Crypto news

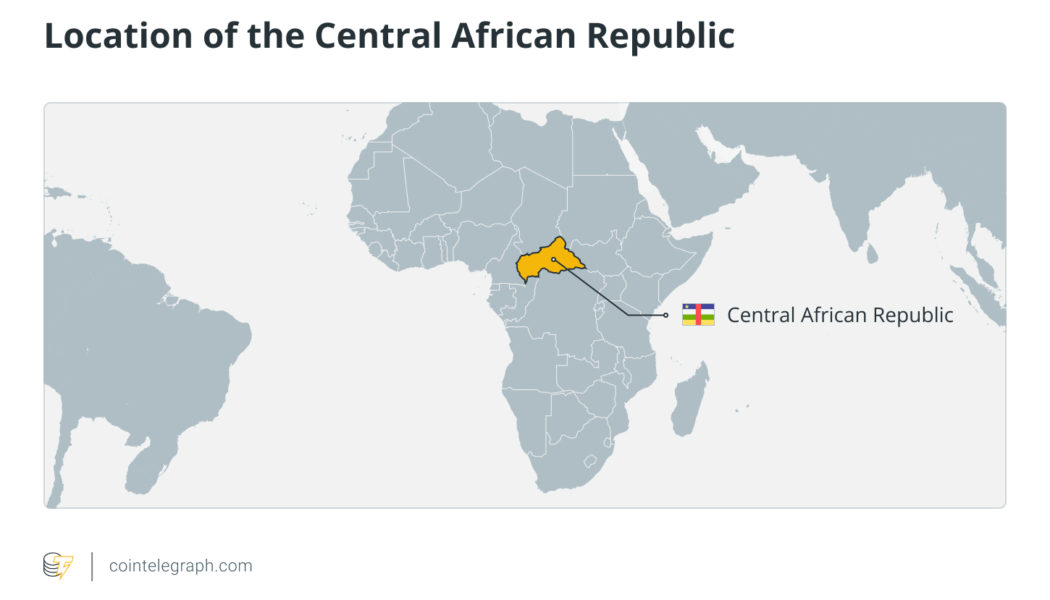

Bitcoin, Sango Coin and the Central African Republic

In the spring of 2022, the Central African Republic (CAR) became the first African country to adopt Bitcoin (BTC) as a legal tender. As the second country globally to recognize Bitcoin in such a fashion, the CAR followed in El Salvador’s footsteps. El Salvador has since boasted surging tourism numbers, a resilient economy and a healthy amount of free PR since allowing its citizens to make everyday purchases with the seminal cryptocurrency. The CAR, a substantially less economically developed economy than its Central American counterpart, would hope to emulate El Salvador’s success. Despite the nation’s vast natural resource wealth, the CAR is plagued by economic mismanagement, meager private and foreign investment, and systemic governmental issues. It is one of the poorest countries on the...

Digital Currency Group under investigation by U.S. authorities: Report

Crypto conglomerate Digital Currency Group, or DCG, are under investigation by the United States Department of Justice’s Eastern District of New York (EDNY) and the Securities and Exchange Commission (SEC), according to a Bloomberg report. The authorities are digging into internal transfers between DCG and its subsidiary crypto lending firm Genesis Global Capital, noted the report citing people familiar with the matter. Prosecutors have already requested interviews and documents from both the companies, while the SEC is running an early-stage similar inquiry. As of yet, no indictment has been brought against DCG, nor have both U.S. authorities provided any information about the case. According to a spokesperson for DCG, the company was unaware of the investigation. “DCG h...

El Salvador’s Bitcoin strategy evolved with the bear market in 2022

Cryptocurrency adoption has been on the rise in El Salvador in recent years, with the country becoming the first in the world to adopt Bitcoin (BTC) as a legal tender. This landmark decision has attracted the attention of the global cryptocurrency community and has sparked discussions on the potential benefits and challenges of widespread adoption. El Salvador’s controversial move with its cryptocurrency adoption would not have been possible if it was not due to President Nayib Bukele, who garnered international attention after announcing the Bitcoin adoption plan and passed it into law. The legislation required all businesses within the country to accept Bitcoin as a form of payment for goods and services. As a legal tender, Bitcoin now has the same status as traditional fiat currencies, ...

