Crypto news

Myanmar shadow government declares stablecoin USDT an official currency

Myanmar’s shadow government, the National Unity Government (NUG), led by the supporters of jailed leader Aung San Suu Kyi, has declared United States dollar-based stablecoin Tether (USDT) as an official currency for local use. Per a report published in Bloomberg, the NUG will accept Tether for its ongoing fundraising campaign seeking to topple the current military regime in Myanmar. The shadow government also raised $9.5 million through the sale of “Spring Revolution Special Treasury Bonds” offered to the Myanmar diaspora across the world. The group aims to raise $1 billion through the sale of NUG-issued bonds. The NUG Ministry of Planning, Finance, and Investment posted an announcement regarding the move on Facebook on Monday. Announcement regarding NUG acceptance of Tether. Source:...

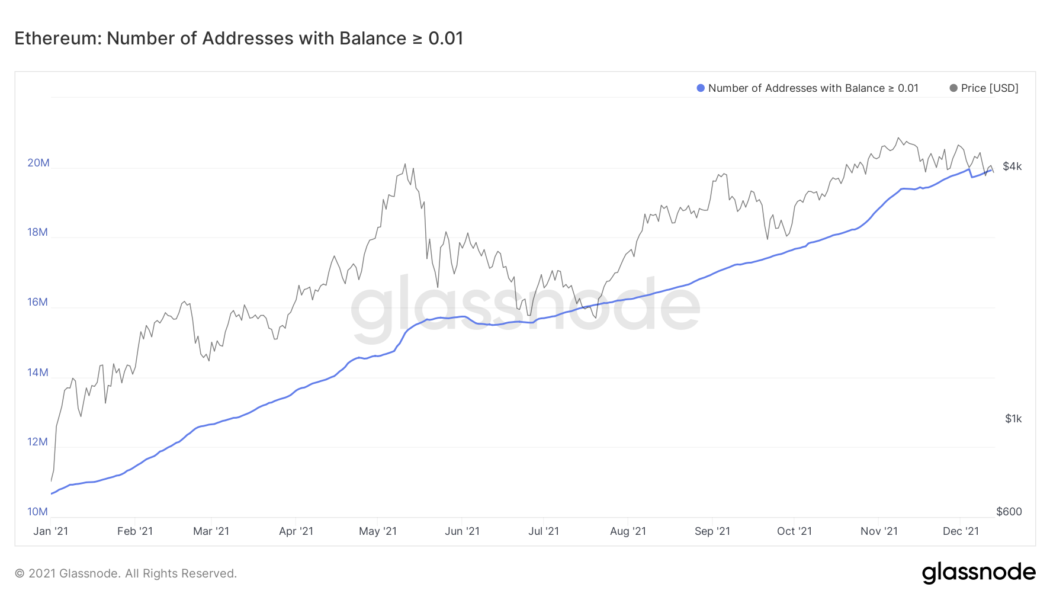

Small Ethereum investors increase exposure as ETH loses $4K level

Ethereum’s native token Ether (ETH) has dropped by over 18% after establishing an all-time high around $4,867 on Nov. 10, now trading near $3,900. Nonetheless, the plunge has not deterred retail investors from buying the token in small quantities. According to data gathered by Glassnode — a blockchain analytics platform, the number of Ether addresses holding less than or equal to 0.01 ETH reached a record high level of 19.95 million on Dec. 4, the day ETH dropped to as low as $3,575 (data from Coinbase). Ethereum addresses with balances less than or equal to 0.01. Source: Glassnode Meanwhile, the number of Ethereum wallets with balances of at least 0.1 ETH also kept climbing despite Ether’s correction from $4,867 to $3,575, eventually hitting a new all-time high of 6.37 million...

Bitcoin price slips below $47K as stocks, crypto prepare for this week’s FOMC meeting

Bitcoin (BTC) bulls are once again on the defensive foot after the breakout momentum that put the price above $50,000 on the weekend evaporated and pulled the price under $47,000. Analysts say the slight pullback in equities markets and the upcoming Federal Open Market Committee (FOMC) meeting are the primary reasons for Dec. 13’s pullback and a few suggest that a revisit to the swing low at $42,000 could be on the cards. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what analysts are saying about the current Bitcoin price action and what they expect in the short term. Fed tapering talks put pressure on the market The current headwinds facing BTC are in large part being influenced by regulatory matters in the United States, as highlighted in a recent report from D...

SEC chair’s regulatory agenda fails to include clarity on crypto, says Hester Peirce

Hester Peirce, a commissioner for the United States Securities and Exchange Commission known by many in the space as Crypto Mom, is pushing back against the regulatory body’s agenda for not including clarification on digital assets. In a Monday joint statement, Peirce and SEC Commissioner Elad Roisman said they were “disappointed” in the failure of chairperson Gary Gensler’s regulatory agenda to include items aimed at helping companies raise capital, furthering investor protection, undoing recent rules passed by the commission and providing clarification on crypto. According to the two regulators, Gensler’s uncertain stance on digital assets may create problems for firms looking to operate in the space. “Rather than taking on the difficult task of formulating rules to allow investors and r...

