Crypto news

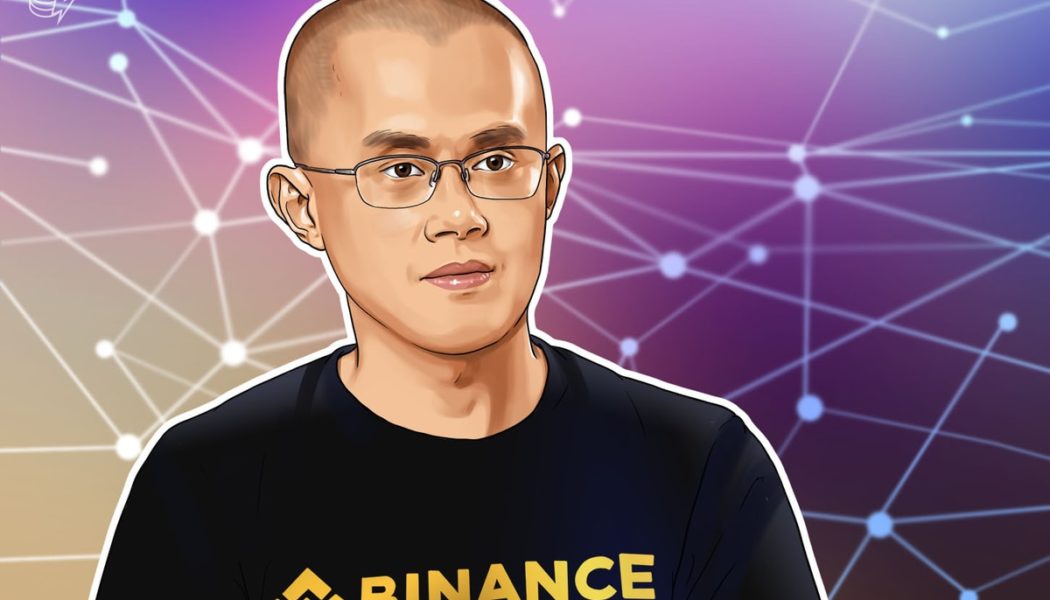

CZ addresses reasons behind Binance’s recent FUD

Binance CEO Changpeng “CZ” Zhao took to Twitter on Dec. 23 to share his perspective on the reasons behind the recent fear, uncertainty, and doubt (FUD) surrounding the crypto exchange. According to CZ in the thread, Binance’s FUD is primarily caused by external factors – not by the exchange itself. One of the reasons mentioned by the CEO was that part of the crypto community hates centralization. “Regardless if a CEX helps with crypto adoption at a faster rate, they just hate CEX,” he noted. CZ also pointed out that Binance has been seen as competition by many industry players, with increasingly lobbying against the exchange and “loaning sums of money to small media that’s worth many times the media outlet’s market value, including buying the...

