Crypto news

FTX paid $12M retainer to a New York law firm before bankruptcy filing

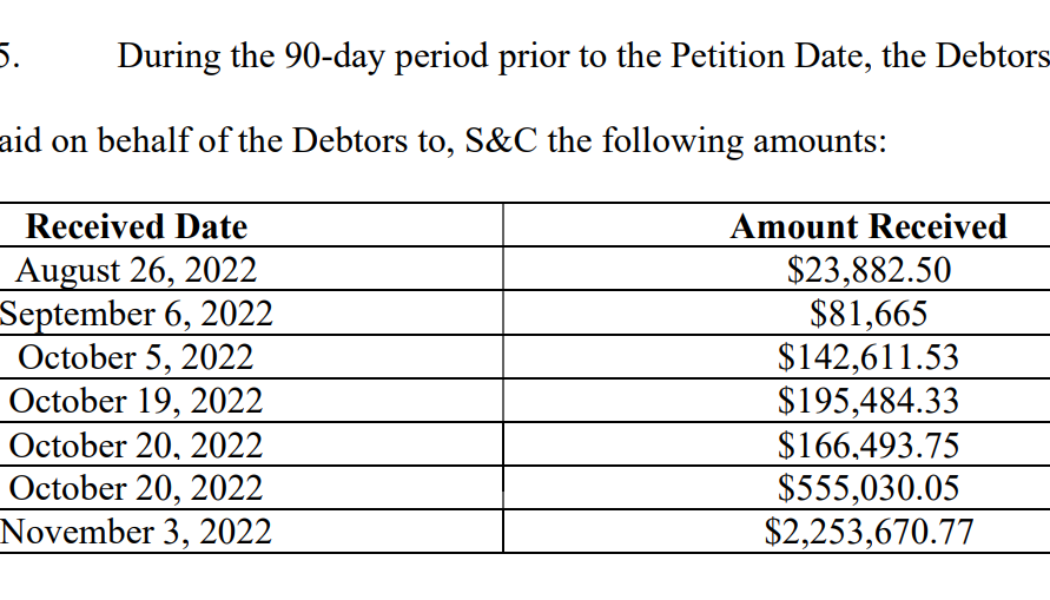

Defunct crypto exchange FTX paid a retainer of $12 million to bankruptcy lawyers as security for payment of its fees and expenses amid Chapter 11 bankruptcy proceedings, shows a court filing dated Dec. 21. Sullivan & Cromwell LLP (S&C), a law firm headquartered in New York City, received $12 million from West Realm Shires Services Inc. on behalf of FTX for legal services. In addition, the filing confirmed that over the past 90 days, i.e., since Aug. 26, 2022, FTX paid nearly $3.5 million to S&C. Snippet of the court filing revealing FTX’s historical payments to S&C law firm. Source: aboutblaw.com Based on the information provided, FTX paid at least $15.5 million to avail and retain the legal services of S&C. The filing further revealed that S&C currently ...

Crypto billionaires lost $116B since March: Report

The bear market and the wave of bankruptcies in the crypto industry drained $116 billion from the pockets of founders and investors in the past nine months, according to recent estimates by Forbes. The loss represents the combined personal equity of 17 people in the space, with over 15 losing more than half of their fortunes since March. As a result, 10 names were removed from the crypto billionaires list. One of the major losses was attributed to Binance CEO Changpeng “CZ” Zhao. In March, his 70% stake in the crypto exchange was valued at $65 billion, but it is now worth $4.5 billion. Coinbase CEO Brian Armstrong has a net worth estimated at $1.5 billion, down from $6 billion in March. The fortune of Ripple’s co-founder Chris Larsen was reduced from $4.3 billion to...

What is an NFT whitelist, and how can you join one?

