Crypto news

What is Swan Bitcoin and how does it work?

When someone wants to buy Bitcoin (BTC), they usually take the route of a cryptocurrency exchange. Newbies may buy BTC on just any exchange they come across, while those with some sort of experience may opt for a reputable one. The exercise though bears little fruit as most exchanges function almost identically as centralized entities, often working as custodians of the crypto assets of the buyers. The security factor is generally limited to passwords and 2-factor authentication (for the buyers who have opted for it). Customer support, wallet support and ease of use are other factors that buyers might consider when zeroing in on an exchange to buy Bitcoin. Exchanges have a drawback when it comes to supporting customers who want to buy Bitcoin. With an array of digital coins on their platfo...

BTC price preserves $16.5K, but funding rates raise risk of new Bitcoin lows

Bitcoin (BTC) staged a modest recovery on Dec. 29 as United States stock markets rebounded in step. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $10,000 BTC price targets stick Data from Cointelegraph Markets Pro and TradingView showed BTC/USD recovering above $16,600 at the Wall Street open after wicking below $16,500 for a second day. The pair remained unappealing to traders, many of whom feared a deeper retracement may still occur around the new year. In a list of potential “capitulation targets,” Crypto Tony doubled down on a price of $10,000 and lower for Bitcoin, while also revealing expectations for Ether (ETH) to dip as low as $300. “Things change quick, but if we hit these areas I begin to ladder,” part of accompanying commentary read. Daan Crypto Trades, meanwhile,...

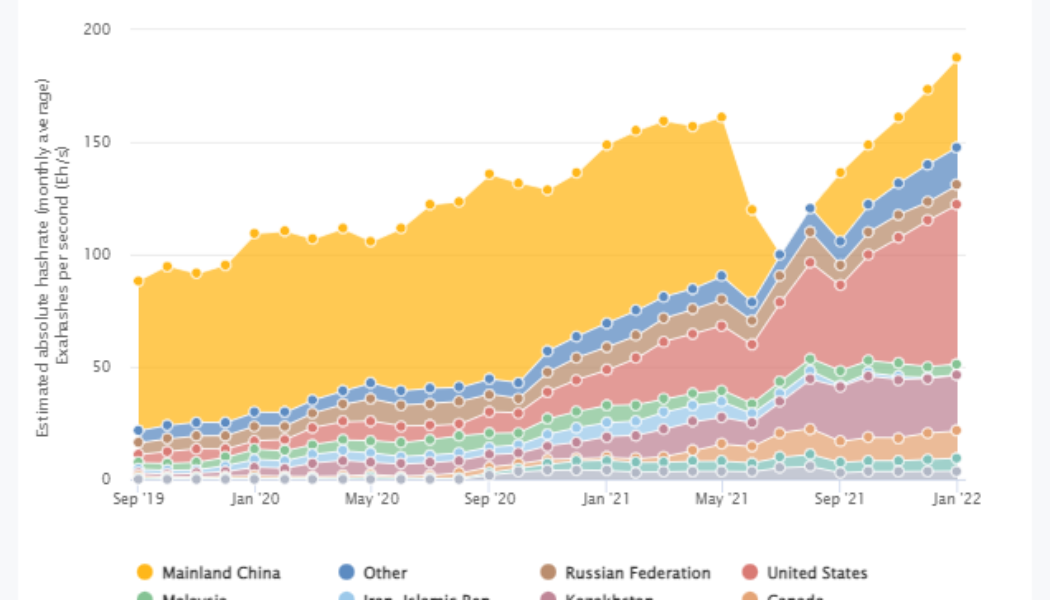

Chinese Communist Party official pleads guilty to helping Bitcoin miners

According to a report published by state-owned daily news program Xinwen Lianbo on Dec. 29, Xiao Yi, the former Communist Party secretary of the City of Fuzhou, pleaded guilty to corruption charges in the Zhejiang Hangzhou Intermediate People’s Court. During his tenure as director from 2008 to 2021, Yi was accused of accepting over 125 million Chinese yuan ($18 million) in bribes related to construction programs and illicit promotions. In addition to the aforementioned counts, Yi also pleaded guilty to charges related to business transactions between himself and Bitcoin (BTC) miners from 2017 to 2021. It is unclear if the series of charges were related. As reported by Xinwen Lianbo: “During his 2017 to 2021 tenure as the Communist Party Secretary of the City of Fuzhou, Xiao Yi provided sup...

Celsius wants to extend the deadline for claims as lawyer fees mount

Bankrupt crypto lender Celsius Network is planning to file a motion that would extend the deadline for users to submit their claims by another month. The crypto community has started to grow impatient, noting that Celsius’ lawyer fees have continued to stack up and are eating away at the lender’s estate. In a Dec. 29 tweet, Celsius announced that it would seek to extend the current deadline for claims from Jan. 3 to early February. The bankruptcy court is set to hear the motion on Jan. 10, and according to Celsius, the Jan. 3 deadline will be extended until at least then. Celsius is preparing to file a motion later this week requesting an extension of the bar date, which is the deadline to file a claim, from January 3, 2023, until early February. — Celsius (@CelsiusNetwork) Dec...

