Crypto news

Coinbase agrees to $100M settlement with NY regulator

The New York State Department of Financial Services, or NYDFS, has reached an agreement with Coinbase following an investigation into the cryptocurrency exchange’s compliance program. In a Jan. 4 announcement, the NYDFS said Coinbase will pay a $50-million fine in response to violations of New York’s financial services and banking laws, as well as invest $50 million to correct its compliance program. According to the financial regulator, the crypto exchange had many compliance “deficiencies” related to anti-money laundering (AML) requirements. The NYDFS reported issues with Coinbase’s process for onboarding users and monitoring transactions. “Coinbase has acknowledged its failures in this respect to the Department,” said the NYDFS. “Furthermore, certain of these issues have been known to C...

Web3 projects aim to create engagement between fans and sports leagues

The multi-billion-dollar sports industry is undergoing a digital transformation and Web3 elements are likely to play a major role. This notion was highlighted in Deloitte’s “2022 Sports Industry Outlook” report, which predicts an acceleration in the blending of real and digital worlds, along with growing markets for nonfungible tokens (NFTs) and immersive technologies. According to the report, such advances may lead to a significant increase in fan engagement. This is an important point to consider, given that fan engagement has long served as the backbone for ensuring sponsor revenue, ticket and merchandise sales, along with the overall popularity of a sports league. Yet as technology advances, sports fans have expressed interest in forming deeper relationships with sports leagues. ...

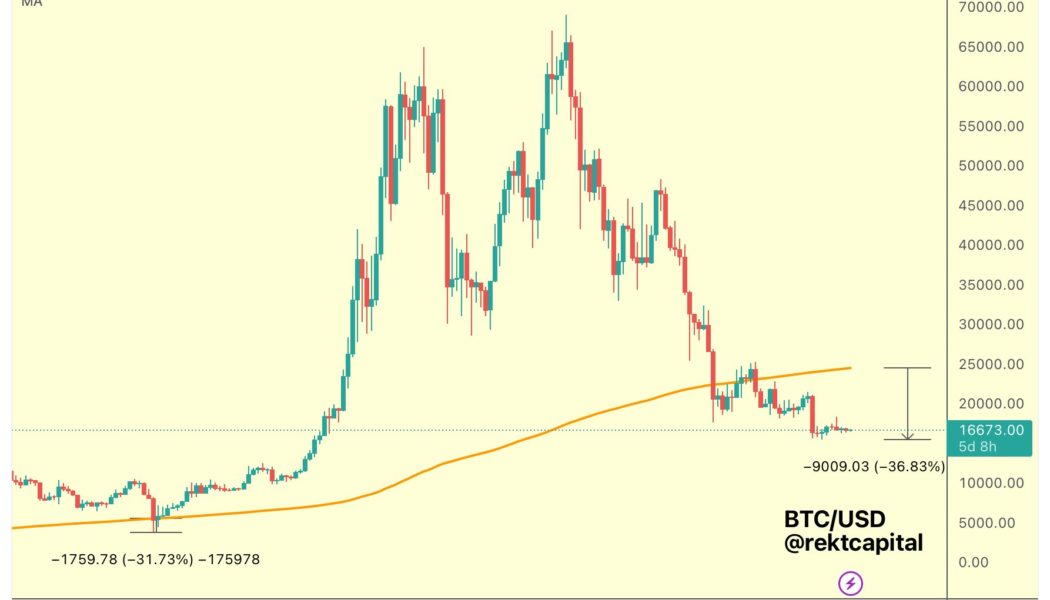

$16.8K Bitcoin now trades further below this key trendline than ever

Bitcoin (BTC) is now further below a key moving average than it was at the pit of the March 2020 COVID-19 crash. In a tweet on Jan. 4, popular trader and analyst Rekt Capital revealed just how remarkable the current Bitcoin bear market really is. BTC price 200-week moving average out of reach Not only has Bitcoin now spent more time below its 200-week moving average (WMA) than ever before, it is now further beneath it than at any time in history. Looking at the weekly BTC/USD chart, Rekt Capital confirmed that as of Jan. 4, BTC/USD traded around 37% below the 200 WMA. This, he noted, was “Deeper than the -31% retracement in March 2020.” The numbers provide interesting reading in a bear market which has yet to see BTC price retracements from all-time highs rival previous bottoms in percenta...