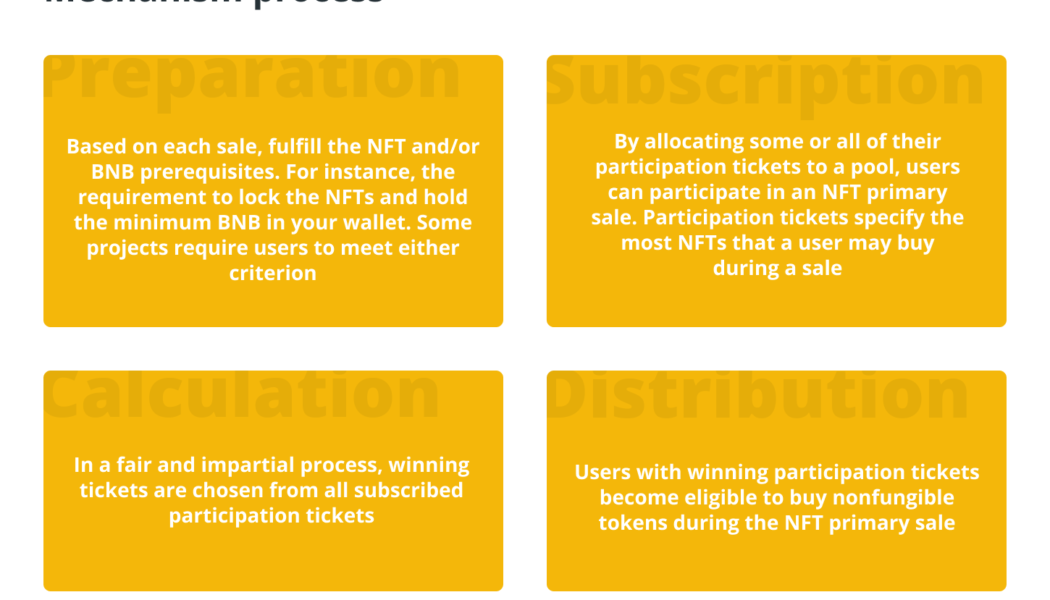

Crypto-based scams are constantly sweeping the nonfungible token (NFT) space; therefore, staying updated is the most significant way to prevent both new and existing NFT scams. Other than fraud, intense rivalry for newly minted NFTs may cause prices to rise and transaction fees to skyrocket, making them unaffordable for early supporters. Nonetheless, these issues have been solved by NFT providers by establishing whitelists or allowlists, giving special privileges and access to a newly minted nonfungible token. Before public minting begins, nonfungible token projects employ allowlists to restrict who can mint NFTs. For example, one can mint NFTs without being concerned about gas wars if they are on the whitelist. This article will discuss the NFT whitelisting concept and process, why ...

SBF sent home, FTX heads plead guilty, and Binance gets Voyager assets: Hodler’s Digest, Dec. 18-24

Top Stories This Week SBF sent home after his parents put up their house to cover his astronomical bail bond Sam Bankman-Fried will spend the holidays with his family in Palo Alto, California, after his parents secured $250 million in bail funds with the equity in their home. Among the conditions of the bail are home detention, location monitoring and his passport surrender. The former FTX CEO signed surrender documents on Dec. 20, allowing his extradition from the Bahamas to the United States, where he faces eight charges that could keep him behind bars for the rest of his life. Bankman-Fried will now wait for his sentence at home with his family. Caroline Ellison and Gary Wang plead guilty to fraud charges Former Alameda Research CEO Caroline Ellison and FTX co-founder Gary Wang have ple...

BTC price levels to watch as Bitcoin limps into Christmas under $17K

Bitcoin (BTC) entered the Christmas holiday period unchanged at $16,800 as an eerie lack of volatility persevered. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Hopeful price target sees Bitcoin at $17,400 Data from Cointelegraph Markets Pro and TradingView confirmed another day of an almost imperceptible range for BTC/USD just below $17,000. The pair had struggled to break out despite multiple potential catalysts coming from United States economic data prints. With the holiday season ahead, a Santa rally appeared unlikely, while a lack of significant events to come further reduced the chances of flash volatility. In weekend analysis, however, Michaël van de Poppe, founder and CEO of trading firm Eight, nonetheless reiterated the possibility of a step higher to ne...

Xmas dinner table: What to tell your family about what happened in crypto this year

After a lackluster rise of crypto in 2021, which saw many new crypto millionaires and several crypto startups attain unicorn status, came the dramatic fall in 2022. The industry was plagued by macroeconomic pressures, scandals and meltdowns that wiped out fortunes virtually overnight. As 2022 comes to a close, many crypto proponents are perplexed about the state of the industry, especially in light of the recent FTX collapse and the contagion it has caused, taking down several firms associated with it. Many who couldn’t stop talking about crypto and recommending their family to invest in it last year at Christmas dinner could see the tables turn this year, with them having a lot of explaining to do about the state of crypto today. While as awkward as that conversation is going to be,...