Bitcoin price would surge past $600K if ‘hardest asset’ matches gold

Bitcoin (BTC) is due to copy gold’s explosive 1970s breakout as it becomes the world’s “hardest asset” in 2024. That was one forecast from the latest edition of the Capriole Newsletter, a financial circular from research and trading firm Capriole Investments. Bitcoin due big moves “and more” in 2020s Despite BTC price action flagging at nearly 80% below its latest all-time high, not everyone is bearish about even its mid-term outlook. While calls for a further drop before BTC/USD finds its new macro bottom remain, Capriole believes that 2023 will be bright for Bitcoin as a reserve asset. The reason, it says, lies in the world economy’s financial history of the past century, and in particular, the United States after the dollar deanchored from gold completely in 1971. Gold, as t...

Microstrategy Bitcoin purchase divides the crypto community

Software analytics company MicroStrategy recently added more Bitcoin (BTC) to the firm’s holdings. Members of the crypto community had mixed reactions to the move. In a recent tweet, MicroStrategy’s executive chairman Michael Saylor announced that the firm had made another Bitcoin purchase. The move puts the firm’s total BTC holdings at 132,500 BTC, purchased for a total of $4.03 billion but worth only around $2.1 billion at the time of writing. Many commended the move, while some brought up some potential negative effects. Michael Saylor, you are a rock star. Your mission Jim aka Michael Saylor, if you choose to accept it, is to bank the unbanked throughout the world. — The Young Gentleman (@YoungGentlaman) December 28, 2022 A community member praised the MicroStrategy chairman, cal...

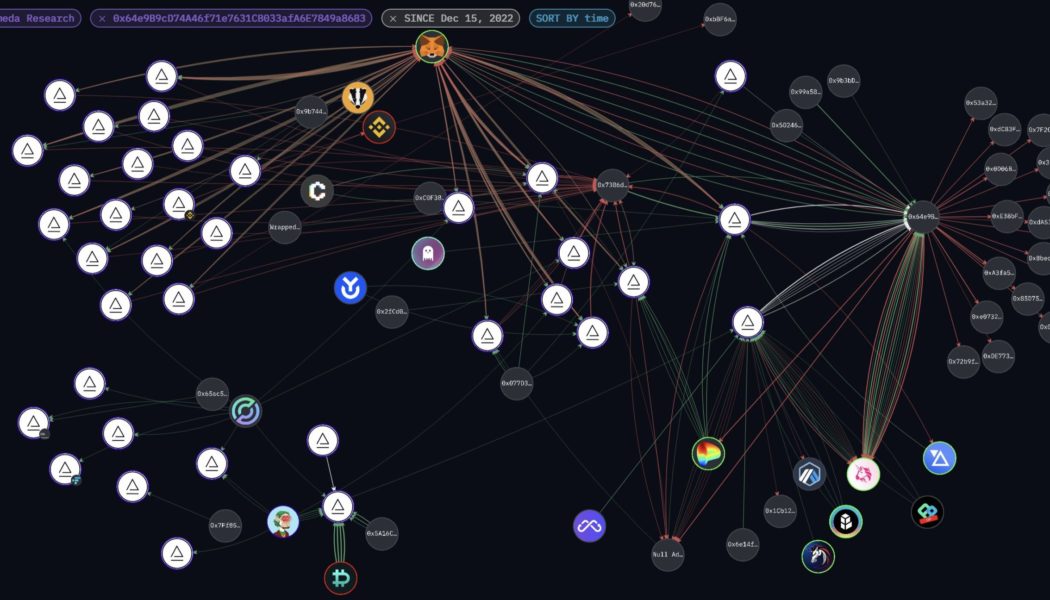

Alameda wallets funnel over $1.7M via crypto mixers overnight

30 cryptocurrency wallets linked to Alameda Research, the bankrupt sister company of crypto exchange FTX, became active on Dec. 28 following four weeks of inactivity. These wallets swapped and mixed over $1.7 million worth of crypto assets through various crypto-mixing services. Crypto mixers are often used by market exploiters and criminals to obscure the transaction path so that the funds cannot be traced to the original source. As Cointelegraph reported on Dec. 28, the sudden movement of funds from Alameda wallets just days after Sam Bankman Fried was released on bail raised suspicions across the crypto community. Nearly 24 hours later, it seems the culprit behind these fund transfers used extensive planning to hide transaction routes. According to data shared by the crypto forensic gro...

