Crypto news

Crypto Stories: How Bitcoin helped a couple start a family

Bitcoin (BTC) gains helped “Noodle,” a London-based Bitcoiner, to afford in vitro fertilization (IVF) treatments for his family. Noodle’s story comes to life in the latest edition of Cointelegraph’s Crypto Stories. IVF treatments can be expensive, with success rates ranging from 4% to 38%, depending on various factors. Fortunately, profits from buying and holding Bitcoin provided the necessary funds for Noodle to start a family. Noodle, who first heard about Bitcoin in 2012, decided to sell some of his BTC to pay for IVF treatment for his wife. He favored selling BTC over taking out a loan, converting over $70,000 in Bitcoin into fiat currency over a few years to pay for the treatments. [embedded content] Noodle’s journey with Bitcoin began when he was at the gym. An acquaintance introduce...

BTC price lurches toward $16K as stocks, dollar wobble in final session

Bitcoin (BTC) teased more volatility at the Dec. 30 Wall Street open with BTC/USD heading ever closer to $16,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Will new year deliver “long-awaited volatility?” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD wicking down to lows of $16,337 on Bitstamp. The pair had been gradually upping the volatility in the days after Christmas, as analysts eyed the likelihood of a final burst of action before the yearly close. “Last trading day of the year for TradFi, but crypto will trade through the holiday weekend. Perhaps we may see some of that long awaited BTC volatility around the Weekly/Monthly close and the start of 2023,” on-chain analysis resource Material Indicators ventured. Popular trader and analy...

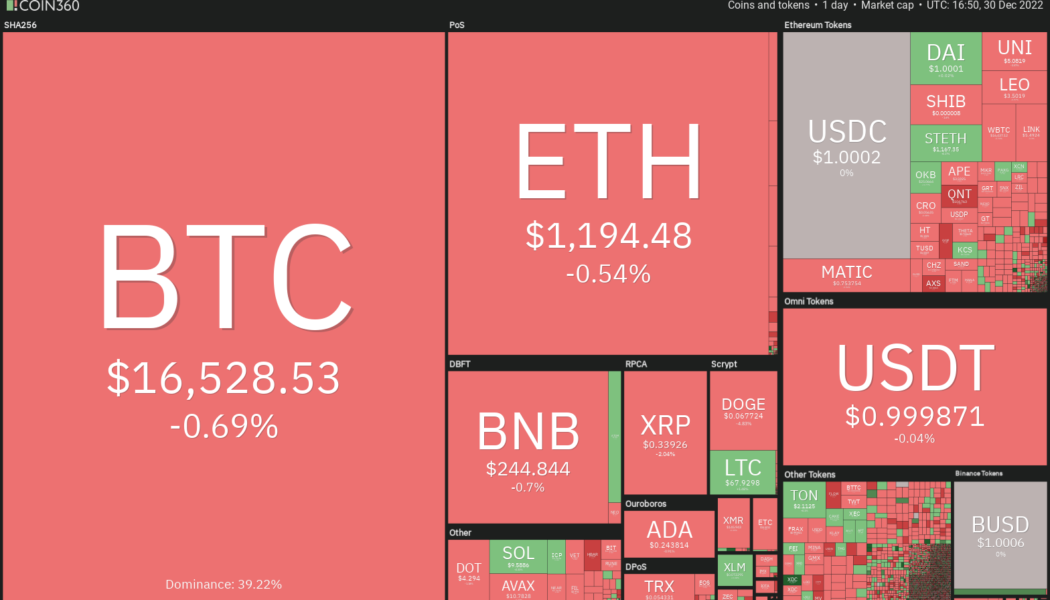

Price analysis 12/30: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

Investors have faced a tumultuous year in 2022 as stocks, bonds, and the cryptocurrency sector have all witnessed sharp declines. As of Nov. 30, the performance of a traditional portfolio comprising 60% stocks and 40% bonds has been the worst since 1932, according to a report by Financial Times. The next big question troubling crypto investors is whether the pain in Bitcoin (BTC) is over or will the downtrend continue in 2023. Analysts seem to be divided in their opinion for the first quarter of the new year. While some expect a drop to $10,000 others anticipate a rally to $22,000. Daily cryptocurrency market performance. Source: Coin360 While the near-term remains uncertain, research and trading firm Capriole Investments said in its latest edition of the Capriole Newsletter that Bitcoin c...

