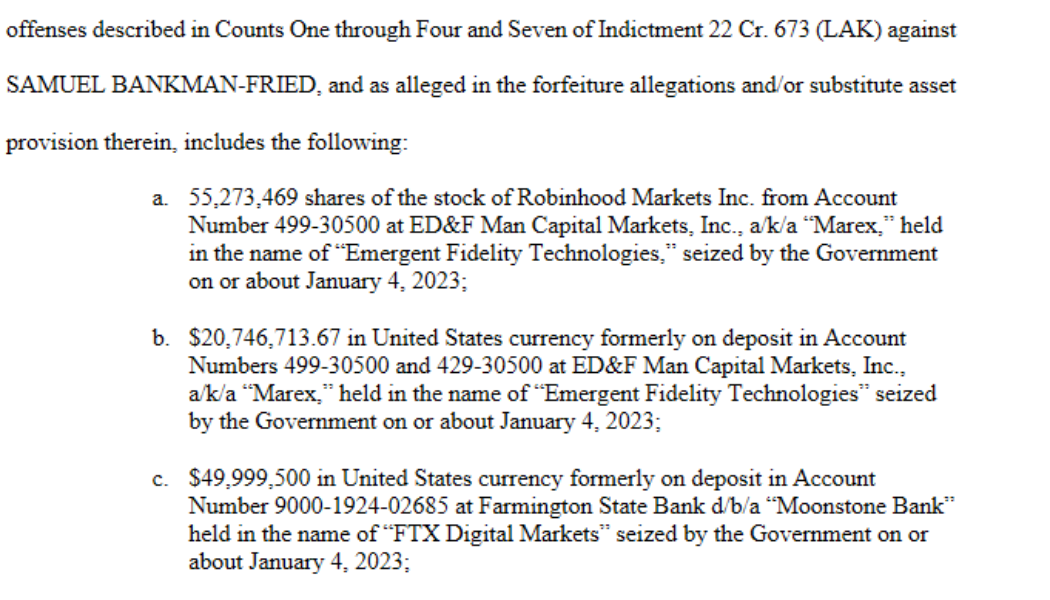

SBF to forfeit $700M worth of assets if found guilty of fraud

According to new court filings, disgraced FTX founder Sam Bankman-Fried (SBF) will be subject to the forfeiture of roughly $700 million worth of assets if he were to be found guilty of fraud. In a court document filed on Jan 20, U.S. federal prosecutor Damian Williams outlined that the “government respectfully gives notice that the property subject to forfeiture” covers a long list of assets across fiat, shares and crypto. The filings state that most of the assets were seized by the government between Jan.4 and Jan. 19, while it is also looking to lay claim to “all monies and assets” belonging to three separate Binance accounts. Looking at the list of seized assets, the biggest allocations include 55,273,469 Robinhood (HOOD) shares worth roughly $525.5 million at the time of writing, $94.5...

FTX VCs liable to ‘serious questions’ around due diligence — CFTC Commissioner

Amid ongoing investigations around the defunct crypto exchange FTX, the Commodity Futures Trading Commission (CFTC) questions the due diligence conducted by institutional investors and their accountability regarding the loss of users’ funds. CFTC Commissioner Christy Goldsmith Romero stated that VCs that had to write down their investments in millions of dollars to nearly zero raises “serious questions” about the due diligence conducted over the last year, speaking to Bloomberg. CFTC Commissioner Christy Goldsmith Romero questioning the VCs that once backed FTX. Source: Bloomberg She raised concerns about FTX CEO John Ray’s revelations in court about not having any records and controls over the exchange’s financials. I’m glad Mr. Ray is finally paying lip service to turning the excha...

