Crypto news

These 4 altcoins may attract buyers with Bitcoin stagnating

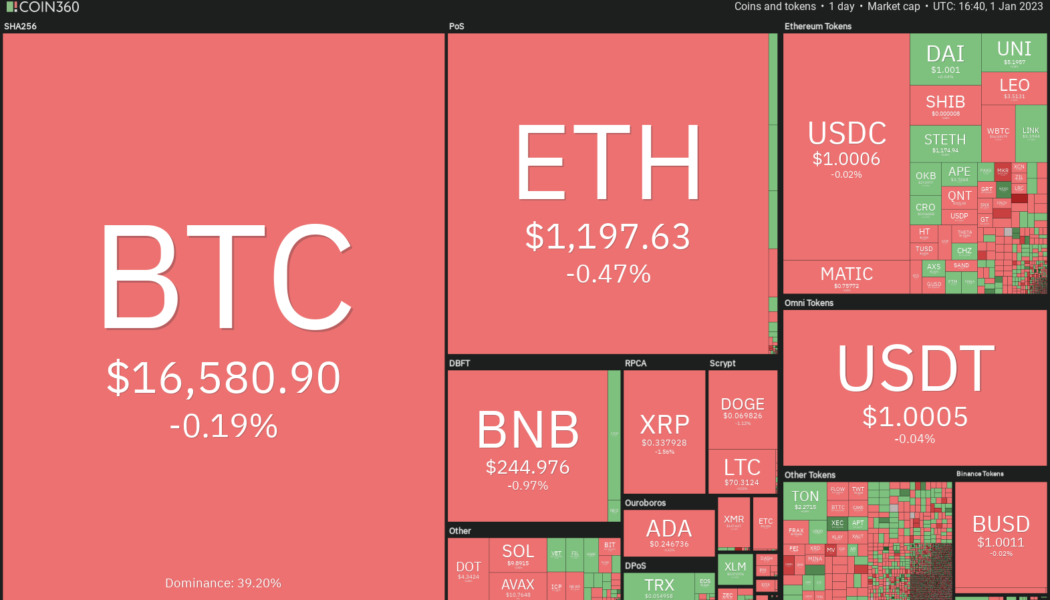

Bitcoin’s (BTC) volatility remained subdued in the final few days of the last year, indicating that investors were in no hurry to enter the markets. Bitcoin ended 2022 near $16,500 and the first day of the new year also failed to ignite the markets. This suggests that traders remain cautious and on the lookout for a catalyst to start the next trending move. Several analysts remain bearish about Bitcoin’s near-term price action. David Marcus, CEO and founder of Bitcoin firm Lightspark, said in a blog post released on Dec. 30 that he does not see the crypto winter ending in 2023 and not even in 2024. He expects that it will take time to rebuild consumer trust but believes the current reset may be good for legitimate firms over the long term. Crypto market data daily view. Source: Coin360 The...

SushiSwap CEO proposes new tokenomics for liquidity, decentralization

Jared Grey, CEO of the decentralized exchange Sushiswap, has plans to redesign the tokenomics of the SUSHI token, according to a proposal introduced on Dec. 30 in the Sushi’s forum. As part of the new proposed tokenomics model, time-lock tiers will be introduced for emission-based rewards, as well as a token burning mechanism and a liquidity lock for price support. The new tokenomics aims to boost liquidity and decentralization in the platform, along with strengthening “treasury reserves to ensure continual operation and development,” noted Grey. In the proposed model, Liquidity Providers (LPs) would receive 0.05% of swap fees revenue, with higher volume pools receiving the biggest share. LPs will also be able to lock their liquidity to earn boosted, emissions-based rewar...

What is USD Coin (USDC), fiat-backed stablecoin explained

USDC offers instant payments, saves users from the cryptocurrency market’s price volatility and is audited by a regulated auditing firm, making it a transparent stablecoin. However, it does not offer price appreciation opportunities, and investors may incur high transaction and withdrawal fees while dealing with USDC. One of the key advantages of the USD Coin is the speed of the transaction. Usually, one must wait a long time to send and receive USD because institutions such as banks and their complex procedures slow down the processing of transactions. Nonetheless, USDC allows instant clearing and settlement of payments. In addition, stablecoins like USDC saves users from the price volatility of cryptocurrencies, as leading American financial institutions ensure that Circle&...