Will My Investments Ever Recover From Crypto Winter? – Here’s Why Metacade (MCADE) Could Be a Good Opportunity

After the highs of 2021, 2022 turned into a more challenging year for cryptocurrencies, with price falls in Q1 of 2022 settling into a longer-term cooling period known as a “crypto winter.” This cooling trend has lasted most of the year after a series of high-profile blows. The crypto winter of 2022 isn’t the first time crypto markets have suffered significant price falls. The first crypto winter occurred in 2014, with another following three years later. Many experts believe this current cooling to be part of the cyclical nature of markets rather than a protracted ice age. However, experts agree that any return to 2021 highs looks a long way off. One new crypto project that is bucking the trend and looking like a wise investment opportunity is Metacade. The recent Metacade beta ...

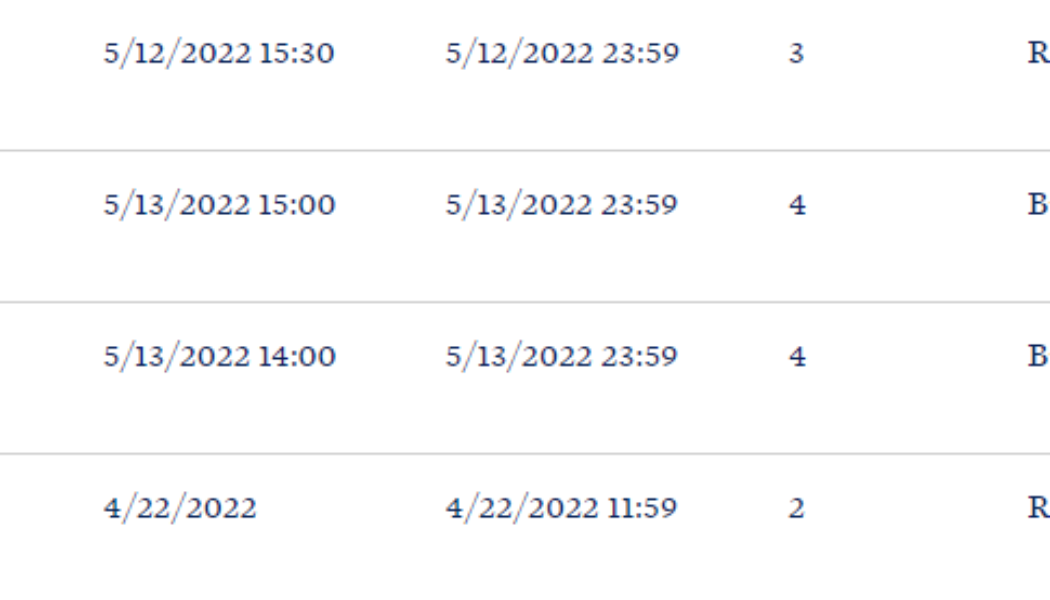

SBF met with Biden’s senior advisers 2 months before FTX’s collapse: Report

Former FTX CEO Sam Bankman-Fried met with government officials at the White House on at least four separate occasions in 2022, one of which reportedly occurred just two months before the fall of his crypto empire. Most of the meetings were disclosed in visitor logs that are posted by the White House every month, with the records showing that Bankman-Fried met with Counselor to the President Steve Ricchetti on April 22 and May 12, along with another meeting on May 13 meeting with policy adviser Charlotte Butash. However, according to a Dec. 29 Bloomberg report, the former FTX CEO also met with the president’s counselor Ricchette as recently as Sept. 8, a meeting that did not show up on the visitor logs. White House 2022 visitor logs featuring Sam Bankman-Fried. Source: The White House ...

