Crypto news

Sam Bankman-Fried to reportedly plead not guilty to criminal charges

Former FTX CEO Sam Bankman-Fried (SBF), currently free on a $250 million bail bond, will reportedly plead not guilty to the alleged FTX and Alameda-related financial frauds in court on Jan. 3. SBF was arrested in the Bahamas at the request of the U.S. government under suspicion of defrauding investors and misappropriation of funds held on the FTX crypto exchange. Following a court hearing on Dec. 22, SBF was released on bail and is slated to appear on court on Jan.3 before U.S. District Judge Lewis Kaplan in Manhattan. During the hearing, SBF is expected to enter a plea of not guilty to the criminal charges, according to a Reuters report. On Dec. 13, the SEC charged the former FTX CEO with violating the anti-fraud provisions of the Securities Act of 1933 and the Securities Exchange Act of ...

Winners and losers of 2022: A disastrous year that saw few winners among a sea of losers

2022 was supposed to be the year crypto went mainstream, with a significant chunk of traditional venture capital firms betting heavily on the ecosystem in 2021. However, with one disaster after another, 2022 turned out to be a catastrophic year for the nascent crypto ecosystem. Some of the biggest names touted as pivotal to taking the crypto ecosystem forward turned out to be the orchestrators of its worst year in recent memory. That said, quite a few protagonists rose to the occasion. These winners proved that crypto is not just about a few select individuals and companies but a vibrant ecosystem that can survive significant setbacks. Let’s start with some of the biggest winners of the crypto ecosystem in 2022. The list includes individuals, companies and anonymous groups working for the ...

Bitcoin stays put with yearly close set to seal 60% YTD BTC price loss

Bitcoin (BTC) kept traders guessing to the last minute into the 2022 yearly close as volatility remained absent from the market. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView BTC price: Where’s the volatility? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD clinging to a familiar area around $16,500. The pair continued to disappoint players on both sides of the trade after a sideways Christmas, ignoring the potential significance of the simultaneous weekly, monthly, quarterly and yearly candle close. “Technical resistance and overhead liquidity suggests sub $17k local top, but anything goes in the Wild Wild West,” on-chain analytics resource Material Indicators wrote in part of commentary on the Binance BTC/USD order book. An accompanying chart nonethe...

Crypto Biz: Did Michael Saylor buy the Bitcoin bottom for once?

Business intelligence firm MicroStrategy is showing no signs of backing down on its Bitcoin gambit. Right around the time that Sam Bankman-Fried was being exposed as a fraud, MicroStrategy was scooping up more Bitcoin (BTC) — this time, the firm bought as close to the bottom as it’s ever gotten. While Bitcoin can always go lower, seeing a MicroStrategy buy around $17K is refreshing. Interestingly, MicroStrategy also sold some BTC earlier this month — but not for the reason you think (more on that below.) The final Crypto Biz newsletter of 2022 discusses MicroStrategy’s Bitcoin buy, Fidelity Investments’ foray into the metaverse, Changpeng Zhao’s response to haters and the collective woes of Bitcoin miners. MicroStrategy adds to Bitcoin stake despite steep loss Business intelligence firm Mi...

DeFi sees exploits and exit scam drama in the last week of 2022: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. For DeFi, the last week of 2022 saw another slew of exploits, insider job accusations and exit scam drama. It all started on Christmas, when Defrost Finance, a decentralized leveraged trading platform on the Avalanche blockchain, was exploited by a DeFi flash loan attack causing $12 million in losses. However, the hacker behind the attacks reportedly returned a portion of the funds the next day. Security analytic firm Certik looked into the chain of events and concluded that the $12 million of funds drained were a part of an exit scam. On Dec. 26, when the Defrost exploit saga was unfolding, Bitkeep, a multichain ...

Proof of reserves is becoming more effective, but not all its challenges are technical

Proof of reserves (PoR) has gone from a buzzword to a roar in recent weeks as the crypto world tries to recover from the shock and losses of the current crypto winter. After a flurry of discussion and work, criteria and rankings for adequate PoR are beginning to appear, but the fine points of how to conduct proof of reserves, or even who should do it, remain open questions. The difference between proof of assets and proof of reserves was pointed out quickly, along with their deficiencies by themselves. Traditional auditors’ attempts at providing PoR were soon frustrated, with major firms stepping up and quickly retreating. I’m sorry but no. This is not PoR. This is either ignorance or intentional misrepresentation. The merkle tree is just hand wavey bullshit without an auditor to mak...

‘Crypto winter’ won’t end in 2023 — Bitcoin advocate David Marcus

Bitcoin (BTC) and crypto will need until at least 2024 to “recover from the abuse of unscrupulous players,” says one of the industry’s best-known names. In a blog post released on Dec. 30, David Marcus, CEO and founder of Bitcoin firm Lightspark, disappointed bulls with his outlook for the coming years. Marcus: “Crypto winter” will likely last until 2025 Less than two months after the FTX meltdown, the repercussions continue to unsettle sentiment and price performance alike. For Marcus, famous for his crypto role at Meta and before that PayPal, bad actors have a lot to answer for, and their specter will remain with the crypto industry beyond 2023. While mentioning FTX only once, he referenced what he called “unscrupulous players” dragging out marke...