Bitcoin ‘not undervalued yet,’ says research as BTC price drifts nearer to $16K

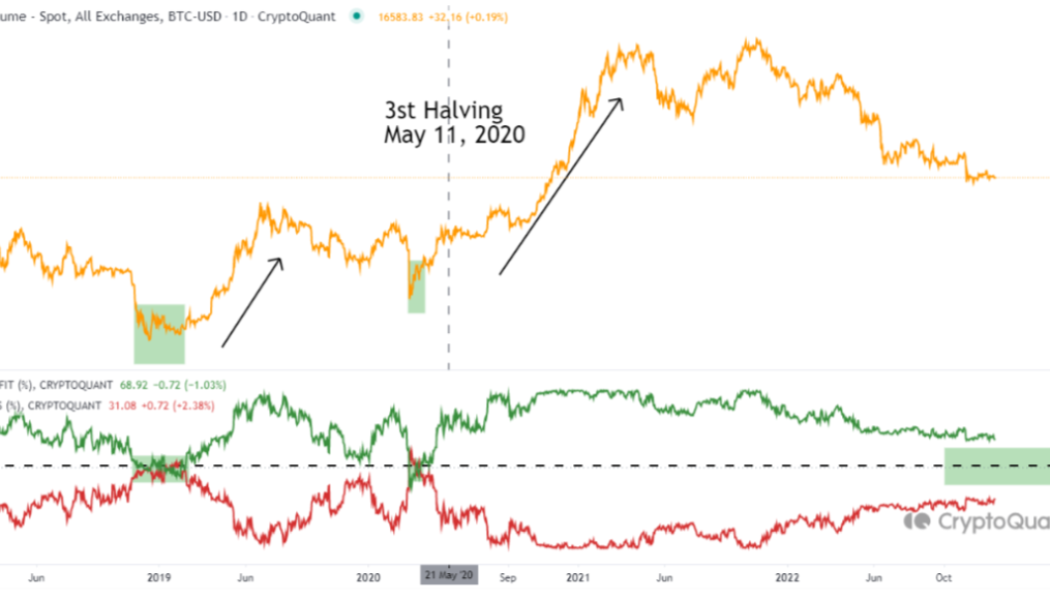

Bitcoin (BTC) may not be at a good value enough for a macro price bottom, according to analysis from CryptoQuant. In a blog post on Dec. 29, a contributor to the on-chain analytics platform flagged one BTC price indicator with further left to fall. Profitability indicator lacks key cross At nearly 80% below all-time highs, BTC/USD is nearing the zone in which it bottomed during previous bear markets. As CryptoQuant’s MAC_D notes, there is no shortage of instruments pointing to the 2022 bear market bottom already forming. Despite this, however, the signs are not yet unanimous, and pointing to transactions in profit and loss, he warns that cheaper BTC prices may still enter. CryptoQuant’s unspent transaction outputs (UTXOs) in profit and loss indicator currently shows around 30% of transacti...

10 crypto tweets that aged like milk: 2022 edition

To put it lightly, it has been a wild year for the crypto sector. In the span of less than 12 months, the third-most valuable stablecoin imploded, leading to a domino effect that saw crypto lender Celsius go bankrupt, Three Arrows Capital’s founders go runabout and one of crypto’s most “altruistic” executives flown home in cuffs. In this article, Cointelegraph has selected 10 crypto-related tweets that have aged like spoilt milk. Do Kwon — “Steady lads” On May 10, just as the algo-stablecoin formerly known as TerraUSD started to fall below its dollar peg, the Terraform Labs founder attempted to allay fears of a further depeg, tweeting: “Deploying more capital – steady lads.” Well, we all know what happened after. The collapse of the Terra ecosystem in May 2022 saw more than $40 billi...