Dead cat bounce? Bitcoin price nears $23,000 in fresh 5-month high

Bitcoin (BTC) took a swing at $23,000 into Jan. 21 as Asia buyers drove fresh market strength. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bid liquidity causes suspicion Data from Cointelegraph Markets Pro and TradingView showed BTC/USD battling bears to reach $22,790 on Bitstamp overnight — its highest since August. With new multi-month peaks coming in quick succession despite fears of a major correction, Bitcoin continued to surprise as traders cleared the way for more upside. As noted by intraday trader Skew, Asia was leading the way into the weekend, with sellside pressure from market makers being absorbed on exchanges. “Another rally driven by asia bid. TWAP buyers absorbing the sell pressure from MMs. Large spot bid lifting offers & ask wall pulled prior to anothe...

DeFi should complement TradFi, not attack it: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. Following FTX’s demise, the DeFi space is up for a complete remodel as crypto users demand better security and compliance practices. SushiSwap’s roadmap for the coming year includes the development of a decentralized exchange (DEX) aggregator, a decentralized incubator and “several stealth projects.” All these projects combined can grow its market share 10x, said the CEO. The co-founder and CEO of Ava Labs spoke with Cointelegraph at the World Economic Forum in Davos, Switzerland, on the future of DeFi and traditional finance (TradFi) and said DeFi should complement TradFi, not attack it. Another DeFi report sugge...

Stellar joins CFTC’s Global Markets Advisory Committee as one of four crypto orgs

The Stellar Development Foundation (SDF) has become the newest member of the United States Commodity Futures Trading Commission (CFTC) Global Markets Advisory Committee (GMAC), the blockchain announced on its blog. The committee is preparing to meet on Feb. 13 for the first time in over a year. SDF supports the Stellar blockchain, which is used for crypto-fiat transfers. The foundation will be represented on the committee by chief operating officer Jason Chlipala. He wrote in the company blog that “we hope to bring the unique perspective of Layer 1 protocols” to the GMAC and: “As part of the Committee, SDF will highlight the role of stablecoins in the digital asset markets and real-world use cases, including leveraging stablecoins in the delivery of humanitarian aid.” Stellar is the issuer...