Two crypto-related ETFs were the worst-performing in Australia for 2022

Cryptocurrency-related exchange-traded funds (ETFs) have taken the two top spots for the worst-performing ETFs in Australia for the year, with the same story playing out in the United States. BetaShares Crypto Innovators ETF (CRYP) and Cosmos Global Digital Miners Access ETF (DIGA) have provided investors Down Under with respective negative returns of nearly 82% and 72% year to date (YTD) throughDec. 30. BetaShares launched its ETF on the Australian Securities Exchange (ASX) in October 2021, mere weeks before most cryptocurrencies hit all-time highs that they’re yet to regain. CRYP was down slightly over 81.8% YTD at the time of writing. Image: Google Finance CRYP provides exposure to publicly listed blockchain and crypto companies such as Coinbase and mining company Riot Blockchain, among...

Solana joins ranks of FTT, LUNA with SOL price down 97% from peak — Is a rebound possible?

Solana (SOL), the cryptocurrency once supported by Sam Bankman-Fried, pared some losses on Dec. 30, a day after falling to its lowest level since February 2021. Solana price down 97% from November 2021 peak On the daily chart, SOL’s price rebounded to around $10.25, up over 20% from its previous day’s low of approximately $8. SOL/USD weekly price chart. Source: TradingView Nevertheless, the intraday recovery did little to offset the overall bear trend — down 97% from its record peak of $267.50 in November 2021, and down over 20% in the past week. But while the year has been brutal for markets, Solana now joins the ranks of the worst-performing tokens of 2022, namely FTX Token and LUNA, which are down around 98%. FTT (red) vs. LUNA (green) vs. SOL (blue) ...