Australia overtakes El Salvador to become 4th largest crypto ATM hub

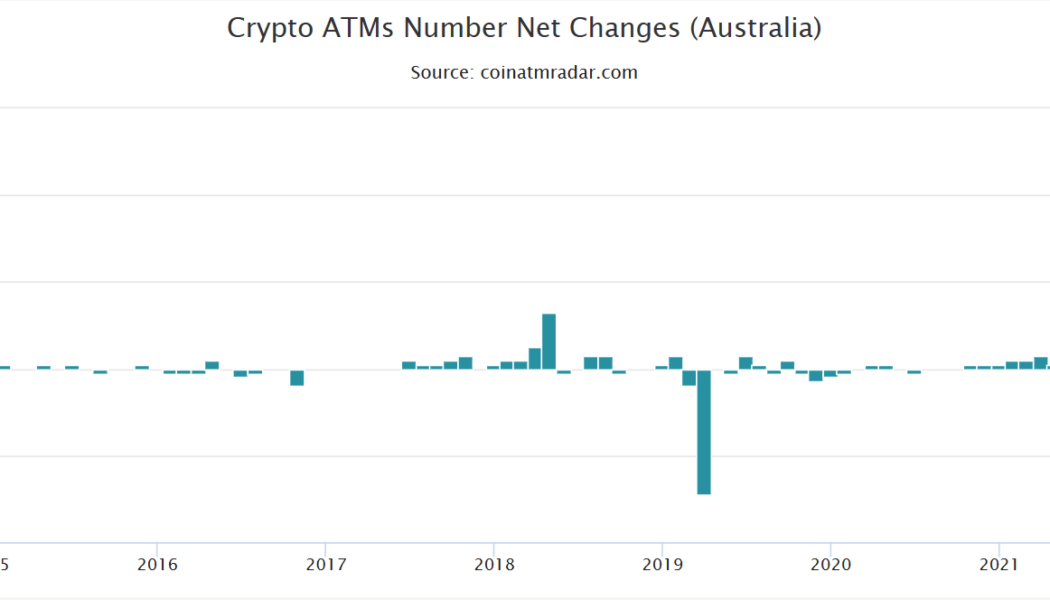

El Salvador, the first country to legalize Bitcoin (BTC), has been pushed down yet another spot in total crypto ATM installations as Australia records 216 ATMs stepping into the year 2023. As part of El Salvador’s drive to establish Bitcoin as a legal tender, President Nayib Bukele had decided to install over 200 crypto ATMs across the country. While this move made El Salvador the third largest crypto ATM hub at the time after the United States and Canada in September 2021, Spain and Australia overtook the Central American country’s ATM count in 2022. On October 2022, Cointelegraph reported that Spain became the third-largest crypto ATM hub after installing 215 crypto ATMs. However, Spain continued its installation drive and is home to 226 crypto ATMs at the time of writing. El Salvador’s ...

US lawmakers under pressure following FTX collapse: Report

Legislators in the United States seem to be reevaluating the crypto industry and its regulatory needs in light of FTX’s collapse. According to the Wall Street Journal, since the crypto exchange filed for bankruptcy in November, lawmakers have been under pressure to set a new regulatory framework for cryptocurrencies. Several proposals are in the works that would apply existing banking, securities, and tax rules to cryptocurrencies, and lawmakers are calling on the Securities and Exchange Commission (SEC) to adopt an aggressive approach to the crypto market. In a December House hearing, Rep. Jake Auchincloss, who is also a member of the bipartisan Congressional Blockchain Caucus, reportedly noted that “it’s time for the blockchain investors and entrepreneurs to build thing...

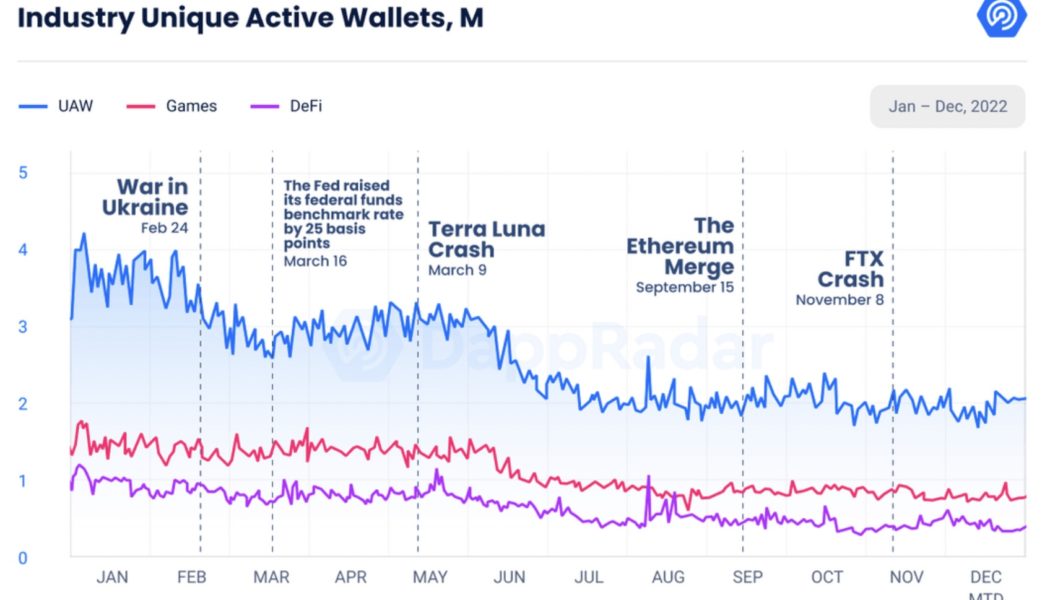

2023 will see the death of play-to-earn gaming

Play-to-earn gaming enabled by blockchain technology has grown exponentially over the few years. Gamers have embraced the opportunity to collect cryptocurrencies or nonfungible tokens (NFTs) that have been produced in blockchain-based games. Through the advent of this new technology, players have been able to generate income by selling in-game NFTs or earning cryptocurrency rewards, both of which can be exchanged for fiat cash. Because of this, according to data from Absolute Reports, the estimated value of the GameFi industry will grow to $2.8 billion by 2028, with a compound annual growth rate of 20.4% over the same period. But such predictions may well prove to be unfounded. Given the rate of exponential growth over recent years, one might think that there was absolutely n...

