Crypto news

‘DeFi is the most dangerous part of the crypto world,’ says Senator Elizabeth Warren

Massachusetts Senator Elizabeth Warren did not hold back in her criticism of decentralized finance (DeFi), expressing concern about how a run on stablecoins would affect the average investor. In a Tuesday hearing with the Senate Banking Committee discussing stablecoins, Warren questioned Hilary Allen, a professor at the American University Washington College of Law, as to whether a run on stablecoins could potentially endanger the United States financial system. Though Allen said an “en masse” redemption of stablecoins from people who had lost faith in the tokens would be unlikely to have “systemic consequences” for traditional markets at present, the DeFi system would be more likely to feel the effects. Warren countered that because stablecoins provided “the lifeblood of the DeFi eco...

Mintable app to support minting NFTs on the layer two Immutable X protocol

Mintable marketplace announced its partnership with Immutable X, a StarkWare-based layer-two solution for nonfungible tokens (NFTs) on Ethereum, to make over 24 million NFTs on Immutable X available for sale on Mintable. This integration will enable users to deposit ETH and ERC-20 tokens with instant confirmation and no gas fees. According to Mintable’s Twitter thread, Mintable and Immutable X share a vision to scale NFT marketplaces by offering access to NFTs to the masses. 1/We’re thrilled to partner up with @Immutable X – the 1st & leading Layer 2 for #NFTs on Ethereum! All NFTs on Immutable X are now available for trade on https://t.co/NJ1lSPqL1Q! ✅ Zero gas fees✅Instant secure trades✅100% carbon neutral. Details: https://t.co/TQh7Cggq2z — Mintable ...

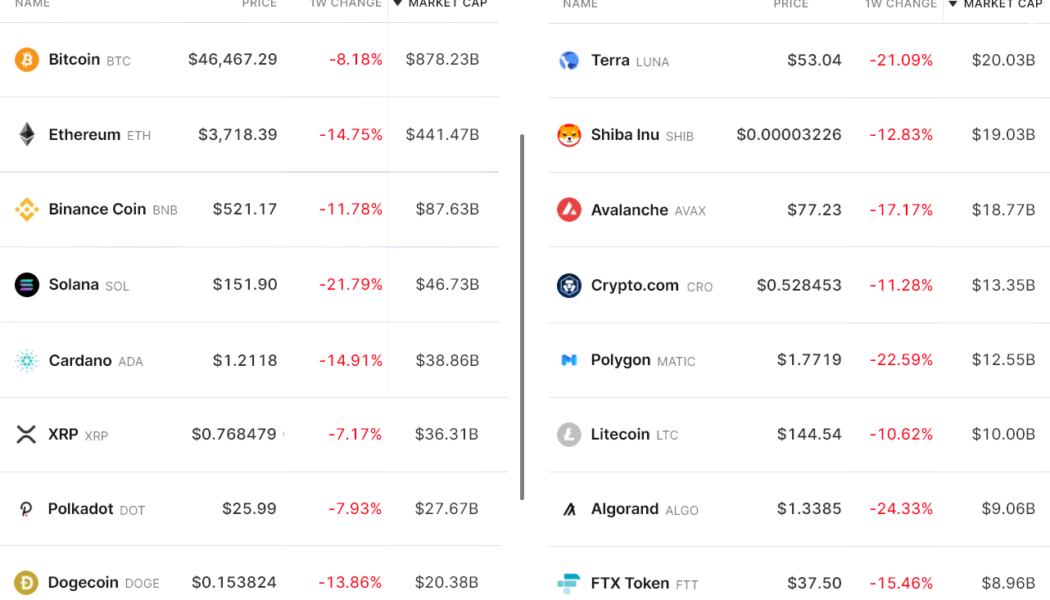

Data suggests traders view $46,000 as Bitcoin’s final line in the sand

Dec. 13 will likely be remembered as a “bloody Monday” after Bitcoin (BTC) price lost the $47,000 support, and altcoin prices dropped by as much as 25% within a matter of moments. When the move occurred, analysts quickly reasoned that Bitcoin’s 8.5% correction was directly connected to the Federal Open Market Committee (FOMC) meeting, which starts on Dec. 15. Investors are afraid that the Federal Reserve will eventually start tapering, which simply put, is a reduction of the Federal Reserve’s bond repurchasing program. The logic is that a revision of the current monetary policy would negatively impact riskier assets. While there’s no way to ascertain such a hypothesis, Bitcoin had a 67% year-to-date gain until Dec. 12. Therefore, it makes sense for investors to pocket those profits a...