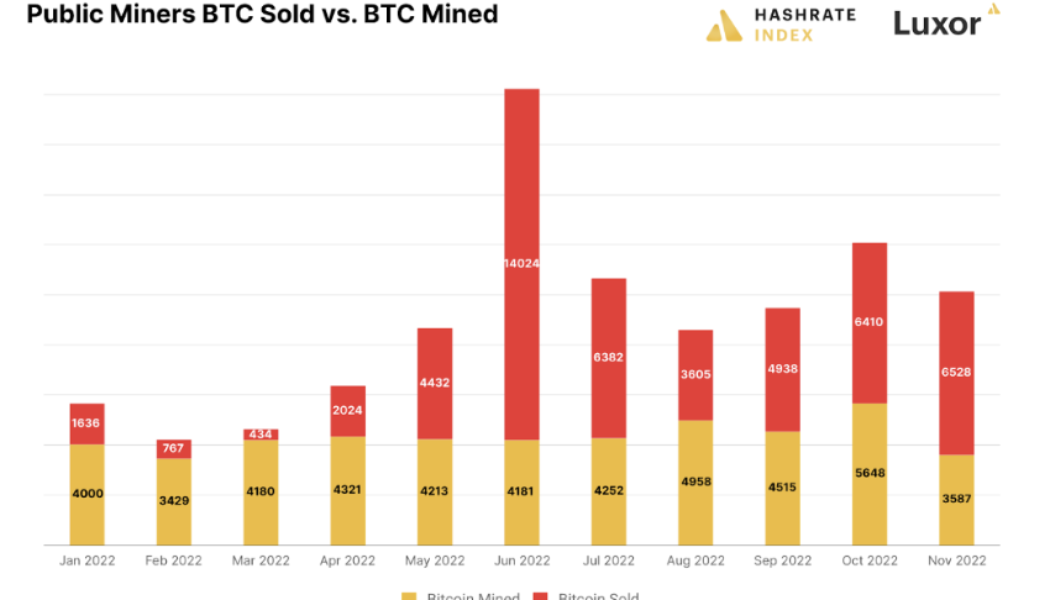

Bitcoin price rally provides much needed relief for BTC miners

Bitcoin mining powers network transactions and BTC price. During the 2021 bull run, some mining operations raised funds against their Bitcoin ASICs and BTC reserves. Miners also preordered ASICs at a hefty premium and some raised funds by conducting IPOs. As the crypto market turned bearish and liquidity seized within the sector, miners found themselves in a bad situation and those who were unable to meet their debt obligations were forced to sell the BTC reserves near the market bottom or declare bankruptcy Notable Bitcoin mining bankruptcies in 2022 came from Core Scientific, filing for bankruptcy, but BTC’s early 2023 performance is beginning to suggest that the largest portion of capitulation has passed. Despite the strength of the current bear market, a few miners were able to i...

Bitcoin mining in a university dorm: A cooler BTC story

The humble university dorm is a place for students taking their undergraduate degrees to study, rest, make new friends, host wild dorm parties and, of course, mine Bitcoin (BTC). A master’s student in market research and self-described “data guy,” Blake Kaufman, has hooked up an S9 Bitcoin miner to the Bitcoin network. He won the S9 miner in a raffle at a mid-Michigan Bitcoin meetup and immediately set about learning how to use it. Blake has consistently shown up to every https://t.co/2Q6OuIwW4O event with at least one friend, a tremendous attitude, and unmatched enthusiasm. Glad you won the S9 raffle! Hash away at those KYC free sats, and enjoy the heat this winter! https://t.co/AQNzDjnDGC — Mid-Michigan Bitcoin (@517Bitcoin) November 17, 2022 During a video call with Cointelegraph,...

NFT Steez and Cryptoys CEO discuss the future of toys and entertainment within Web3

This week, NFT Steez met with Cryptoys founder Will Weinraub to discuss the current role of play and toys in regard to their integration with nonfungible tokens and Web3 as a whole. Weinraub believes that the act of play is “not restricted to children” and that as adults, “we still crave the element of play throughout life.” According to him, “play has evolved” through the development of technology. NFTs, especially in gaming, have highlighted this layer of ownership through play. Weinraub and Cryptoys theorize that “adults are just looking for ways to feel like kids again.” Keeping the question of “how play evolves” at the forefront, Weinraub said this is a core tenet of his experience with the evolution of play. Weinraub emphasized how profoundly the internet ...

Bitcoin eyes $21.4K zone as analyst predicts BTC price will chase gold

Bitcoin (BTC) rose toward new multi-month highs on Jan. 20 as analysis predicted a new trading range above $18,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin price range “well defined” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD testing but preserving support at $21,000. The pair edged higher at the Wall Street open, in line with United States equities as the third trading week of an explosive January drew to an end. Despite misgivings over the rally’s fundamental strength, Bitcoin continued to avoid significant corrections, with exchange order book analysis revealing $23,000 as the next big resistance zone to crack. “I view the lack of BTC liquidity below $18k and above $23k as a lack of sentiment for those levels at this time,”...

FTX bankruptcy lawyer: debtors face ‘assault by Twitter’ stemming from Sam Bankman-Fried

James Bromley, one of the lawyers representing debtors in FTX’s bankruptcy case, has criticized social media activity against his law firm promulgated by posts from former CEO Sam Bankman-Fried. In a Jan. 20 hearing in the District of Delaware, lawyers spoke on motions dealing with potential conflicts of interest between Sullivan & Cromwell, the law firm tasked with the investigation of FTX’s bankruptcy, and the crypto exchange. Bromley, a partner at Sullivan & Cromwell, pushed back against the narrative that the law firm would be unable to act as a disinterested examiner given it had previously provided legal services to FTX and one of its former partners, Ryne Miller, went on to become the FTX US lead counsel. On Jan. 19, former FTX chief regulatory officer Daniel Friedberg filed...