Macroeconomic data points toward intensifying pain for crypto investors in 2023

Undoubtedly, 2022 was one of the worst years for Bitcoin (BTC) buyers, primarily because the asset’s price dropped by 65%. While there were some explicit reasons for the drop, such as the LUNA-UST crash in May and the FTX implosion in November, the most important reason was the U.S. Federal Reserve policy of tapering and raising interest rates. Bitcoin’s price had dropped 50% from its peak to lows of $33,100 before the LUNA-UST crash, thanks to the Fed rate hikes. The first significant drop in Bitcoin’s price was due to growing market uncertainty around potential rate hike rumors in November 2021. By January 2022, the stock market had already started showing cracks due to the increasing pressure of imminent tapering, which also negatively impacted crypto prices. BTC/USD daily price chart. ...

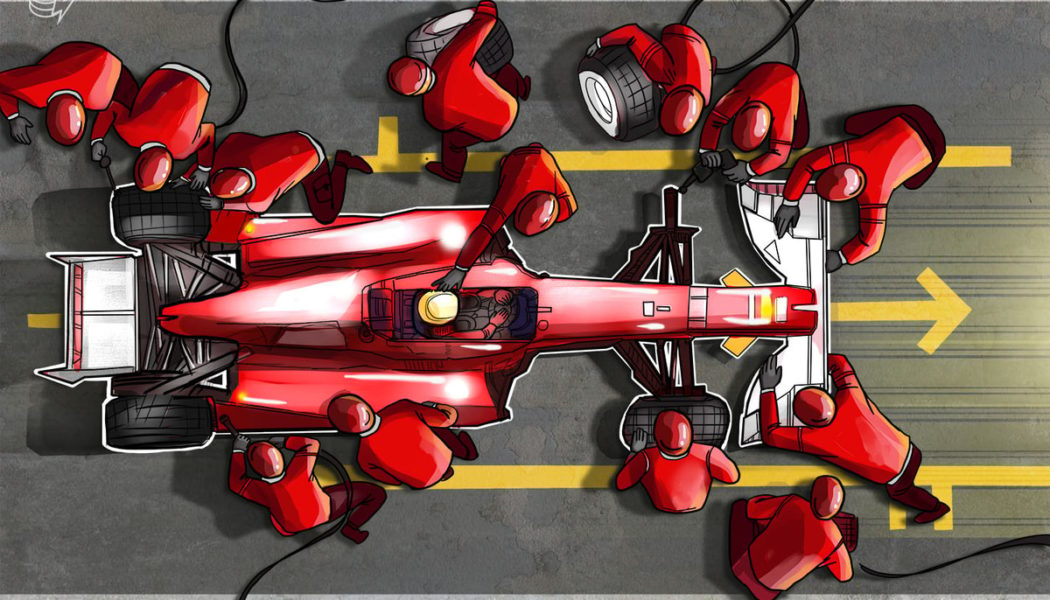

Ferrari cuts ties with crypto sponsor ahead of 2023 Formula One season

Scuderia Ferrari, the racing division of luxury carmaker Ferrari, joined the growing list of Formula One racing teams to end partnerships with their cryptocurrency sponsors. Ferrari exited its multi-year partnership deals with Velas Blockchain and chip manufacturing giant Snapdragon, resulting in a cumulative $55 million loss for the Italian team ahead of the 2023 season. The Ferrari-Velas partnership from 2021 — set at $30 million a year — was aimed at increasing fan engagement through nonfungible tokens (NFTs) and other shared initiatives. However, the team was noncompliant with the clauses that permit Velas to create NFT images, according to RacingNews365. On November 2022, Mercedes, too, bore a loss of $15 million after suspending its partnership with FTX as the crypto exchange filed f...

Wyre imposes up to a 90% withdrawal limit for all users

Crypto payment platform Wyre modified its withdrawal policy to limit users from cashing out up to 90% of their assets just days after two former employees allegedly hinted the possibility of a shutdown. On Jan. 7, 2023, Wyre imposed a withdrawal limit on its platform, citing “the best interest of our community.” Following the policy modification, Wyre users can withdraw up to 90% of their crypto funds as the company explores strategic options to circumvent the prolonged bear market. We are modifying our withdrawal policy. While customers will continue to be able to withdraw their funds, at this time, we are limiting withdrawals to no more than 90% of the funds currently in each customer account, subject to current daily limits. — Wyre (@sendwyre) January 7, 2023 In addition, the company ap...

