Crypto news

Marathon Digital experiments with overclocking to increase competitive advantage

One of the largest Bitcoin mining operations in North America, Marathon Digital Holdings, has shared in an update that it has been experimenting with overclocking to increase its competitive advantage in the Bitcoin mining industry. Overclocking is the practice of increasing the clock speed of a computer’s central processing unit (CPU) or graphics processing unit (GPU) beyond the manufacturer’s rated maximum speed, potentially leading to improved performance in certain tasks. According to the company’s press release, it produced 475 BTC in December 2022, bringing its total mined Bitcoins in the fiscal year of 2022 to 4,144 BTC, a 30% increase from 3,197 BTC which was produced in 2021. Marathon’s Chairman and CEO, Fred Thiel commented on the company’s decision to experimen...

Ethereum’s Shanghai upgrade could supercharge liquid staking derivatives — Here’s how

The crypto market witnessed the DeFi summer of 2020, where decentralized finance applications like Compound and Uniswap turned Ether (ETH) and Bitcoin (BTC) into yield-bearing assets via yield farming and liquidity mining rewards. The price of Ether nearly doubled to $490 as the total liquidity across DeFi protocols quickly surged to $10 billion. Toward the end of 2020 and early 2021, the COVID-19-induced quantitative easing across global markets was in full effect, causing a mega-bull run that lasted almost a year. During this time, Ether’s price increased nearly ten times to a peak above $4,800. After the euphoric bullish phase ended, a painful cool-down journey was exacerbated by the UST-LUNA crash which began in early 2022. This took Ether’s price down to $800. A ray of hope eventually...

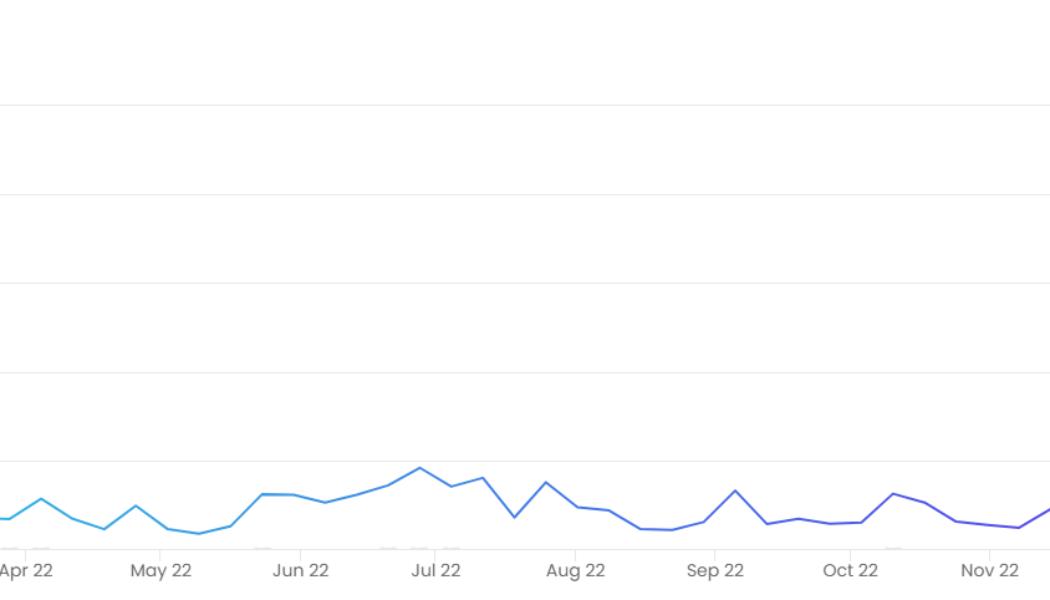

2023 could be a rocky year for crypto venture investments: Galaxy Research

Last year was a big one for crypto venture capital despite multiple high-profile meltdowns and the FUD (fear, uncertainty, and doubt) tsunami that followed. However, the funds may not flow as easily this year, a crypto researcher warns. The number of deals and amount invested by venture firms into Web3 and crypto startups was a little over $30 billion in 2022, according to Galaxy Research Galaxy’s head of firmwide research, Alex Thorn, described it as a “monster year” that was only just eclipsed by the $31 billion in VC investments in 2021. However, in a Jan. 5 report, Thorn stated that macroeconomic and crypto market conditions led to significant investment drawdowns in Q3 and Q4. This will likely continue into 2023, until macro and crypto market conditions improve. Thorn noted that there...

Doubts mount over Huobi’s future as harsh layoff rumors denied

Speculation on Twitter that crypto exchange Huobi has laid off staff and shuttered internal communications have prompted the community to advise users to withdraw funds, despite an adviser to the exchange denying the rumors. In a Jan. 5 tweet, Huobi adviser Justin Sun addressed rumors of purported insolvency, saying the business development of the exchange was “good” and the “security of users’ assets will always be fully protected.” Sun also seemingly brushed off speculation around disgruntled staff, saying Huobi will “fully respect the legal demands of local employees.” Earlier, on Jan. 3, crypto journalist Colin Wu reported that Sun changed Huobi employee salaries from being paid in fiat to being paid in either Tether (USDT) or USD Coin (USDC). Wu claimed the staff who disagreed with th...