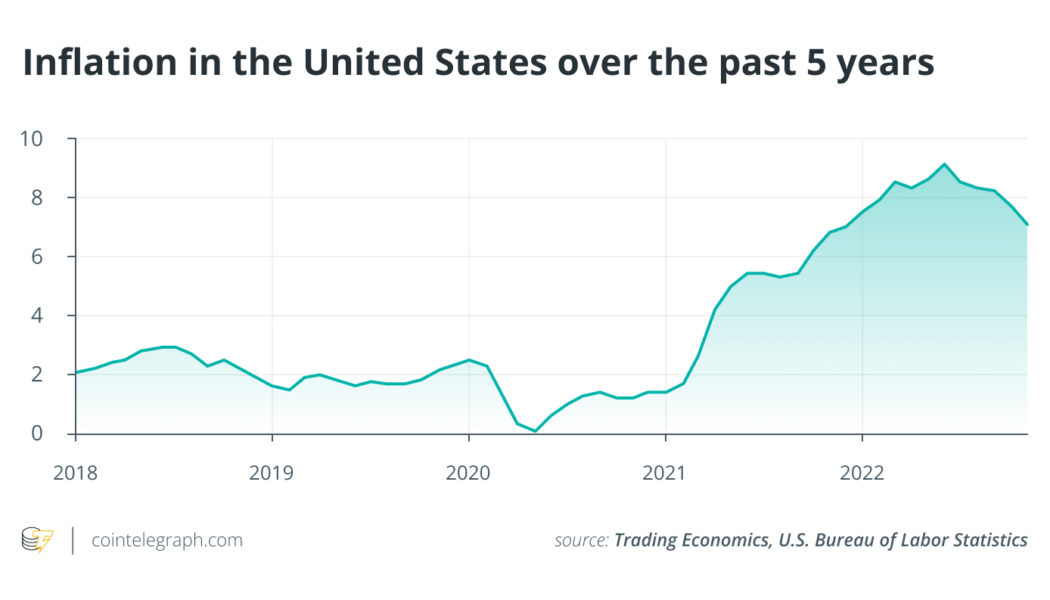

Time in the market: Ways to approach crypto investing in 2023

2022 was brutal for cryptocurrency and nonfungible token (NFT) investors. Bitcoin (BTC) hit its yearly low on Nov. 21, almost exactly a year after it reached its all-time high price of $69,044. After such a tumultuous year, how should crypto investors plan for 2023? Firstly, this space has critical risks worth considering before investing. Macroeconomic risks Investors must recognize the macro and systemic risks impacting the crypto industry as 2023 draws near. The war in Ukraine has led to an energy crisis caused by sanctions on Russian energy. The United States Federal Reserve’s monetary policy response to inflation continues to unsettle markets. The crypto contagion from recent bankruptcies continues injecting volatility into the market, with increasing regulatory pressure and miner cap...

French investors sued Binance for over 2.4 million euros in losses

Binance France and its parent company Binance Holdings Limited are being sued by 15 investors in France over alleged misleading commercial practices and fraudulent concealment, according to local media reports. In a complaint filed on Dec. 14, the plaintiffs claimed that Binance violated French laws by advertising and distributing crypto services before receiving registration from the country’s authorities. As reported by Cointelegraph, France’s financial market regulator, the Autorité des marchés financiers, has granted Binance a license as a digital asset provider in May 2022. The license allowed the crypto exchange to offer services such as assets custody and crypto trading. The complaint reportedly contains screenshots showing Binance’s social media activity pri...

Women who made a contribution to the crypto industry in 2022

2022 saw the continued rise of disruptive blockchain-centric concepts such as decentralized finance, GameFi, nonfungible tokens and Web3. Notably, some of the related projects that thrived in 2022 were headed by women, which is a good indicator of progress in an otherwise male-dominated sector. The increased involvement of women in the cryptocurrency field signals growing inclusivity and maturation of the sector, which encourages diversity and the embrace of ideas that resonate more with underrepresented subsets of the population. That said, a group of eminent women reached unprecedented levels of accomplishment in the blockchain and cryptocurrency industries in 2022 due to their ambition, innovation, leadership skills and dedication. Cointelegraph had the chance to speak with Nodira...

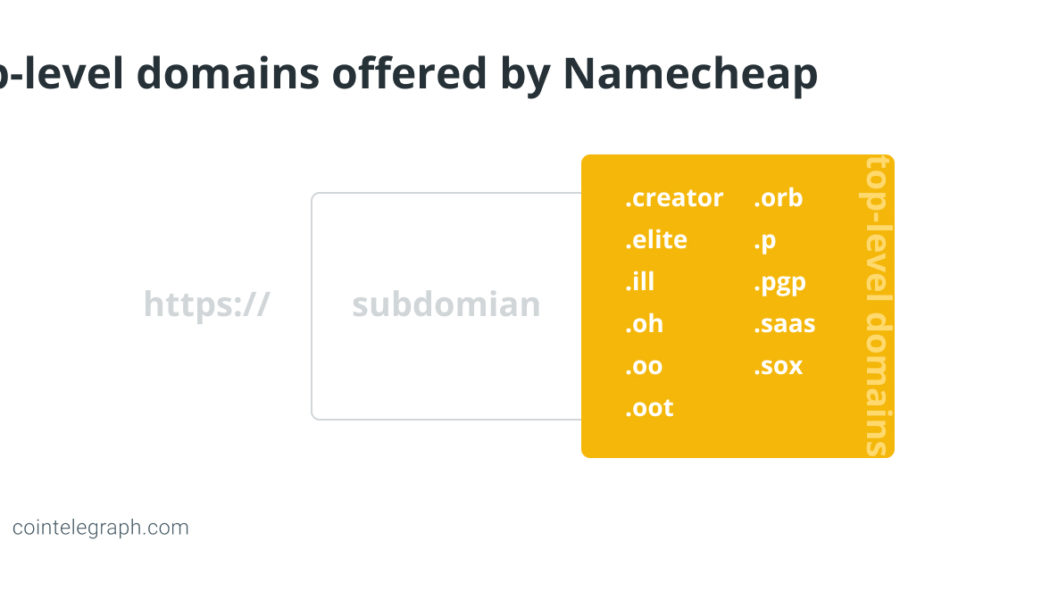

What are Handshake (HNS) domains, and how do they work?

A particular topic of interest in the blockchain space is the emergence of blockchain-related projects in the domain name system (DNS) and domain ecosystem. Handshake, in particular, has been gaining attention among decentralized technology enthusiasts for its potential to revolutionize how people think about and interact with domains, especially in the context of Web3. What is a handshake (HNS) domain? Handshake (HNS) is a decentralized, permissionless naming protocol that allows for peer-to-peer communication and provides an accessible alternative to centrally managed domain names, such as .com, country-code domains and other generic domains. As a decentralized peer-to-peer domain naming protocol, Handshake aims to serve as a DNS chain alternative to the current default root chain. Also,...