FTX, Bahamian FTX DM reach agreement on info sharing, disposition of property, assets

The FTX Debtors, made up of FTX and its affiliated debtors, and FTX Digital Markets (FTX DM), the Bahamian subsidiary of FTX, announced Jan. 6 that they have reached a cooperation agreement regarding the FTX Debtors’ Chapter 11 bankruptcy case in Delaware and the provisional liquidation of FTX DM in the Bahamas. Under the agreement, the parties will “share information, secure and return property to their estates, coordinate litigation against third parties and explore strategic alternatives for maximizing stakeholder recoveries.” They have also set parameters for cooperation in each other’s court cases. In addition, the parties agreed the joint provisional liquidators will take the lead in the disposition of real estate in the Bahamas and confirm digital assets “under the control of ...

Hedge funds subpoenaed by U.S. prosecutors as Binance probe unfolds: Report

United States prosecutors are investigating hedge funds’ relationships with cryptocurrency exchange Binance for money-laundering violations. According to anonymous sources cited by the Washington Post, the U.S. attorney’s office for the Western District of Washington in Seattle subpoenaed investment firms to provide records of communications with Binance in the past months. The allegedly subpoenas do not mean prosecutors are bringing charges against the crypto exchange or hedge funds, as authorities are still evaluating evidence and a possible settlement with Binance, according to legal specialists. Binance did not immediately respond to Cointelegraph’s request for comment. Binance is under probe in the United States since 2018, when prosecutors began investigating a number of cases ...

SBF pleads not guilty, crypto layoffs, and bank run on Silvergate: Hodler’s Digest, Jan. 1-7

Top Stories This Week Sam Bankman-Fried enters not guilty plea for all counts in federal court Former FTX CEO Sam Bankman-Fried (has pleaded not guilty to all charges related to the collapse of the crypto exchange, including wire fraud and securities fraud. He faces eight criminal counts, which could result in 115 years in prison if convicted. Furthemore, a petition has been filed by Bankman-Fried’s legal team asking a court to redact and not disclose certain information on individuals acting as sureties for his $250-million bond, alleging threats against his family. US Feds put together ‘FTX task force’ to trace stolen user funds A task force organized by the Southern District of New York has been formed to track and recover missing customer funds as well as investigate and prosecute the ...

FTX asset sales challenged by U.S. Trustee: Report

Bankrupt crypto exchange FTX’s plans to sell its digital currency futures and clearinghouse LedgerX, among other businesses, were challenged by the U.S. Trustee on Jan. 7, according to Reuters. As per the filing, U.S. Trustee Andrew Vara called for an independent investigation before any sale, claiming that valuable information related to the exchange’s bankruptcy could be compromised. The document states: “The sale of potentially valuable causes of action against the Debtors’ directors, officers and employees, or any other person or entity, should not be permitted until there has been a full and independent investigation into all persons and entities that may have been involved in any malfeasance, negligence or other actionable conduct.” In an effort to recov...

Bitcoin price nears 3-week high as trader says sub-7% CPI may see $19K

Bitcoin (BTC) traded nearer $17,000 on Jan. 7 after the end of the year’s first trading week delivered a spike higher. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView All eyes on CPI Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it briefly passed the $17,000 mark the day prior. The pair had seen flash volatility on the back of fresh economic data from the United States, this nonetheless fading to leave the key level “unflipped” as resistance. Nonetheless, the brief uptick delivered Bitcoin’s highest price point since Dec. 20, 2022. Reacting, market participants continued to look to next week’s Consumer Price Index (CPI) print as a key potential catalyst for risk assets. “Unemployment will rally in the coming months. Yields will fall of a cliff if CPI is...

OpenAI will lead to better art and narration in Web3 games — Immutable exec

The creation of smart contracts and Web3 interfaces has led to an entirely new play-to-earn or nonfungible token (NFT) genre of video games. But during the 2021 crypto bull market and subsequent crash of 2022, many of the games in this niche went through incredible ups and downs in terms of player count and transaction volume. Despite this volatility, one Web3 gaming executive who spoke to Cointelegraph says that new innovations in artificial intelligence (AI) will make the genre better than it has ever been. Alex Connelly is the chief technology officer of Immutable, developer of the Gods Unchained digital collectible trading card game and Immutable X NFT platform. He told Cointelegraph that OpenAI, an AI-focused American research laboratory dedicated to developing friendly AI application...