Crypto news

Altcoin Roundup: 3 metrics that traders can use to effectively analyze DeFi tokens

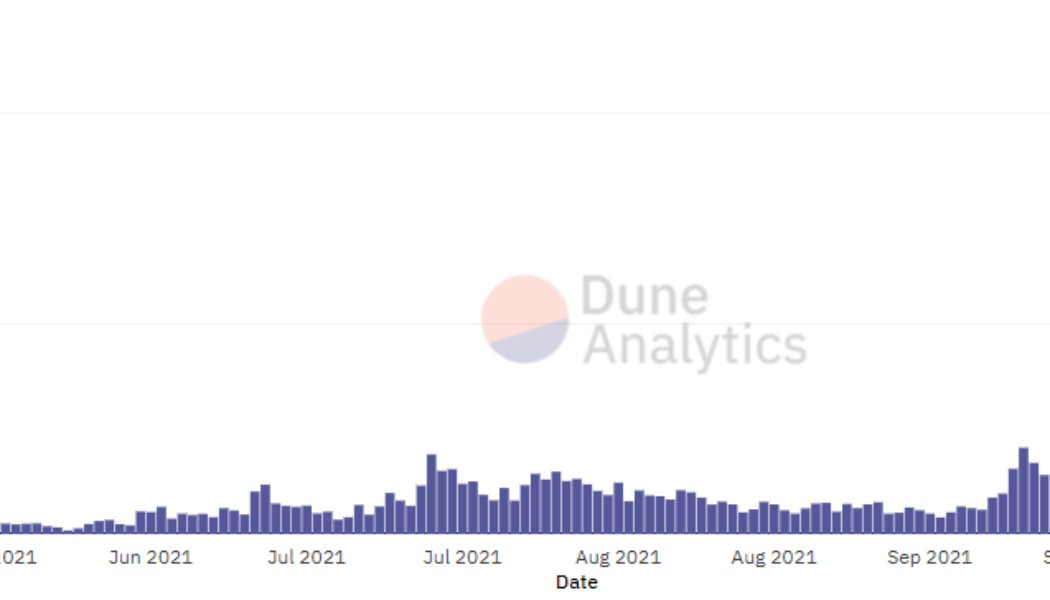

Much to the chagrin of cryptocurrency proponents who call for the immediate mass adoption of blockchain technology, there are many “digital landmines” that exist in the crypto ecosystem such as rug pulls and protocol hacks that can give new users the experience of being lost at sea. There’s more to investing than just technical analysis and gut feelings. Over the past year, a handful of blockchain analysis platforms launched dashboards with metrics that help provide greater insight into the fundamentals supporting — or the lack thereof — a cryptocurrency project. Here are three key factors to take into consideration when evaluating whether an altcoin or decentralized finance (DeFi) project is a sound investment. Check the project’s community and developer activity One of the basic wa...

Assembly announces $100M capital raise, receives praise from Iota co-founder Dominik Schiener

On Friday, Assembly, a decentralized layer one smart contract network built within the Iota ecosystem, announced it had raised $100 million from private investors, including LD Capital, HyperChain Capital and Huobi Ventures. The project stated that the funds will be used to accelerate the development of decentralized finance protocols, nonfungible tokens (NFTs) and play-to-earn crypto games. Iota is a blockchain designed for facilitating Internet-of-Things transactions. Its proprietary technology consists of a system of decentralized acyclic graphs that can connect to one another in multiple vectors as opposed to in-series as with a regular blockchain. As a result, one new block can validate two other blocks, leading to self-sustainable transaction verification. This allegedly leads to the...