Crypto can get weird: The 5 strangest stories of the industry in 2022

From Terra to FTX, 2022 has given us many weird crypto stories. While investors have been enduring a bear market that saw the crypto industry sink below the $1 trillion market capitalization mark, adoption in the space has been growing, and old mysteries were finally solved. From the incredible short squeeze of a bankrupt company’s token to old anti-crypto arguments used by a major central bank, we’re getting weird with five stories the best fiction writers couldn’t dream up. “Comedic rapper” charged over Bitfinex hack Back in 2016, popular cryptocurrency exchange Bitfinex suffered a major security breach that saw attackers steal 119,756 Bitcoin (BTC), worth approximately $72 million at the time. It was one of the largest crypto hacks in history, and although Bitfinex continued operating, ...

Blockware sued over alleged misrepresentation of miners’ performance

London-based Faes & Company filed a complaint against crypto mining firm Blockware Solutions LLC on Dec. 17, claiming it misrepresented the performance capability of its miners and lacked adequate power access to keep the machines running. Plaintiffs allege losses of $250,000 and are seeking compensatory and punitive damages. According to the complaint, the parties entered into contracts in October 2021 for Faes to buy $525,000 worth of Bitcoin miners and related hosting services. As part of the agreement, Blockware would host Faes’ miners at one of its server facilities, which it allegedly owns and operates for a monthly hosting fee and energy costs. Related: Public Bitcoin mining companies plagued with $4B of collective debt The plaintiff alleges that at the time of the a...

LastPass attacker stole password vault data, showing Web2’s limitations

Password management service LastPass was hacked in August 2022, and the attacker stole users’ encrypted passwords, according to a Dec. 23 statement from the company. This means that the attacker may be able to crack some website passwords of LastPass users through brute force guessing. Notice of Recent Security Incident – The LastPass Blog#lastpasshack #hack #lastpass #infosec https://t.co/sQALfnpOTy — Thomas Zickell (@thomaszickell) December 23, 2022 LastPass first disclosed the breach in August 2022 but at that time, it appeared that the attacker had only obtained source code and technical information, not any customer data. However, the company has investigated and discovered that the attacker used this technical information to attack another employee’s device, which was then used...

Bridge attacks will still pose major challenge for DeFi in 2023 — Security experts

Security has been a critical challenge for decentralized finance (DeFi) and its evolution. Between 2020 and 2022, hackers stole over $2.5 billion through vulnerabilities on cross-chain bridges, Token Terminal data shows. This is a substantial amount compared with other security breaches. Issues with bridges have a root cause: All of them have an “inherent vulnerability,” Theo Gauthier, founder and CEO of Toposware, told Cointelegraph. According to Gauthier, no matter how secure a bridge is on its own, it is “entirely reliant on the security of the chains it connects,” meaning any breach or bug within one of the two bridged chains makes the overall bridge vulnerable. Briefly, bridges are used to connect different blockchains and aim to address the lack of standards between protocols. I...