Top 3 Avalanche ecosystem tokens to buy on December 13: AVAX, LINK, and TIME

AVAX saw an increase in trading volume by 32% in the last 24 hours. LINK saw an increase in trading volume by 8% in the last 24 hours. TIME has the potential for solid growth. Avalanche is a layer-one blockchain designed to be a platform for decentralized applications and custom blockchain networks, where AVAX is its native token. Chainlink integrated with Avalanche to supercharge decentralized finance (DeFi) development, where LINK is its native token. Wonderland is the first decentralized reserve currency protocol available on the Avalanche Network, where TIME is its native token. Should you buy Avalanche (AVAX)? On December 13, Avalanche (AVAX) had a value of $83.6. To get a better perspective as to what kind of value point this is for the token, we will go over its all-time high value ...

Recruiters say crypto firms seeking leadership in engineering, legal and finance

The crypto industry has enjoyed astronomical growth over the last couple of years. Now, talent recruitment experts say that crypto firms are in dire need of good leadership to scale their businesses. Previously seen as a nascent market, crypto is now a fast-maturing industry that attracts a lot of talent, David Richardson, partner at executive search firm Heidrick & Struggles, told Cointelegraph. “It’s all driven by the growth rate of these firms and hiring leaders that can help them continue to scale and continue to keep pace with the growth rate in the business,” he said. Crypto companies are looking for executives who have scaled businesses successfully. They are ready to onboard such talent without prior knowledge of crypto or digital currency, added Heidrick & Struggles ...

Bank of Russia to ban mutual funds from investing in Bitcoin

The Russian central bank continues its strict policies regarding the cryptocurrency industry, now officially banning mutual funds from investing in cryptocurrencies like Bitcoin (BTC). On Dec. 13, the Bank of Russia published an official statement on regulating investment opportunities by mutual investment funds. Despite expanding the number of assets available for investment by mutual funds, the document prohibits fund managers from buying cryptocurrencies as well as “financial instruments whose value depends on prices of digital assets.” The statement emphasizes that mutual funds are not allowed to provide crypto exposure both to either qualified or unqualified investors. The Bank of Russia previously recommended asset managers to exclude cryptocurrencies from exposure in mutual funds in...

Bitcoin loses $48K on Wall Street open as trader warns altcoins look ‘REKT’ against BTC

Bitcoin (BTC) declined into the Wall Street open on Dec. 13 as stocks came off Friday’s record close. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Data from Cointelegraph Markets Pro and TradingView showed BTC/USD diving below $48,000 to reach multi-day lows at the time of writing. Equities had been tipped to add to all-time highs prior to the start of trading, this getting off to a cold start on the day with gains slipping. Correspondingly, Bitcoin added to losses which totaled over $3,000 in 24 hours. Traders thus continued to eye sideways or consolidatory movements for the near term, steering clear of any outright bullish calls. “Something like this would drive people nuts,” Scott Melker, known as the Wolf of all Streets, commented on a fresh chart ...

Daft Punk meets CryptoPunks as Novo faces up to NFTs

Just recently, NFT collector CryptoNovo was posing for hundreds of photos, taking meetings with top tech companies and attending scores of invitation-only parties across New York City. Today, the former-schoolteacher-turned-Metaverse-mascot is raking leaves in his suburban Illinois front yard. “Dude,” Novo remarks excitedly as he works, “That just happened.” That would be NFT.NYC, the early November conference/gathering/bacchanal that represented a coming-out party of sorts for the nonfungible token community. While NFT.NYC 2021 was the third event in what will almost certainly become a series of (at least) annual affairs, it represented an explosion in popularity over the 2020 offering. Ticket sales jumped. Additional days were added. NFT.NYC ballooned to a four-day extravaganza at which ...

3 reasons why Ethereum price can drop below $3K by the end of 2021

Ethereum’s native token Ether (ETH) reached an all-time high around $4,867 earlier in November, only to plunge by nearly 20% a month later on rising profit-taking sentiment. And now, as the ETH price holds $4,000 as a key support level, risks of further selloffs are emerging in the form of multiple technical and fundamental indicators. ETH price rising wedge First, Ether appears to have been breaking out of “rising wedge,” a bearish reversal pattern that emerges when the price trends upward inside a range defined by two ascending — but converging — trendlines. Simply put, as the Ether price nears the Wedge’s apex point, it risks breaking below the pattern’s lower trendline, a move that many technical chartists see as a cue for more losses ahead. In doing so, t...

Matt Zhang on a mission to reinvent crypto for institutional investors

Institutional interest in cryptocurrencies is increasing as the space continues to mature. A survey released on Dec. 8 by European investment manager Nickel Digital Asset Management found that 85% of institutional investors and wealth managers have dedicated teams to review cryptocurrencies and digital assets. The study noted that the investors surveyed manage around $108.4 billion in assets. The London-based firm also released a report in September of this year showing that 62% of global institutional investors with zero exposure to cryptocurrencies expect to make their first crypto investments within the next year. It’s also notable that Wall Street veterans are beginning to enter the crypto industry. Most recently, Matt Zhang, a former trading executive at the global bank Citi, la...

A letter to Zuckerberg: The Metaverse is not what you think it is

Dear Lord Sugar Mountain, Attention: to my Facebook friend who is building a version of the metaverse that nobody wants as a starter. The last few years must certainly not have been easy. Your business model centered around polarization and, subsequently, outrage has ironically unified many of us against relying too much on your social media platform. Your government — whose sniper rifle accuracy you know all too well as they took out your ill-conceived stablecoin project shortly after your expensive global advertising campaign went live — has tuned in to the many whistleblowers exposing how your company captures and sells attention. It has called you in for questioning. Although to be fair, they also needed to speak with you to better understand the basics of digital ad revenue. What do p...