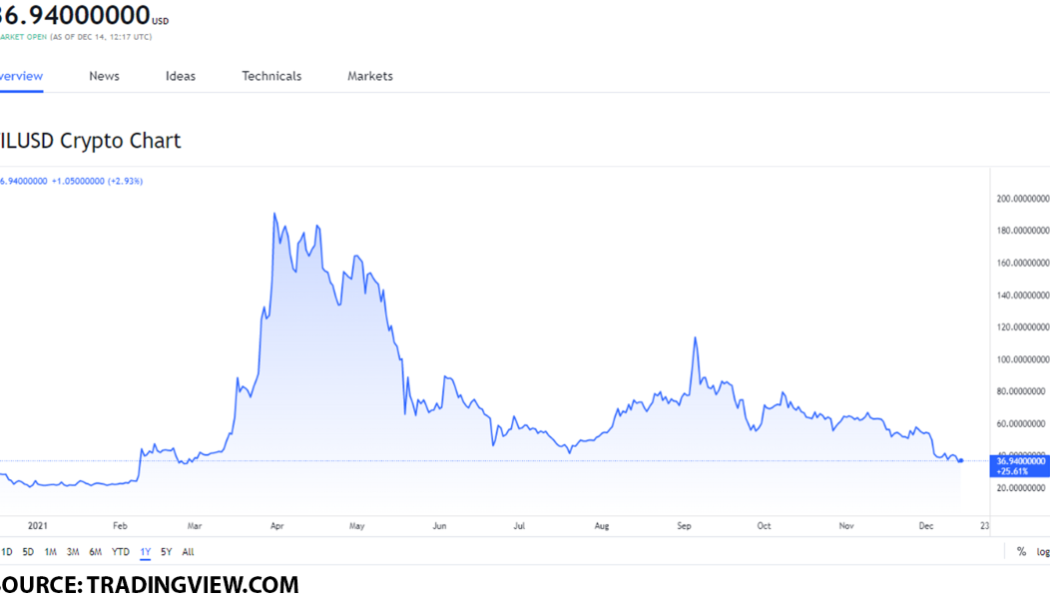

Top 3 storage tokens to buy on December 14: FIL, BTT, and AR

In the last 24 hours, FIL’s trading volume increased by 45%. BitTorrent has huge potential for growth at its current value point. Arweave’s trading volume increased by 91% in the last 24 hours. Filecoin (FIL) is a token used to pay for data storage, data retrieval as well as any other transactions that occur on the Filecoin network. BitTorrent (BTT) is used as the native cryptocurrency within the network, which allows users to access specific features. BTT is a TRC-10 utility token that powers the most popular decentralized protocols and applications. Arweave (AR) is a decentralized data storage protocol that allows users to store documents and applications. AR is the native token that is used to incentivize miners to keep copies of data and pay for the transaction fees. Should you b...

Cardano’s ADA price eyes 30% rally with a potential ‘triple bottom’ setup

Cardano (ADA) may rally by nearly 30% in the coming days as it forms a classic bullish reversal pattern. Sharp ADA rebound underway Dubbed “triple bottom,” the pattern typically occurs at the end of a downtrend and consists of three consecutive lows printed roughly atop the same level. This means triple bottoms indicate sellers’ inability to break below a specific support level on three back-to-back attempts, which ultimately paves the way for buyers to take over. In a perfect scenario, the return of buyers to the market allows the instrument to retrace sharply toward a higher level, called the “neckline,” that connects the highs of the previous two rebounds. The move follows up with another breakout, this time taking the price higher by as much as the distance between the pattern’s bottom...

IEEE Blockchain Identity of Things standardization working group kicks off

Six worldwide corporations have banded together to start the IEEE blockchain Identity of Things standardization. According to IEEE Chair of the Identity of Things Working Group Dr. Xinxin Fan, researchers from Lockheed Martin, Ericsson, Lenovo, Huawei, Bosch, IoTeX and China Academy of Information and Communications Technology are developing the global standards for blockchain-based decentralized identities in an effort that commenced two years ago. Related: Decentralized identity can bring the analog world into the digital one After two years of research, the six major global businesses have provided the proof of concept for blockchain-based decentralized identification (DID) for IoT devices, which Dr. Fan started in 2019 with the World Wide Web Consortium (W3C). IEEE is a non-profit...