Ethereum founder says he hopes Solana gets a ‘chance to thrive’

Ethereum founder Vitalik Buterin showed sympathy for competitor Solana (SOL) in a Dec. 30 tweet. He said that “smart people” tell him that Solana has “an earnest smart developer community,” and suggested that the opportunists who were involved with the project in the past have been “washed out.” Buterin also expressed hope that the Solana community “gets its fair chance to thrive.” Some smart people tell me there is an earnest smart developer community in Solana, and now that the awful opportunistic money people have been washed out, the chain has a bright future. Hard for me to tell from outside, but I hope the community gets its fair chance to thrive — vitalik.eth (@VitalikButerin) December 29, 2022 The price of SOL has fallen by over 90% since its peak, partially because of the coin’s a...

Bithumb’s largest shareholder executive found dead following allegations of embezzlement

Mr. Park Mo, the vice president of Vidente, the largest shareholder of South Korean Cryptocurrency exchange Bithumb,was reportedly found dead in front of his home at 4 am, on the morning of Dec. 30. Prior to his death, Mr. Mo had been named as a primary suspect in an investigation launched by South Korean prosecutors for his alleged involvement in the embezzling funds at Bithumb-related companies, as well as, manipulating stock prices. In October 2021, the Financial Investigation Division of the Seoul Southern District Prosecutor’s Office launched an investigation into allegations made against Mr. Park Mo, which led to the seizing of Bithumb-affiliated companies such as Vident, Inbiogen, and Bucket Studio. Vident, a KOSDAQ-listed company, is known to be Bithumb’s la...

Sam Bankman-Fried denies moving funds from Alameda wallets

Sam Bankman-Fried, the former CEO of the now-defunct FTX exchange, has denied moving funds tied to Alameda wallets, days after he was released on a $250 million bond. On Dec. 30, Fried tweeted to his 1.1 million followers, denying any involvement in the movement of funds from Alameda wallets. In response to the allegations that he may have been responsible for moving funds out of Alameda wallets, he shared: “None of these are me. I’m not and couldn’t be moving any of those funds; I don’t have access to them anymore.” None of these are me. I’m not and couldn’t be moving any of those funds; I don’t have access to them anymore.https://t.co/5Gkin30Ny5 — SBF (@SBF_FTX) December 30, 2022 SBF’s tweet was in response to a news story published by Coint...

New research indicates boomers make better crypto investors

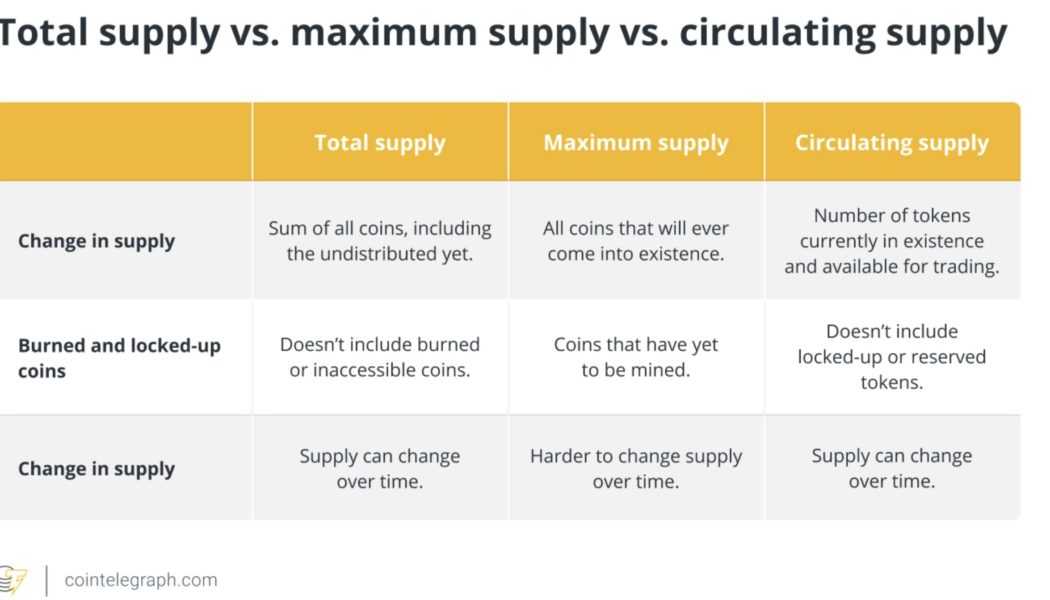

As a millennial, it’s hard to say this, but boomers are doing crypto better. They are taking research methods used in the traditional markets and applying them to crypto projects, according to a new report from Bybit and consumer research company Toluna. The report says that 34% of boomers spend “a few days” doing due diligence on a project before investing — 50% more than other generations. More concerning still, “64% of North American investors spend less than two hours or don’t DYOR at all.” Boomers are also more likely to focus their research on technical factors such as tokenomics, revenue and competitor landscape. Compare this with their younger compatriots, who are more likely to prize reputational elements such as a charismatic founder and “website aesthetics.” This shows that bein...