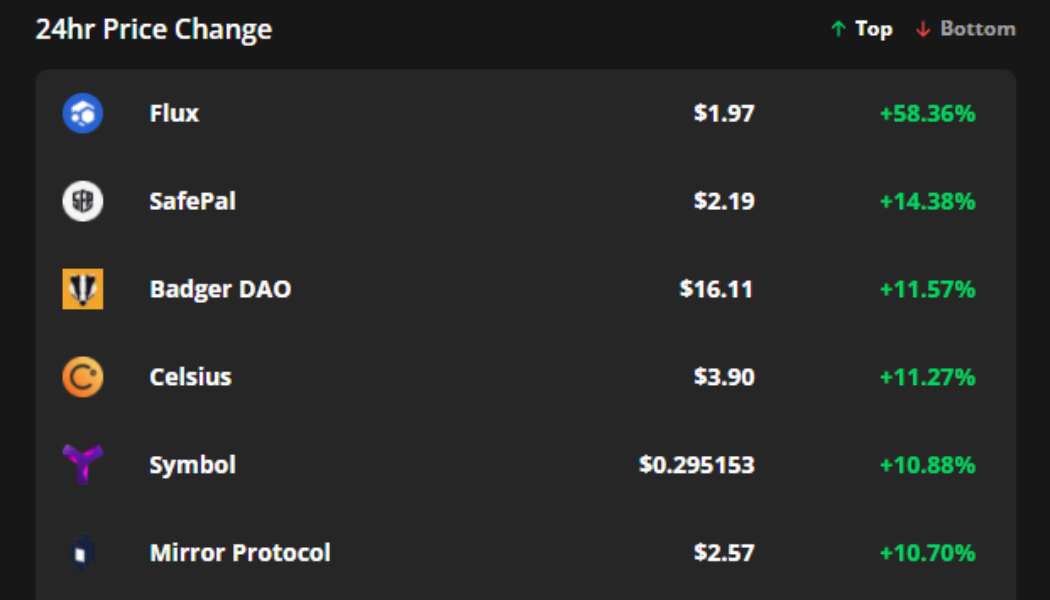

FLUX, SFP and Badger DAO surge even as Bitcoin price falls to $47K

The year-long mantra that the crypto market would see a blow-off top in December has proven to be a dud thus far and for the last week, most cryptocurrencies have been under sell pressure and Bitcoin (BTC) is encountering difficulty in trading above $47,000. That said, it’s not all bad news for cryptocurrency holders on Dec. 10 because several altcoins have managed to post double-digit gains due to new exchange listings and protocol upgrades. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were Flux (FLUX), SafePal (SFP) and Badger DAO (BADGER). FLUX benefits from the “Binance bump” Flux is a GPU mineable proof-of-work p...

Finance Redefined: AWS turns crypto exchanges offline, and Sushi CTO resigns, Dec. 3–10

Welcome to the latest edition of Cointelegraph’s decentralized finance newsletter. Although the markets may be down and technical indicators built upon AWS malfunctioning, fear not young degens, fundamental news and the spirit of Wagmi is abundant as ever. So, read on and discover all you need to know about the most important events of this week. What you’re about to read is a shorter, more succinct version of the newsletter. For a comprehensive summary of DeFi’s developments over the last week, subscribe below. AWS outage highlights the need for truly decentralized exchanges. An Amazon Web Service outage this week produced significant cascading effects on the global supply chain and delivery industry, as well as hours-long operational disruptions to decentralized exchange dYdX and le...

Former SushiSwap CTO writes short reflection about leadership failures at blockchain DEX

On Friday, Joseph Delong, former chief technology officer of decentralized exchange, or DEX, SushiSwap, published a brief reflection of experiences during his tenure. Delong unilaterally resigned two days prior, citing internal structural chaos among developers behind the popular DEX. In explaining his decision, Delong outlined failures to scale operations, lack of organization skills, problematic contributors, and poor communication as the primary reasons. On Twitter and among blockchain personalities alike, Delong received mostly praises for coming public with his experience and learning from his mistakes. According to Delong, he did not inform the Sushi community when problems began to surface amongst developers he managed, nor did he engage with users enough to build rapport for the pr...

South Africa Set For a Boost in NFT Adoption in the Near Future

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent. You Deserve to Make Money Even When you are looking for Dates Online. So we reimagined what a dating should be. It begins with giving you back power. Get to meet Beautiful people, chat and make money in the process. Earn rewards by chatting, sharing photos, blogging and help give users back their fair share of Internet revenue.

Cryptocurrency and Cybercrime: 3 Insights You Need to Know

Image sourced from Shutterstock. Criminals have kept pace with changing technologies by no longer wanting their crimes to generate hard cash – bitcoin has become the currency of choice. That’s particularly true for cybercrime, where ransomware is booming as criminals infiltrate organisations’ IT systems and threaten to publish or destroy crucial data unless a ransom is paid in Bitcoin. Here are 3 insights you need to know about the links between cybercrime and cryptocurrency: 1. Cryptocurrency is Fuelling Cybercrime Ransomware payments have become so huge that attacks are mounting daily. A recent high-profile case was an attack on the US Colonial Pipeline, causing the system that carries 2.5 million barrels of oil a day to be shut off. It’s become such a lucrative business that some syndic...

South African Crypto Traders should Gear Up for Stricter Taxes

Over the last five years, South Africa has emerged as one of the world’s most notable cryptocurrency adopters, and an estimated 13% of its internet users owning or using cryptocurrencies. With the South African Bitcoin/ZAR weekly trading volume – to name just one – currently standing close to R30million, there are various manners in which the South African Revenue Service (SARS) can track the gains made by South African taxpayers who trade cryptocurrencies. This is according to Wiehann Olivier, Partner at the Audit Division of Mazars in South Africa, who says that there are various techniques SARS could apply for the direct taxing of cryptocurrencies. “To start, the fact that cryptocurrencies were created to allow for anonymous, frictionless and trusted peer-to-peer transaction to be condu...

More Women In Africa are Turning To Cryptos, Research Shows

Sourced from Hacker Noon. The COVID-19 pandemic has brought the global economy to a standstill and put millions of people under financial stress. Understandably, people from all walks of life started looking for alternative income streams. Not only are these side jobs providing women with additional income, but they are also giving individuals an opportunity to develop new skills in the bitcoin and blockchain space. Blockchain skills are in high demand internationally and may unlock new career opportunities or set the ground for running a successful business in the future. Beyond speculative activities, bitcoin already drives a whole range of entrepreneurial ventures including arbitrage, remittance, e-commerce and educational projects, to name a few. /* custom css */ .tdi_3_b38.td-a-...

Who let the Doge out

Who let the Doge out