Ukrainian bank uses Stellar to launch electronic hryvnia pilot

Tascombank, one of the oldest commercial banks in Ukraine, is launching a Stellar-based pilot for Ukraine’s national fiat currency, the hryvnia. The Stellar Development Foundation (SDF) announced on Dec. 14 a private electronic hryvnia pilot launched by Tascombank and fintech company Bitt. The electronic hryvnia pilot is being implemented under the supervision of the National Bank of Ukraine and is supported by the Ministry of Digital Transformation (MDT). Oleksandr Bornyakov, deputy minister of the MDT, said that the pilot project will provide a “technological basis for the issuance of electronic money” and is the “next key step to advance innovation of payment and financial infrastructure in Ukraine.” SDF CEO Denelle Dixon told Cointelegraph that the pilot work has already kicked off, wi...

Umbrella Network launches $15M oracle accelerator program

Decentralized oracle service Umbrella Network has launched a new accelerator program for projects looking to build data pipelines to the cryptocurrency market, a process that many within the industry believe is necessary to grow the emerging domains of blockchain gaming, DeFi and the Metaverse. The $15 million accelerator program intends to fund companies that are bringing new data solutions to the blockchain ecosystem, Umbrella Network announced Tuesday. Sam Kim, a partner at Umbrella Network, told Cointelegraph that his company is focused on funding projects within blockchain gaming, Metaverse, digital advertising, blockchain-based identity, sports and weather, among others. To date, projects in these and other fields have largely relied on centralized systems for running key compu...

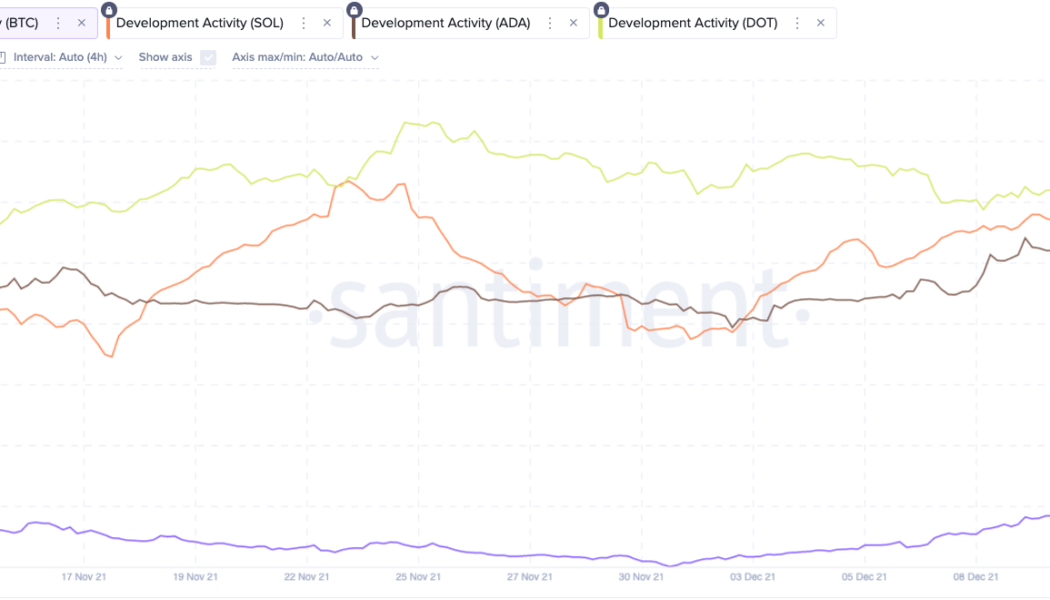

Solana on-chain development increases after a recent DDoS attack

Solana — whose native crypto, SOL, is the fifth-largest cryptocurrency by market capitalization — is leading on-chain development charts despite a recent distributed denial-of-service (DDoS) attack. As per Santiment data, Solana surpassed the daily GitHub submission rates of Polkadot and Cardano to become the leading blockchain over the past month. The number of daily GitHub submissions for Solana reached 90 between Nov. 12 and Monday, followed by Polkadot at 76 and Cardano at 65. Daily GitHub submissions Bitcoin, Solana, Cardano and Polkadot from Nov. 12–Dec. 13, 2021. Source: Santiment The surge in on-chain development activity for Solana comes in the wake of a recent DDoS attack on Thursday that slowed down the network considerably. The fifth-largest blockchain managed to mitigate the i...