How time-weighted average price can reduce the market impact of large trades

Time-weighted average price is an algorithmic trade execution strategy commonly used in traditional finance tools. The goal of the strategy is to produce an average execution price that is relatively close to the time-weighted average price (TWAP) for the period that the user specifies. TWAP is mainly used to reduce a large order’s impact on the market by breaking it down into smaller orders and executing each one at regular intervals over a period of time. How TWAP can reduce the price impact of a large order Bids can influence the price of an asset in the order books or liquidity in the liquidity pools. For example, order books have multiple buy and sell orders at different prices. When a large buy order is placed, the price of an asset rises because all of the cheapest buy orders are be...

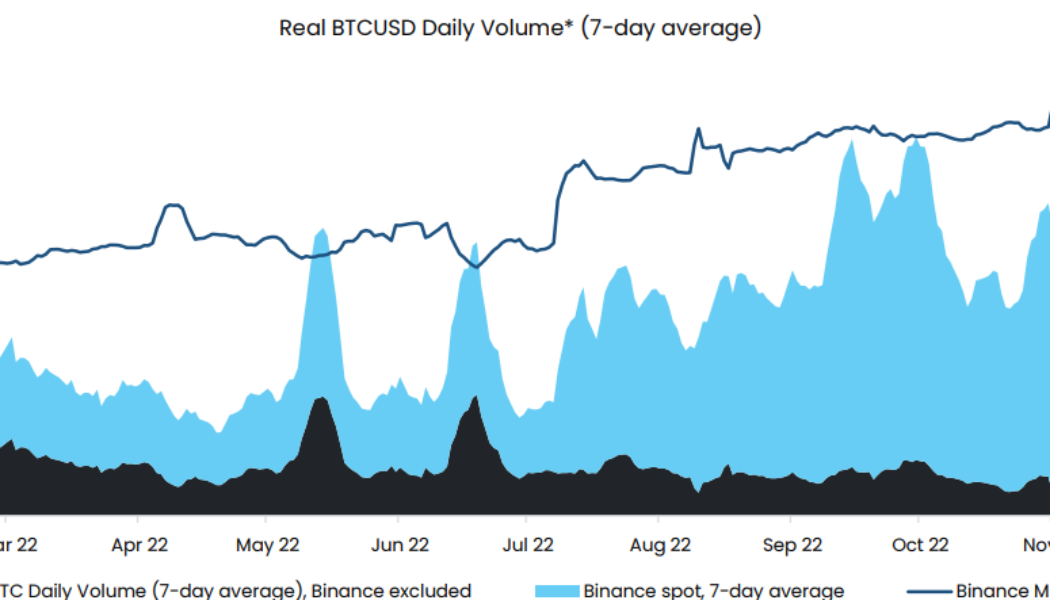

‘Binance is the crypto market’: Arcane crowns the exchange 2022’s winner

During a year plagued by crises such as the collapse of FTX and Celsius, data shows that crypto exchange Binance has emerged as the clear “winner” of 2022 according to Arcane Research. A Jan. 3 report from Arcane highlighted that Binance saw its market dominance soar throughout 2022. As of Dec. 28 last year it had captured 92% of the Bitcoin (BTC) spot market and 61% of the BTC derivatives market by volume: “There are no other evident ‘winners’ of 2022 other than Binance when it comes to the crypto market structure and market dominance. No matter how you look at it in terms of trading activity, Binance is the crypto market.” Binance’s BTC spot market dominance was 45% at the start of 2022 meaning that it more than doubled, while its share of the BTC derivatives market increased by almost o...