BTC price foregoes Santa rally as Bitcoin volatility hits record low

Bitcoin (BTC) failed to deliver a Santa rally for Christmas 2023 as Dec. 25 offered even more sideways BTC price action. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin volatility index plumbs lowest ever levels Data from Cointelegraph Markets Pro and TradingView showed BTC/USD clinging to a tight trading range around $16,800. The pair had stubbornly refused to offer any form of volatility through much of the week, with an absence of a macro trigger reinforcing lackluster performance. “Bitcoin’s volatility is at an all-time low,” William Clemente, founder of crypto research firm Reflexivity, noted alongside a chart of the Bitcoin historical volatility index. Bitcoin historical volatility index 1-week candle chart. Source: TradingView He added that the total crypto...

Bitcoin and these 4 altcoins are showing bullish signs

Cryptocurrency markets lack any signs of volatility going into the year-end holiday season. This suggests that both the bulls and the bears are playing it safe and are not waging large bets due to the uncertainty regarding the next directional move. This indecisive phase is unlikely to continue for long because periods of low volatility are generally followed by an increase in volatility. Willy Woo, creator of on-chain analytics resource Woobull, anticipates that the duration of the current bear market may “be longer than 2018 but shorter than 2015.” Crypto market data daily view. Source: Coin360 The crypto winter has resulted in a loss of more than $116 billion to the personal equity of 17 investors and founders in the cryptocurrency space, according to estimates by Forbes. The carnage ha...

Crypto is a nonexistent asset for big institutional investors – JPMorgan exec

Big institutional investors are still largely staying away from the crypto market, as the asset class’ volatility poses a challenge to money managers, Jared Gross, head of institutional portfolio strategy at JPMorgan Asset Management, told Bloomberg. “As an asset class, crypto is effectively nonexistent for most large institutional investors,” Gross noted, explaining that “the volatility is too high, the lack of an intrinsic return that you can point to makes it very challenging.” Gross believes that most institutional investors are currently “breathing a sigh of relief that they didn’t jump into that market”, which is unlikely to happen anytime soon. The bear market also brought to an end the idea that Bitcoin (BTC) could be a form of digital gold or serv...

Former Alameda CEO confirms firm borrowed billions from FTX customer deposits as part of plea deal

Caroline Ellison, the former CEO of Alameda Research, said as part of her plea deal that she was aware FTX funds had been made available for the venture capital firm’s investments. In a transcript of proceedings for her plea deal in the Southern District of New York released on Dec. 23, Ellison acknowledged the financial ties between FTX and Alameda at the center of prosecutors’ case against former FTX CEO Sam Bankman-Fried. According to the former Alameda CEO, Alameda had access to a “borrowing facility” through FTX from 2019 to 2022. “I understood that FTX executives had implemented special settings on Alameda’s FTX.com account that permitted Alameda to maintain negative balances in various fiat currencies and crypto currencies,” said Ellison. “In practical terms, this arrangement permit...

Web3 projects would rather get hacked than pay bounty: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. Uniswap, one of the leading decentralized exchange platforms, is integrating debit and credit card support for its users. It will allow Uniswap users to buy cryptocurrency directly with their cards. An ex-employee caused Ankr protocol’s recent $5 million hack. The DeFi protocol alerted relevant authorities and is seeking to prosecute the attacker while shoring up its security practices. A Web3 developer has claimed that many crypto ecosystem projects would rather get hacked than pay bounties. After reporting and helping patch a smart contract vulnerability, the developer claims that the projects he helped started ...