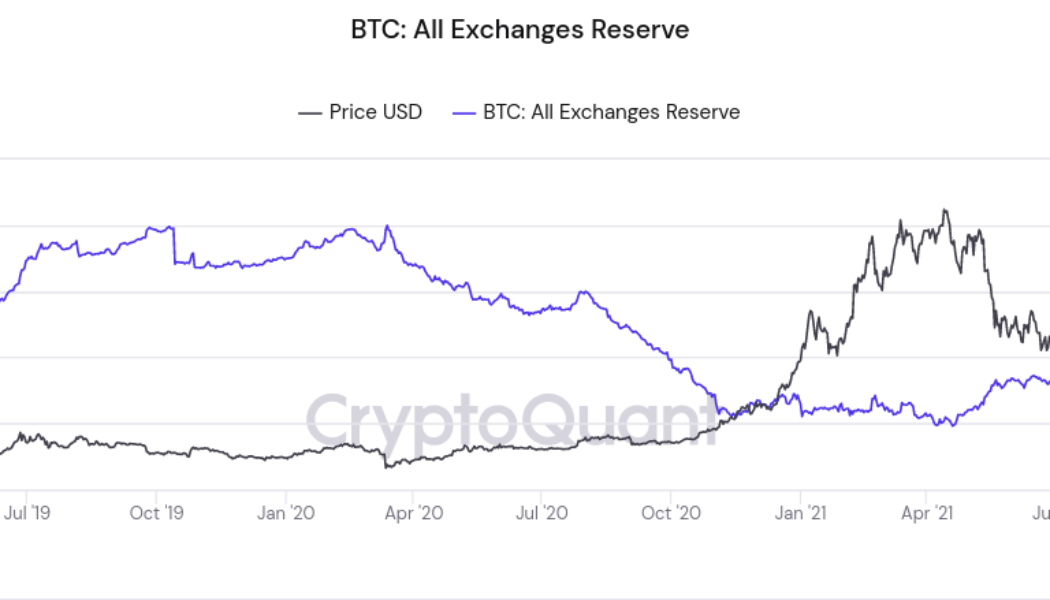

‘Monster bull move’ means whales could secure the next Bitcoin price surge

Bitcoin (BTC) whales are the center of attention this week as buying and selling habits split the BTC price narrative. New findings from on-chain analytics firm CryptoQuant show derivatives investors leading the way when it comes to bullish bets on Bitcoin. “Sick” BTC price indicator favors bulls The second half of November produced a marked uptick in the buy/sell ratio on major derivatives trading platform Deribit, and for contributing analyst Cole Garner, this is a sure sign that price action will react positively in the near term. “I recently discovered the ratio of market buys & sells of perpetuals on Deribit Exchange is a sick leading indicator,” he commented. “This is a 30 day WMA. Strong bullish trends in the metric have preceded every strong bullish price trend of this bull. An...

Look out below! Analysts eye $40K Bitcoin price after today’s dip to $45.7K

On Monday, Bitcoin’s short-term outlook worsened after the price fell to an intra-day low at $45,672, a far cry from the weekend’s promising rally above the $50,000 level. With the year nearly complete, and all-time highs nearly 33% away, traders are most likely readjusting their expectations and pushing the $100,000 BTC target a bit further into 2022. Daily cryptocurrency market performance. Source: Coin360 Day traders, 4-hour chart watchers and over-leveraged longs are likely freaking out (unless they went short from $50,000 over the weekend or at this morning’s weakness), but let’s zoom out a little bit to see where Bitcoin price stands. BTC/USDT daily chart. Source: TradingView On the daily timeframe, we can see the price struggling to breakout away from the trend of daily lower ...

Law Decoded: A different Congress hearing, Dec. 6–13

The biggest regulatory story of the week was a United States House Committee on Financial Services hearing squarely focused on crypto. Even the event’s title — “Digital Assets and the Future of Finance: Understanding the Challenges and Benefits of Financial Innovation in the United States” — conveyed a different vibe than countless previous Congressional meetings that had been first and foremost about investor protection or security risks or threats to financial stability. Judging from reactions from many industry participants and experts, the exchange has been received as an overwhelming net positive, with legislators asking informed questions and otherwise acting like their goal was to understand this new thing rather than act on preconceived notions. Of course, there were tired qu...