SBF to enter plea deal, Mango’s exploiter arrested, and Celsius news: Hodler’s Digest, Dec. 25-31

Top Stories This Week Bankman-Fried may enter plea in NY federal court next week before Judge Lewis Kaplan Former FTX CEO Sam Bankman-Fried is scheduled to appear in court on the afternoon of Jan. 3 to enter a plea on two counts of wire fraud and six counts of conspiracy against him in relation to the collapse of the FTX cryptocurrency exchange. After being released on a $250 million bail bond, Bankman-Fried reportedly met with Michael Lewis, author of The Big Short: Inside the Doomsday Machine, a bestseller that was turned into a movie, spurring speculation that a film about the disgraced exchange’s saga is on the way. SBF borrowed $546M from Alameda to fund Robinhood share purchase In another headline related to Sam Bankman-Fried, an affidavit by the founder of FTX revealed that he previ...

Top crypto funding stories of 2022

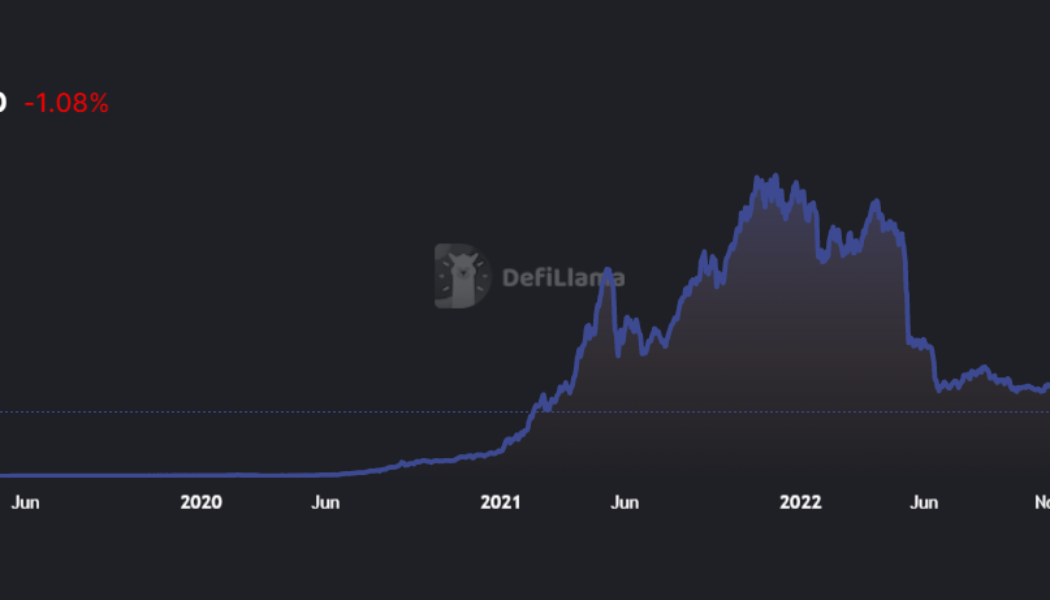

2022 was a watershed year for crypto venture capital, as investors poured tens of billions of dollars into blockchain-focused startups despite the overwhelmingly bearish trend in asset prices. Is the VC-dominated crypto funding model good for the industry? Only time will tell. Cointelegraph Research is still in the process of tallying all the funding figures for the year, but 2022 easily outpaced all other years in terms of total capital raised and deals completed. VC inflows were above $14 billion in each of the first two quarters before receding to just under $5 billion in the third quarter — still an impressive tally given the industry-wide contagion sparked by the sudden collapses of Celsius, Three Arrows Capital, Genesis, BlockFi and FTX, among others. Against this backdrop, we’...

Companies and investors may need to return billions in funds paid by FTX

The collapse of FTX Group may not yet be finished with its contagious spread, as clawback provisions could force businesses and investors to return billions of dollars paid in the months leading up to the crypto exchange’s collapse, an insolvency attorney told Cointelegraph. In short, a “clawback” refers to money paid out that is required to be returned due to special circumstances or events, such as an insolvent company that needs to recover funds paid within 90 days before filing for Chapter 11. If the creditor is an insider, the 90-day period is extended to one year. As a result, creditors could seek a clawback on transfers made by FTX to external parties, including the $2.1 billion paid by FTX to Binance when Binance exited its Series A investment in FTX. Changpeng “CZ” Zhao, Binance‘s...