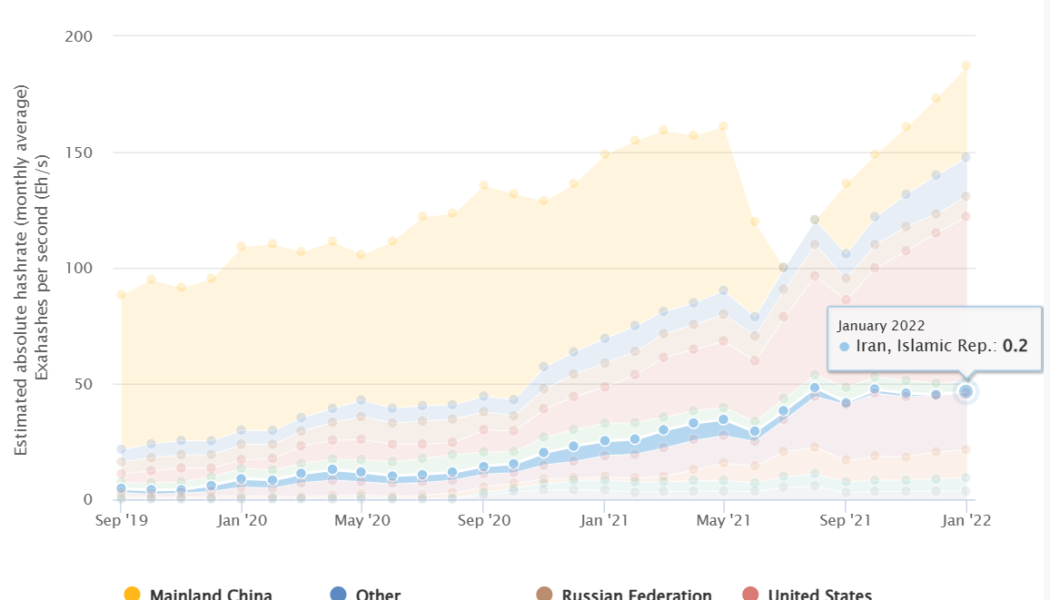

Iran court orders the release of seized crypto mining equipment

Iranian authorities seized numerous crypto mining equipment over the past two years, citing stress on energy grids during winter. Now, a court ordered the release of crypto-mining equipment that was previously seized as a measure to conserve energy. Since 2021, Iran’s Organization for Collection and Sale of State-Owned Property (OCSSOP) has seized mining equipment — both authorized and unauthorized — due to looming power shortage concerns. However, the authorities had a change of heart amid winter as they ordered the release of the seizure. As explained by Abdolmajid Eshtehadi, the head of Iran’s Ministry of Economic Affairs and Finance: “Currently some 150,000 crypto mining equipment are held by the OCSSOP, a large part of which will be released following judicial rulings. Mach...

Indonesia to launch national crypto exchange in 2023: Report

As a part of its reform of crypto regulation, Indonesia will create a crypto exchange in 2023, according to reports. The platform is planned to be launched prior to a shift of regulatory power from commodities to securities authority. On Jan. 4, the head of the Commodity Futures Trading Regulatory Agency of Indonesia (Bappebti), Didid Noordiatmoko, stated that a crypto exchange should be set up this year. The move comes as a part of broader financial reform launched in December 2022. In accordance with the reform, in the next two years, the crypto oversight will be taken from Bappebti, a commodities-focused agency, by the Financial Services Authority (FSA). The Financial Sector Development and Reinforcement bill (P2SK) was ratified by the House of Representatives of Indonesia on Dec....

US federal agencies release joint statement on crypto asset risks and safe practices

United States federal bank regulatory agencies started off the new year with a statement on crypto assets looking back at the troubles of the crypto sector in 2022. The Federal Reserve, Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC) released a joint statement on Jan. 3 on past problems and their efforts to maintain sound banking practices in spite of those challenges. “It is important that risks related to the crypto-asset sector that cannot be mitigated or controlled do not migrate to the banking system,” the agencies stated. They identified eight specific risks, including fraud, volatility, contagion and similar familiar issues. Related: Approach with caution: US banking regulator’s crypto warning The agencies also noted that, “B...