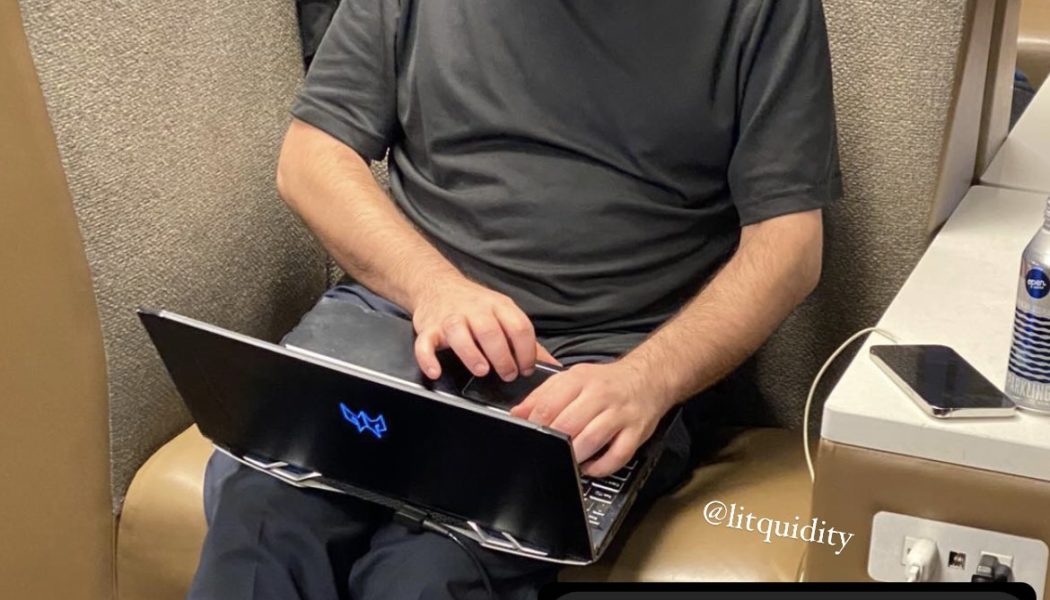

Sam Bankman-Fried found ‘chilling’ in JFK airport lounge on $250M bail bond

The momentary arrest of former FTX CEO Sam Bankman-Fried (SBF) can be attributed to the efforts taken by the crypto community to aid investigations and track down the whereabouts of the infamous entrepreneur. While SBF eventually escaped prison time via a $250 million bail bond, the community continues to monitor his every move publicly. Just three days after being released on a personal recognizance bond, a crypto community member allegedly spotted SBF “chilling” in a John F. Kennedy International Airport lounge. The supporting images were shared on Twitter by @litcapital, which shows SBF sitting on a lounge chair with access to a laptop and mobile phone. Sam Bankman-Fried found at the JFK airport lounge. Source: Twitter Based on the pictures, other community members confirmed that SBF’s ...

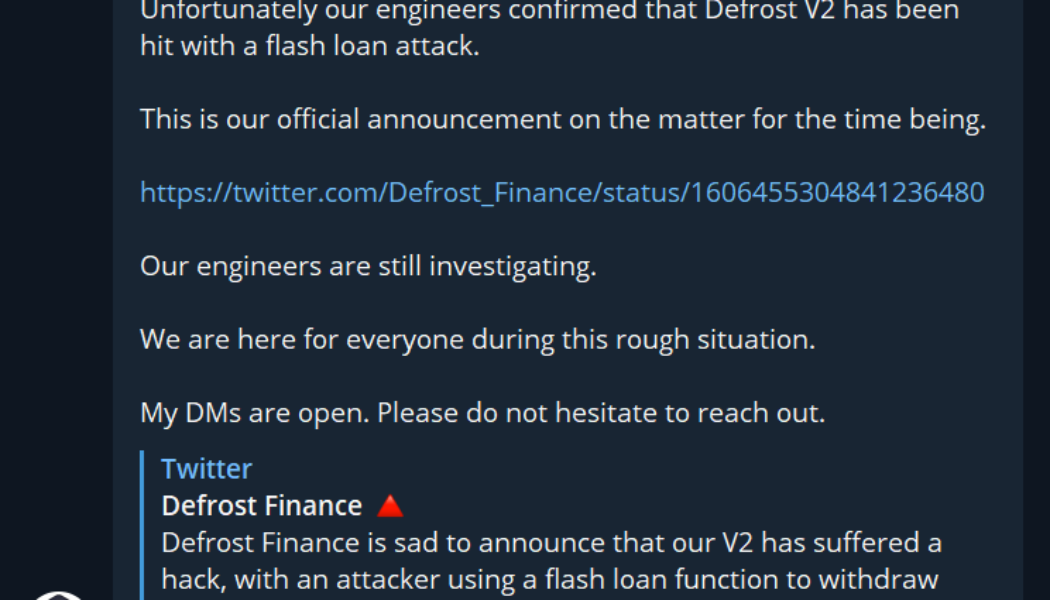

DeFi flash loan hacker liquidates Defrost Finance users causing $12M loss

Defrost Finance, a decentralized leveraged trading platform on Avalanche blockchain, announced that both of its versions — Defrost V1 and Defrost V2 — are being investigated for a hack. The announcement came after investors reported losing their staked Defrost Finance (MELT) and Avalanche (AVAX) tokens from the MetaMask wallets. Moments after a few users complained about the unusual loss of funds, Defrost Finance’s core team member Doran confirmed that Defrost V2 was hit with a flash loan attack. At the time, the platform believed that Defrost V1 was not impacted by the hack and decided to close down V2 for further investigation. Core team member Doran confirming attack on Defrost Finance. Source: Telegram At the time, the platform believed Defrost V1 was not impacted by the hack...