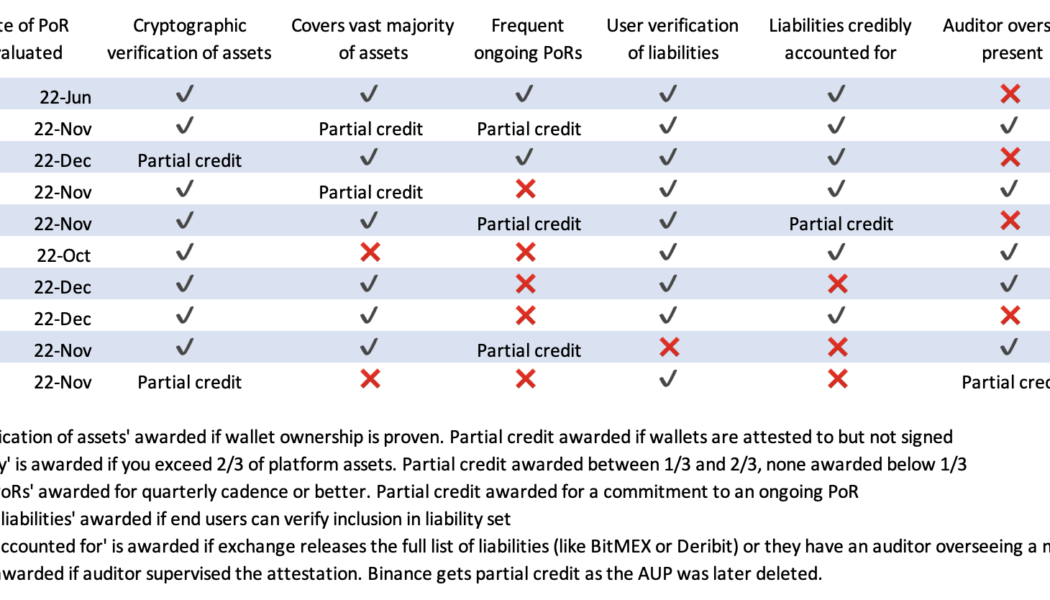

Nic Carter dives into proof-of-reserves, ranks exchange attestations

Bitcoin advocate Nic Carter has released an in-depth analysis of centralized exchange proof-of-reserves and ranked the attestations provided by some of the most prominent crypto trading platforms in the space. Carter published a detailed examination of the quality of several exchanges’ proof-of-reserves (PoR). The crypto executive used parameters such as attestation to assets held and a disclosure of liabilities, incorporating a third-party auditor, demonstrating credibility by taking a PoR for all assets and committing to an ongoing procedure to determine which PoRs are of the best quality. PoR scores of crypto exchanges. Source: Medium Crypto trading platforms Kraken and BitMEX topped the list. According to Carter, Kraken, which employed Armanino for its proof-of-reserves, gi...

False alarm: DOJ did not classify MNGO as a commodity

Avraham Eisenberg was arrested in Puerto Rico on Dec. 26 on commodities fraud and manipulation charges relating to the $110 million exploit of the decentralized Mango Markets exchange. Eisenberg had self-identified as the actor behind what he called a “highly profitable trading strategy” and insisted that he had taken “legal open market actions, using the protocol as designed.” Eisenberg’s arrest predictably lit up crypto Twitter, with some observers paying particular attention to the fact that commodities fraud charges were being pressed in a case involving a crypto coin: “AVRAHAM EISENBERG, the defendant, willfully and knowingly, directly and indirectly, used and employed, and attempted to use and employ, in connection with a swap, a contract of sale of a commodity in interstate an...

Vader will shut down stablecoin USDV, cannot find a ‘breakthrough’

The app that produces stablecoin Vader Protocol US Dollar (USDV) will be shut down, according to a Dec. 29 announcement from its developers. We are sunsetting Vader Protocol: https://t.co/C3AKHo9URj Existing $VADER and $USDV holders, please visit the webapp to redeem the treasury: https://t.co/SnRlvpXnaQ For all technical issues related to the claim, please check in at the channel on Discord. — Vader (@VaderProtocol) December 29, 2022 Vader protocol was an algorithmic stablecoin network similar to the failed Terra network. It was supposed to encourage arbitrages to keep USDV always equal to $1. When Terra assets depegged in May from the real-world assets they were supposed to represent, the Vader team paused the mint function of the app. It hoped to prevent users from exposing themselves t...

The 10 largest crypto hacks and exploits in 2022 saw $2.1B stolen

It’s been a turbulent year for the cryptocurrency industry — market prices have taken a huge dip, crypto giants have collapsed and billions have been stolen in crypto exploits and hacks. It was not even halfway through October when Chainalysis declared 2022 to be the “biggest year ever for hacking activity.” As of Dec. 29, the 10 largest exploits of 2022 have seen $2.1 billion stolen from crypto protocols. Below are those exploits and hacks, ranked from smallest to largest. 10: Beanstalk Farms exploit — $76M Stablecoin protocol Beanstalk Farms suffered a $76 million exploit on April 18 from an attacker using a flash loan to buy governance tokens. This was used to pass two proposals that inserted malicious smart contracts. The exploit was initially thought to have cost around $182 mil...

Crypto’s recovery requires more aggressive solutions to fraud

It’s hardly an exaggeration to say that our industry is facing tough times. We’ve been in the midst of a “crypto winter” for some time now, with the prices of mainstays, including Bitcoin (BTC) and Ether (ETH), tumbling. Likewise, monthly nonfungible token (NFT) trading volumes have fallen more than 90% since their multibillion dollar peak back in January of this year. Of course, these declines have only been exacerbated by the numerous black swan events rocking the crypto world, such as the FTX and Three Arrows Capital meltdowns. Taken together, it shouldn’t be a surprise that crypto is facing a trust deficit. While the destructive actions of reckless CEOs must be addressed and the individuals responsible for these events must be held accountable, our industry cannot stop there if w...