Users need to go under the engine in Web3 — HashEx CEO

Hacking in Web3 is easy because it uses the same pattern that’s been used since the inception of the internet — pretending to be someone else. Due to the complexity and the “cool factor” of Web3 projects, one can easily — and mistakenly — assume that it takes Mr. Robot level of advanced hacking techniques to pull off a successful attack. In truth, however, it only takes a sinister ad placed on Google search results, an impostor Telegram group or a deviously-crafted email to break the security barriers of the Web3 ecosystem. Blockchain projects can use top-notch smart contracts, securely integrate crypto wallets and use best practices in each digital step across the board. But they still need help with the social aspect of user protection. Web3 takes the “ownership” from central entit...

Crypto adoption in 2022: What events moved the industry forward?

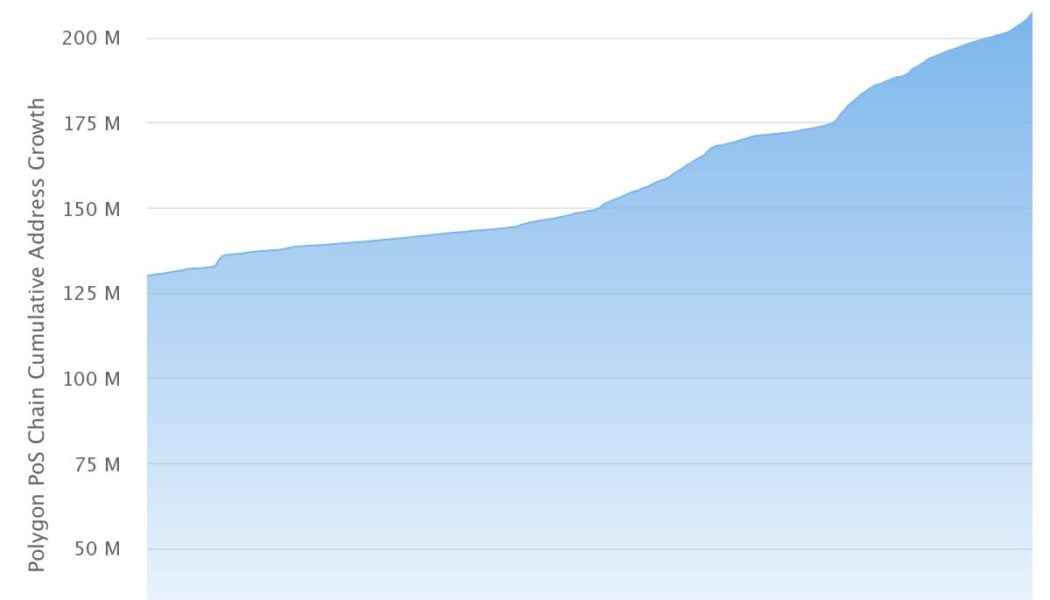

It’s no secret that the crypto market was gripped by bearish pressure for the entirety of 2022. However, amid all the volatility and chaos, many positive news stories appeared as well — especially regarding the global adoption of digital assets and crypto-related technologies in general. Looking back at 2022, here are some key adoption-related events that helped drive the industry last year. Polygon accrues 200 million addresses despite challenging 2022 Even though an air of financial uncertainty has shrouded the crypto market since the end of 2021, Polygon — a layer-2 scaling solution running alongside the Ethereum blockchain, allowing for speedy transactions and low fees — continued to witness a lot of growth in 2022. To this point, the network’s unique address count recently surpassed t...

Ripple CEO optimistic about US ‘regulatory clarity for crypto’

Ripple’s CEO, Brad Garlinghouse, shared in a Jan. 3 Twitter thread he’s “cautiously optimistic” about the United States gaining “breakthrough” regulatory clarity for the cryptocurrency industry in 2023. To mark the first day of the 118th Congress, Garlinghouse shared his hopes of 2023 being the year the U.S. gained regulatory clarity for crypto and added support for regulation is “bipartisan & bicameral.” Today is the first day of the 118th Congress. While prior efforts at regulatory clarity for crypto in the US have stalled, I am cautiously optimistic that 2023 is the year we will (finally!) see a breakthrough. A thread on why… — Brad Garlinghouse (@bgarlinghouse) January 3, 2023 Garlinghouse said the U.S. was not starting with a “blank slate” for regulation, r...