Bankman-Fried may enter plea in NY federal court next week before Judge Lewis Kaplan

Former FTX CEO Sam Bankman-Fried is scheduled to appear in court on the afternoon of Jan. 3 to enter a plea on two counts of wire fraud and six counts of conspiracy against him in relation to the collapse of the FTX cryptocurrency exchange, Reuters reported on Dec. 28, citing court records. Bankman-Fried will appear before District Judge Lewis Kaplan in Manhattan. Judge Kaplan was assigned to the case on Dec. 27 after the original judge on the case, Ronnie Abrams, recused herself due to connections between FTX and the Davis Polk & Wardwell law firm, where her husband is a partner. The firm provided advisory services to FTX in 2021. Kaplan was nominated by U.S. President Bill Clinton in 1994 and is known for his straightforward manner and efficient handling of courtroom proce...

Which celebrities joined and left crypto in 2022?

The crypto world is still developing at lightning speed. The adoption of projects built on blockchain technology has increased tremendously in 2022, and this is partly due to the celebrities who have contributed to it. Thanks to these well-known people, crypto-related projects have reached a large audience, through their social media accounts and the many news outlets that wrote about them. The developments in cryptocurrencies, nonfungible tokens (NFTs) and metaverse platforms have led to new ways people can make money and alternative methods to consume art and entertainment. They have also led to innovative ways people can communicate and interact with one another online. For example, people can even connect with their idols in this digital meeting place. But are there any celebrities lef...

3Commas CEO confirms API key leak following warning from CZ

Binance CEO Changpeng Zhao (CZ) warned his 8 million Twitter followers on Dec. 28 that he is “reasonably sure” that API key leaks are taking place at the cryptocurrency trade management platform. I am reasonably sure there are wide spread API key leaks from 3Commas. If you have ever put an API key in 3Commas (from any exchange), please disable it immediately. Stay #SAFU. — CZ Binance (@cz_binance) December 28, 2022 The disclosure by CZ followed an incident on Dec. 9, when Binance cancelled the account of a user who complained about losing funds a day earlier. That user claimed a leaked API key tied to 3Commas was used “to make trades on low cap coins to push up the price to make profit.” Binance declined to reimburse the user. CZ tweeted that the loss was unverifiable, and if the company m...

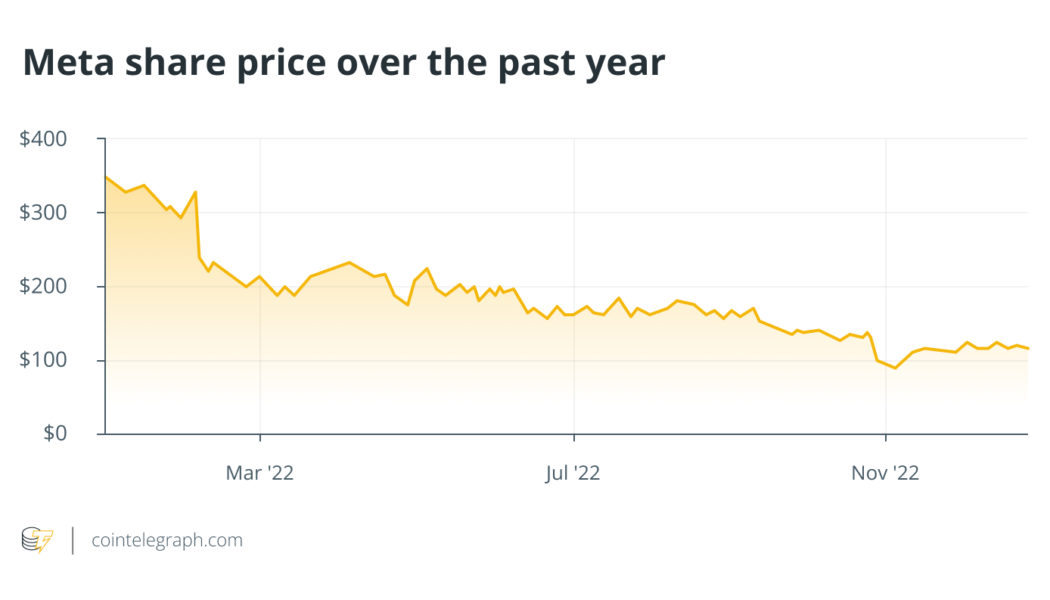

What to expect from crypto the year after FTX

Cryptocurrency had its Lehman moment with FTX — or, perhaps, another Lehman moment. The macroeconomic downturn has not spared crypto, and as November rolled around, nobody knew that we were in for the collapse of an empire worth billions of dollars. As the rumors of bankruptcy began to take hold, a bank run was inevitable. Sam “SBF” Bankman-Fried, the once effective altruist now under house arrest, continued to claim that assets were “fine.” Of course, they were not. From Genesis to Gemini, most major crypto organizations have been affected by the contagion effect in the aftermath. The problem with exchanges like Binance, Coinbase and FTX Time and time again, the feeble layer of stability has been broken down by the hammer of macroeconomic stress in an atmosphere of centralization. It can ...