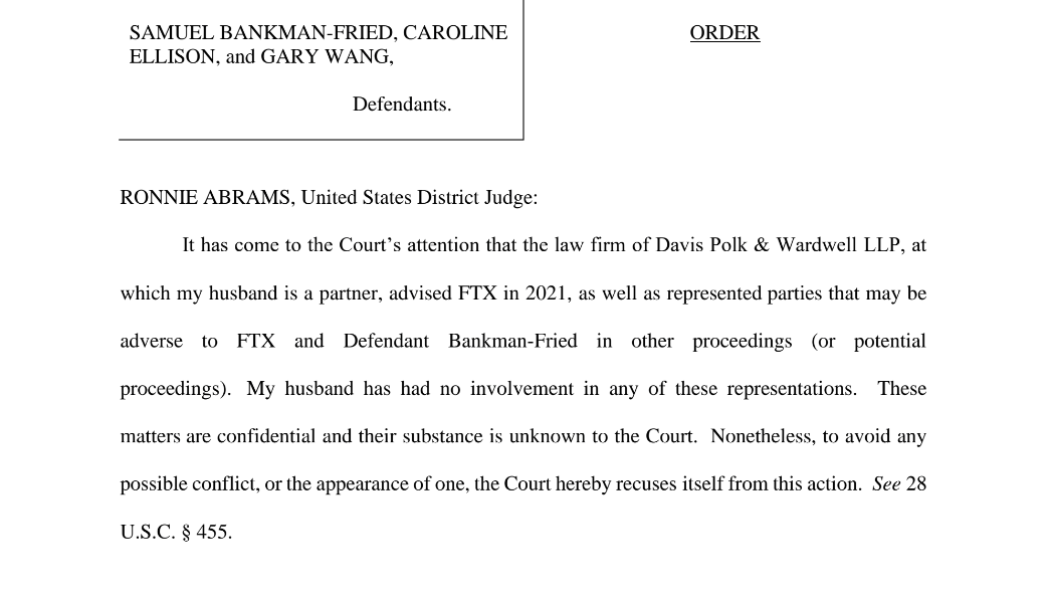

Judge pulls out of SBF-FTX case citing husband’s law firm’s advisory link

The ongoing legal proceedings around former FTX CEO Sam Bankman-Fried (SBF) took a new turn as District Judge Ronnie Abrams withdrew her participation from the case. The United States District Court for the Southern District of New York rescued itself from the FTX case after revealing that a law firm — which employs Abrams’ husband as a partner — had advised the crypto exchange in 2021. In a Dec. 23 filing, Judge Abrams revealed that her husband, Greg Andres, is a partner at Davis Polk & Wardwell, a law firm where he has been employed since June 2019. Additionally, it was highlighted that the law firm had advised FTX in 2021. Abrams also stated that the law firm represented parties that may be adverse to FTX and SBF in other legal proceedings. “My husband has had no involvement i...

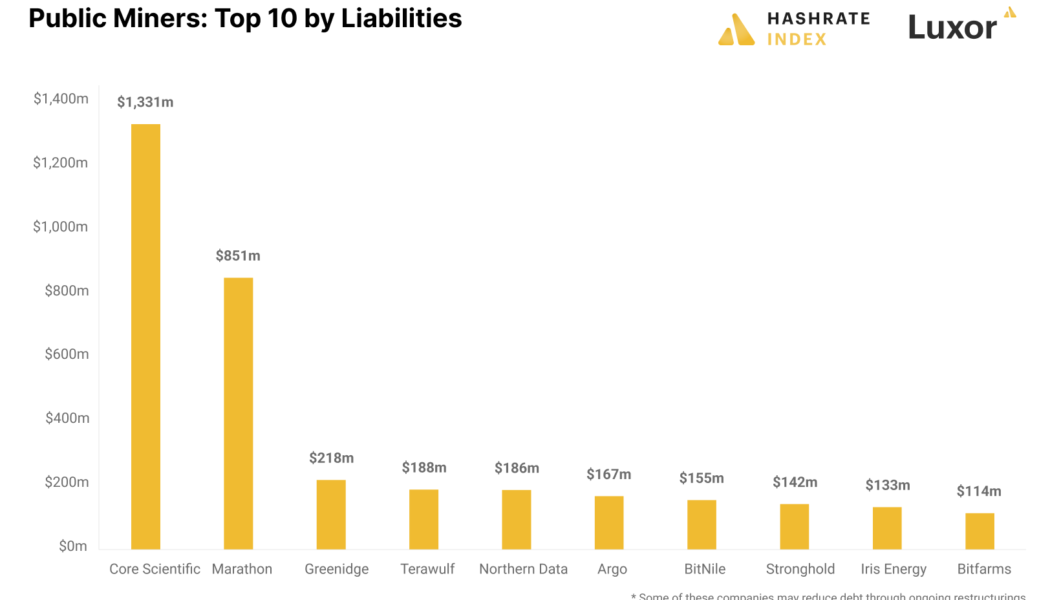

Public Bitcoin mining companies plagued with $4B of collective debt

The recent bankruptcy filing of Bitcoin (BTC) miner Core Scientific despite a $72M relief offer from creditors raised questions about the overall health of the bitcoin mining community amid a prolonged bear market. Turns out, the public bitcoin miners owe more than $4 billion in liabilities and require an immediate restructuring to get out of the unsustainably high debt levels. The Bitcoin mining community took up massive loans during the 2021 bull market, negatively impacting their bottom lines during a subsequent bear market. Bitcoin mining data analytics by Hashrate Index show that just the top 10 Bitcoin mining debtors cumulatively owe over $2.6 billion. Public Bitcoin mining companies with highest debt. Source: Hashrate Index Core Scientific, the biggest debtor among the lot — with $1...