1.5M houses could be powered by the energy Texas miners returned

During the winter storm in Texas in December 2022, Bitcoin (BTC) mining operators returned up to 1,500 megawatts of energy to the distressed local grid. It became possible due to the flexibility of mining operations and the ancillary services, provided by the state authorities. In his commentary to Satoshi Action Fund, Texas Blockchain Council president Lee Bratcher stated that miners returned up to 1,500 megawatts to the Texas grid. This amount of energy would be enough to heat “over 1.5 million small homes or keep 300 large hospitals fully operational,” according to the calculations from the Bitcoin advocacy group. While there’s no specification regarding the exact time period in which miners have accumulated such an amount of power, the global Bitcoin mining hashrate dropped by 30...

US authorities are turning their attention to FTX’s Nishad Singh: Report

The United States Securities and Exchange Commission and Commodity Futures Trading Commission and prosecutors are reportedly investigating former FTX engineering director Nishad Singh for potentially having a role in defrauding investors and users. According to a Jan. 5 report from Bloomberg, U.S. officials are looking at individuals in former FTX CEO Sam Bankman-Fried’s inner circle as part of their criminal probe of the exchange’s collapse. Bankman-Fried has pleaded not guilty to all criminal charges against him, but former Alameda Research CEO Caroline Ellison and FTX co-founder Gary Wang reached plea deals with prosecutors in December, admitting to fraud at the company. Sam Bankman-Fried has arrived in court for his arraignment. We’re told he will plead not guilty to all the cha...

Asia Express: China’s NFT market, Moutai metaverse popular but buggy…

In a joint effort between the state-owned Chinese Technology Exchange, the state-owned Art Exhibitions China and the corporation Huban Digital Copyrights Ltd, China’s first national NFT marketplace is scheduled to come online this week. It’s designed as a secondary market for trading digital collectibles, along with copyrights for digital assets. Perhaps unsurprisingly, it’s built on China’s national Wenbao, or “cultural protection” blockchain, which helps verify the authenticity of artifacts and commercial goods. Currently, only the NFT platform’s landing page is accessible. 1400 blockchain firms in China On Dec. 29, the state-owned China Academy for Information and Communications Technology, or CAICT, disclosed in its national white paper that over 1,400 blockchain firms are operating in...

Mutant Ape Planet creator arrested in NY for alleged $2.9M NFT ‘fraud’

The developer of a Mutant Ape Yacht Club knock-off collection — Mutant Ape Planet — has been arrested in New York, charged with allegedly “defrauding” investors of $2.9 million in a “rug pull scheme.” The arrest took place on Jan. 4 at the John F. International Airport in New York, with homeland security agent Ivan J. Arvelo alleging that French national “Aurelien Michel perpetrated a rug pull scheme” and stole “nearly $3 million from investors for his own personal use,” stating: “Purchasers of Mutant Ape Planet NFTs thought they were investing in a trendy new collectible, but they were deceived and received none of the promised benefits” Internal Revenue Service agent Thomas Fattorusso was also cited in a press release from the Department of Justice, alleging that “Miche...

Metacade Gears Up for 100x Gains after MCADE is selling out quickly in Presale

Metaverse and GameFi company Metacade (MCADE) is causing quite a stir in the crypto industry. With its presale selling out quickly, there is already talk of Metacade gearing up for 100x gains. Read on to learn why so many crypto analysts and experts are so excited by this P2E (play-to-earn) newcomer – and why you should waste no time in checking out the Metacade presale. For a great investment opportunity, it has to be Metacade If you’re looking to invest in cryptos in 2023, the GameFi / P2E sector offers excellent potential. And if you’re looking to invest in the best GameFi / P2E companies, Metacade is gaining increasing traction and standing in the sector. In fact, some seasoned market watchers have been talking of potential 100x gains from the Metacade presale, based on its g...

Alex Mashinsky sued by NY AG for allegedly hiding Celsius’ ‘dire financial condition’

New York Attorney General Letitia James has filed a lawsuit against Alex Mashinsky, alleging the Celsius founder and CEO made numerous “false and misleading statements” which led to investors losing billions. In a Jan. 5 announcement, the New York Attorney General’s office announced the lawsuit, which allegedly involved defrauding investors — including more than 26,000 residents of the U.S. state — out of billions of dollars worth of crypto. According to James, Mashinsky’s actions leading up to Celsius declaring bankruptcy contributed to investor losses by misrepresenting the platform’s financial condition and failing to abide by certain regulatory requirements. “As the former CEO of Celsius, Alex Mashinsky promised to lead investors to financial freedom but led them down a path of f...